Global Tax Advisory Services Market Size to worth USD 68.05 Billion by 2033

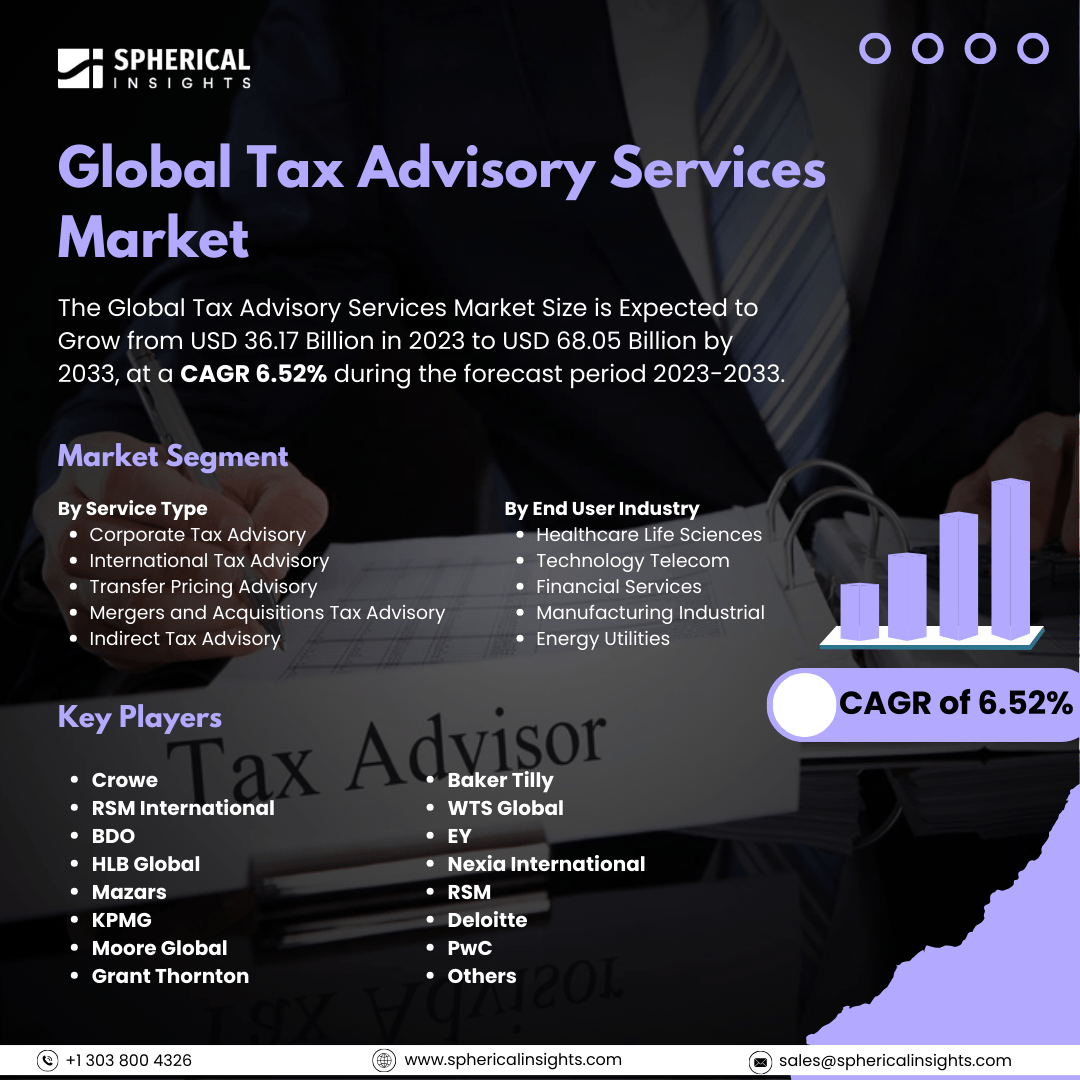

According to a research report published by Spherical Insights & Consulting, The Global Tax Advisory Services Market Size is Expected to Grow from USD 36.17 Billion in 2023 to USD 68.05 Billion by 2033, at a CAGR 6.52% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Tax Advisory Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Corporate Tax Advisory, International Tax Advisory, Transfer Pricing Advisory, Mergers and Acquisitions Tax Advisory, and Indirect Tax Advisory), By End User Industry (Healthcare Life Sciences, Technology Telecom, Financial Services, Manufacturing Industrial, and Energy Utilities), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The tax advisory services market includes a variety of professional services designed to help individuals and businesses navigate complex tax regulations and optimize their tax situations. This market is influenced by several factors, such as the increasing complexity of tax laws, the globalization of businesses, and a growing emphasis on compliance and risk management. As companies expand their international operations, they encounter intricate tax regulations that require expert guidance. Additionally, the rise of digital financial services has increased the demand for tax planning and advisory services. However, the market also faces challenges, including the high costs associated with hiring tax advisors and the potential for changes in tax legislation that can disrupt established practices. Furthermore, the growing availability of automated tax software solutions creates competition for traditional advisory services, forcing firms to adapt and innovate to remain relevant in this rapidly changing landscape.

The corporate tax advisory segment is predicted to hold the largest market share through the forecast period.

Based on the service type, the tax advisory services market is classified into corporate tax advisory, international tax advisory, transfer pricing advisory, mergers and acquisitions tax advisory, and indirect tax advisory. Among these, the corporate tax advisory segment is predicted to hold the largest market share through the forecast period. The increasing complexity of tax regulations and the heightened scrutiny from tax authorities worldwide are driving companies to seek specialized guidance. Businesses need assistance to navigate intricate tax laws, optimize their tax positions, and ensure compliance, resulting in a growing demand for expert advisory services. Additionally, the rise of multinational corporations and cross-border transactions further enhances the need for sophisticated tax strategies.

The healthcare life sciences segment is anticipated to hold the highest market share during the projected timeframe.

Based on the end user industry, the tax advisory services market is divided into healthcare life sciences, technology telecom, financial services, manufacturing industrial, and energy utilities. Among these, the healthcare life sciences segment is anticipated to hold the highest market share during the projected timeframe. The industry continues to undergo rapid innovation and face regulatory changes. The surge in biotechnology, pharmaceuticals, and medical devices has created a pressing need for expert tax advisory services to help navigate complex tax laws and incentives specific to these sectors. Moreover, companies in this field are striving to maximize their research and development tax credits while ensuring compliance with evolving regulations, which is expected to lead to a significant increase in demand for specialized tax advisory services.

North America is estimated to hold the largest share of the tax advisory services market over the forecast period.

North America is estimated to hold the largest share of the tax advisory services market over the forecast period. In the U.S. and Canada, robust and diverse economies, characterized by numerous multinational corporations and a well-established financial services sector, are driving the demand for tax advisory services. The advanced regulatory environment in these countries compels businesses to seek expert guidance for managing compliance and optimizing tax liabilities. Additionally, ongoing changes in tax legislation, including reforms and new incentives, create a continuous need for professional tax advisory services in this region.

Asia Pacific is expected to grow the fastest during the forecast period. The demand for tax advisory services is also driven by rapid economic development, increasing foreign direct investment, and the expansion of multinational enterprises in the Asia Pacific region. As countries like China and India enhance their regulatory frameworks and attract international businesses, the need for specialized tax advisory services becomes essential. The growing complexity of tax systems, coupled with an increasing awareness among companies about the benefits of tailored tax strategies, positions the Asia Pacific as a key growth area in the tax advisory sector.

Company Profiling

Major key players in the tax advisory services market includes Crowe, RSM International, BDO, HLB Global, Mazars, KPMG, Moore Global, Grant Thornton, Baker Tilly, WTS Global, EY, Nexia International, RSM, Deloitte, PwC, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, Lichen China Limited, a provider of financial and taxation services in China, has introduced an AI-powered software developed using GPT-based technology. This software serves as a virtual financial and tax advisor for both individuals and businesses. The company’s consultants will utilize the newly launched tool, Lichen AI Robot 1.0, to reduce client service costs and enhance efficiency in delivering solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the tax advisory services market based on the below-mentioned segments:

Global Tax Advisory Services Market, By Service Type

- Corporate Tax Advisory

- International Tax Advisory

- Transfer Pricing Advisory

- Mergers and Acquisitions Tax Advisory

- Indirect Tax Advisory

Global Tax Advisory Services Market, By End User Industry

- Healthcare Life Sciences

- Technology Telecom

- Financial Services

- Manufacturing Industrial

- Energy Utilities

Global Tax Advisory Services Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa