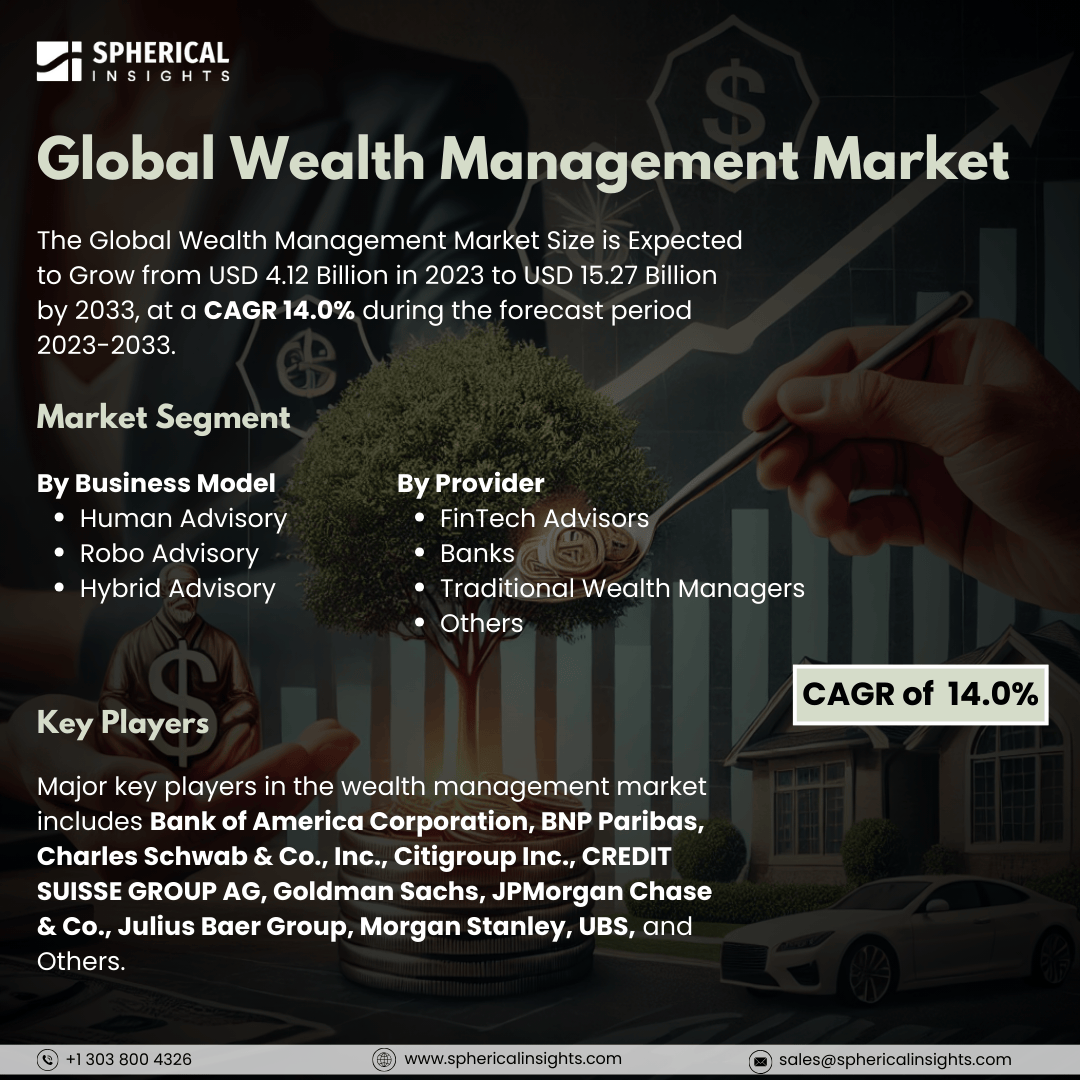

Global Wealth Management Market Size to worth USD 15.27 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Wealth Management Market Size is Expected to Grow from USD 4.12 Billion in 2023 to USD 15.27 Billion by 2033, at a CAGR 14.0% during the forecast period 2023-2033.

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Wealth Management Market Size, Share, and COVID-19 Impact Analysis, By Business Model (Human Advisory, Robo Advisory, and Hybrid Advisory), By Provider (FinTech Advisors, Banks, Traditional Wealth Managers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Wealth management is a financial service that assists individuals and families in achieving their financial goals by building and preserving wealth over time. This service encompasses a variety of financial offerings. The wealth management market is influenced by several factors. Strong economic growth can lead to higher incomes and increased wealth, resulting in greater savings and investment opportunities. Additionally, the growing popularity of online trading and the adoption of robo-advisory and virtual financial assistance solutions have increased the demand for wealth management platforms. Furthermore, big data analytics and artificial intelligence (AI) are creating new business opportunities for wealth management firms, as customers seek improved experiences with financial services. However, wealth management also faces several challenges that can hamper its growth and effectiveness. Regulatory pressures impose stringent compliance requirements, which can increase operational costs and complexity for firms. Additionally, the rise of digital platforms has intensified competition, compelling traditional wealth management firms to quickly adapt to technological advancements.

The human advisory segment is predicted to hold the largest market share through the forecast period.

Based on the business model, the wealth management market is classified into human advisory, robo advisory, and hybrid advisory. Among these, the human advisory segment is predicted to hold the largest market share through the forecast period. The demand for personalized financial advice and relationship-based services is on the rise. Clients increasingly seek tailored solutions that account for their unique financial goals, risk tolerance, and life circumstances. This trend stems from a growing awareness of the complexities involved in wealth management, which highlights the importance of a human touch in developing effective strategies. Additionally, the expertise and trust that human advisors offer continue to be valued, particularly among high-net-worth individuals who prefer comprehensive and nuanced approaches to managing their assets.

The traditional wealth managers segment is anticipated to hold the highest market share during the projected timeframe.

Based on the provider, the wealth management market is divided into fintech advisors, banks, traditional wealth managers, and others. Among these, the traditional wealth managers segment is anticipated to hold the highest market share during the projected timeframe. Traditional wealth managers remain prominent largely due to their established reputation and experience in delivering reliable financial advice and asset management services. These firms are well-equipped to serve affluent clients by offering a wide range of services, from investment management to estate planning. This capability fosters long-term relationships built on trust and performance. As investors seek stability and proven expertise in a rapidly changing financial landscape, traditional wealth managers are expected to thrive by leveraging their historical knowledge and client-centric approach.

North America is estimated to hold the largest share of the wealth management market over the forecast period.

North America is estimated to hold the largest share of the wealth management market over the forecast period. The growth of wealth management services in North America is driven by a combination of high disposable incomes, a substantial population of affluent individuals, and a well-developed financial services ecosystem. The presence of numerous leading wealth management firms and financial institutions in the region ensures broad access to various investment products and advisory services. Furthermore, the increasing trend of financial literacy among North American consumers has led to a greater willingness to engage in wealth management services, which solidifies the region’s dominant position in the market.

Europe is expected to grow the fastest during the forecast period, the wealth management sector is propelled by a rising number of high-net-worth individuals and an increasing demand for sophisticated financial solutions. The region's diverse economic landscape, along with ongoing regulatory changes, presents new opportunities for wealth management firms to innovate and adapt their services to meet evolving client needs. Additionally, the growing emphasis on sustainable and impact investing is attracting a younger demographic of investors, further driving market growth. As firms in Europe capitalize on these trends, they are likely to experience accelerated expansion in their wealth management offerings.

Company Profiling

Major key players in the wealth management market includes Bank of America Corporation, BNP Paribas, Charles Schwab & Co., Inc., Citigroup Inc., CREDIT SUISSE GROUP AG, Goldman Sachs, JPMorgan Chase & Co., Julius Baer Group, Morgan Stanley, UBS, and Others.

Recent Development

- In February 2024, Schroders Personal Wealth (SPW), a British multinational asset management company, has announced the launch of a new platform designed to improve the client journey and experience. This significant strategic initiative allows SPW to manage client funds and investments internally. With renewed partnerships with SEI and Benchmark, the platform will enable SPW to provide integrated advice, investment, and platform services to its clients.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the wealth management market based on the below-mentioned segments:

Global Wealth Management Market, By Business Model

- Human Advisory

- Robo Advisory

- Hybrid Advisory

Global Wealth Management Market, By Provider

- FinTech Advisors

- Banks

- Traditional Wealth Managers

- Others

Global Wealth Management Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa