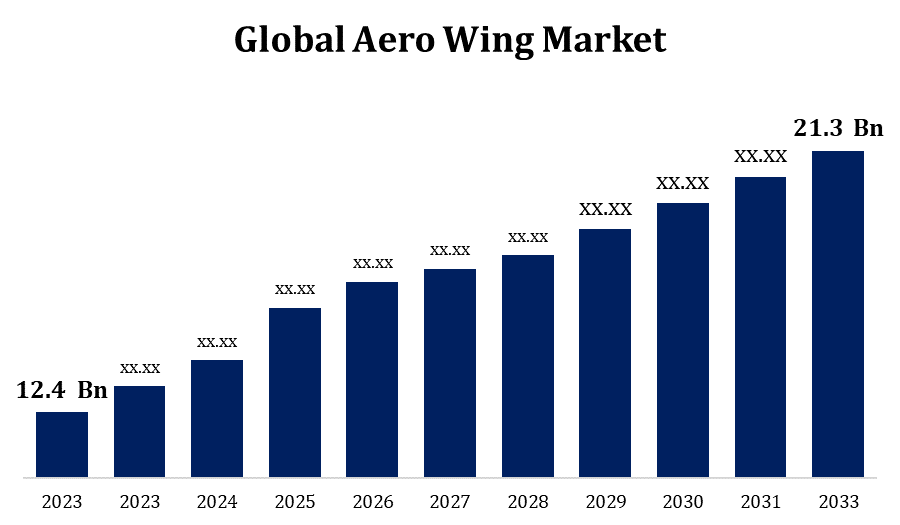

Global Aero Wing Market Size To Worth USD 21.3 Billion by 2033 | CAGR of 5.56%

Category: Aerospace & DefenseGlobal Aero Wing Market Size To Worth USD 21.3 Billion by 2033

According to a Research Report published by Spherical Insights & Consulting, the Global Aero Wing Market Size to Grow from USD 12.4 Billion in 2023 to USD 21.3 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.56% during the Forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 Market data tables and figures & charts from the report on the."Global Aero Wing Market Size by Platform (Military, Commercial), by Type of Build (Conventional Skin Fabrication, Composite Skin Fabrication) and by Material (Alloys, Metals, Composite), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033."Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aero-wing-market

Wings are essential components in commercial aviation, providing lift and stability to an aircraft. The commercial aircraft wing market is influenced by airline fleet expansions, fuel economy rules, and wing design and material developments. Military aircraft also require novel wing technology to boost manoeuvrability and mission-specific capabilities. Defence spending, geopolitical factors, and technological advancements all have an impact on the military aircraft wing market. The aerospace industry relies on a complex global supply network. Companies specialising in the production of aircraft wings, both large OEMs (Original Equipment Manufacturers) and smaller suppliers, contribute to overall market dynamics.

Aero Wing Market Value Chain Analysis

The value chain starts with the acquisition of raw materials like advanced composites, aluminium alloys, and other materials used in wing manufacturing. Suppliers play a crucial role in supplying high-quality materials to manufacturers. Their efficiency and dependability have an impact on the overall quality and cost-effectiveness of aero wings. The manufacturing process involves changing basic materials into aero wings. This stage entails cutting, shaping, and assembling several components. OEMs are significant players in the aerospace business, designing and manufacturing entire aircraft, including aero wings. Aero wing producers collaborate with OEMs to meet aircraft design criteria, performance standards, and regulatory requirements. Aero wings must undergo extensive testing and quality control methods to ensure their safety and reliability. After fabrication and testing, aero wings are delivered to assembly lines or final aircraft assembly facilities. The logistics network is crucial for delivering goods on time and effectively. The last stage of the value chain is delivering the completed aircraft to airlines or other end users. Aero wings increase the overall performance and efficiency of the aircraft.

Aero Wing Market Opportunity Analysis

There are prospects for developing and applying novel materials, like as carbon fibre composites, to make aero wings lighter, more fuel efficient, and environmentally friendly. The growing emphasis on fuel efficiency and environmental sustainability opens up opportunities for aero wings that help to minimise aircraft emissions while increasing overall efficiency. Participation in next-generation aircraft programmes enables aero-wing manufacturers to get part in cutting-edge aviation efforts. Opportunities may arise to fulfil the specific requirements of regional and business aviation. Designing wings for smaller aircraft or those with specific performance requirements could be a niche market. As airlines and operators seek to extend the life of their existing fleets, offering aftermarket services such as maintenance, repair, and aero wing improvements can be a profitable choice.

Composite materials are known for their excellent strength-to-weight ratios. Manufacturers can considerably reduce aircraft weight by using composites in the wings. Lighter wings improve fuel efficiency, reducing airline operational costs. Composites are typically more fatigue-resistant and durable than traditional materials. This can result in aircraft wings with a longer operational life and less maintenance, saving operators money. Composite materials offer greater design flexibility, allowing for innovative and complex wing designs. This flexibility can lead to improved aerodynamics and overall aircraft performance.

Developing and manufacturing advanced composite wings can be costly. The initial investment in materials and technology may pose challenges for both manufacturers and airlines, lowering the overall cost-effectiveness of the solution. The aerospace industry is founded on complex global supply chains. Geopolitical conflicts, natural disasters, and global events (such as pandemics) can all disrupt raw material and component supply, affecting production schedules and delivery deadlines. Weight reduction through the use of new materials is critical for fuel economy. Weight reduction, on the other hand, frequently sacrifices durability and structural integrity. Finding the right balance is difficult for designers.

Insights by Platform

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. The overall increase in air travel demand, which is driven by factors such as population growth, urbanisation, and increased disposable income, is important to the commercial aviation sector's success. More passengers necessitate more commercial aircraft, which raises demand for Aero Wings. The demand for long-haul flights has grown, spurring the procurement of wide-body aircraft. These aircraft frequently have longer wings to facilitate their long-distance capability. The increase in long-haul routes drives up demand for commercial Aero Wings. The expansion of low-cost carriers in numerous markets has increased demand for narrow-body aircraft. These aircraft, which are frequently flown by low-cost carriers, may have specific Aero Wing requirements for short- to medium-haul flights.

Insights by Type of Build

The conventional skin fabrication segment accounted for the largest market share over the forecast period 2023 to 2033. Advances in traditional materials and manufacturing processes, such as advancements in aluminium alloys and traditional assembly methods, can help to promote growth in the conventional skin fabrication industry. Adherence to industry standards and certification criteria is essential in the aircraft sector. Manufacturers' ability to meet and exceed these criteria may have an impact on the growth of the traditional skin fabrication business. The need to upgrade current aircraft fleets could drive growth in the conventional skin manufacturing business. Upgrading older aircraft with improved skin materials or designs can extend their operational life and performance.

Insights by Material

The metals segment accounted for the largest market share over the forecast period 2023 to 2033. Metallic wings are made with well-established technology that have been refined over decades. This procedural competence increases the efficiency and cost-effectiveness of metal wing fabrication. Metals, especially aluminium, are typically less expensive than modern composite materials. This cost issue is essential for both aircraft manufacturers and airlines, especially for commercial aircraft with large production numbers. The metals sector may expand as a result of the need to alter existing aircraft fleets. Upgrading historic aeroplanes with metallic wings can be an inexpensive way to extend their life.

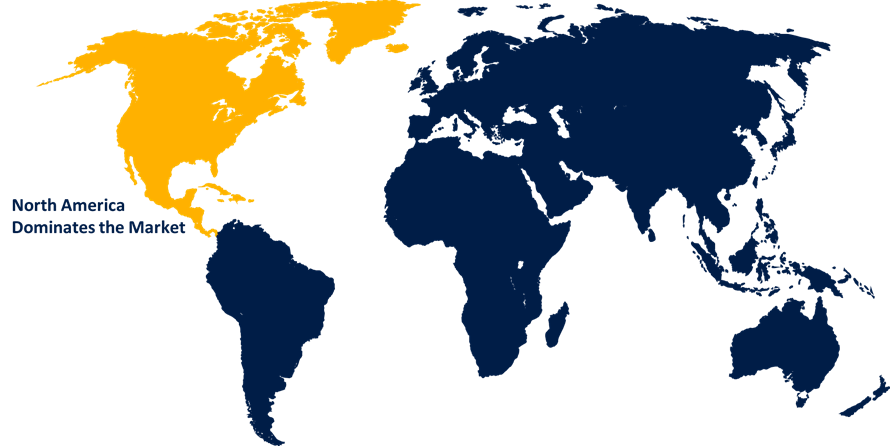

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aero Wing Market from 2023 to 2033. North America is home to some of the world's largest and most powerful aerospace companies, including Boeing (based in the United States), a major manufacturer of commercial and military aircraft wings. The aerospace industry in North America is well-known for its emphasis on advanced technology and innovation. This includes the development and application of novel materials, manufacturing techniques, and design concepts in the production of aircraft wings. North America has a robust commercial aviation business, with major airlines operating large fleets.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Increasing air travel demand, growing middle-class populations, and economic development have all contributed to increased demand for commercial aircraft, affecting the Aerowing industry. Countries such as China and India are emerging as significant players in the aerospace industry. Both countries have made major investments in the development and production of aircraft components, such as wings. The Asia-Pacific region has seen an increase in low-cost carriers (LCCs), resulting in a demand for more fuel-efficient and affordable aircraft.

Recent Market Developments

- In January 2024, Airbus Helicopters is expanding its unmanned aerial system portfolio with the acquisition of Aerovel.

Major players in the market

- Airbus Group

- United Technologies Corporation (UTC)

- General Dynamics Corporation

- Lockheed Martin

- Northrop Grumman

- Embraer Executive Jets

- Raytheon Company

- The Boeing Company

- Mitsubishi Aircraft

- Bombardier Aerospace

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aero Wing Market, Platform Analysis

- Military

- Commercial

Aero Wing Market, Type of Build Analysis

- Conventional Skin Fabrication

- Composite Skin Fabrication

Aero Wing Market, Material Analysis

- Alloys

- Metals

- Composite

Aero Wing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?