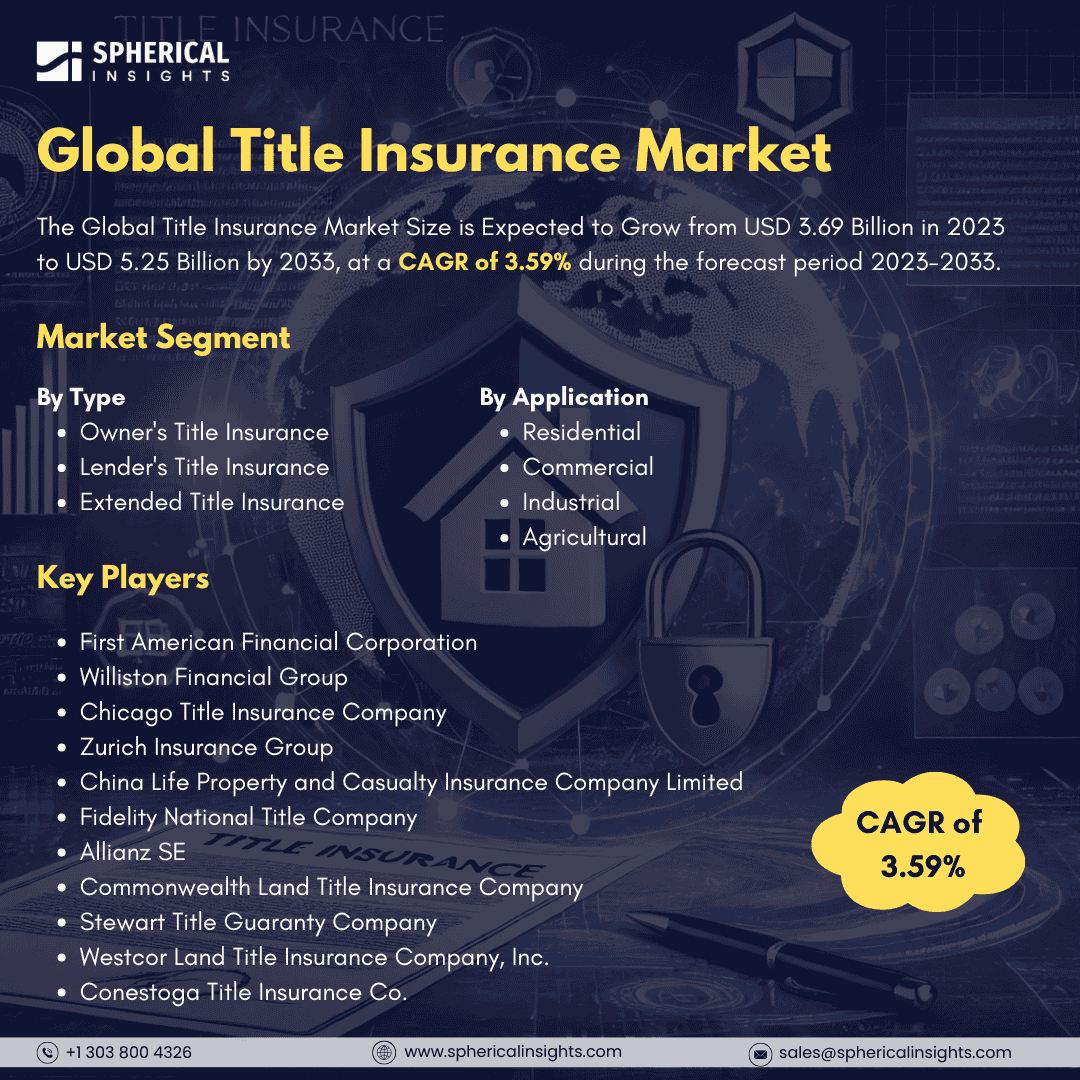

Global Title Insurance Market Size to worth USD 5.25 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Title Insurance Market Size is Expected to Grow from USD 3.69 Billion in 2023 to USD 5.25 Billion by 2033, at a CAGR of 3.59% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Title Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Owner's Title Insurance, Lender's Title Insurance, and Extended Title Insurance), By Application (Residential, Commercial, Industrial, and Agricultural), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Title insurance is a type of insurance that protects against financial losses that may arise from defects in a property's title. It is a contract that guarantees the insured will be compensated if a liability occurs that was previously unknown to the buyer or lender. Title insurance coverage can include legal costs, losses from fraudulent transactions, undisclosed encumbrances, and other title-related issues. Title insurance policies come with specific terms, conditions, and exclusions. The title insurance market is driven by several key factors, including the increasing complexity of real estate transactions, rising property ownership rates, and growing consumer awareness of the importance of title protection. As more individuals buy and sell properties, the potential for title disputes and claims rises, prompting buyers to seek insurance to safeguard their investments. Additionally, growth in both the residential and commercial real estate sectors, along with regulatory advancements in property laws, further boost the demand for title insurance. However, the title insurance market faces several challenges. Economic downturns, property market volatility, a lack of customer awareness regarding the need for title insurance, complex regulatory landscapes, high costs, and limited competition within the industry can restrict its growth. These factors often lead to less customer-centric pricing and service options.

The owner's title insurance segment is predicted to hold the largest market share through the forecast period.

Based on the type, the title insurance market is classified into owner's title insurance, lender's title insurance, and extended title insurance. Among these, the owner's title insurance segment is predicted to hold the largest market share through the forecast period. The demand for title insurance is increasing as homeowners become more aware of the importance of protecting their property rights. As real estate transactions grow more complex, buyers are looking for title insurance to safeguard against potential defects and claims. This growth is further driven by the rising number of residential and commercial property transactions, as buyers want to ensure their investments are protected from legal disputes and ownership challenges.

The residential segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the title insurance market is divided into residential, commercial, industrial, and agricultural. Among these, the residential segment is anticipated to hold the highest market share during the projected timeframe. The ongoing growth in the housing market, along with the increasing number of homebuyers seeking protection against title issues, is contributing to this demand. More individuals and families are investing in residential properties, leading to a greater need for title insurance that covers potential risks such as liens and ownership disputes. Additionally, the trend of first-time buyers entering the market—often with less knowledge about title risks—further increases the uptake of residential title insurance.

North America is estimated to hold the largest share of the title insurance market over the forecast period.

North America is estimated to hold the largest share of the title insurance market over the forecast period. The title insurance sector is benefiting from a well-established real estate industry and the widespread use of title insurance as a standard practice in property transactions. The region has a robust legal framework that supports property rights and a high level of consumer awareness regarding title insurance. Economic factors, such as a stable housing market and increasing home sales, also support the growth of this sector.

Europe is expected to grow the fastest during the forecast period. European nations enhance their property transaction processes and legal frameworks, the demand for title insurance is likely to rise significantly. Factors such as increasing real estate investments, cross-border transactions, and a growing emphasis on protecting property rights are all contributing to this rapid growth, making title insurance an essential component of the real estate market in Europe.

Company Profiling

Major key players in the title insurance market includes First American Financial Corporation, Williston Financial Group, Chicago Title Insurance Company, Zurich Insurance Group, China Life Property and Casualty Insurance Company Limited, Fidelity National Title Company, Allianz SE, Commonwealth Land Title Insurance Company, Stewart Title Guaranty Company, Westcor Land Title Insurance Company, Inc., Conestoga Title Insurance Co.

Recent Developments

- In May 2024, DUAL Australia is introducing a new business line in the Asia Pacific region through its specialized title insurance team, DUAL Asset. Leading this initiative is Chris Hammond, the Head of Asia Pacific for DUAL Asset.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the title insurance market based on the below-mentioned segments:

Global Title Insurance Market, By Type

- Owner's Title Insurance

- Lender's Title Insurance

- Extended Title Insurance

Global Title Insurance Market, By Application

- Residential

- Commercial

- Industrial

- Agricultural

Global Title Insurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa