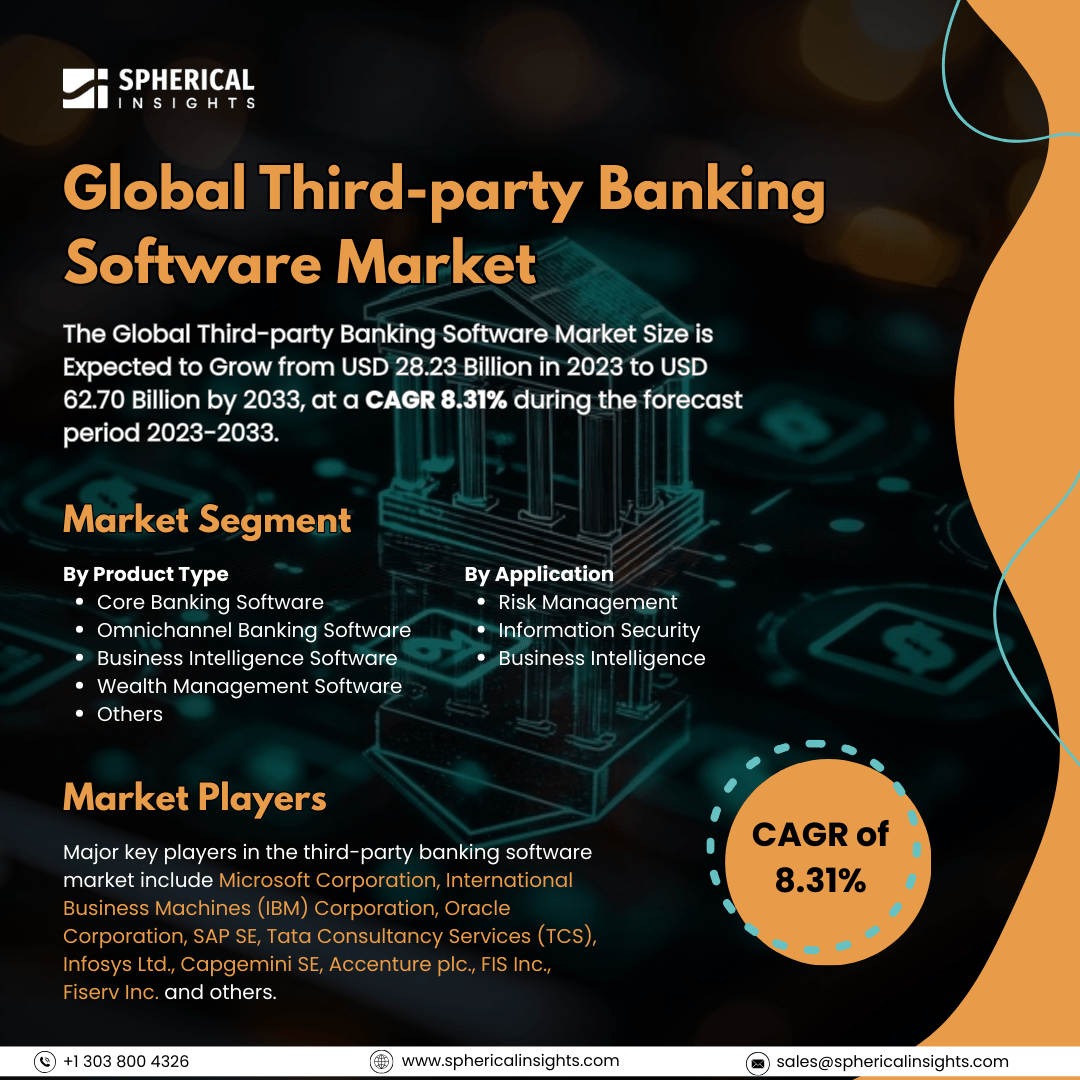

Global Third-party Banking Software Market Size to worth USD 62.70 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Third-party Banking Software Market Size is Expected to Grow from USD 28.23 Billion in 2023 to USD 62.70 Billion by 2033, at a CAGR 8.31% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Third-party Banking Software Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Core Banking Software, Omnichannel Banking Software, Business Intelligence Software, Wealth Management Software, and Others), By Application (Risk Management, Information Security, and Business Intelligence), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The third-party banking software market refers to the industry that provides software solutions for financial institutions. These solutions are developed by independent vendors, known as third-party banking software providers (FPPs). This market is primarily driven by several factors, including the increasing demand for digital banking experiences, growing customer expectations for seamless online services, strict regulatory compliance requirements, the rise of open banking initiatives, and the necessity for specialized solutions to manage complex financial operations. As a result, banks are adopting advanced third-party software to enhance functionality and efficiency. However, there are significant challenges in the third-party banking software market. These include concerns about data security and privacy, integration complexities with existing systems, resistance to change within banks, potential cost burdens associated with implementation and maintenance, a lack of skilled professionals to manage the software, and the difficulties in navigating complex regulatory compliance issues when adopting new third-party solutions.

The core banking software segment is predicted to hold the largest market share through the forecast period.

Based on the Product Type, the third-party banking software market is classified into core banking software, omnichannel banking software, business intelligence software, wealth management software, and others. Among these, the core banking software segment is predicted to hold the largest market share through the forecast period. The rapid changes in the banking sector present a risk that institutions may become ineffective if they do not adapt to these changes. As a result, banks have recognized the significant impact that digital technology has on consumers and their evolving expectations. Many of these expectations can be met through the adoption of core banking software. Consequently, the considerable efforts of various companies to enhance their banking software products are also driving the growth of this segment.

The risk management segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the third-party banking software market is divided into risk management, information security, and business intelligence. Among these, the risk management segment is anticipated to hold the highest market share during the projected timeframe. The application of risk management in third-party banking software allows banking institutions to enhance the effectiveness of their risk assessment processes and helps mitigate potential losses. The increasing frequency of security breaches, along with stricter regulatory requirements and advancements in the Internet of Things (IoT), is expected to drive further growth in this sector.

North America is estimated to hold the largest share of the third-party banking software market over the forecast period.

North America is estimated to hold the largest share of the third-party banking software market over the forecast period. The banking industry in North America is projected to grow, fueled by the increasing acceptance of third-party software aimed at enhancing operational efficiency. The presence of major players like Microsoft and IBM is anticipated to positively influence the industry’s growth. Additionally, North America is at the forefront of the digitalization of the Banking, Financial Services, and Insurance (BFSI) sector, which is expected to drive the demand for third-party software.

Asia Pacific is expected to grow the fastest during the forecast period. The growth in this sector can be attributed to notable regulatory requirements and the developing IT infrastructure in countries such as China, India, and Japan. Additionally, the efforts made by various organizations in the region to promote the use of third-party banking software are expected to further contribute to the expansion of this segment.

Company Profiling

Major key players in the third-party banking software market include Microsoft Corporation, International Business Machines (IBM) Corporation, Oracle Corporation, SAP SE, Tata Consultancy Services (TCS), Infosys Ltd., Capgemini SE, Accenture plc., FIS Inc., Fiserv Inc. and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the third-party banking software market based on the below-mentioned segments:

Global Third-party Banking Software Market, By Product Type

- Core Banking Software

- Omnichannel Banking Software

- Business Intelligence Software

- Wealth Management Software

- Others

Global Third-party Banking Software Market, By Application

- Risk Management

- Information Security

- Business Intelligence

Global Third-party Banking Software Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa