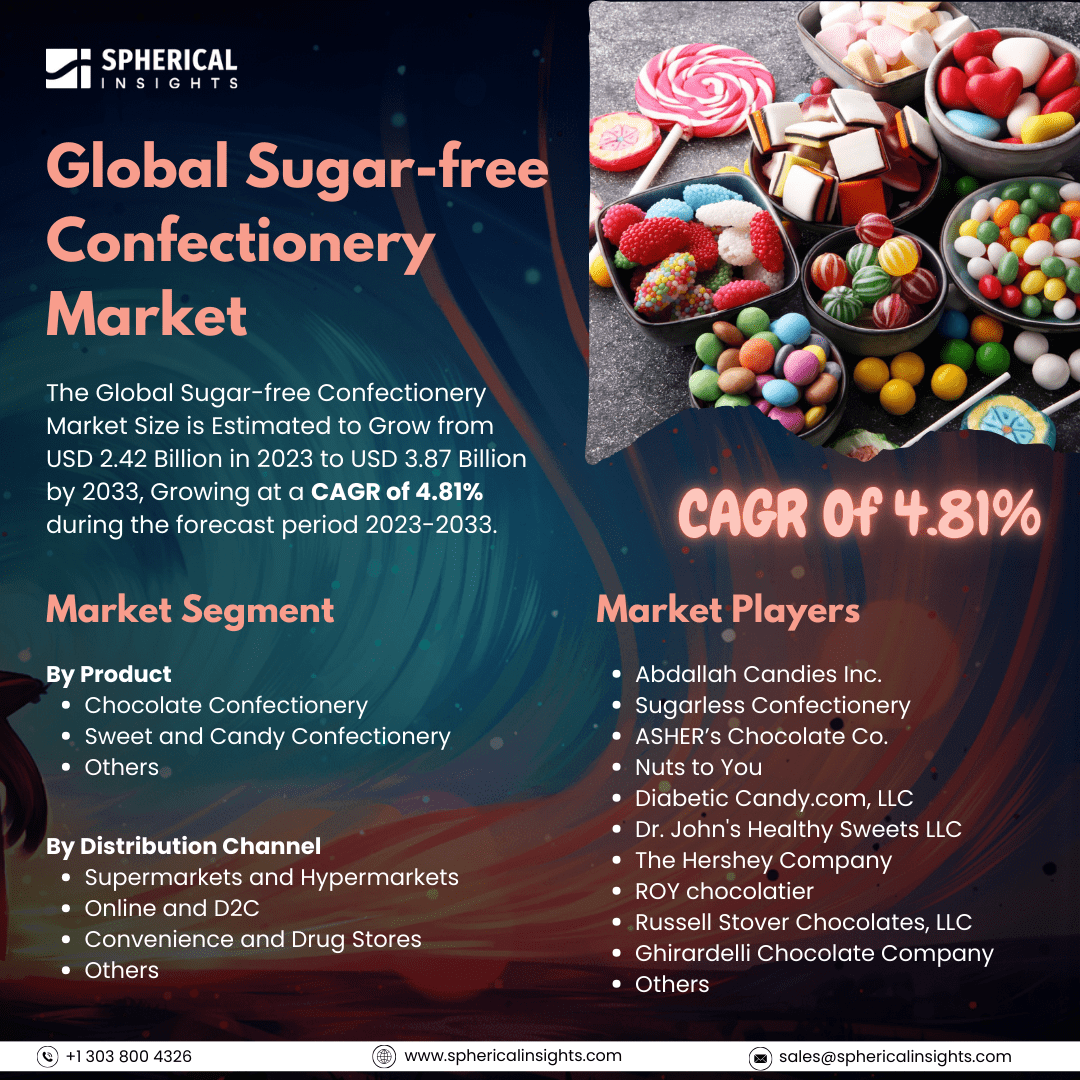

Global Sugar-free Confectionery Market Size To Worth USD 3.87 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Sugar-free Confectionery Market Size is Estimated to Grow from USD 2.42 Billion in 2023 to USD 3.87 Billion by 2033, Growing at a CAGR of 4.81% during the forecast period 2023-2033.

Browse key industry insights spread across 215 pages with 110 Market data tables and figures & charts from the report on the Global Sugar-free Confectionery Market Size, Share, and COVID-19 Impact Analysis, By Product (Chocolate Confectionery, Sweet and Candy Confectionery, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Online and D2C, Convenience and Drug Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The market for sugar-free chocolates, candies, and other confections is known as the global sugar-free confectionery market. These goods contain lactitol, erythritol, and xylitol as sugar alternatives. Sales of sugar-free products such as confectionery are mostly driven by the rising incidence of diseases like diabetes, hypertension, and obesity that are associated with a high sugar intake as well as the adoption of diets that embrace health and wellness trends. Products made using sugar alternatives or natural sweeteners like stevia, erythritol, and xylitol comprise the sugar-free confectionery business. These items include candies, chocolates, gum, and other sweets. Choosing sugar-free options is further encouraged by the rising popularity of alternative diet plans like low-carb, keto, and paleo, which assist limit sugar and carbohydrate intake. Producers are expanding their product lines to include sugar-free chocolates, gummies, candies, lollipops, and pastries, as well as sugar-free versions of traditional sweets like fudge, caramel, and hard candies. By offering a variety of choices, the category attracts more customers by satisfying a wider range of consumer tastes and preferences. However, the high production costs involved in employing substitute sweeteners and preserving product quality are some of the biggest barriers to the market for sugar-free confections.

The chocolate confectionery segment held the largest share of 40.57% in 2023 and is estimated to grow at a CAGR of 2.78% throughout the projection period.

Based on the product, the global sugar-free confectionery market is categorized into chocolate confectionery, sweet and candy confectionery, and others. Among these, the chocolate confectionery segment held the largest share of 40.57% in 2023 and is estimated to grow at a CAGR of 2.78% throughout the projection period. The market is driven by chocolate confections because they appeal to people of all ages and demographics. Whether in its original or sugar-free form, it is a popular choice due to its rich taste and texture. Additionally, the market is expanding due to the introduction of dark chocolate, which has several health benefits, such as antioxidants and possible heart health benefits. The industry expansion is also being aided by notable innovation in the production of sugar-free alternatives that maintain the allure of conventional chocolate.

The supermarkets and hypermarkets segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the global sugar-free confectionery market is divided into supermarkets and hypermarkets, online and D2C, convenience and drug stores, and others. Among these, the supermarkets and hypermarkets segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. A wide variety of items, including sugar-free confections, are available in supermarkets and hypermarkets. This extensive assortment appeals to a diverse consumer by accommodating a range of dietary needs, tastes, and preferences. They also allow customers to purchase sugar-free candy in addition to other household goods and groceries at one location.

North America is expected to hold the largest share of the global sugar-free confectionery market through the forecast period.

North America is expected to hold the largest share of the global sugar-free confectionery market through the forecast period. Increased consumer demand for sugar-free products is driving the market's expansion in North America due to growing knowledge of the harmful effects of sugar on health, including diabetes and obesity. Dietary changes, including sugar-free substitutes, are also necessary because of the region's high rates of diabetes, obesity, and heat-related illnesses. In addition, regional governments' implementation of policies and recommendations that encourage better eating and impose taxes on sugar-filled goods is contributing to the growth. Furthermore, North America has a strong retail network that includes both online and physical stores, which makes sugar-free candy readily available to customers.

Asia Pacific is predicted to grow at the fastest CAGR of the global sugar-free confectionery market over the forecast period. Asia-Pacific consumers have become more health-conscious due to a consistent increase in disposable income levels and increased access to health-related information. As a result, there has become more emphasis on reducing sugar consumption, especially among metropolitan individuals. Furthermore, the demand for healthier food substitutes is being driven by the expanding middle class in nations such as China, India, and Southeast Asia. Spending on sugar-free chocolates and candies is growing among consumers.

Company Profiling

Major key players in the global sugar-free confectionery market include Abdallah Candies Inc., Sugarless Confectionery, ASHER’s Chocolate CO., Nuts to You, Diabetic Candy.com, LLC, Dr. John's Healthy Sweets LLC, THE HERSHEY COMPANY, ROY chocolatier, Russell Stover Chocolates, LLC, Ghirardelli Chocolate Company, and others.

Recent Developments

- In May 2024, Asher's Chocolate declared the arrival of a new line of sugar-free chocolates, including Mini Peanut Butter Cups, Raspberry Jellies, and Vanilla Caramels. Since they are prepared with high-quality ingredients and natural sweeteners, these products are a great choice for people with diabetes, those watching their sugar intake, and those on the ketogenic diet. The chocolates are sold at a few Delaware Valley retail locations as well as the company's web store.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global sugar-free confectionery market based on the below-mentioned segments:

Global Sugar-free Confectionery Market, By Product

- Chocolate Confectionery

- Sweet and Candy Confectionery

- Others

Global Sugar-free Confectionery Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Online and D2C

- Convenience and Drug Stores

- Others

Global Sugar-free Confectionery Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa