Global Sukuk Market Size to worth USD 4263.3 Billion by 2033

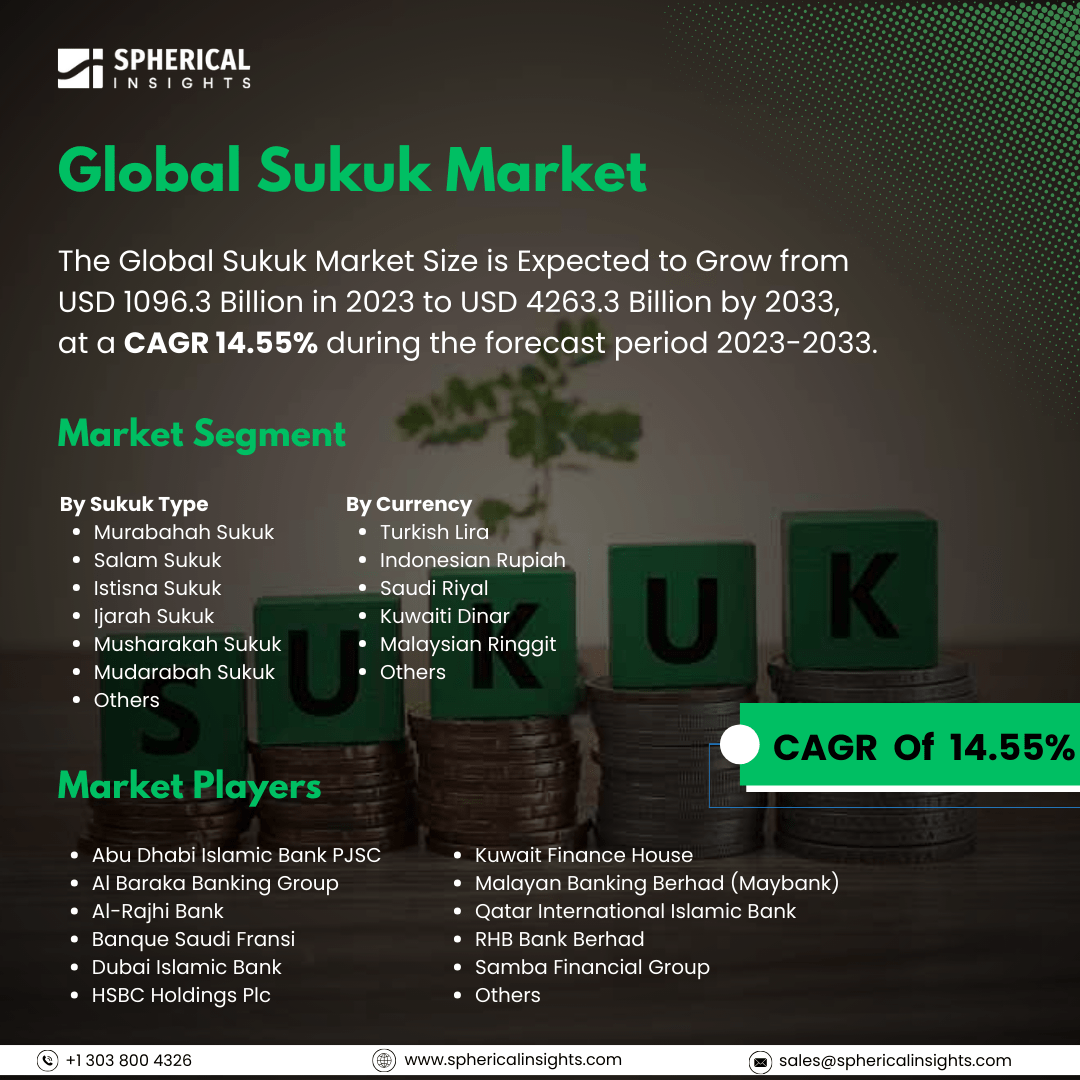

According to a research report published by Spherical Insights & Consulting, The Global Sukuk Market Size is Expected to Grow from USD 1096.3 Billion in 2023 to USD 4263.3 Billion by 2033, at a CAGR 14.55% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Sukuk Market Size, Share, and COVID-19 Impact Analysis, By Sukuk Type (Murabahah Sukuk, Salam Sukuk, Istisna Sukuk, Ijarah Sukuk, Musharakah Sukuk, Mudarabah Sukuk, and Others), By Currency (Turkish Lira, Indonesian Rupiah, Saudi Riyal, Kuwaiti Dinar, Malaysian Ringgit, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The Sukuk market refers to a marketplace for financial instruments known as Sukuk, which are similar to bonds but are specifically issued in Islamic nations. Sukuk is a type of Islamic bond that represents ownership shares in an asset or a portfolio of assets. This market is primarily driven by the increasing acceptance of Islamic finance principles worldwide, especially in Muslim-majority regions. Investors in these areas seek Sharia-compliant investment options, which means avoiding interest (Riba) and excessive uncertainty (Gharar). Instead, returns are based on ownership of underlying assets rather than fixed interest payments, making Sukuk an attractive alternative to conventional bonds for both Muslim and non-Muslim investors who are looking for ethical investments. Despite its growth, the Sukuk market faces several challenges that hinder its expansion. Key issues include regulatory inconsistencies across different jurisdictions, which create barriers to issuance and investment; a lack of standardized frameworks and practices that can lead to confusion among investors; and limited awareness and understanding of Sukuk products in some regions. Furthermore, economic fluctuations and geopolitical uncertainties may affect investor confidence, while competition from conventional bonds and other financial instruments can also limit the appeal of Sukuk. These factors collectively impact liquidity and market depth, making it difficult for the Sukuk market to reach its full potential.

The murabahah sukuk segment is predicted to hold the largest market share through the forecast period.

Based on the Sukuk Type, the sukuk market is classified into murabahah sukuk, salam sukuk, istisna sukuk, ljarah sukuk, musharakah sukuk, mudarabah sukuk, and others. Among these, the murabahah sukuk segment is predicted to hold the largest market share through the forecast period. This is due to its structured financing model, which provides a clear and transparent pricing mechanism. This model appeals to a wide range of investors seeking compliance with Sharia law while ensuring predictable returns. The increasing demand for ethical investment opportunities, coupled with robust regulatory support and the rising number of issuances, further solidifies its position as a preferred choice among Islamic finance instruments.

The Malaysian ringgit segment is anticipated to hold the highest market share during the projected timeframe.

Based on the currency, the sukuk market is divided into Turkish lira, Indonesian rupiah, Saudi riyal, Kuwaiti dinar, Malaysian ringgit, and others. Among these, the Malaysian ringgit segment is anticipated to hold the highest market share during the projected timeframe. This is due to Malaysia's status as a leading hub for Islamic finance and its well-established regulatory framework. The country's strong economic fundamentals, coupled with the government's commitment to promote and support Islamic financial instruments, enhance investor confidence in the ringgit-denominated sukuk. Additionally, the growing demand for Sharia-compliant investments from both local and international investors further solidifies the Malaysian ringgit's position as a preferred currency in the sukuk market, driving its growth and popularity in the region.

Asia Pacific is estimated to hold the largest share of the sukuk market over the forecast period.

Asia Pacific is estimated to hold the largest share of the sukuk market over the forecast period. The growth of sukuk is driven by a robust Islamic finance ecosystem within the region and a rising demand for Sharia-compliant investment products. Countries like Malaysia and Indonesia are leading the charge, supported by strong regulatory frameworks and an expanding base of investors seeking ethical financing solutions. With the region's economic growth and government initiatives promoting Islamic finance, the attractiveness of sukuk in the Asia Pacific is likely to increase.

Europe is expected to grow the fastest during the forecast period. Interest in Islamic finance is on the rise in Europe, with a growing number of issuances from corporations and governments in the region. The diverse investor base is increasingly seeking alternative investment opportunities, and Sukuk presents a compelling option that aligns with ethical and sustainable investment principles. Additionally, the supportive regulatory environment in several European countries is fostering innovation and enhancing market access, contributing to the rapid expansion of the sukuk landscape.

Company Profiling

Major key players in the sukuk market include Abu Dhabi Islamic Bank PJSC, Al Baraka Banking Group, Al-Rajhi Bank, Banque Saudi Fransi, Dubai Islamic Bank, HSBC Holdings Plc, Kuwait Finance House, Malayan Banking Berhad, Qatar International Islamic Bank, RHB Bank Berhad, Samba Financial Group, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, Lunate Capital LLC, based in Abu Dhabi, launched an exchange-traded fund (ETF) that tracks global Islamic bonds, aiming to meet the increasing demand for stable investment opportunities in the region. The Chimera JPMorgan Global Sukuk ETF is set to be listed on the Abu Dhabi Securities Exchange. Its objective is to replicate the performance of the J.P. Morgan Global Investment Grade Sukuk Index, which comprises over 70 liquid, US dollar-denominated sukuk instruments.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the sukuk market based on the below-mentioned segments:

Global Sukuk Market, By Sukuk Type

- Murabahah Sukuk

- Salam Sukuk

- Istisna Sukuk

- Ijarah Sukuk

- Musharakah Sukuk

- Mudarabah Sukuk

- Others

Global Sukuk Market, By Currency

- Turkish Lira

- Indonesian Rupiah

- Saudi Riyal

- Kuwaiti Dinar

- Malaysian Ringgit

- Others

Global Sukuk Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa