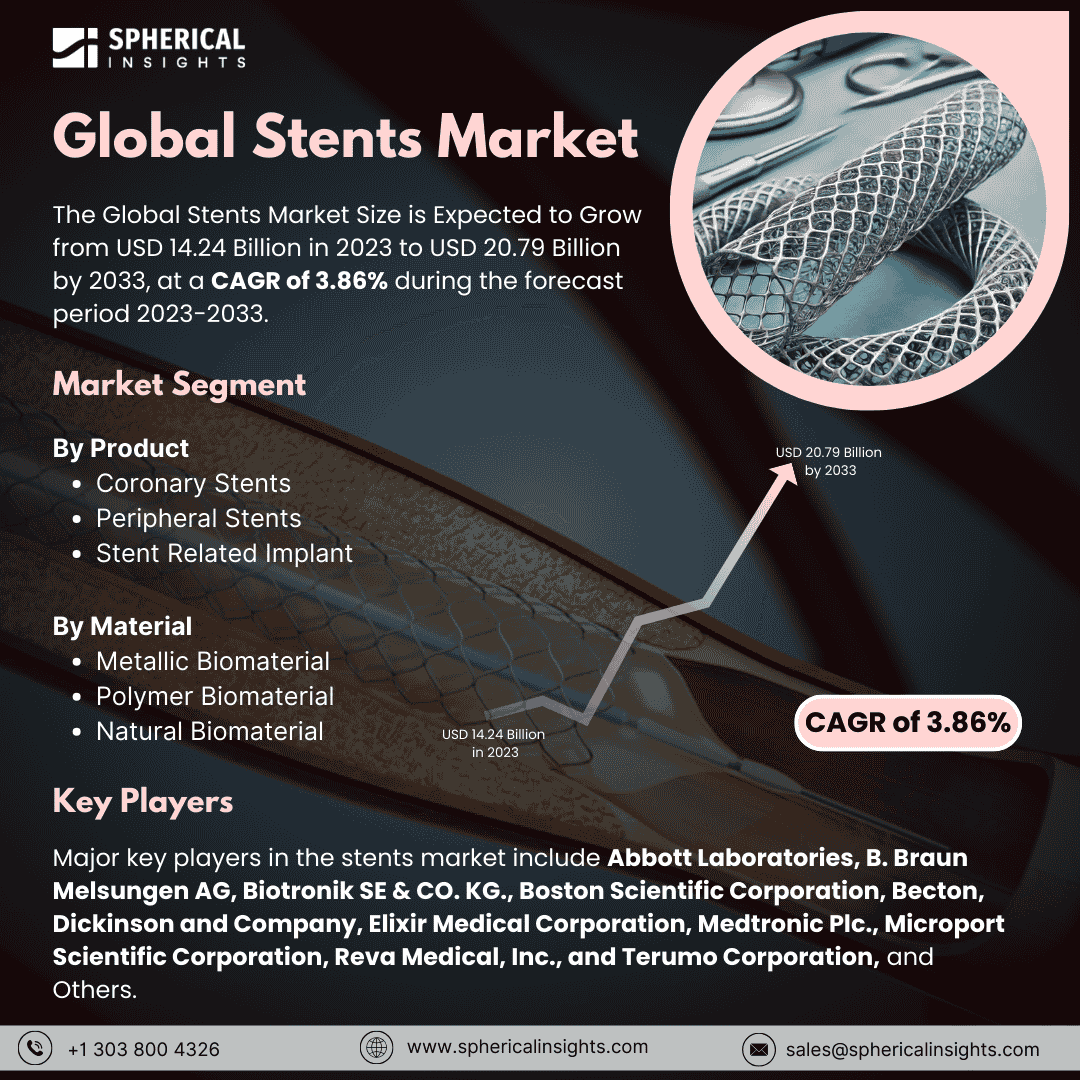

Global Stents Market Size to worth USD 20.79 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Stents Market Size is Expected to Grow from USD 14.24 Billion in 2023 to USD 20.79 Billion by 2033, at a CAGR of 3.86% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Stents Market Size, Share, and COVID-19 Impact Analysis, By Product (Coronary Stents, Peripheral Stents, and Stent-Related Implants), By Material (Metallic Biomaterial, Polymer Biomaterial, and Natural Biomaterial), By End-User (Hospital and Ambulatory Surgical Centers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

A tiny, mesh-like tube called a stent is placed into a restricted or blocked route, like an artery or duct, to maintain its opening and guarantee appropriate fluid drainage or blood flow with medical treatments like angioplasty, stents are frequently used to treat illnesses like coronary artery disease by assisting with the restoration of normal cardiac blood circulation. The growing demand for minimally invasive procedures like angioplasty, which have advantages including smaller incisions, quicker recovery periods, and fewer complications, is anticipated to fuel the growth of the stent market. Stent technological advancements like drug-eluting and bioresorbable stents have also helped the industry expand since they provide better patient outcomes, which makes them even more alluring. The Government of India's price cap on cardiac stents is one important government move for the stent business. The goal of this program is to increase stents' accessibility and affordability for patients. Prices for Drug-Eluting Stents (DES) and Bare Metal Stents (BMS) were set by the National Pharmaceutical Pricing Authority (NPPA) at Rs. 29,600 and Rs. 7,260, respectively, excluding VAT and other municipal taxes. However, the market for stents can be greatly impacted by stent recalls and failures, which can result in major health issues, a decline in patient confidence, and heightened regulatory scrutiny that hinders market expansion.

The coronary stents segment is predicted to hold the highest market share through the forecast period.

Based on the product, the stents market is classified into coronary stents, peripheral stents, and stent-related implants. Among these, the coronary stents segment is predicted to hold the highest market share through the forecast period. The most often utilized stent type worldwide, coronary stents are used to treat coronary arteries that are narrowed or occluded as a result of cardiovascular disorders. This category includes bioabsorbable, drug-eluting, and bare-metal stents. Lilac, femoral-popliteal, renal, and carotid stents are all part of the expanding peripheral stents market, which is predicted to increase its market share significantly. Stent grafts and other implantable devices are included in the stent-related implant segment, which has a lower market share.

The metallic biomaterial segment is anticipated to hold the highest market share during the projected timeframe.

Based on the material, the stents market is divided into metallic biomaterial, polymer biomaterial, and natural biomaterial. Among these, the metallic biomaterial segment is anticipated to hold the highest market share during the projected timeframe. Metallic biomaterials like stainless steel, cobalt-chromium alloy, and platinum-chromium alloy are commonly used in stent production due to their strength and compatibility with the human body. However, polymer and natural biomaterials are growing in popularity due to their unique advantages, such as biodegradability and flexibility, and their ability to stimulate tissue growth, making them suitable for bioresorbable stents.

The hospital segment is anticipated to hold the highest market share during the projected timeframe.

Based on the end-user, the stents market is divided into hospital and ambulatory surgical centers. Among these, the hospital segment is anticipated to hold the highest market share during the projected timeframe. Stent operations are primarily performed in hospitals because of their state-of-the-art facilities and highly qualified staff. Same-day operations are more affordable and need less recovery time at ambulatory surgery facilities (ASCs). Hospitals have a larger market share because stent operations are more complicated.

North America is estimated to hold the largest share of the stents market over the forecast period.

North America is estimated to hold the largest share of the stents market over the forecast period. The North America stent market dominates due to chronic disease prevalence, elderly population, industry presence, healthcare infrastructure, and increased awareness. Key players and research institutions are focused on developing innovative stents for various medical conditions, driving market growth.

Asia Pacific is predicted to have the fastest CAGR growth in the stents market over the forecast period. The Asia Pacific region is predicted to experience the fastest growth due to factors like the aging population in countries like China and India, which currently has 149 million individuals aged 60 and above, accounting for 10.5% of the population as of July 2022.

Company Profiling

Major key players in the stents market include Abbott Laboratories, B. Braun Melsungen AG, Biotronik SE & CO. KG., Boston Scientific Corporation, Becton, Dickinson and Company, Elixir Medical Corporation, Medtronic Plc., Microport Scientific Corporation, Reva Medical, Inc., and Terumo Corporation, and Others.

Recent Development

- In September 2024, leading coronary stent supplier Translumina Therapeutics began operations in the United Arab Emirates. With more than 10 years of safety and effectiveness research behind them, their partnership with the prestigious German Heart Center has resulted in the development of cutting-edge drug-eluting stent technologies, such as the most researched DES in the world.

- In July 2024, the NMPA approved the first next-generation bioresorbable cardiac stent, Firesorb, for sale to Shanghai MicroPort Medical (Group) Co., Ltd., a subsidiary of MicroPort Scientific Corporation. In important clinical metrics including success rates and late lumen loss, pre-market research had demonstrated that Firesorb performed on par with permanent drug-eluting stents.

- In May 2024, in India, Abbott introduced the XIENCE Sierra, a novel coronary stent system intended to treat artery blockages. For complicated cardiac conditions, this XIENCE family addition provides enhanced safety. Abbott's inventions have continuously improved the field of angioplasty, which is a technique to open blocked or constricted arteries. Stent implantation is usually required to maintain the artery's openness.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the stents market based on the below-mentioned segments:

Global Stents Market, By Product

- Coronary Stents

- Peripheral Stents

- Stent Related Implant

Global Stents Market, By Material

- Metallic Biomaterial

- Polymer Biomaterial

- Natural Biomaterial

Global Stents Market, By End User

- Hospital

- Ambulatory Surgical Center

Global Stents Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa