Global Processed Animal Protein Market Size to Exceed USD 17.5 Billion by 2033

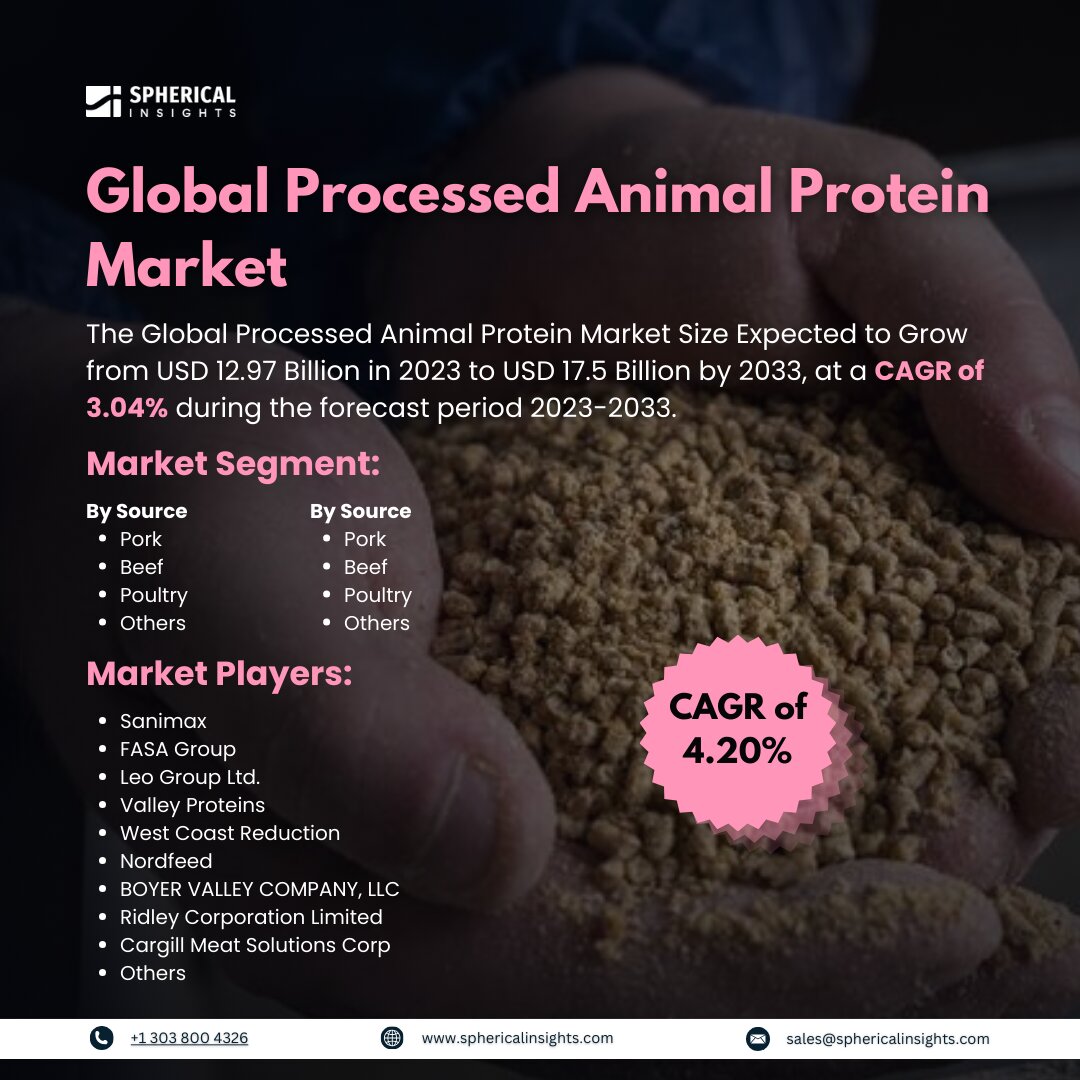

According to a research report published by Spherical Insights & Consulting, the Global Processed Animal Protein Market Size Expected to Grow from USD 12.97 Billion in 2023 to USD 17.5 Billion by 2033, at a CAGR of 3.04% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Processed Animal Protein Market Size, Share, and COVID-19 Impact Analysis, By Source (Pork, Beef, Poultry, and Others), By Form (Liquid and Dry), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

PAPs, or processed animal protein, are nutrient-dense feed additives that help create healthy animals. The demand for items made from meat and poultry has grown dramatically in recent years. The amount of animal waste produced by the meat processing industry has increased significantly as a result of these factors. Additionally, the market for processed animal protein is expanding due to two factors: rising meat consumption and growing animal waste. Consumption of meat has increased significantly in recent years. The use of processed meat has led to an increase in the production of animal waste, which requires effective handling. However, the process of disposing of animal feces is expensive and necessitates labor, supplies, transportation, and land.

The poultry segment is expected to hold a significant market share through the forecast period.

Based on the source, the global processed animal protein market is categorized as pork, beef, poultry, and others. Among these, the poultry segment is expected to hold a significant market share through the forecast period. The rising demand for egg and poultry meat products in the processed animal protein sector is responsible for the surge in demand.

The dry segment is expected to grow at the fastest CAGR during the projected timeframe.

The global processed animal protein market is segmented by form into liquid and dry. Among these, the dry segment is expected to grow at the fastest CAGR during the projected timeframe. Pellets and powder feed are the main forms of animal feed products found in the processed animal protein industry, along with feathers, blood, and meals. Since they are easily absorbed in water and combined with other goods, animal owners favor dry forms.

North America is projected to hold the largest share of the global processed animal protein market over the projected timeframe.

North America is projected to hold the largest share of the global processed animal protein market over the projected timeframe. The United States is the largest market in North America. Animal by-products from meat processing account for over 48% of the nation's total, and they are unfit for human consumption. The ecological impact of animal waste is decreased as a result of the processing of animal by-products into feather meals, blood meals, and other related goods. These products made from animal proteins also contribute to the creation of supplements used in the feed business.

Asia Pacific is projected to grow at the fastest CAGR growth of the global processed animal protein market during the forecast period. Asia Pacific is one of the major markets because of the region's high livestock production. China, Japan, and India are major producers of poultry, beef, and pork products, and they rely on high-quality animal feed to boost their output. This industry is a chance for manufacturers of processed animal protein to boost their profit margin by introducing creative and affordable solutions for farmers.

Competitive Analysis

Major vendors in the global processed animal protein market are Sanimax, FASA Group, Leo Group Ltd., Valley Proteins, West Coast Reduction, Nordfeed, BOYER VALLEY COMPANY, LLC, Ridley Corporation Limited, Sonac, Tyson Foods, Inc., JBS USA Holdings Inc., Cargill Meat Solutions Corp, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In July 2021, a Ukrainian firm called Feednova declared that it would open a facility to turn animal waste into feed and pet food. Plant installation is expected to cost around USD 20 million.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global processed animal protein market based on the below-mentioned segments:

Global Processed Animal Protein Market, By Source

Global Processed Animal Protein Market, By Form

Global Processed Animal Protein Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa