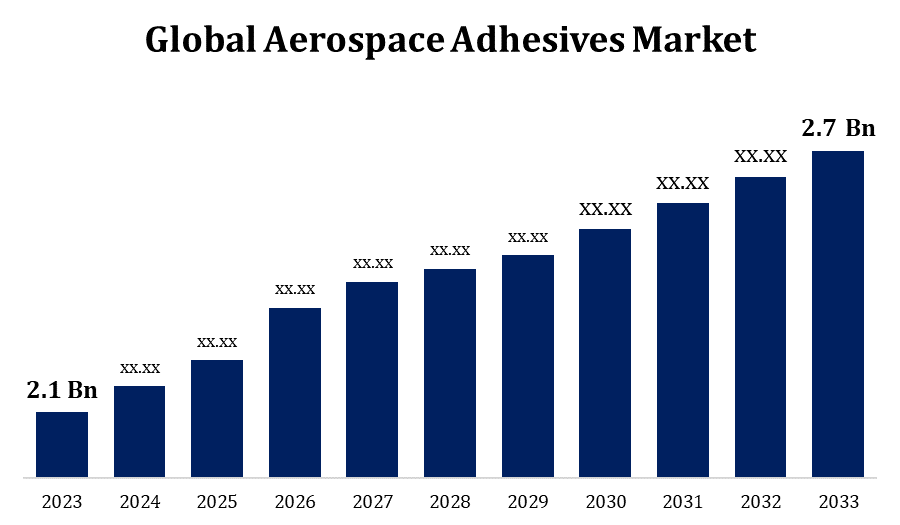

Global Aerospace Adhesives Market Size To Worth USD 2.7 Billion by 2033 | CAGR of 2.54%

Category: Aerospace & DefenseGlobal Aerospace Adhesives Market Size To Worth USD 2.7 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Aerospace Adhesives Market Size to Grow from USD 2.1 Billion in 2023 to USD 2.7 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 2.54% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 218 pages with 110 Market data tables and figures & charts from the report on the "Global Aerospace Adhesives Market Size, Share, and COVID-19 Impact Analysis, By Product (Water-based, Solvent-based), By Application (Commercial Aviation, Military Aviation, General Aviation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aerospace-adhesives-market

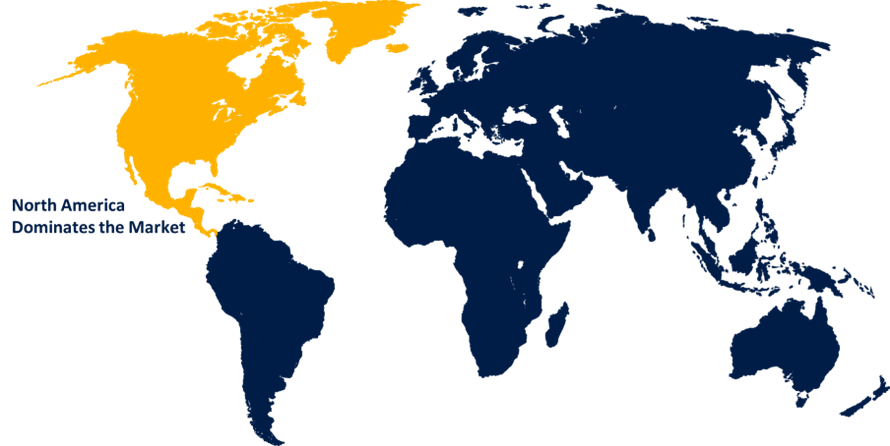

As there is a growing need for lighter and more fuel-efficient aircraft, the aerospace adhesives market is expanding significantly. Because they are strong and resilient to high pressure, temperature swings, and vibrations, adhesives are essential for joining different components together. The market is being driven by the increasing use of sophisticated composite materials in military and commercial aircraft to lower weight and improve performance. The growing emphasis on using high-performance adhesives in place of conventional fasteners is also fuelling the market's rise. Aerospace adhesive demand is also supported by significant industries such as maintenance, repair, and overhaul (MRO) services. Geographically speaking, North America dominates because of its well-established aerospace sector, but Asia-Pacific is starting to show promise as a profitable market due to the growing number of aircraft manufacturers in the region.

Aerospace Adhesives Market Value Chain Analysis

The value chain of the aerospace adhesives market is made up of distributors, producers, suppliers of raw materials, and end users, all of whom are essential to producing high-quality goods. The producers of adhesives rely on raw material suppliers to supply them with necessary ingredients such as resins, polymers, and curing agents so they may create solutions specifically designed for aircraft use. In order to improve adhesive qualities including bonding strength, durability, and resistance to harsh environmental conditions, manufacturers concentrate on research and development. Distributors then operate as a link between producers and consumers by guaranteeing prompt delivery and adherence to aircraft regulations. OEMs (original equipment manufacturers) of aircraft, MRO (maintenance, repair, and overhaul) companies, and defence contractors that employ adhesives for upgrades and assembly are examples of end users. Aerospace adhesives are guaranteed to meet strict performance, safety, and regulatory standards thanks to this integrated value chain.

Aerospace Adhesives Market Opportunity Analysis

Growing demand for lightweight, fuel-efficient aircraft and technical improvements are driving considerable potential prospects in the aerospace adhesives market. High-performance adhesives are starting to replace conventional mechanical fasteners in the aviation sector as a result of the industry's shift towards composite materials and the requirement to lower the total weight of aircraft. This trend creates opportunities for adhesive formulation innovation, such as the creation of high-temperature and flame-resistant adhesives. New market opportunities are also presented by the increasing attention being paid to electric aircraft and urban air mobility (UAM), as both industries call for specialised bonding solutions. Furthermore, there will likely be a significant need for adhesives due to the growth of the Maintenance, Repair, and Overhaul (MRO) industry, especially in Asia-Pacific and the Middle East. This will present profitable prospects for adhesive makers and suppliers.

The rise of the global aerospace sector is the primary driver of the robust growth observed in the aerospace adhesives market. Adhesive use has surged as a result of increased commercial aircraft production rates brought on by fleet modernisation and rising air travel demand. Advanced materials like composites are being used more frequently as a result of industrial pressure to create designs that are lightweight and fuel-efficient. However, assembly and structural bonding of composites require specific adhesives. Additionally, the defence industry's expenditures on unmanned aerial vehicles (UAVs) and advanced military aircraft support market expansion. More prospects are being driven by the growth of new aerospace programs and regional expansion in emerging markets, especially in Asia-Pacific. Advances in adhesive technology are contributing to this rise by allowing manufacturers to meet increasingly demanding performance and safety regulations.

One of the key issues is the high expense of creating sophisticated adhesives that adhere to strict aircraft regulations and are difficult for producers to keep prices competitive. These adhesives also need to adhere to stringent performance, safety, and environmental laws. This means that they must go through extensive testing and certification procedures, which lengthens the time to market. Additional cost constraints come from fluctuations in raw material costs, particularly for speciality resins and polymers. Additionally, there are restrictions on the market regarding adhesive compatibility with more recent composite materials, which may affect performance and durability over the long run. Furthermore, safety concerns have caused the aircraft industry to accept new technology somewhat slowly, which might impede innovation and the broad application of innovative adhesive solutions.

Insights by Product

The water based products segment accounted for the largest market share over the forecast period 2023 to 2033. Water-based adhesives are becoming more popular as the industry places a higher priority on safer and more environmentally friendly materials. They emit fewer volatile organic compounds (VOCs) than solvent-based alternatives. These adhesives minimise application-related health and safety hazards for workers while providing outstanding bonding qualities. The performance of water-based adhesive formulations has been enhanced, making them appropriate for a range of aerospace applications, such as non-structural assemblies and interior cabin components. The market for water-based adhesives is predicted to increase as aircraft manufacturers strive to fulfil strict compliance regulations and lessen their environmental impact. This will create growth prospects for businesses who concentrate on eco-friendly and sustainable product lines.

Insights by Application

The commercial aviation segment accounted for the largest market share over the forecast period 2023 to 2033. The requirement for high-performance adhesives is rising as a result of major aeroplane manufacturers like Boeing and Airbus increasing production to meet the growing demand for new, fuel-efficient models. By permitting the use of cutting-edge composite materials, these adhesives significantly contribute to the reduction of aircraft weight, improving fuel efficiency, and lowering emissions. Demand is also being fuelled by the requirement for lightweight bonding materials for interior elements like panelling and seating. The commercial aviation segment will continue to be a prominent growth driver for the aerospace adhesives market as airlines focus on fleet modernisation and upgrades to enhance operational efficiency and passenger comfort.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aerospace Adhesives Market from 2023 to 2033. High rates of manufacturing for both military and commercial aircraft, along with a significant amount of maintenance, repair, and overhaul (MRO) work, are driving the region's robust demand. Adhesive demand is also supported by the U.S. government's emphasis on modernising its defence fleet and growing space exploration investments. Furthermore, North America's strict safety and quality regulations generate a need for speciality adhesives that guarantee structural integrity and superior performance in challenging circumstances. Additionally, the area is a centre for adhesive technology research and development, which promotes creativity and makes it possible for producers to create high-performing goods that are specifically suited to changing aeronautical applications.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. As a result of growing passenger traffic, fleet expansion, and the establishment of new aircraft production facilities, nations such as China, India, and Japan are developing their aerospace capabilities. The region’s focus on establishing indigenous aerospace programs, together with collaborations with global firms, is growing demand for high-performance adhesives. Significant funding for space exploration and defence initiatives also opens up new growth opportunities. The region's expanding Maintenance, Repair, and Overhaul (MRO) industry is bolstered by the growing requirement to service an expanding fleet of aircraft, which further improves market prospects. Aerospace adhesive manufacturers find the Asia-Pacific region to be a lucrative market due to favourable government policies and initiatives that support local manufacturing and decrease reliance on imports.

Recent Market Developments

- In July 2022, Hexcel Corporation has collaborated with Spirit AeroSystems Europe at its Aerospace Innovation Centre (AIC) to work together on developing sustainable manufacturing technologies that will enhance future aircraft production.

Major players in the market

- PPG Industries

- 3M

- Henkel

- Solvay

- Flamemaster

- Chemetall

- Royal Adhesives & Sealants

- Dow Corning

- Permatex

- Master Bond

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Adhesives Market, Product Analysis

- Water-based

- Solvent-based

Aerospace Adhesives Market, Application Analysis

- Commercial Aviation

- Military Aviation

- General Aviation

Aerospace Adhesives Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?