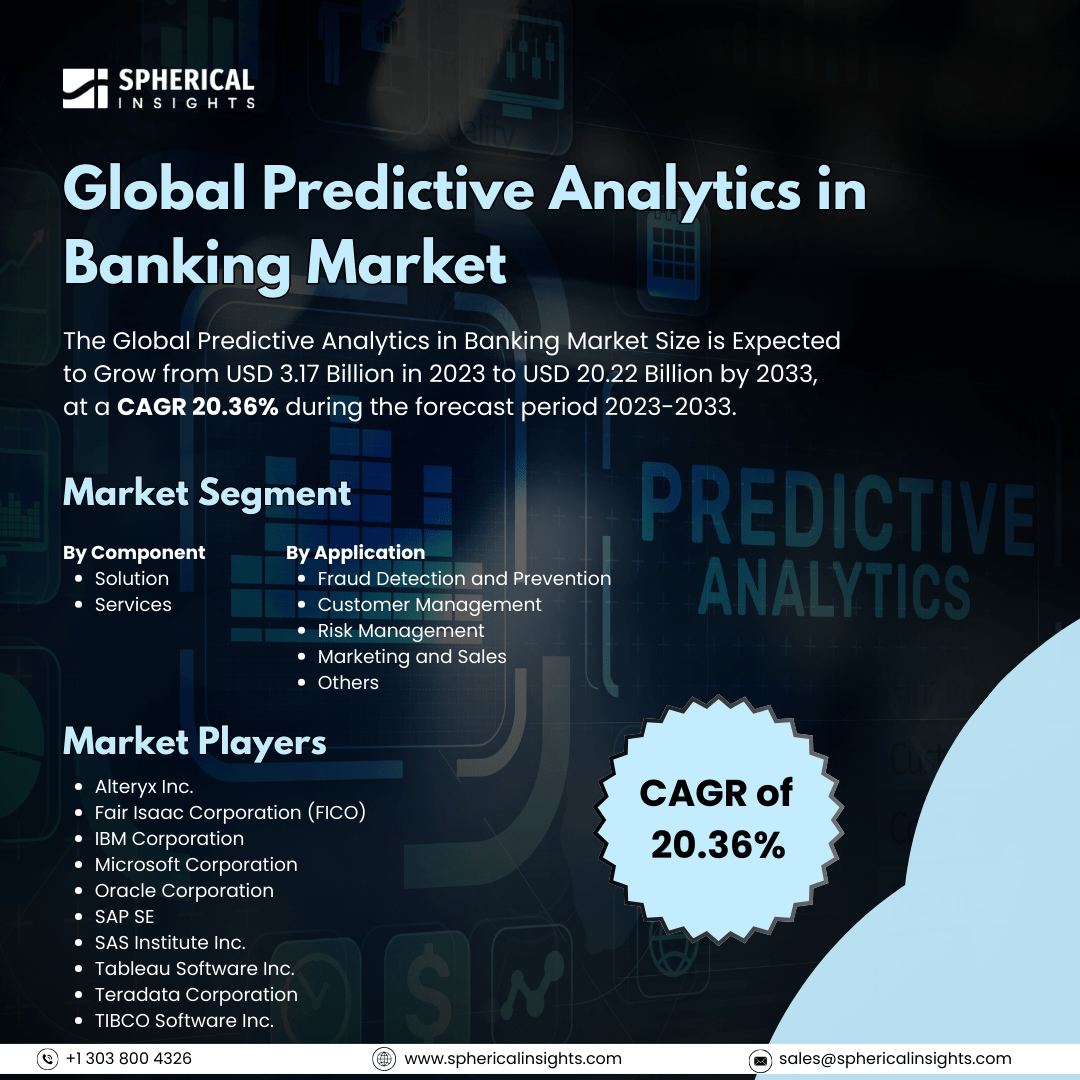

Global Predictive Analytics in Banking Market Size to worth USD 20.22 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Predictive Analytics in Banking Market Size is Expected to Grow from USD 3.17 Billion in 2023 to USD 20.22 Billion by 2033, at a CAGR 20.36% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Predictive Analytics in Banking Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Services), By Application (Fraud Detection and Prevention, Customer Management, Risk Management, Marketing and Sales, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The reconciliation software market offers tools that help organizations compare and reconcile their financial records, ensuring that the balances in internal and external accounts are accurate. This market is primarily driven by the need to automate and streamline financial processes, reduce manual errors, improve data accuracy, comply with regulations, and enhance financial transparency. Key factors contributing to its growth include the increasing adoption of cloud-based solutions, rising data complexity, the integration of advanced technologies such as AI and machine learning, and a growing demand for faster reconciliation times across various industries. However, several factors are hindering the reconciliation software market. These include high initial implementation costs, a lack of awareness about the benefits of this software among smaller businesses, potential security concerns related to data handling, complex integration with existing systems, resistance to change within organizations, and the need for specialized skills to operate the software effectively. All of these issues can make companies hesitant to adopt reconciliation software readily.

The solution segment is predicted to hold the largest market share through the forecast period.

Based on the component, the predictive analytics in banking market is classified into solution and services. Among these, the solution segment is predicted to hold the largest market share through the forecast period. The growing demand for advanced analytical tools that enhance operational efficiency and decision-making processes across various industries is driving widespread adoption. As organizations strive to utilize vast amounts of data, it becomes crucial to implement comprehensive solutions that integrate predictive analytics capabilities. These solutions enable businesses to identify trends, optimize performance, and improve customer experiences, resulting in a significant competitive advantage.

The customer management segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the predictive analytics in banking market is divided into fraud detection and prevention, customer management, risk management, marketing and sales, and others. Among these, the customer management segment is anticipated to hold the highest market share during the projected timeframe. Businesses are increasingly focusing on personalized customer experiences and effective relationship management through predictive analytics. By gaining insights into customer behavior, preferences, and needs, companies can tailor their offerings and marketing strategies. This customer-centric approach not only enhances satisfaction and loyalty but also boosts revenue, making it a vital area of investment for organizations looking to succeed in competitive markets.

North America is estimated to hold the largest share of the predictive analytics in banking market over the forecast period.

North America is estimated to hold the largest share of the predictive analytics in banking market over the forecast period. This is largely due to its technological advancements and strong financial infrastructure. The presence of major financial institutions and a robust regulatory environment fosters innovation and investment in predictive analytics solutions. Additionally, the increasing emphasis on data-driven decision-making and risk management within banking operations accelerates the adoption of predictive analytics in the region.

Europe is expected to grow the fastest during the forecast period. This is driven by increasing investments in digital transformation and the adoption of advanced analytics solutions across various sectors. The region's focus on compliance with regulatory standards and data protection laws encourages financial institutions to utilize predictive analytics for better risk management and customer insights. Furthermore, the rise of fintech companies and collaborations between traditional banks and technology firms are facilitating the integration of predictive analytics, contributing to Europe’s swift expansion in this field.

Company Profiling

Major key players in the predictive analytics in banking market include Alteryx Inc., Fair Isaac Corporation, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., Tableau Software Inc., Teradata Corporation, TIBCO Software Inc., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In January 2025, KlariVis, a trusted data analytics platform for community banks, has partnered with FinGoal, a leader in transaction data insights, to launch a powerful new suite of dashboards and insights called Transactional Intelligence. This collaboration aims to help financial institutions strengthen customer relationships, identify revenue opportunities, and achieve profitable growth.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the predictive analytics in banking market based on the below-mentioned segments:

Global Predictive Analytics in Banking Market, By Component

Global Predictive Analytics in Banking Market, By Application

- Fraud Detection and Prevention

- Customer Management

- Risk Management

- Marketing and Sales

- Others

Global Predictive Analytics in Banking Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa