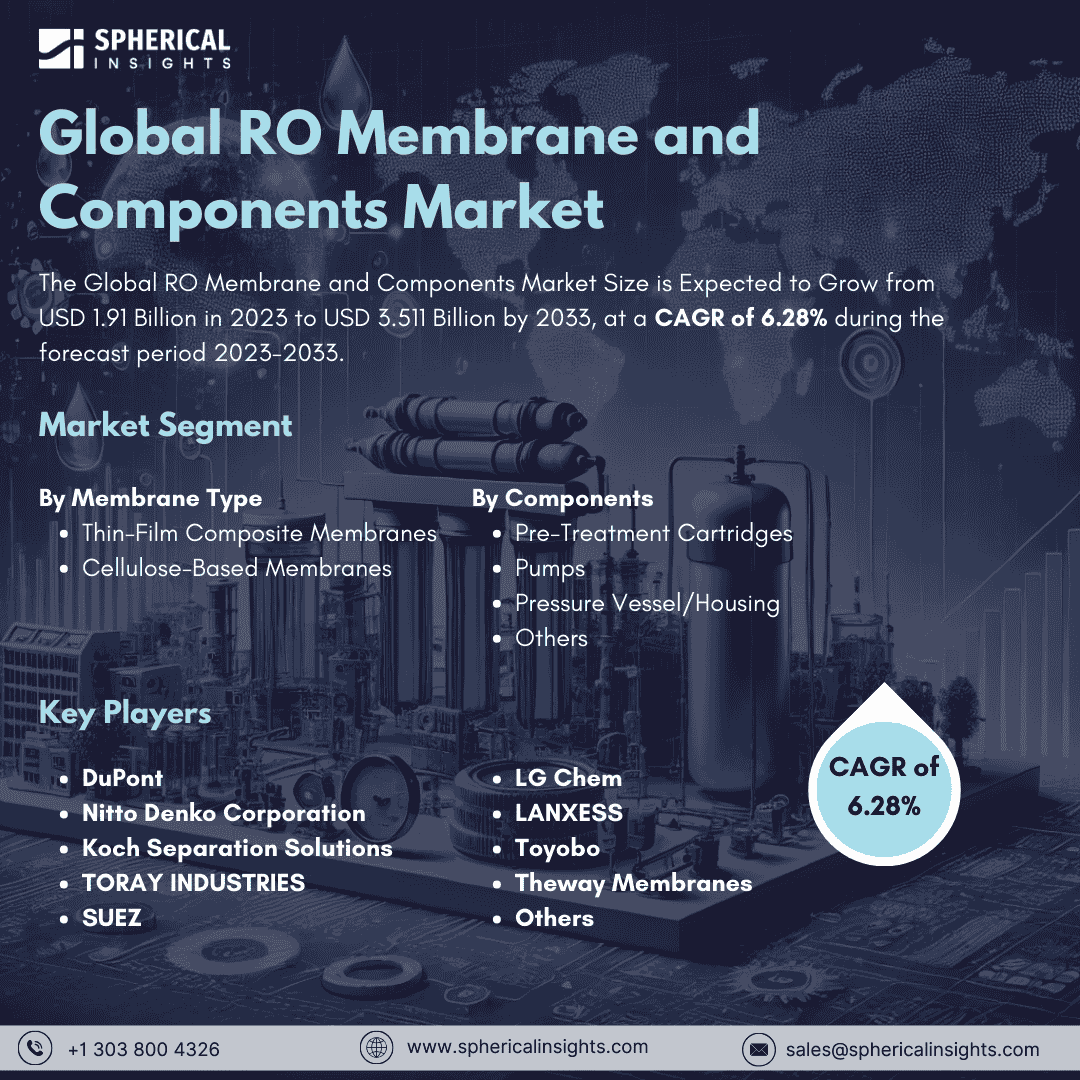

Global RO Membrane and Components Market Size to worth USD 3.511 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global RO Membrane and Components Market Size is Expected to Grow from USD 1.91 Billion in 2023 to USD 3.511 Billion by 2033, at a CAGR of 6.28% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global RO Membrane and Components Market Size, Share, and COVID-19 Impact Analysis, By Membrane Type (Thin-Film Composite Membranes and Cellulose-Based Membranes), By Components (Pre-Treatment Cartridges, Pumps, Pressure Vessel/Housing, and Others), By End-User (Water & Wastewater Treatment, and Industrial Processing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

A very effective filtration membrane called a reverse osmosis (RO) membrane is made to eliminate a variety of impurities from water. It removes pollutants by forcing water through a semi-permeable membrane under pressure. Growing public awareness of water contamination is predicted to increase demand for RO membrane water treatment systems. RO membranes remove impurities from water by pushing them across a semipermeable membrane, thereby producing clean drinking water by moving water from concentrated to less concentrated areas. RO membranes are frequently employed as crossflow filters because they maintain flow turbulence while regulating solid thickness and avoiding blockage. Water pollution has become a greater concern as a result of urbanization, which is defined by population growth and industrialization. Additionally, urbanization affects the environment by causing poor water quality and health problems in urban areas. Consequently, the need for clean water has taken precedence, opening up additional prospects for the RO membrane sector. Regulations governing the usage of reverse osmosis (RO) systems have been introduced by the Indian government. For instance, the Environment (Protection) Amendment Rules, 2021 states that RO systems should only be utilized in locations where the water does not meet the Bureau of Indian Standards (BIS) for drinking water. This seeks to prevent water wastage and guarantee that important minerals are not lost from the water. However, RO systems can be costly, limiting their use for small-scale users and developing regions, and their high production of wastewater raises environmental concerns.

The thin-film composite membranes segment is predicted to hold the greatest market share through the forecast period.

Based on the membrane type, the RO membrane and components market is classified into thin-film composite membranes and cellulose-based membranes. Among these, the thin-film composite membranes segment is predicted to hold the greatest market share through the forecast period. Thin-film composite (TFC) membranes are semipermeable membranes used for water purification or desalination and are used in chemical applications like batteries and fuel cells.

The pre-treatment cartridges segment is anticipated to hold the highest market share during the projected timeframe.

Based on the components, the RO membrane and components market is divided into pre-treatment cartridges, pumps, pressure vessels/housing, and others. Among these, the pre-treatment cartridges segment is anticipated to hold the highest market share during the projected timeframe. In water systems, pre-treatment cartridges are crucial for preserving membrane performance and life. Postponed particle matter found in raw feed water can harm membranes, clog brine stations, and result in high differential pressure. One easy and affordable way to lessen the amount of particulate matter that reaches the membrane surface is by cartridge filtering.

The water and wastewater treatment segment is anticipated to hold the highest market share during the projected timeframe.

Based on the end-user, the RO membrane and components market is divided into water & wastewater treatment, and industrial processing. Among these, the water and wastewater treatment segment is anticipated to hold the highest market share during the projected timeframe. Water scarcity, better regulations, and rising demand from nations are driving growth in the water and wastewater treatment segment, a major industry in the RO membrane market.

North America is estimated to hold the largest share of the RO membrane and components market over the forecast period.

North America is estimated to hold the largest share of the RO membrane and components market over the forecast period. The power, pharmaceutical, oil and gas, food and beverage, and cost-effective water treatment and desalination industries are likely to boost their use of RO membranes, which will enhance demand for them in North America. While alternative industrial wastewater treatment applications present growth prospects, the municipal wastewater treatment market is a sizable market.

Asia Pacific is predicted to have the fastest CAGR growth in the RO membrane and components market over the forecast period. The need for RO membranes and components is anticipated to increase in China, Japan, and India as a result of increased industry, environmental concerns, water contamination, and urban population development.

Company profiling

Major key players in the RO membrane and components market include DuPont, Nitto Denko Corporation, Koch Separation Solutions, TORAY INDUSTRIES, SUEZ, LG Chem, LANXESS, Toyobo, Theway Membranes, and Others.

Recent Development

- In November 2023, a new fouling-immune brackish water RO membrane Early Access Program was recently introduced by ZwitterCo. These membranes have a 90% cleaning frequency reduction, which lowers operating costs and extends membrane lifespan6. By addressing the persistent problem of membrane fouling, this invention improves the effectiveness and economy of water treatment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the RO membrane and components market based on the below-mentioned segments:

Global RO Membrane and Components Market, By Membrane Type

- Thin-Film Composite Membranes

- Cellulose-Based Membranes

Global RO Membrane and Components Market, By Components

- Pre-Treatment Cartridges

- Pumps

- Pressure Vessel/Housing

- Others

Global RO Membrane and Components Market, By End-User

- Water & Wastewater Treatment

- Industrial Processing

Global RO Membrane and Components Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa