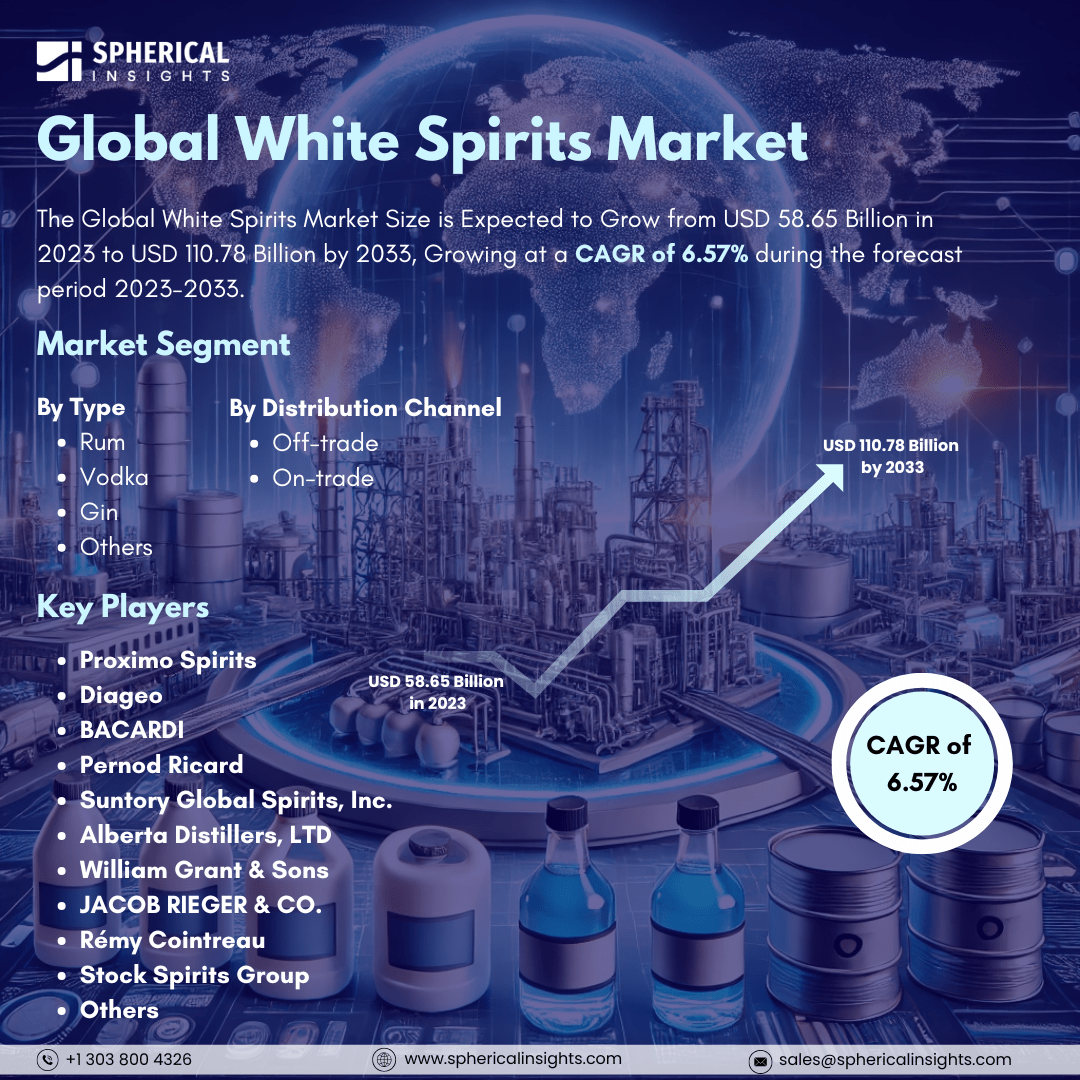

Global White Spirits Market Size to Worth USD 110.78 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global White Spirits Market Size is Expected to Grow from USD 58.65 Billion in 2023 to USD 110.78 Billion by 2033, Growing at a CAGR of 6.57%during the forecast period 2023-2033.

Browse key industry insights spread across 215 pages with 110 Market data tables and figures & charts from the report on the Global White Spirits Market Size, Share, and COVID-19 Impact Analysis, By Type (Rum, Vodka, Gin, and Others), By Distribution Channel (Off-trade and On-trade), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

White spirits are defined as alcoholic substances that are clear, flavorless, and typically not aged in wooden barrels. To make them appear clear, some white spirits are aged in barrels before getting filtered. The market for premium white spirits has increased due to the global trend toward high-end goods and the growing appeal of cocktail culture. To improve their drinking experiences, consumers are looking for more distinctive and upscale spirits. To adapt to consumers' shifting preferences, this change has prompted companies to make investments in creative product creation and marketing techniques. Growing disposable incomes and economic expansion are driving the market. Premium spirits and other high-end goods are becoming more and more popular as economies expand and people's disposable incomes rise. The demand for white spirits is driven by rising purchasing power, particularly in developing nations. Additionally, the success of cocktail bars and restaurants, as well as the growing trend of casual drinking around the world, are contributing to the market's growth. However, producers and distributors may face difficulties as a result of stringent laws governing the manufacture, sale, and promotion of alcoholic beverages, which could hinder market expansion.

The vodka segment is expected to hold the largest market share of the global white spirits market through the forecast period.

Based on the type, the white spirits market is categorized into rum, vodka, gin, and others. Among these, the vodka segment is expected to hold the largest market share of the global white spirits market through the forecast period. Vodka is a common ingredient in a variety of cocktails and mixed beverages due to its adaptability and neutral flavor. Additionally, the economical production of vodka makes it more accessible and less expensive than other white spirits such as gin and whiskey. Its market is still growing as a result of the rising demand for vodka-based drinks, particularly in developing nations.

The off-trade segment is predicted to hold the highest market share of the global white spirits market through the projected period.

Based on the distribution channel, the white spirits market is divided into off-trade and on-trade. Among these, the off-trade segment is predicted to hold the highest market share of the global white spirits market through the projected period. Off-trade channels including supermarkets, hypermarkets, and liquor stores are a popular choice among consumers due to their simplicity and accessibility. Customers can simply choose their preferred brands and compare prices owing to the large selection of products offered through off-trade channels. The demand for white spirits bought through off-trade channels has also surged due to the growing trend of home consumption, which is being driven by variables such as shifting lifestyles and economic factors.

Asia Pacific is expected to hold the largest share of the white spirits market through the forecast period.

Asia Pacific is expected to hold the largest share of the white spirits market through the forecast period. The region's rapidly increasing urbanization, growing disposable incomes, and expanding population have all contributed to a significant surge in the market for alcoholic beverages. In many Asian countries, social events and celebrations are culturally significant and frequently involve the consumption of white spirits, which further fuels this desire. Furthermore, the region's demand for high-end white spirits is being driven even higher by the expanding trend of at-home cocktail cultures and the growing popularity of Western-style bars and restaurants.

North America is predicted to grow at the fastest CAGR of the white spirits market over the forecast period. Due to the growing popularity of mixed drinks and cocktails as well as the trend of throwing parties at home, there is a greater demand for white spirits in North America. The market's expansion has also been aided by the region's booming tourism sector and regular international gatherings and festivals. Major players devote a high priority to creating new goods and marketing plans to satisfy the various tastes and preferences of their customer base.

Company Profiling

Major key players in the white spirits market include Proximo Spirits, Diageo, BACARDI, Pernod Ricard, Suntory Global Spirits, Inc., Alberta Distillers, LTD, William Grant & Sons, JACOB RIEGER & CO., Rémy Cointreau, Stock Spirits Group., and Others.

Recent Developments

- In November 2024, Cardi B's Whipshots and Pernod Ricard-owned Kahlúa collaborated to produce Chocolate Sips, a limited-edition chocolate liqueur.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the white spirits market based on the below-mentioned segments:

Global White Spirits Market, By Type

Global White Spirits Market, By Distribution Channel

Global White Spirits Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa