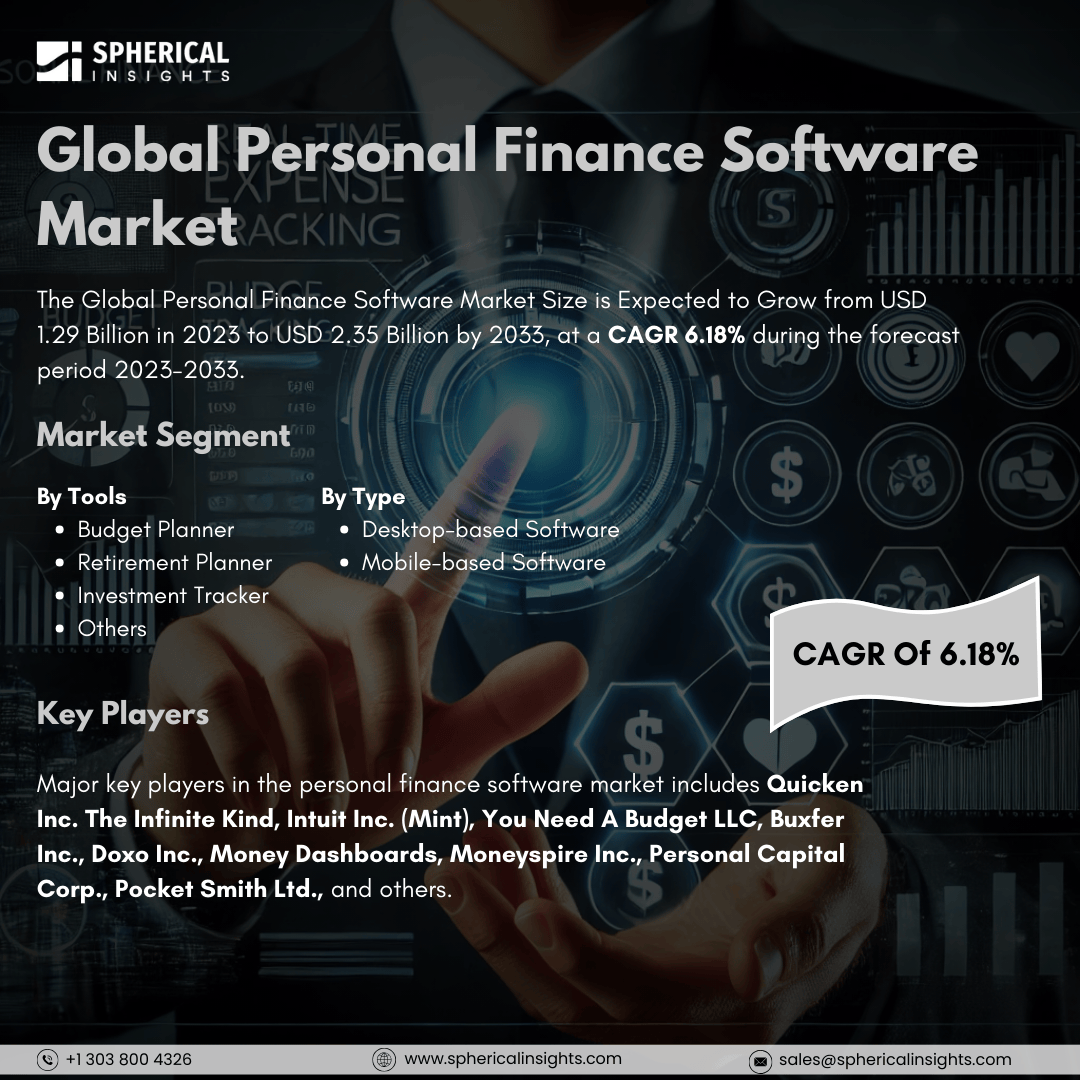

Global Personal Finance Software Market Size to worth USD 2.35 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Personal Finance Software Market Size is Expected to Grow from USD 1.29 Billion in 2023 to USD 2.35 Billion by 2033, at a CAGR 6.18% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Personal Finance Software Market Size, Share, and COVID-19 Impact Analysis, By tools (Budget Planner, Retirement Planner, Investment Tracker, and Others), By Type (Desktop-based Software, Mobile-based Software), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Personal finance software is a digital tool designed to help individuals manage their money effectively. It enables users to track spending, create budgets, plan for future expenses, monitor financial goals, and organize and analyze their personal finances. The market for personal finance software is driven by several key factors. There is an increasing need for financial literacy, the rise of digital banking, and a growing emphasis on budgeting and saving among consumers. As more consumer seek to manage their finances efficiently, these tools offer features that assist with tracking expenses, planning budgets, and monitoring investments. Additionally, the widespread use of smartphones and greater internet access have made these solutions more accessible. The integration of artificial intelligence and machine learning further enhances user experiences by providing personalized financial advice. However, the personal finance software market also faces several challenges. Privacy and security concerns are significant, as many users are hesitant to share sensitive financial information online. High competition leads to market saturation, making it difficult for new entrants to stand out. Furthermore, a lack of technological literacy among certain demographics, particularly older users, can hamper the adoption of these tools. Additionally, subscription costs and the perceived complexity of some software options may deter potential users.

The budget planner segment is predicted to hold the largest market share through the forecast period.

Based on the tools, the personal finance software market is classified into budget planner, retirement planner, investment tracker, and others. Among these, the budget planner segment is predicted to hold the largest market share through the forecast period. This is due to the increasing focus on financial management and planning among consumers and businesses, there is a growing demand for effective resource allocation tools. Economic uncertainties and the need for financial discipline have led more individuals and organizations to seek out budget planners. These planners offer essential features such as expense tracking, goal setting, and personalized financial advice, which help users enhance their financial stability and achieve their financial objectives.

The desktop-based software segment is anticipated to hold the highest market share during the projected timeframe.

Based on the type, the personal finance software market is divided into desktop-based software, mobile-based software. Among these, the desktop-based software segment is anticipated to hold the highest market share during the projected timeframe. Desktop applications remain popular due to their established user base and robust functionality. Many users prefer these applications for their comprehensive features, enhanced security, and the ability to handle complex financial tasks without relying on internet connectivity. Such software typically includes advanced analytics, reporting tools, and customization options that cater to both professional and personal finance needs, making it the preferred choice for users who prioritize performance and reliability.

North America is estimated to hold the largest share of the personal finance software market over the forecast period.

North America is estimated to hold the largest share of the personal finance software market over the forecast period. The market is driven by high consumer awareness and the considerable presence of established software providers. The region's advanced technological infrastructure, combined with rising disposable incomes, enables consumers to invest in sophisticated financial tools. Moreover, the growing trend of financial literacy and the increasing demand for personalized financial solutions further strengthen the region's leading position in the market.

Asia Pacific is expected to grow the fastest during the forecast period. The growth in the Asia Pacific region is driven by an expanding middle class and an increase in smartphone penetration. As more individuals in this region become financially literate and look for effective ways to manage their finances, the demand for innovative financial solutions is surging. Additionally, the rise of fintech companies and the adoption of digital payment systems are enhancing the accessibility and popularity of personal finance software, positioning Asia Pacific as a key growth area in the market.

Company Profiling

Major key players in the personal finance software market includes Quicken Inc. The Infinite Kind, Intuit Inc. (Mint), You Need A Budget LLC, Buxfer Inc., Doxo Inc., Money Dashboards, Moneyspire Inc., Personal Capital Corp., Pocket Smith Ltd., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the personal finance software market based on the below-mentioned segments:

Global Personal Finance Software Market, By Tools

- Budget Planner

- Retirement Planner

- Investment Tracker

- Others

Global Personal Finance Software Market, By Type

- Desktop-based Software

- Mobile-based Software

Global Personal Finance Software Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa