Global Travel Credit Card Market Size to worth USD 57.10 Billion by 2033

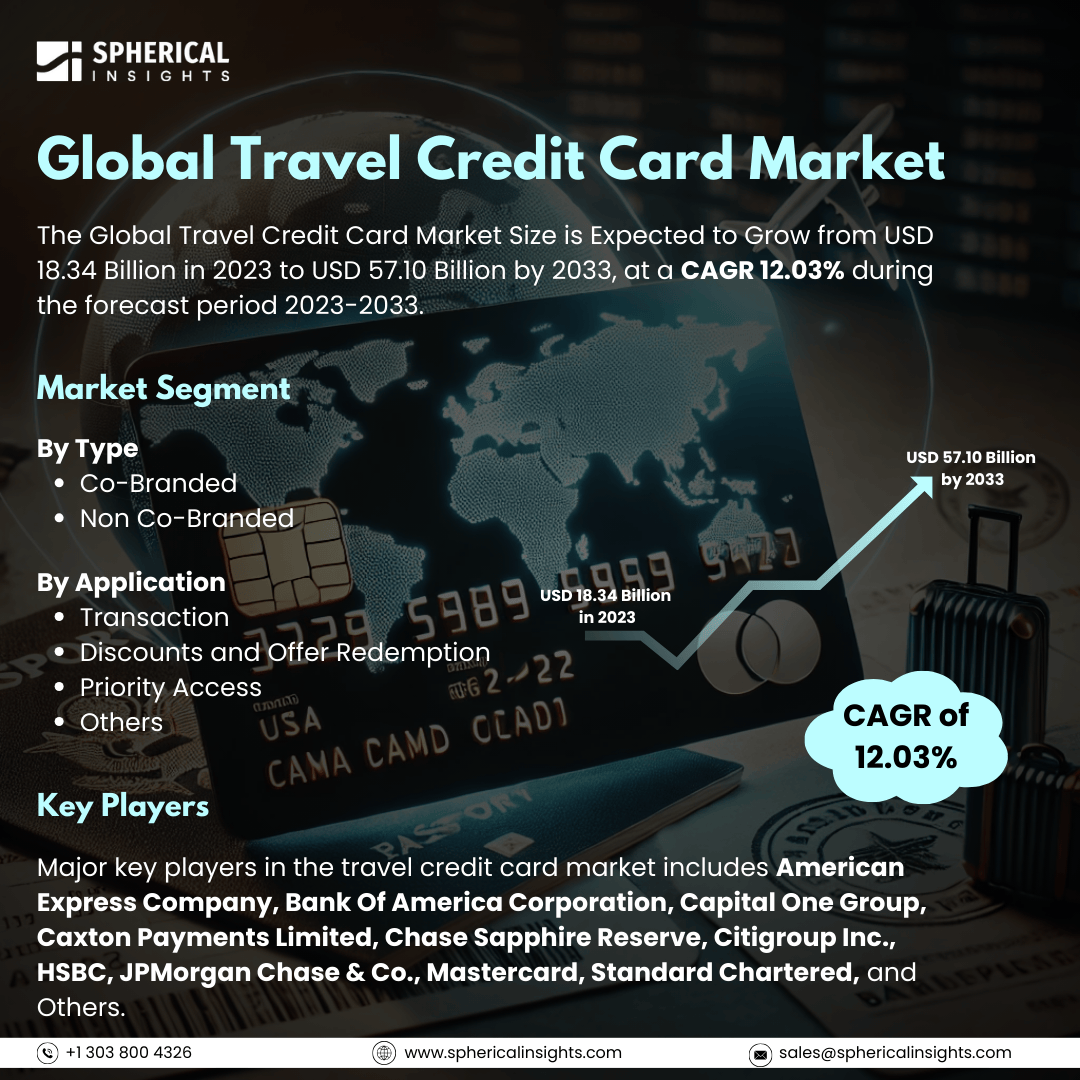

According to a research report published by Spherical Insights & Consulting, The Global Travel Credit Card Market Size is Expected to Grow from USD 18.34 Billion in 2023 to USD 57.10 Billion by 2033, at a CAGR 12.03% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Travel Credit Card Market Size, Share, and COVID-19 Impact Analysis, By type (Co-Branded, Non Co-Branded), By Application (Transaction, Discounts and Offer Redemption, Priority Access, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The travel credit card market refers to the industry that offers credit cards specifically designed for frequent travelers. These cards provide rewards and benefits for travel-related expenses, along with convenience, security, and financial flexibility. The market is expected to grow for several reasons: consumers are motivated to adopt travel credit cards due to the attractive benefits and rewards they provide. Additionally, as disposable income and overall affluence increase, so does the demand for these cards. Furthermore, as travel becomes easier and more accessible, the interest in travel credit cards is expected to rise. However, some factors can hamper the growth of the travel credit card market. High annual fees and interest rates can deter some consumers from choosing travel credit cards. Additionally, limited acceptance of these cards and partner restrictions may also restrict market growth.

The non co-branded segment is predicted to hold the largest market share through the forecast period.

Based on the type, the travel credit card market is classified into co-branded, non co-branded. Among these, the non co-branded segment is predicted to hold the largest market share through the forecast period. The segmental growth due to their broad appeal and flexibility, non co-branded credit cards offer a variety of rewards and benefits that are not tied to specific brands. This makes them attractive to consumers who value versatility in their spending options. Additionally, the absence of brand restrictions allows cardholders to maximize their rewards across diverse categories, further enhancing their appeal. As consumers seek greater control over their spending and rewards, the non co-branded segment is well-positioned to capture a significant share of the market.

The transaction segment is anticipated to hold the highest market share during the projected timeframe.

Based on the application, the travel credit card market is divided into transaction, discounts and offer redemption, priority access, and others. Among these, the transaction segment is anticipated to hold the highest market share during the projected timeframe. The growth of credit card transactions is driven by the increasing number of digital transactions and the shift towards cashless payments. As consumers increasingly prefer the convenience of using credit cards for everyday purchases, the transaction segment benefits from enhanced usage and higher adoption rates. This growth is further supported by the integration of advanced payment technologies, such as mobile wallets and contactless payments, which streamline the transaction process and attract more users to credit card offerings.

North America is estimated to hold the largest share of the travel credit card market over the forecast period.

North America is estimated to hold the largest share of the travel credit card market over the forecast period. The market for travel credit cards is particularly robust, primarily due to the region's well-established financial infrastructure and high consumer spending on travel. With a substantial number of travel enthusiasts and a growing trend towards experiential spending, credit card issuers in North America are increasingly focusing on travel rewards and benefits to attract customers. The presence of major financial institutions and competitive offers further solidifies North America's leading position in the travel credit card market.

Asia Pacific is expected to grow the fastest during the forecast period. The demand for travel credit cards is expected to surge, driven by rising disposable incomes, a burgeoning middle class, and increased travel frequency among consumers. As more individuals in this region embrace credit cards for travel-related expenses, the appeal of these cards is set to grow. Additionally, the expanding digital payment ecosystem and advancements in fintech are making credit cards more accessible, further driving adoption rates. This combination of economic development and shifts in consumer behaviour positions Asia-Pacific as a key area for growth in the travel credit card market.

Company Profiling

Major key players in the travel credit card market includes American Express Company, Bank Of America Corporation, Capital One Group, Caxton Payments Limited, Chase Sapphire Reserve, Citigroup Inc., HSBC, JPMorgan Chase & Co., Mastercard, Standard Chartered, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, SBI Card launched its first travel-focused credit card, the 'SBI Card MILES.' This card offers a range of travel benefits, including the ability to convert Travel Credits into Air Miles and Hotel Points. It also provides enhanced rewards on all travel bookings and grants access to airport lounges.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the travel credit card market based on the below-mentioned segments:

Global Travel Credit Card Market, By Type

- Co-Branded

- Non Co-Branded

Global Travel Credit Card Market, By Application

- Transaction

- Discounts and Offer Redemption

- Priority Access

- Others

Global Travel Credit Card Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa