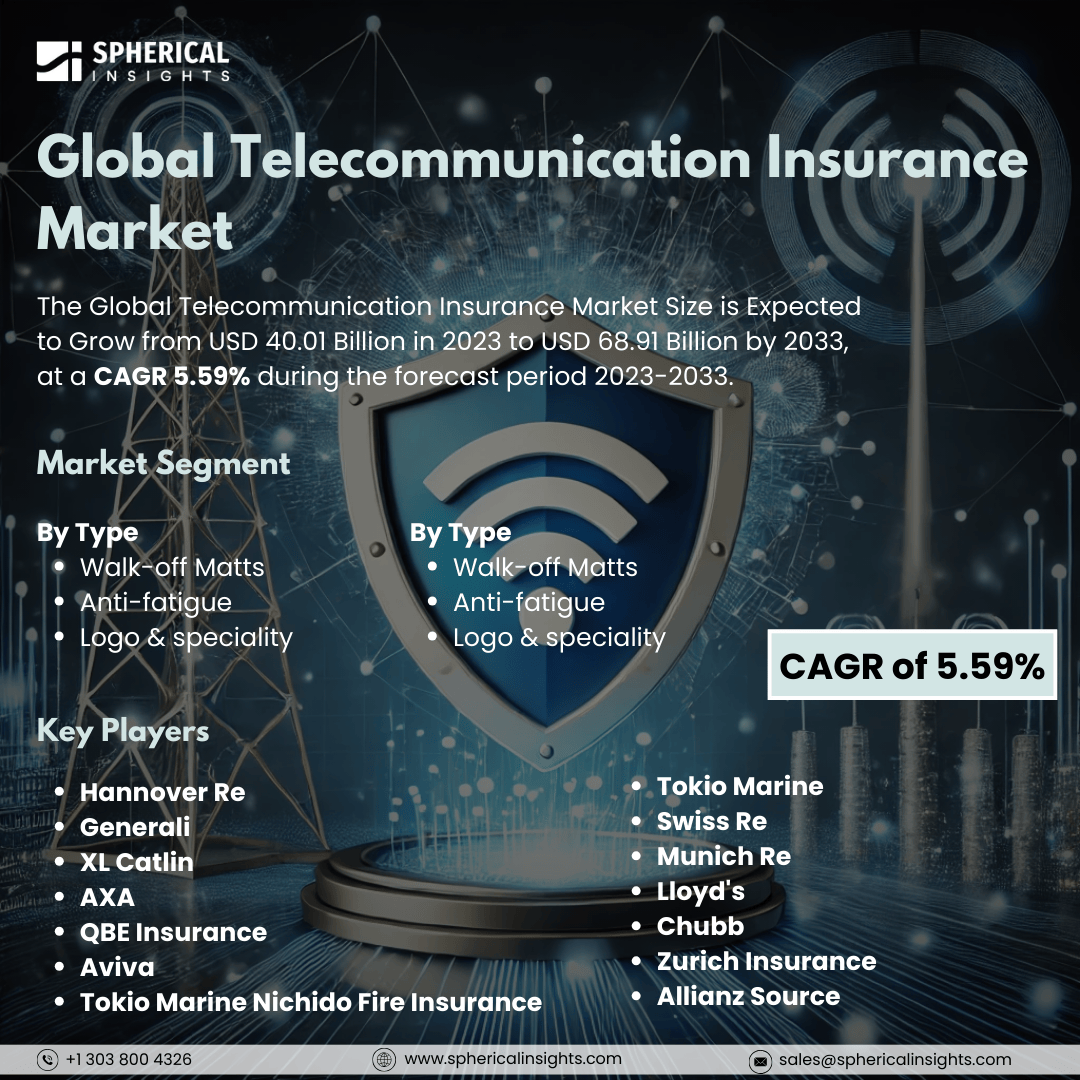

Global Telecommunication Insurance Market Size to worth USD 68.91 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Telecommunication Insurance Market Size is Expected to Grow from USD 40.01 Billion in 2023 to USD 68.91 Billion by 2033, at a CAGR 5.59% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Telecommunication Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Property Insurance, Liability Insurance, Business Interruption Insurance, Cyber Insurance, and Professional Indemnity Insurance), By Business Size (Small and Medium Enterprises (SMEs), Large Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Telecommunications insurance encompasses various policies designed to protect telecommunications companies and professionals from financial losses, liabilities, and other risks. The telecommunications insurance market is primarily driven by the rapid growth of the telecommunications sector, increasing digitalization, and a rising incidence of cyber threats. The emergence of new technologies, particularly 5G, further fuels the demand for specialized insurance products that address specific risks, thereby driving market growth. Moreover, an increasing awareness among telecom operators about the importance of risk management and business continuity plans contributes to the rising demand for tailored insurance solutions. As telecom companies expand their networks and services, they encounter heightened operational risks, such as network outages, data breaches, and challenges related to regulatory compliance. Additionally, the growing reliance on cloud services and the Internet of Things (IoT) necessitates comprehensive coverage to safeguard against potential losses.

The bulk property insurance segment is predicted to hold the largest market share through the forecast period.

Based on the coverage type, the telecommunication insurance market is classified into bulk property insurance, liability insurance, business interruption insurance, cyber insurance, and professional indemnity insurance. Among these, the bulk property insurance segment is predicted to hold the largest market share through the forecast period. This is due to its comprehensive coverage options; bulk property insurance is particularly appealing to large commercial properties and portfolios. This segment caters to businesses looking to mitigate risks related to property damage, natural disasters, and liability claims, thereby providing a sense of security for substantial investments. As industries continue to expand and diversify their asset bases, the demand for bulk property insurance is expected to rise, driven by the need for tailored solutions that address specific operational risks and compliance requirements.

The small and medium enterprises (SMEs) segment is anticipated to hold the highest market share during the projected timeframe.

Based on the business size, the telecommunication insurance market is divided into small and medium enterprises (SMEs), large enterprises. Among these, the small and medium enterprises (SMEs) segment is anticipated to hold the highest market share during the projected timeframe. Small and medium-sized enterprises (SMEs) increasingly recognize the importance of insurance in safeguarding their operations against unforeseen events. With growing awareness of risk management and the rising number of SMEs worldwide, there is a significant demand for customized insurance products that meet their unique needs. Contributing factors include government support for SMEs, favourable insurance policies, and an increasing reliance on technology, which together make insurance more accessible and essential for their sustainability and growth.

North America is estimated to hold the largest share of the telecommunication insurance market over the forecast period.

North America is estimated to hold the largest share of the telecommunication insurance market over the forecast period. The demand for specialized insurance solutions is largely driven by a well-established telecommunications infrastructure and the presence of numerous leading telecommunication companies. Rapid technological advancements and an increasing reliance on digital communication services create a need for insurance that covers potential risks associated with cyber threats, equipment damage, and service interruptions. Additionally, a favourable regulatory environment and significant investment in telecom innovations further boost the demand for comprehensive insurance coverage, solidifying North America's dominant position in the market.

Asia Pacific is expected to grow the fastest during the forecast period. The growth of insurance demand is driven by rapid economic development, urbanization, and an increased focus on technological advancements. The rise of digitalization across various sectors, coupled with the emergence of a growing middle class, has led to a heightened demand for both telecommunications services and the corresponding insurance solutions. Furthermore, the increasing frequency of natural disasters in the region necessitates robust insurance coverage to mitigate risks associated with property and business operations.

Company Profiling

Major key players in the telecommunication insurance market includes Hannover Re, Generali, XL Catlin, AXA, QBE Insurance, Aviva, Tokio Marine Nichido Fire Insurance, Tokio Marine, Swiss Re, Munich Re, Lloyd's, Chubb, Zurich Insurance, Allianz Source, and Others.

Recent Development

- In March 2024, bolttech and stc will explore expanding their partnership to integrate Internet of Things-enabled solutions beyond mobile devices into various aspects of a customer's digital lifestyle, including protection for home appliances, health electronics, and cyber assets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the telecommunication insurance market based on the below-mentioned segments:

Global Telecommunication Insurance Market, By Coverage Type

- Property Insurance

- Liability Insurance

- Business Interruption Insurance

- Cyber Insurance

- Professional Indemnity Insurance

Global Telecommunication Insurance Market, By Business Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Global Telecommunication Insurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa