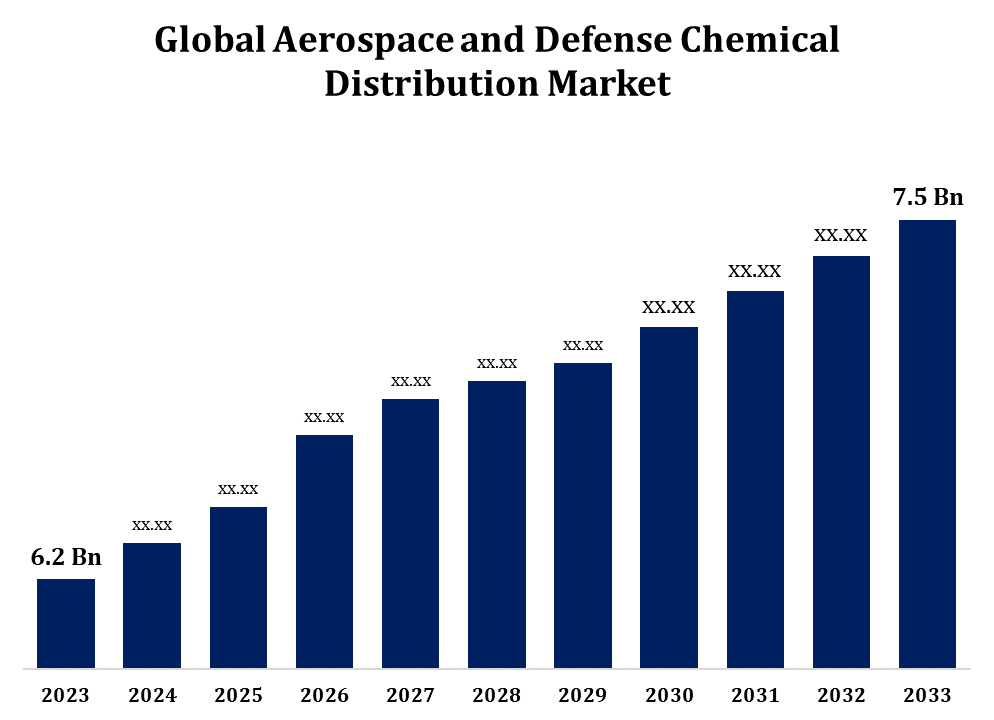

Global Aerospace and Defense Chemical Distribution Market Size To Worth USD 7.5 Billion By 2033 | CAGR of 1.92%

Category: Aerospace & DefenseGlobal Aerospace and Defense Chemical Distribution Market Size To Worth USD 7.5 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Aerospace and Defense Chemical Distribution Market Size to Grow from USD 6.2 Billion in 2023 to USD 7.5 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 1.92% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 222 pages with 110 Market data tables and figures & charts from the report on the "Global Aerospace and Defense Chemical Distribution Market Size, Share, and COVID-19 Impact Analysis, By Product (Lubricants & Greases, Oils & Hydraulic Fluids, Adhesives & Sealants, Paints & Coatings, Cleaners & Solvents, and Others), By End-use (Aerospace and Defense), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/aerospace-and-defense-chemical-distribution-market

The aerospace and defense chemical distribution market is fueled by the growing demand for specialized chemicals, such as adhesives, sealants, coatings, lubricants, and cleaning agents, which are critical for aircraft manufacturing, maintenance, and defense operations. As the aerospace sector expands, particularly with the increase in commercial air travel and defense expenditures, the need for chemical solutions that ensure performance, safety, and regulatory compliance becomes more pressing. Major players in this market prioritize distribution efficiency to ensure that global supply chains adhere to the stringent quality and safety standards established by the aerospace and defense industries. Furthermore, sustainability initiatives are gaining momentum, with a focus on eco-friendly chemicals and materials. While North America and Europe currently dominate the market due to their robust aerospace and defense sectors, emerging economies are anticipated to offer significant growth opportunities in the years ahead.

Aerospace and Defense Chemical Distribution Market Value Chain Analysis

The value chain of the aerospace and defense chemical distribution market consists of several stages, spanning from raw material suppliers to end users. It starts with chemical manufacturers creating specialized products, such as coatings, adhesives, and lubricants, which are crucial for aerospace and defense applications. Distributors serve an essential role as intermediaries between manufacturers and customers, ensuring that chemicals are delivered in accordance with strict safety, quality, and environmental regulations. These distributors frequently offer value-added services, including packaging, storage, logistics, and technical support, to address the complex requirements of aerospace OEMs (Original Equipment Manufacturers) and MRO (Maintenance, Repair, and Overhaul) service providers. End users, which include aircraft manufacturers, defense contractors, and airlines, depend on these chemicals for production and maintenance. Effective distribution is vital for ensuring continuity and reliability in the highly regulated aerospace and defense sectors.

Aerospace and Defense Chemical Distribution Market Opportunity Analysis

The aerospace and defense chemical distribution market offers substantial growth opportunities driven by advancements in aircraft technology, rising defense budgets, and an increasing emphasis on maintenance, repair, and overhaul (MRO) services. The demand for lightweight, fuel-efficient aircraft is boosting the need for high-performance adhesives, coatings, and composite materials. Additionally, the growing adoption of eco-friendly and sustainable chemical solutions, such as green coatings and bio-based lubricants, presents new market potential, particularly as regulatory agencies implement stricter environmental standards. Emerging markets in the Asia-Pacific region, the Middle East, and Latin America are witnessing heightened defense spending and aerospace manufacturing, further broadening the distributor customer base. Moreover, the integration of digital solutions, including inventory management and tracking systems, offers opportunities to enhance supply chain efficiency and customer satisfaction, driving market expansion.

Technological advancements in aerospace, including the development of lightweight, fuel-efficient aircraft and the adoption of advanced materials like composites and carbon fiber, are propelling growth in the aerospace and defense chemical distribution market. These innovations create a demand for specialized chemicals, such as high-performance adhesives, coatings, and sealants, which are essential for ensuring structural integrity, durability, and safety in extreme conditions. Additionally, the rise of additive manufacturing (3D printing) for aircraft components has heightened the need for custom chemical solutions, including specialized resins and powders. The increasing emphasis on sustainability and reducing carbon emissions is further driving the adoption of eco-friendly chemicals, such as water-based coatings and bio-lubricants. Distributors capable of providing these advanced, compliant chemical products are well-positioned to capitalize on the growing technological demands within the aerospace and defense sectors.

The aerospace and defense chemical distribution market encounters several challenges, particularly regarding stringent regulatory compliance and safety standards. The industry must navigate strict environmental, health, and safety regulations that differ by region, complicating global operations. The management of hazardous materials, such as adhesives, coatings, and lubricants, necessitates specialized handling, storage, and transportation, which elevates operational costs. Additionally, the market is affected by supply chain disruptions, especially due to geopolitical tensions, fluctuating raw material prices, and transportation bottlenecks. Maintaining consistent quality and timely delivery across global markets is essential but challenging because of these issues. Another significant challenge is the rising demand for sustainable and eco-friendly chemicals, compelling distributors to modify their product portfolios to meet regulatory and customer expectations while ensuring performance and safety standards, which can be both costly and time-consuming.

Insights by Products

The Adhesives & Sealants segment accounted for the largest market share over the forecast period 2023 to 2033. As manufacturers increasingly adopt composite materials, advanced adhesives and sealants have become crucial for bonding and sealing these structures, providing high strength while minimizing component weight. These products are vital for ensuring the integrity, durability, and safety of aircraft in extreme operational conditions. The segment also benefits from innovations in adhesive technologies, including epoxy-based adhesives and high-performance sealants, which offer superior resistance to temperature, pressure, and corrosion. Furthermore, the emergence of electric and hybrid aircraft, along with a rising demand for eco-friendly solutions, is generating new opportunities for distributors offering sustainable adhesives and sealants that comply with stringent aerospace and defense standards.

Insights by End Use

The aerospace segment accounted for the largest market share over the forecast period 2023 to 2033. The demand for specialized chemicals, including adhesives, sealants, coatings, and lubricants, is rising as aircraft manufacturers emphasize lightweight, fuel-efficient designs that utilize advanced materials like composites and carbon fiber. The movement toward more sustainable aviation, encompassing electric and hybrid aircraft, is further driving the need for innovative, eco-friendly chemical solutions. Additionally, maintenance, repair, and overhaul (MRO) services represent a significant growth area, as airlines aim to prolong the lifecycle of their aircraft using high-performance chemicals. With an increase in aircraft deliveries and a thriving aviation sector, the aerospace segment continues to present substantial growth opportunities for chemical distributors worldwide.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aerospace and Defense Chemical Distribution Market from 2023 to 2033. The region hosts major aircraft manufacturers like Boeing, Lockheed Martin, and Northrop Grumman, which significantly depend on chemical products for manufacturing, maintenance, and repair processes. Rising defense expenditures, particularly in the U.S., are driving the demand for specialized chemicals, including coatings, adhesives, sealants, and lubricants utilized in both aircraft production and military applications. North America's strict regulatory framework, encompassing environmental and safety standards, shapes the chemical supply chain, compelling distributors to ensure compliance. Furthermore, the region is at the forefront of technological advancements, including lightweight aircraft materials and eco-friendly chemicals, which contribute to market growth. North America's emphasis on sustainability also promotes the adoption of greener chemicals, creating new opportunities for distributors in this highly competitive landscape.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. These countries are making significant investments to modernize their defense systems and expand their commercial aviation fleets, which is increasing the demand for chemicals like adhesives, coatings, lubricants, and sealants for aircraft production, maintenance, and repair. The region's growing emphasis on sustainability and eco-friendly materials also provides additional opportunities for distributors offering green chemical solutions. However, the market faces challenges, including regulatory complexities, particularly due to differing safety and environmental standards across countries. Despite these obstacles, the region is emerging as a key player in the global aerospace and defense chemical distribution market, with developing local supply chains and infrastructure attracting international distributors and manufacturers.

Recent Market Developments

- On March 2019, Univar Solutions Inc. has announced the successful completion of its acquisition of Nexeo Solutions. This acquisition is expected to boost the company's market share in the global aerospace and defense chemical distribution sector, particularly by strengthening its presence in North America and the Asia-Pacific regions.

Major players in the market

- Aero Hardware & Parts Company

- Aerospace Chemical Supplies Ltd

- Aviall, Inc.

- Aviation Chemicals Solutions, Inc.

- Aviocom B.V.

- Boeing Distribution Services

- E.V. Roberts

- Ellsworth Adhesives

- Graco Supply Company

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace and Defense Chemical Distribution Market, Product Analysis

- Lubricants & Greases

- Oils & Hydraulic Fluids

- Adhesives & Sealants

- Paints & Coatings

- Cleaners & Solvents

- Others

Aerospace and Defense Chemical Distribution Market, End Use Analysis

- Aerospace

- Defense

Aerospace and Defense Chemical Distribution Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?