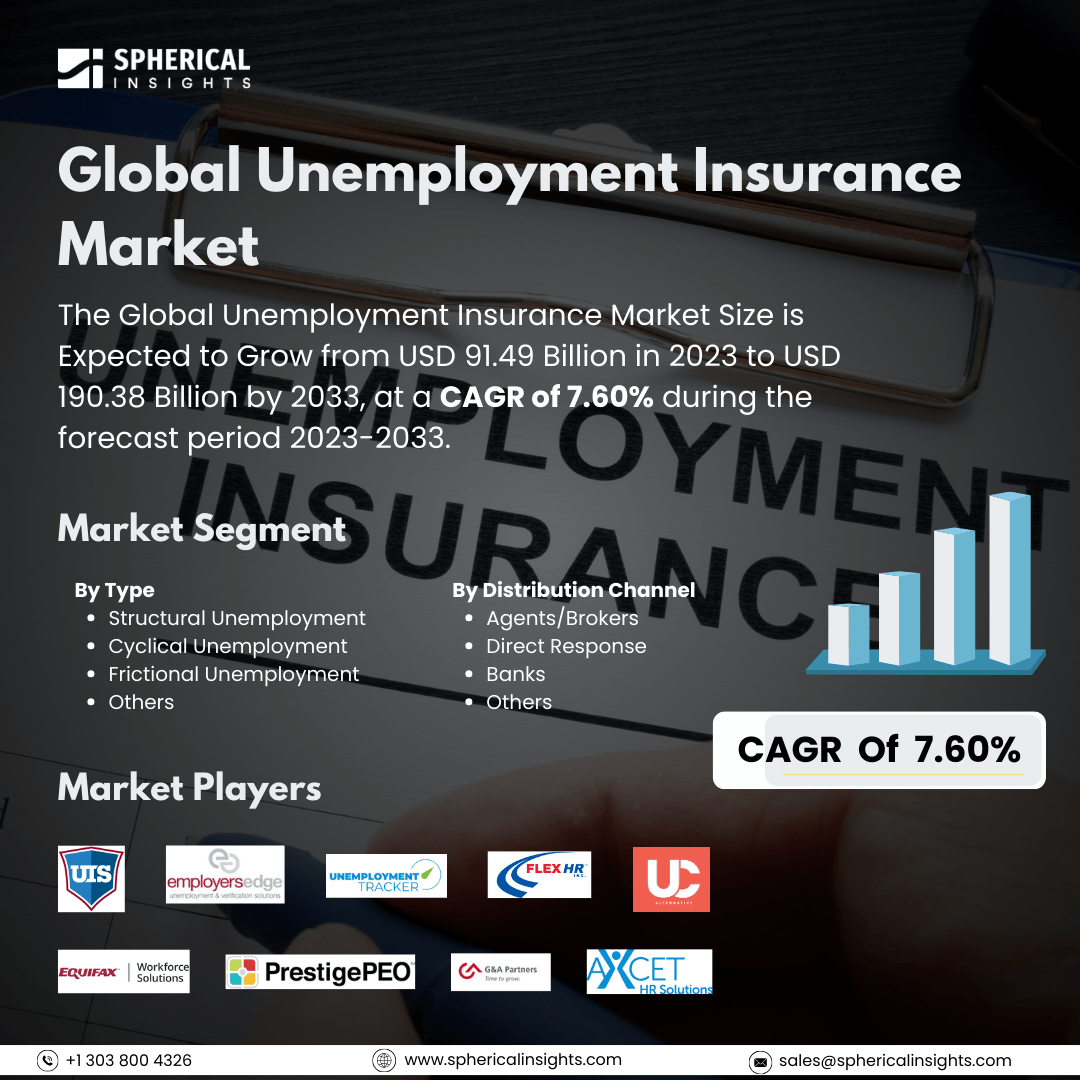

Global Unemployment Insurance Market Size to worth USD 190.38 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Unemployment Insurance Market Size is Expected to Grow from USD 91.49 Billion in 2023 to USD 190.38 Billion by 2033, at a CAGR of 7.60% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Unemployment Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Structural Unemployment, Cyclical Unemployment, Frictional Unemployment, and Others), By Distribution Channel (Agents/Brokers, Direct Response, Banks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Unemployment insurance is a social insurance program that provides temporary financial assistance to workers who find themselves involuntarily unemployed. It is commonly referred to as unemployment benefits, unemployment compensation, or unemployment payments. Several factors influence the unemployment insurance (UI) market, including the design of the UI program, the labor market dynamics, and the overall economy. The amount of UI benefits and the duration after which they increase can affect the timing of layoffs. The generosity of UI benefits can also influence job separations, including voluntary quits and involuntary layoffs. Additionally, UI impacts the labor market through its effects on job searching. The utilization of other social programs may influence the costs associated with UI. Moreover, search externalities can diminish the impact of UI on unemployment levels. Cyclical factors, such as economic downturns, can increase the unemployment rate. Government policies, including high minimum wages, generous social benefits, and restrictive occupational licensing laws, may contribute to institutional unemployment. On the demand side, factors like high interest rates, global recessions, and financial crises can lead to increased unemployment. Several elements can also restrain the unemployment insurance market. For example, moral hazard can either weaken or strengthen the role of unemployment insurance in the economy. Additionally, search frictions and nominal rigidities play a role in the general equilibrium concerning unemployment insurance.

The structural unemployment segment is predicted to hold the largest market share through the forecast period.

Based on the type, the unemployment insurance market is classified into structural unemployment, cyclical unemployment, frictional unemployment, and others. Among these, the structural unemployment segment is predicted to hold the largest market share through the forecast period. Structural unemployment occurs when there is a mismatch between the skills that workers possess and the skills that employers demand. This often results from technological advancements or shifts in the economy. This segment is expected to hold the largest market share throughout the forecast period, as industries increasingly adapt to automation and new technologies, leading to job displacements. As businesses evolve, the need for specialized training programs and policies to address these skill gaps becomes crucial, thereby emphasizing the significance of structural unemployment in labor market dynamics.

The agents/brokers segment is anticipated to hold the highest market share during the projected timeframe.

Based on the distribution channel, the unemployment insurance market is divided into agents/brokers, direct response, banks, and others. Among these, the agents/brokers segment is anticipated to hold the highest market share during the projected timeframe. Intermediaries play a critical role in facilitating unemployment insurance claims and navigating the complexities of the system. They provide essential services such as personalized guidance and support, which enhance the efficiency of the claims process for unemployed individuals. As the demand for expert assistance grows, particularly in a fluctuating job market, agents and brokers are well-positioned to capitalize on their expertise, thereby strengthening their market leadership.

North America is estimated to hold the largest share of the unemployment insurance market over the forecast period.

North America is estimated to hold the largest share of the unemployment insurance market over the forecast period. North America is characterized by its robust economic infrastructure and comprehensive social safety net programs. The region's advanced administrative systems and funding mechanisms for unemployment insurance improve accessibility and efficiency for claimants. Additionally, ongoing economic fluctuations and labor market changes necessitate a strong unemployment insurance framework, ensuring that North America remains a focal point for both individuals seeking support and policymakers aiming for effective employment strategies.

Asia Pacific is expected to grow the fastest during the forecast period. The growth of unemployment insurance solutions is primarily driven by rapid economic development and an increasing awareness of the importance of social safety nets in emerging economies. As countries in this region grapple with urbanization and demographic shifts, the demand for effective unemployment insurance solutions is on the rise. Moreover, governmental initiatives aimed at strengthening labor markets and enhancing skill sets to better align with industry needs further propel the growth of this segment, making the Asia-Pacific region a dynamic landscape for advancements in unemployment insurance.

Company Profiling

Major key players in the unemployment insurance market include Unemployment Insurance Services., Employers Edge, LLC, Unemployment Tracker, Flex HR, Personnel Planners, UC Alternative, Equifax Workforce Solutions, PrestigePEO, G&A Partners, Axcet HR Solutions, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, The Department of Labor and Industrial Relations (DLIR) will introduce new online tools for employers through the State Information Data Exchange System (SIDES). This system has been developed in collaboration with the National Association of State Workforce Agencies (NASWA) and the U.S. Department of Labor.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global unemployment insurance market based on the below-mentioned segments:

Global Unemployment Insurance Market, By Type

- Structural Unemployment

- Cyclical Unemployment

- Frictional Unemployment

- Others

Global Unemployment Insurance Market, By Distribution Channel

- Agents/Brokers

- Direct Response

- Banks

- Others

Global Unemployment Insurance Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa