Global Pharmaceutical Plastic Bottles Market Size to worth USD 13.92 Billion by 2033

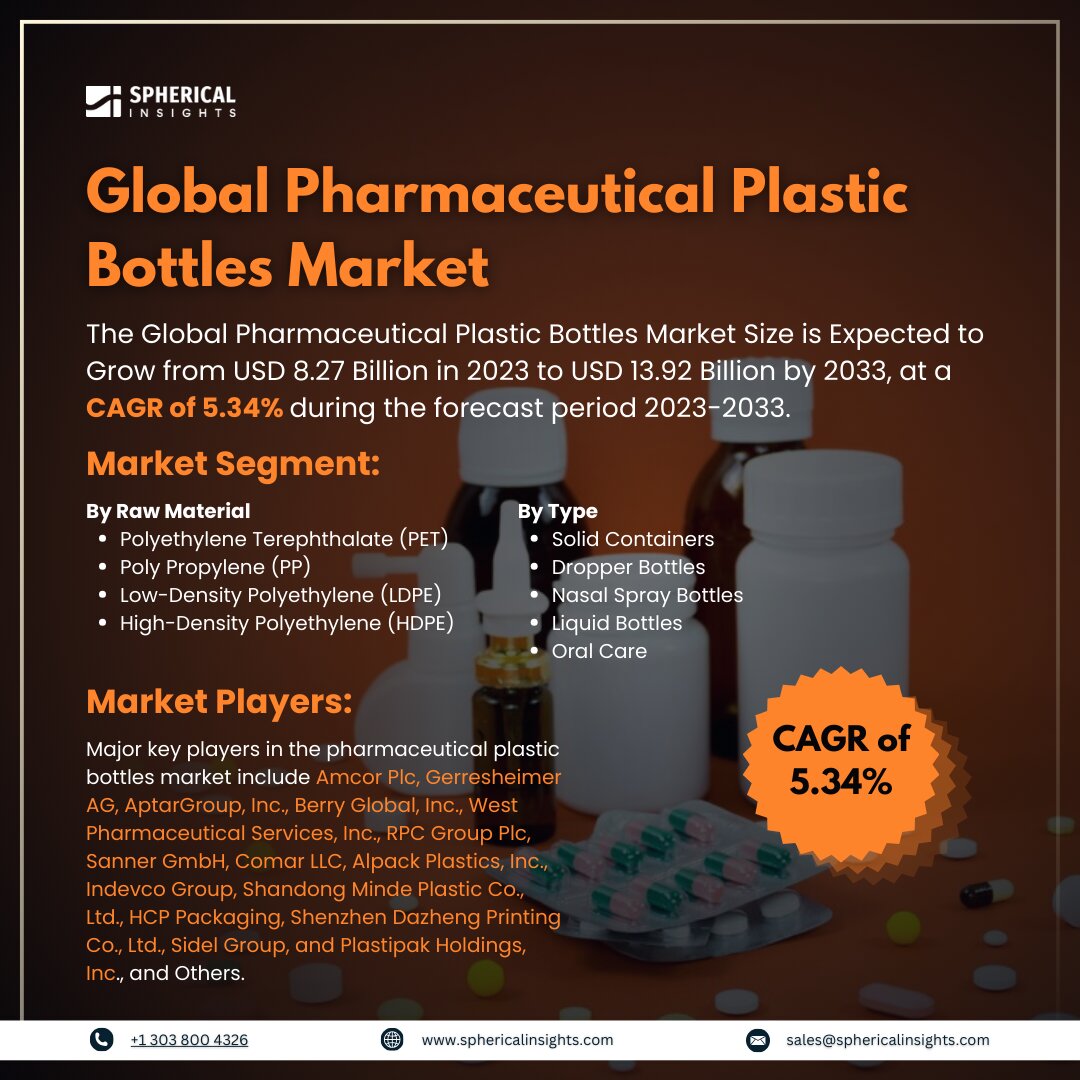

According to a research report published by Spherical Insights & Consulting, the Global Pharmaceutical Plastic Bottles Market Size is Expected to Grow from USD 8.27 Billion in 2023 to USD 13.92 Billion by 2033, at a CAGR of 5.34% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Pharmaceutical Plastic Bottles Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Polyethylene Terephthalate (PET), Poly Propylene (PP), Low-Density Polyethylene (LDPE), and High-Density Polyethylene (HDPE)), By Type (Solid Containers, Dropper Bottles, Nasal Spray Bottles, Liquid Bottles, and Oral Care), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Pharmaceutical plastic bottles are containers designed for storing and dispensing pharmaceutical products, such as medications and solutions. They meet strict regulatory standards for safety, efficacy, and stability. Available in various shapes and materials like PE, PET, and HDPE, they offer flexibility, chemical resistance, and barrier protection. Child-resistant caps and tamper-evident seals are often used to ensure product integrity from production to consumption. Pharmaceutical plastic bottles are gaining popularity due to their effectiveness in packaging medicinal goods in liquid and solid forms. They offer airtight barriers, high impact strength, low water absorption, transparency, heat and flame resistance, and shelf-life extension. The use of appropriate materials is crucial for ensuring the packaging material is suitable for the intended usage. As recycling rates increase and the pharmaceutical industry focuses on reducing environmental impact, demand for plastic pharmaceutical bottles is on the rise. The materials used must be compatible with the medication being stored. As populations age and incomes in developing nations rise, the global healthcare sector has experienced remarkable growth in recent decades. The demand for medications and other medical supplies has increased globally as a result of this. However, pharmaceutical industry regulations aim to reduce environmental impact and cost by transitioning to sustainable materials like bioplastics, requiring manufacturers to conduct extensive research.

The polyethylene terephthalate (PET) segment is predicted to hold the highest market share through the forecast period.

Based on the raw material, the pharmaceutical plastic bottles market is classified into polyethylene terephthalate (PET), poly propylene (PP), low-density polyethylene (LDPE), and high-density polyethylene (HDPE). Among these, the polyethylene terephthalate (PET) segment is predicted to hold the highest market share through the forecast period. PET is a durable material with exceptional barrier properties and recyclability, protecting oxygen, carbon dioxide, and moisture vapor, ensuring long shelf-life for packaged pharmaceutical products. Its high tensile strength and shatter resistance make it cost-effective for larger volumes of transportation.

The rigid bottles segment is anticipated to hold the highest market share during the projected timeframe.

Based on the type, the pharmaceutical plastic bottles market is divided into solid containers, dropper bottles, nasal spray bottles, liquid bottles, and oral care. Among these, the rigid bottles segment is anticipated to hold the highest market share during the projected timeframe. Rigid bottles offer multi-purpose utility and tamper-evidence, making pharmaceutical products safer and more potent. They provide effective barrier protection, vertical storage without stacking concerns, precision dosing via integrated measuring cups or dropper caps, and better grips for users of all ages and abilities.

North America is estimated to hold the largest share of the pharmaceutical plastic bottles market over the forecast period.

North America is estimated to hold the largest share of the pharmaceutical plastic bottles market over the forecast period. The existence of large pharmaceutical corporations, a well-established healthcare industry, and supportive government efforts encouraging healthcare innovation are the main drivers of this leadership. Furthermore, the area has quickly adopted cutting-edge packaging options for medication delivery.

Asia Pacific is predicted to have the fastest CAGR growth in the pharmaceutical plastic bottles market over the forecast period. This is due to a large patient base, increased healthcare spending, and the expansion of the generic medicine industry. The demand for plastic bottle packaging is increasing due to its stiffness and flexibility. Other benefits include moisture barriers, high stability, impact strength, strain resistance, minimal water absorption, transparency, heat and flame resistance, and extended expiration dates.

Competitive Analysis

Major key players in the pharmaceutical plastic bottles market include Amcor Plc, Gerresheimer AG, AptarGroup, Inc., Berry Global, Inc., West Pharmaceutical Services, Inc., RPC Group Plc, Sanner GmbH, Comar LLC, Alpack Plastics, Inc., Indevco Group, Shandong Minde Plastic Co., Ltd., HCP Packaging, Shenzhen Dazheng Printing Co., Ltd., Sidel Group, and Plastipak Holdings, Inc., and Others.

Recent Development

- In April 2024, the Berry Global Group declared that it would expand its healthcare production capacity by up to 30% across three of its European locations by investing in new assets and manufacturing capabilities. In addition to increasing manufacturing efficiency, this expansion attempts to satisfy the rising demand for medicinal plastic bottles.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the pharmaceutical plastic bottles market based on the below-mentioned segments:

Global Pharmaceutical Plastic Bottles Market, By Raw Material

- Polyethylene Terephthalate (PET)

- Poly Propylene (PP)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

Global Pharmaceutical Plastic Bottles Market, By Type

- Solid Containers

- Dropper Bottles

- Nasal Spray Bottles

- Liquid Bottles

- Oral Care

Global Pharmaceutical Plastic Bottles Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa