Global Retail Banking Market Size to worth USD 3,391.77 Billion by 2033

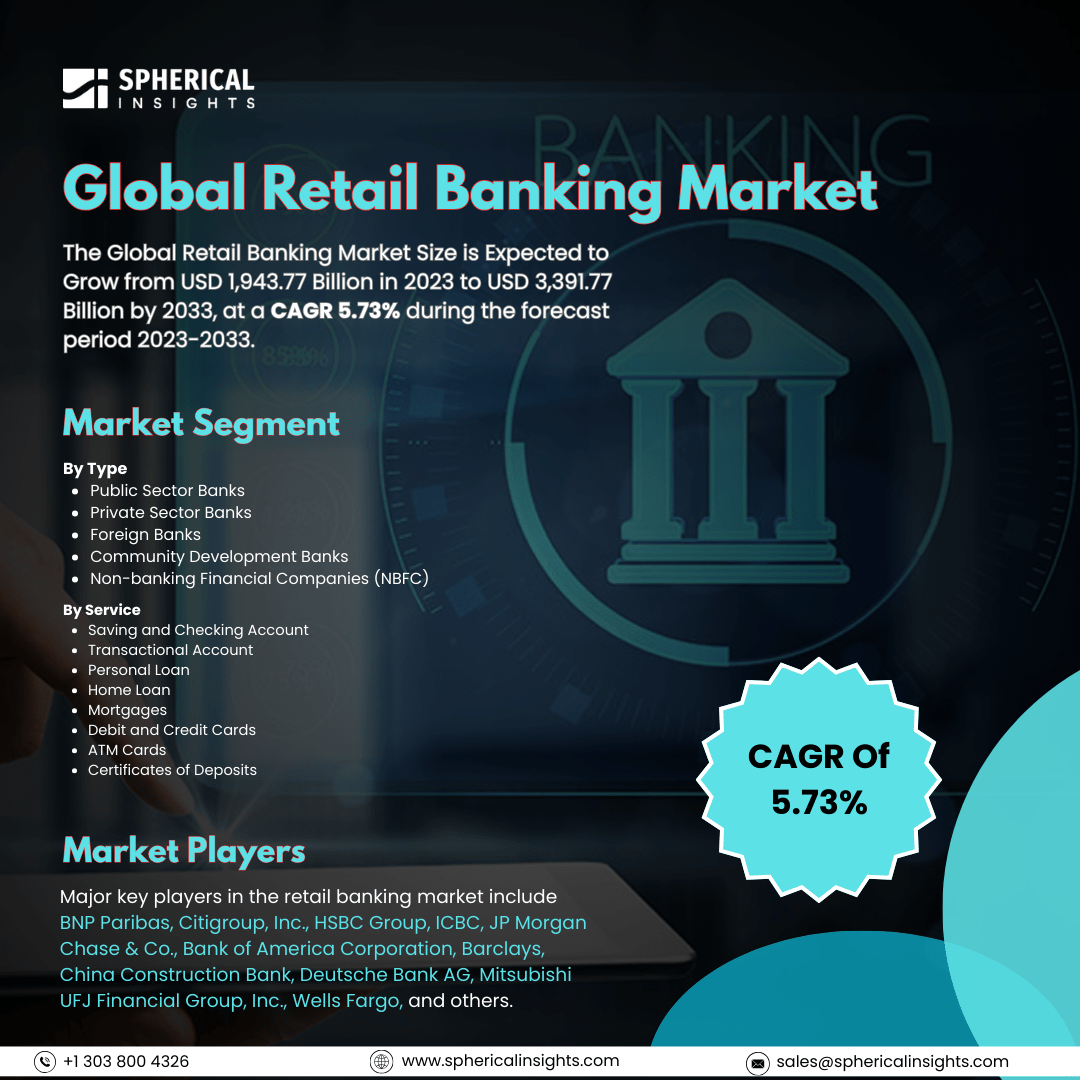

According to a research report published by Spherical Insights & Consulting, The Global Retail Banking Market Size is Expected to Grow from USD 1,943.77 Billion in 2023 to USD 3,391.77 Billion by 2033, at a CAGR 5.73% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Retail Banking Market Size, Share, and COVID-19 Impact Analysis, By Type (Public Sector Banks, Private Sector Banks, Foreign Banks, Community Development Banks, and Non-banking Financial Companies (NBFC)), By Service (Saving and Checking Account, Transactional Account, Personal Loan, Home Loan, Mortgages, Debit and Credit Cards, ATM Cards, and Certificates of Deposits) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The retail banking markets encompass the financial services accessible to individual consumers, also known as consumer banking or personal banking. This market is mainly driven by various factors, including increasing digital adoption, rising disposable incomes, urbanization, advancements in technology, government project that encourage financial inclusion, evolving customer expectations, and the emergence of open banking. These factors collectively contribute to a increasing demand for convenient and accessible financial services through various digital channels, such as mobile banking and online platforms. However, the retail banking market also faces several constraints. These comprise strict regulations, a rise in loan losses due to non-repayment, increasing compliance costs, and the growing competition from Fintech Company that endow with digital-first services. Additionally, banks must continuously adapt to changing customer expectations and technological advancements, which often necessitate significant investment in infrastructure upgrade to stay competitive.

The private sector banks segment is predicted to hold the largest market share through the forecast period.

Based on the type, the retail banking market is classified into public sector banks, private sector banks, foreign banks, community development banks, and non-banking financial companies (NBFC). Among these, the private sector banks segment is predicted to hold the largest market share through the forecast period. This is due to their increasing customer base and enhanced service offerings compared to public sector banks. These institutions are leveraging technology and digital banking solutions to attract younger demographics, improve customer experiences, and streamline operations.

The saving and checking account segment is anticipated to hold the highest market share during the projected timeframe.

Based on the service, the retail banking market is divided into saving and checking account, transactional account, personal loan, home loan, mortgages, debit and credit cards, ATM cards, and certificates of deposits. Among these, the saving and checking account segment is anticipated to hold the highest market share during the projected timeframe. This is driven by the essential nature of these accounts for everyday financial transactions. As consumers increasingly prioritize financial management, institutions are enhancing their offerings with attractive interest rates, low fees, and user-friendly digital platforms. This focus on accessibility and convenience is expected to solidify the segment's leading position in the overall banking market.

Asia Pacific is estimated to hold the largest share of the retail banking market over the forecast period.

Asia Pacific is estimated to hold the largest share of the retail banking market over the forecast period. This is fueled by rapid economic growth, urbanization, and a burgeoning middle class. The region's increasing adoption of digital banking technologies and mobile payment solutions is transforming consumer behavior, leading to higher demand for retail banking services. Additionally, government initiatives to promote financial inclusion are further driving the expansion of banking services across various demographics.

North America is expected to grow the fastest during the forecast period. This is primarily due to the region's advanced financial infrastructure and the widespread adoption of innovative banking technologies. The rise of fintech companies is reshaping traditional banking models, encouraging established banks to enhance their digital services and customer engagement strategies. Furthermore, a strong economic environment and increasing consumer confidence are anticipated to drive higher demand for retail banking products and services in this region.

Company Profiling

Major key players in the retail banking market include BNP Paribas, Citigroup, Inc., HSBC Group, ICBC, JP Morgan Chase & Co., Bank of America Corporation, Barclays, China Construction Bank, Deutsche Bank AG, Mitsubishi UFJ Financial Group, Inc., Wells Fargo, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, Karnataka Bank has launched its first Retail Assets Centre (RAC) in J P Nagara, Bengaluru, to enhance its Retail Banking Services. The RAC serves as a centralized hub for Business Coordination, Credit Underwriting, Sanctions, Operations, Disbursements, and Post Disbursement Services, aiming to meet the growing demand for Retail Loan products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the retail banking market based on the below-mentioned segments:

Global Retail Banking Market, By Type

- Public Sector Banks

- Private Sector Banks

- Foreign Banks

- Community Development Banks

- Non-banking Financial Companies (NBFC)

Global Retail Banking Market, By Service

- Saving and Checking Account

- Transactional Account

- Personal Loan

- Home Loan

- Mortgages

- Debit and Credit Cards

- ATM Cards

- Certificates of Deposits

Global Retail Banking Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa