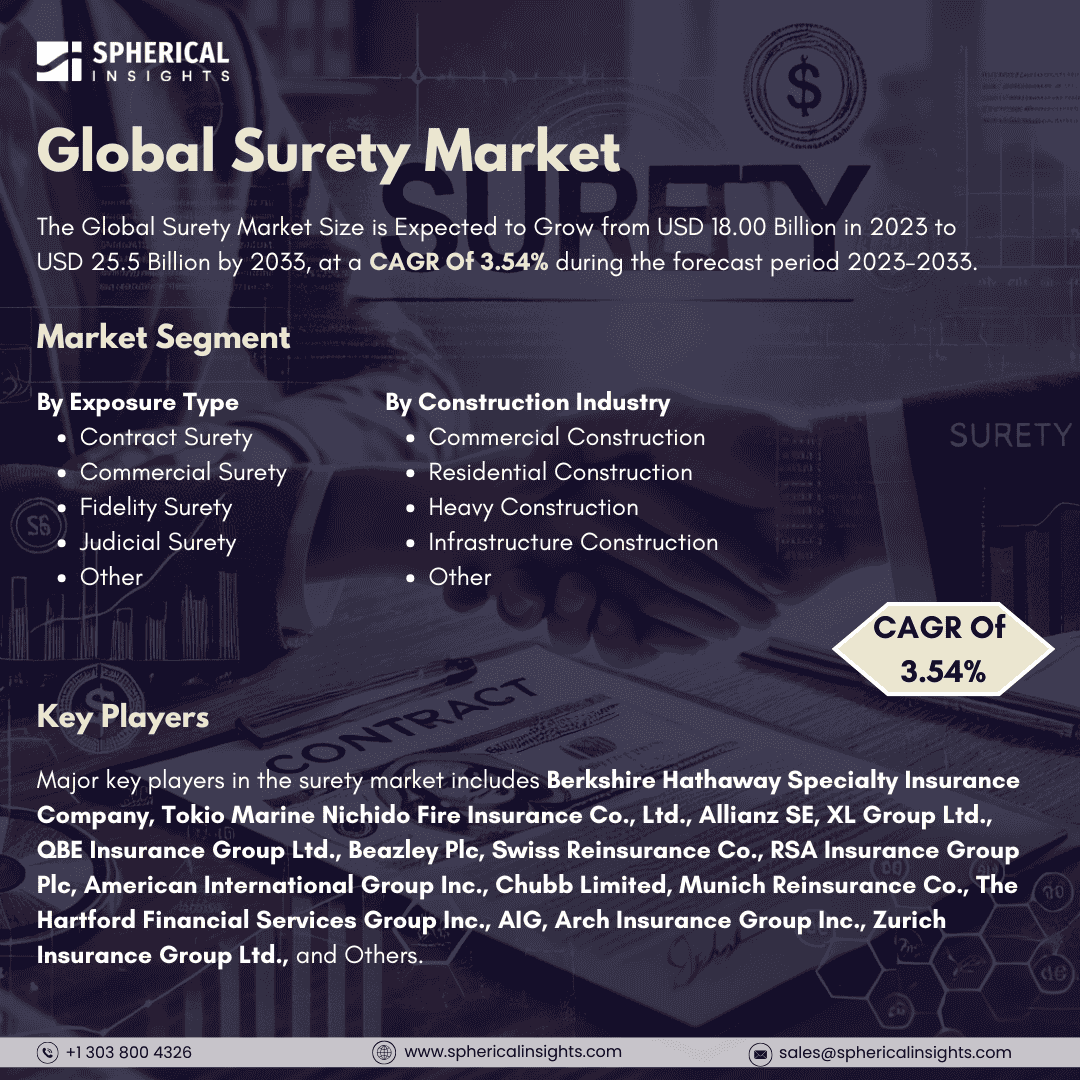

Global Surety Market Size to worth USD 25.5 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Surety Market Size is Expected to Grow from USD 18.00 Billion in 2023 to USD 25.5 Billion by 2033, at a CAGR 3.54% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Surety Market Size, Share, and COVID-19 Impact Analysis, By Exposure Type (Contract Surety, Commercial Surety, Fidelity Surety, Judicial Surety, and Other), By Construction Industry (Commercial Construction, Residential Construction, Heavy Construction, Infrastructure Construction, and Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

A surety is a natural person or a legal person who agrees to repay a loan if the debtor defaults on repayment. This assumption is again etched in black and white in a form of a contract known as a surety bond. The risk regarding further compliance of contracts is most usually the reason for the issuance of surety bonds. Yes, trend factors have an impact on the surety market, including ability to acquire large multibillion-dollar construction contracts with surety bonds outlining their completion. Other important trends include the growth of technology through digital means, artificial intelligence and data analytics which help deal with risks and underwriting. These include expanding the business and increasing revenue, which will create a growing requirement for surety bonds. In addition, the expansion of digital payments means that clients pay faster, and the development of self-issued bonds is also a factor in the expansion of the market. But there are also some weaknesses in the surety market. Development and natural disasters which lead to economic downturns can lead to large amounts of things going bad, thereby increasing the probability of sureties going out of business. Likewise, the risk of putting out a document because the law changes, so compliance requirements change. An insufficient workforce may affect the construction industry and the claro of surety bonds.

The contract surety segment is predicted to hold the largest market share through the forecast period.

Based on the exposure type, the surety market is classified into contract surety, commercial surety, fidelity surety, judicial surety, and other. Among these, the contract surety segment is predicted to hold the largest market share through the forecast period. This is due to its crucial function in delivering financial assurances that safeguard project owners and stakeholders from contractor failures. The growth of this sector is influenced by a rise in construction activities, stricter regulations, and an increasing necessity for risk management solutions across multiple industries. As companies seek stability and confidence in their projects, the dependence on contract surety bonds continues to grow, reinforcing its status as the leading market share holder throughout the projected period.

The commercial construction segment is anticipated to hold the highest market share during the projected timeframe.

Based on the construction industry, the surety market is divided into commercial construction, residential construction, heavy construction, infrastructure construction, and other. Among these, the commercial construction segment is anticipated to hold the highest market share during the projected timeframe. Largely due to the ongoing development of urban infrastructure and corporate projects. As businesses make investments in new buildings and renovations, the demand for construction services, especially in commercial real estate, is on the rise. This expansion is driven by factors including population growth, heightened consumer spending, and favourable economic conditions, all of which collectively increase the requirement for strong commercial construction solutions.

North America is estimated to hold the largest share of the surety market over the forecast period.

North America is estimated to hold the largest share of the surety market over the forecast period. This is resulting from a combination of solid economic growth, extensive infrastructure initiatives, and a well-established construction sector. The region's regulatory structure, which emphasizes the importance of surety bonds for project finance and risk management, strengthens this leadership. Moreover, the presence of many large construction companies and an overall increase in investments from both public and private sectors enhance North America's dominant position in the surety market.

Europe is expected to grow the fastest during the forecast period, boosted by heightened construction activities and greater investment in infrastructure initiatives across various nations. The region is concentrating on upgrading its aging infrastructure, resulting in a significant rise in the demand for surety bonds as a means of ensuring the completion of projects and financial security. Additionally, regulatory reforms and initiatives aimed at strengthening the construction sector are expected to promote the adoption of surety solutions, positioning Europe as a swiftly expanding market in the industry.

Company Profiling

Major key players in the surety market includes Berkshire Hathaway Specialty Insurance Company, Tokio Marine Nichido Fire Insurance Co., Ltd., Allianz SE, XL Group Ltd., QBE Insurance Group Ltd., Beazley Plc, Swiss Reinsurance Co., RSA Insurance Group Plc, American International Group Inc., Chubb Limited, Munich Reinsurance Co., The Hartford Financial Services Group Inc., AIG, Arch Insurance Group Inc., Zurich Insurance Group Ltd., and Others.

Recent Developments

- In June 2024, Tata AIG General Insurance has issued India's largest Performance Surety Bond, valued at over Rs 100 crores, in Mumbai. This milestone comes just two months after the company launched its Surety Insurance Bond offerings to the market. Surety Insurance Bonds are designed to protect project owners or beneficiaries from losses that may arise due to a contractor's non-performance, failure to fulfill obligations, or breach of contractual agreements as outlined in contracts or bidding documents.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the surety market based on the below-mentioned segments:

Global Surety Market, By Exposure Type

- Contract Surety

- Commercial Surety

- Fidelity Surety

- Judicial Surety

- Other

Global Surety Market, By Construction Industry

- Commercial Construction

- Residential Construction

- Heavy Construction

- Infrastructure Construction

- Other

Global Surety Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa