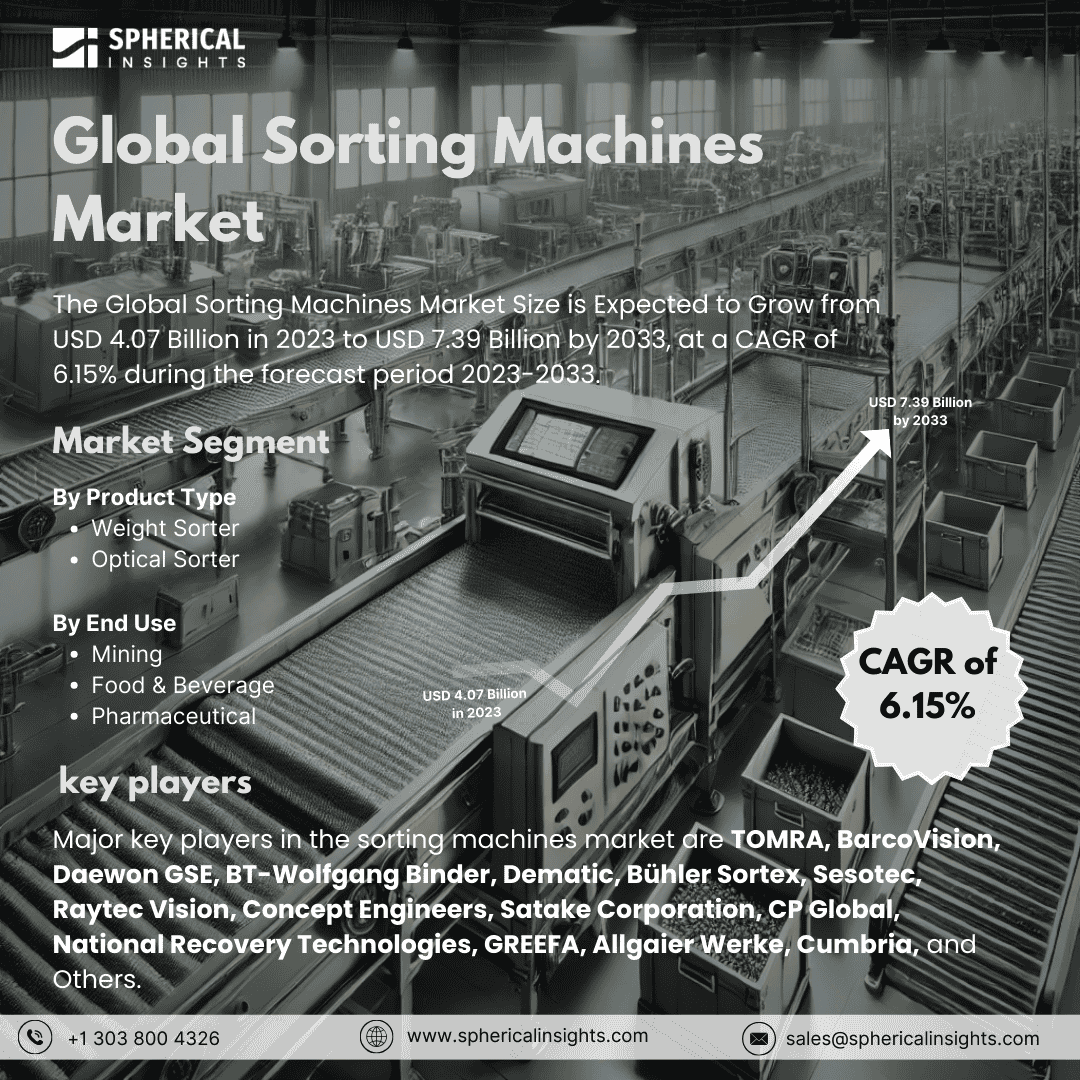

Global Sorting Machines Market Size to worth USD 7.39 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Sorting Machines Market Size is Expected to Grow from USD 4.07 Billion in 2023 to USD 7.39 Billion by 2033, at a CAGR of 6.15% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Sorting Machines Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Weight Sorter and Optical Sorter), By End Use (Mining, Food & Beverage, and Pharmaceutical), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Sorting machines are automated systems to classify and separate materials with specific characteristics such as size, shape, color, weight, and composition. They are used in many recycling, food processing, agricultural, mining, and logistics operations where efficient material handling and sorting are necessary. Sorting machines rely on optical, mechanical, and air classification technologies for accurate identification and sorting. The growing demand for automation in industries and the need for high-efficiency sorting processes have driven the adoption of sorting machines. As businesses focus on reducing labor costs and improving productivity, the market for sorting machines has experienced significant growth. Furthermore, several factors are driving the growth of this market. Increased demand, driven by environmental concerns and more stringent regulatory pressures, related to recycling and waste management solutions has led to increases in the use of sorting machines in recycling plants. Moreover, advances made in machine learning, artificial intelligence, and sensor technologies increased the accuracy and efficiency level of the sorting systems. This is further supplemented by a demand for accelerated production cycles and in areas of food processing and mining, an emphasis on automation contributes to market growth. However, the market faces challenges, including the high initial investment required for advanced sorting machines, which may deter small and medium-sized enterprises from adopting these systems.

The optical sorter segment is predicted to hold the greatest market share through the forecast period.

Based on the product type, the sorting machines market is classified into weight sorter and optical sorter. Among these, the optical sorter segment is predicted to hold the greatest market share through the forecast period. This is attributed to the optical sorting technology is highly valued for its ability to precisely identify and separate materials based on visual characteristics such as color, shape, and size, making it ideal for industries like food processing, recycling, and mining.

The food & beverage segment is anticipated to hold the greatest market share during the projected timeframe.

Based on the end use, the sorting machines market is divided into mining, food & beverage, and pharmaceutical. Among these, the food & beverage segment is anticipated to hold the greatest market share during the projected timeframe. This is driven by the increasing demand for high-quality food products, where sorting machines play a critical role in ensuring food safety, consistency, and quality by efficiently removing contaminants, damaged products, and non-conforming items.

Europe is estimated to hold the largest sorting machines market share over the forecast period.

Europe is estimated to hold the largest sorting machines market share over the forecast period. This growth is attributed to the region's increasing industrial activities, investments in infrastructure development, and a growing focus on automation across various industries, including food processing, mining, and recycling.

Asia-Pacific is predicted to have the fastest CAGR growth in the sorting machines market over the forecast period. This is due to rapid industrialization, increased automation in manufacturing processes, and growing demand for sorting machines across various sectors, including food processing, mining, and recycling. Countries such as China, India, and Japan are investing heavily in technological advancements and infrastructure development, which drives the adoption of sorting machines.

Company Profiling

Major key players in the sorting machines market are TOMRA, BarcoVision, Daewon GSE, BT-Wolfgang Binder, Dematic, Bühler Sortex, Sesotec, Raytec Vision, Concept Engineers, Satake Corporation, CP Global, National Recovery Technologies, GREEFA, Allgaier Werke, Cumbria, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, Dematic officially opened a new office in Riyadh, Saudi Arabia, enhancing its presence in the Middle East. This expansion aims to meet the growing demand for automation solutions, including sorting machines, across various sectors such as e-commerce and pharmaceuticals.

Market Segment

This study forecasts global, regional, and country revenue from 2023 to 2033. Spherical Insights has segmented the sorting machines market based on the below-mentioned segments:

Global Sorting Machines Market, By Product Type

- Weight Sorter

- Optical Sorter

Global Sorting Machines Market, By End Use

- Mining

- Food & Beverage

- Pharmaceutical

Global Sorting Machines Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa