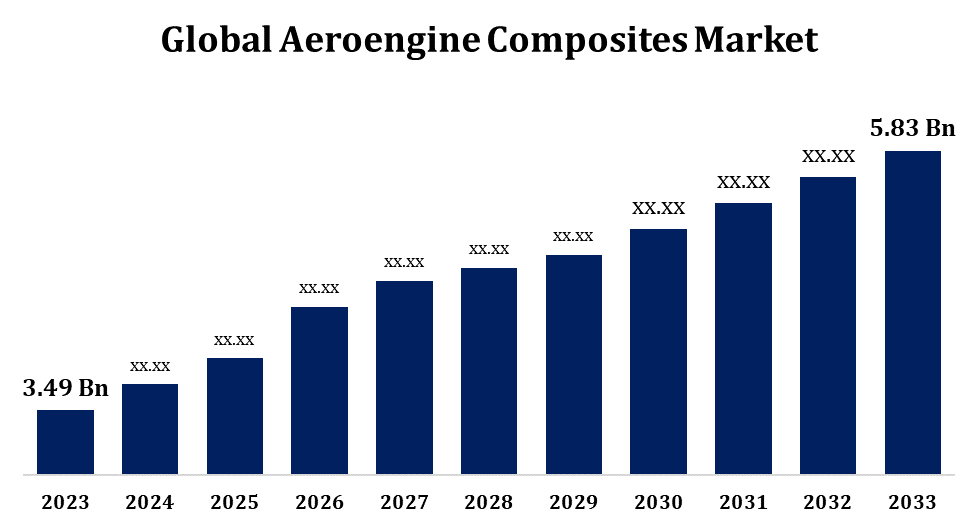

Global Aeroengine Composites Market Size To Worth USD 5.83 Billion By 2033 | CAGR of 5.27%

Category: Aerospace & DefenseGlobal Aeroengine Composites Market Size To Worth USD 5.83 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Aeroengine Composites Market Size to Grow from USD 3.49 Billion in 2023 to USD 5.83 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.27% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 208 pages with 110 Market data tables and figures & charts from the report on the “Global Aeroengine Composites Market Size, Share, and COVID-19 Impact Analysis, by Application (Commercial Aircraft, Military Aircraft, and General Aviation Aircraft), Component (Fan Blades, Fan Case, Guide Vanes, Shrouds, and Other Components), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.” Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/aeroengine-composites-market

The growing need for lightweight and fuel-efficient aircraft is propelling the aeroengine composites market's significant expansion. Engine components are increasingly using composites, especially carbon fiber-reinforced plastics, because of their higher strength-to-weight ratio, resistance to corrosion, and tolerance for high temperatures. Improvements in manufacturing methods that lower prices and increase production efficiency, such automated fibre placement and resin transfer moulding, support the market. To improve performance and sustainability, major players in the aerospace sector are investing in composite material advancements. Further driving market expansion are the emergence of next-generation aircraft and the requirement to adhere to strict emission laws. Constraints could be posed by expensive production costs and difficulties recycling composite materials.

Aeroengine Composites Market Value Chain Analysis

The supply of carbon fibres, resins, and other necessary inputs by raw material suppliers is the first step in the value chain of the aeroengine composites market. Intermediate producers process these materials to make composite preforms, tapes, and textiles for particular aeroengine uses. The next step is the production of engine parts, including as fan blades, casings, and nacelles, by composite component manufacturers using state-of-the-art processes like automated fibre placement and resin transfer moulding. These parts are integrated into engines by original equipment manufacturers (OEMs) and aerospace companies, which frequently work closely with composite producers to achieve customisation and innovation. Research organisations and technology suppliers working to improve composite characteristics and production efficiencies help the value chain. Regulatory agencies also make sure that parts fulfil strict performance and safety requirements.

Aeroengine Composites Market Opportunity Analysis

The growing emphasis on sustainability and fuel efficiency in the aerospace industry presents substantial potential opportunities for the aeroengine composites market. The need for strong, lightweight composites is growing as airlines look to cut expenses and adhere to more stringent environmental standards. Manufacturers now have the chance to produce aeroengine components that are more efficient because to advancements in composite materials, such as advanced carbon fibre and ceramic matrix composites. The market prospects are further improved by the increasing production of next-generation aircraft and the quick uptake of designs heavily reliant on composite materials. More prospects for market expansion are provided by developing economies in the Middle East and Asia-Pacific, as well as by the expanding maintenance, repair, and overhaul (MRO) services aftermarket. Future growth potential can also be attributed to collaborative R&D projects and technology breakthroughs in manufacturing techniques, such 3D printing.

One major element propelling the aeroengine composites market's growth is the notable increase in passenger traffic. The demand for air travel is rising worldwide, especially in developing regions like the Middle East and Asia-Pacific. As a result, airlines are growing their fleets and looking for lighter, more fuel-efficient planes to cut costs. The increase in passenger traffic is forcing original equipment manufacturers (OEMs) to use cutting-edge composite materials in engine components, like ceramic matrix composites and carbon fiber-reinforced plastics, to improve performance and fuel efficiency. The need for aeroengine composites is further increased by the requirement to meet environmental rules and noise reduction standards while accommodating increasing passenger volumes with quieter, more efficient aircraft. Over the upcoming years, this tendency is anticipated to drive strong market expansion.

Advanced composite materials, like carbon fiber-reinforced polymers and ceramic matrix composites, have high production costs that are a major hurdle, especially for smaller businesses. Furthermore, specialised tools and knowledge are needed for complicated production processes, which might limit scalability and increase costs. Because of the composite materials' environmental impact and the strict waste management requirements in place, recycling and disposal of these materials continue to be key concerns. Because composites must adhere to stringent safety and performance standards in the aerospace industry, market participants also confront difficulties in guaranteeing consistent quality and reliability. Moreover, supply chain disruptions can lead to uncertainty in material availability and pricing, which can impact the stability of the market as a whole. Examples of these disruptions include shortages of raw materials and geopolitical conflicts.

Insights by Application

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. In an effort to increase fuel economy, cut emissions, and save operating expenses, airlines are investing in new, lightweight aircraft that make use of cutting-edge composite materials like carbon fiber-reinforced polymers and ceramic matrix composites. Growth in the market is also supported by the increasing production rates of next-generation aircraft, such as the Airbus A350 and Boeing 787, whose engines use a large amount of composite materials. Furthermore, the increased emphasis on lowering aircraft weight in order to meet strict legal requirements and noise abatement orders promotes composites' acceptance in the commercial aviation industry, resulting in long-term growth.

Insights by Component

The fan blades segment accounted for the largest market share over the forecast period 2023 to 2033. Fan blades are using more and more advanced composite materials, like carbon fiber-reinforced plastics, because of their higher strength-to-weight ratio, fatigue resistance, and ability to handle harsh environments. These characteristics allow for significant weight reduction, which improves fuel efficiency and reduces emissions, both of which are in line with the sustainability aims of the aerospace sector. To improve performance and cut noise, leading aircraft and engine manufacturers, including GE Aviation and Rolls-Royce, are incorporating composite fan blades into their next-generation engines. The expansion of the segment is also aided by an increase in worldwide aircraft deliveries and fleet modernisation initiatives.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aeroengine Composites Market from 2023 to 2033. The region's focus on creating fuel-efficient, lightweight engines to comply with strict environmental rules and lower operating expenses is driving up demand for advanced composites including ceramic matrix composites and carbon fiber-reinforced polymers. Growth in the sector is further facilitated by significant expenditures on R&D, government assistance, and defence contracts. The need for composite materials is further fuelled by the growing maintenance, repair, and overhaul (MRO) industry and the increasing production rates of next-generation aircraft.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Developing countries are making significant investments to modernise their fleets of aircraft and build up their own aerospace industries. Government attempts to encourage domestic manufacturing and lessen reliance on outside suppliers further boost this expansion. The use of sophisticated composite materials, such carbon fiber-reinforced plastics, in engine components is speeding up due to the growing need for lightweight, fuel-efficient aircraft to comply with strict pollution regulations. Additionally, there are prospects for composite use in aftermarket applications because to the region's strong maintenance, repair, and overhaul (MRO) business. But obstacles like expensive start-up fees and a lack of technological know-how could prevent expansion.

Recent Market Developments

- In November 2021, Safran Aircraft Engines and Albany International Corp. announced an association extension through 2046. Albany International and Safran signed the first framework agreement in 2006 to establish a joint venture for the development of high-tech composite parts (resin transfer moulded and 3D weaved) designed for aircraft engines, landing gears, and nacelles.

Major players in the market

- Airbus SAS

- Albany International Corp.

- BASF SE

- Comtek Advanced Structures Ltd.

- DuPont de Nemours, Inc.

- FACC AG

- General Dynamics Mission Systems, Inc.

- General Electric Company

- GKN Aerospace Services Limited

- Godrej & Boyce Manufacturing Company Limited

- Hexcel Corporation

- Honeywell International, Inc.

- IHI Corporation

- LMI Aerospace, Inc. by Sonaca SA

- Meggitt PLC by Parker Hannifin Corporation

- Pratt & Whitney by RTX Corporation

- Rolls-Royce PLC

- Safran S.A.

- SGL Carbon SE

- Solvay S.A.

- Spirit AeroSystems Inc.

- Tata Advanced Systems Limited

- Teijin Limited

- Zoltek Corporation by Toray Group

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aeroengine Composites Market, Application Analysis

- Commercial Aircraft

- Military Aircraft

- General Aviation Aircraft

Aeroengine Composites Market, Component Analysis

- Fan Blades

- Fan Case

- Guide Vanes

- Shrouds

- Other Components

Aeroengine Composites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?