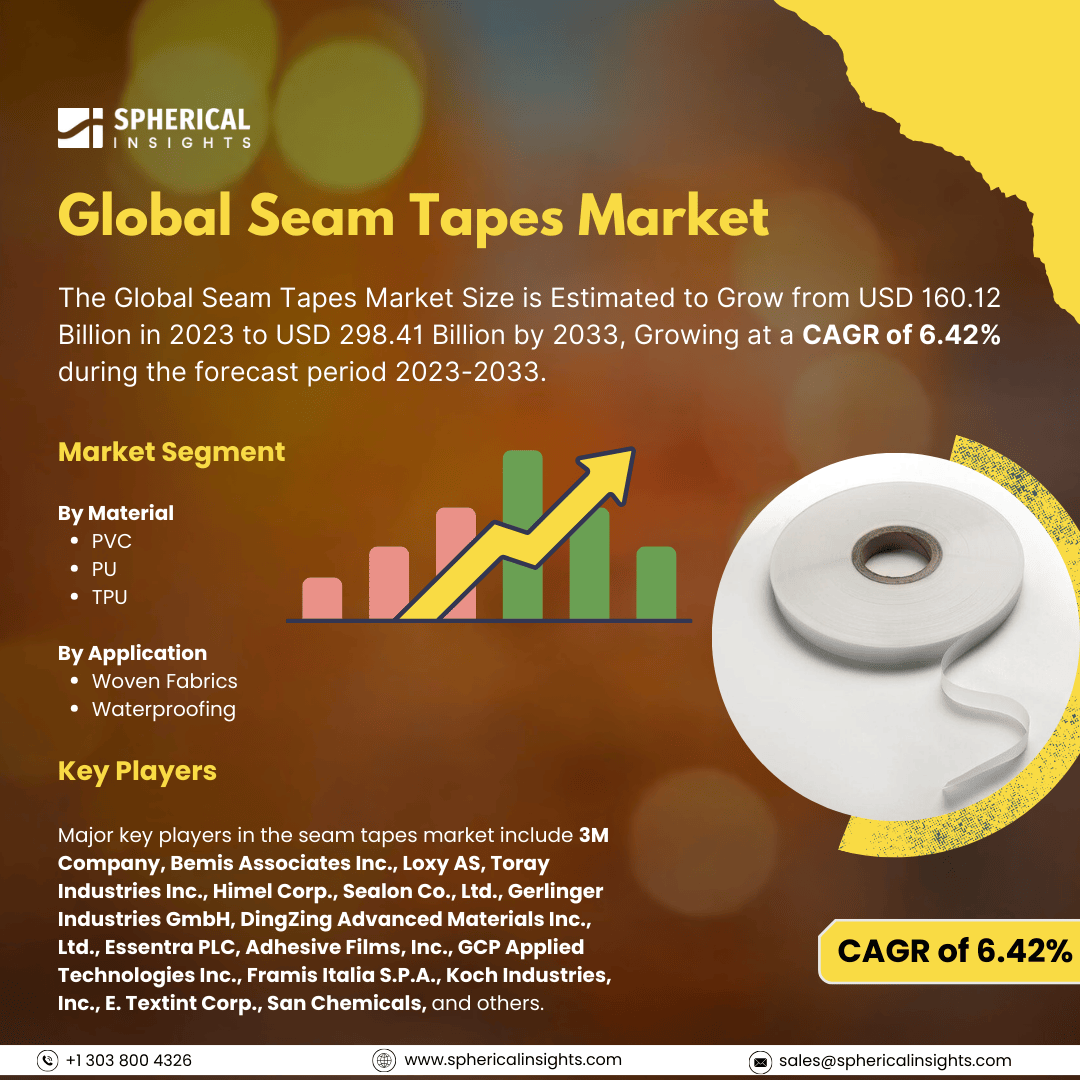

Global Seam Tapes Market Size to Worth USD 298.41 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Seam Tapes Market Size is Estimated to Grow from USD 160.12 Billion in 2023 to USD 298.41 Billion by 2033, Growing at a CAGR of 6.42% during the forecast period 2023-2033.

Browse key industry insights spread across 215 pages with 110 Market data tables and figures & charts from the report on the Global Seam Tapes Market Size, Share, and COVID-19 Impact Analysis, By Material (PVC, PU, and TPU), By Application (Woven Fabrics and Waterproofing), By End-use (Automotive, Healthcare, Apparel & Footwear, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Multi-layered adhesive tapes known as seam tapes are used to stop water from escaping the seam. The rising use of seam tape in clothing manufacturing is one of the main factors driving the industry's growth. Demand for seam tapes that offer durability and waterproofing has increased significantly due to the popularity of high-performance sportswear and outdoor apparel. The need for protective apparel has increased as people participate in outdoor activities and become more health conscious. Particularly among millennials, who place a premium on functionality and quality when choosing clothing, this trend is noticeable. Seam tapes are necessary to produce clothing that satisfies consumer expectations, which are further fueled by the increased awareness of best-fitting intimate apparel. The development of the automobile sector, especially in China and India, is another important factor driving the expansion of the seam tape market. Seam tapes are essential to the production of automobiles because they maintain moisture management, repair electrical connections, and offer waterproofing solutions. Sewing tape consumption is anticipated to expand in line with forecasts of increased vehicle manufacturing in these nations. Seam tape makers can benefit greatly from government actions that further promote this trend of increasing local manufacturing capabilities. However, variability in raw material prices will limit the market's potential for expansion.

The PU segment dominated the largest market share of 62.19% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on material, the seam tapes market is categorized into PVC, PU, and TPU. Among these, the PU segment dominated the largest market share of 62.19% in 2023 and is expected to grow at a significant CAGR during the forecast period. Increasing demand for outdoor and sports clothing is one of the biggest factors. There is an increasing need for high-performance apparel that can endure inclement weather as more customers participate in sports and outdoor activities. The superior waterproofing properties, flexibility, and durability of PU seam tapes make them popular and perfect for jackets, pants, and other outdoor clothing. A rise in the manufacturing of functional apparel as a result of the trend toward active lifestyles has increased demand for PU seam tapes utilized in these applications.

The waterproofing segment accounted for the highest market share of 48.56% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the seam tapes market is classified into woven fabrics and waterproofing. Among these, the waterproofing segment accounted for the highest market share of 48.56% in 2023 and is expected to grow at a significant CAGR during the forecast period. Waterproof apparel and equipment are in high demand due to the growing popularity of outdoor sports and activities. Consumers are looking for more durable clothing that can survive inclement weather, such as rain and snow. Since waterproof seam tapes seal seams to stop water from seeping through needle holes made during sewing, they are crucial to these items. This tendency is especially noticeable in technical clothing made for sports such as climbing, mountaineering, and skiing, where staying dry is essential for both comfort and security.

The apparel and footwear segment accounted for the largest market share of 33.60% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the seam tapes market is divided into automotive, healthcare, apparel & footwear, and others. Among these, the apparel and footwear segment accounted for the largest market share of 33.60% in 2023 and is expected to grow at a significant CAGR during the forecast period. Demand for high-performance apparel and footwear has directly increased as a result of the growing trend towards health and fitness, which has also led to a growth in outdoor activities and sports participation. Clothing that is breathable, waterproof, and long-lasting is becoming more and more necessary as customers participate in sports such as running, hiking, and water sports. By effectively sealing against water penetration and guaranteeing comfort during physical activities, seam tapes significantly improve the functionality of these products. Sports participation rates have reportedly increased significantly, which is fueling the need for seam-sealed equipment made to operate well in demanding environments.

Asia Pacific is expected to hold the largest share of the seam tapes market through the forecast period.

Asia Pacific is expected to hold the largest share of the seam tapes market through the forecast period. Asia Pacific is residence to some of the world's biggest centers for clothing production, including Bangladesh, Indonesia, Vietnam, India, and China. The market is significantly influenced by the region's supremacy in textile manufacturing. Its low labor costs and convenient access to raw materials are driving this growth, which attracts firms looking to create seam tapes for a range of apparel and footwear applications. Another important market driver is the Asia-Pacific automobile sector.

North America is predicted to grow at the fastest CAGR of the seam tapes market over the forecast period. Demand for high-performance clothing and equipment with cutting-edge qualities such as breathability and waterproofing is rising as consumers grow more picky about the quality of products. Manufacturers use seam tapes to improve the quality and usefulness of their products because of this consumer preference. The emphasis on performance-driven garments has increased the use of seam sealing technology in several industries, such as outdoor gear, fashion clothes, and footwear.

Major key players in the seam tapes market include 3M Company, Bemis Associates Inc., Loxy AS, Toray Industries Inc., Himel Corp., Sealon Co., Ltd., Gerlinger Industries GmbH, DingZing Advanced Materials Inc., Ltd., Essentra PLC, Adhesive Films, Inc., GCP Applied Technologies Inc., Framis Italia S.P.A., Koch Industries, Inc., E. Textint Corp., San Chemicals, and others.

Recent Developments

- In June 2023, Fosroc, Inc. introduced "Polyurea WH 100," a new waterproof seam tape. The substance can be used for several purposes, including sealing flat roofs, because it is hand-applied.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the seam tapes market based on the below-mentioned segments:

Global Seam Tapes Market, By Material

Global Seam Tapes Market, By Application

- Woven Fabrics

- Waterproofing

Global Seam Tapes Market, By End-use

- Automotive

- Healthcare

- Apparel & Footwear

- Others

Global Seam Tapes Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa