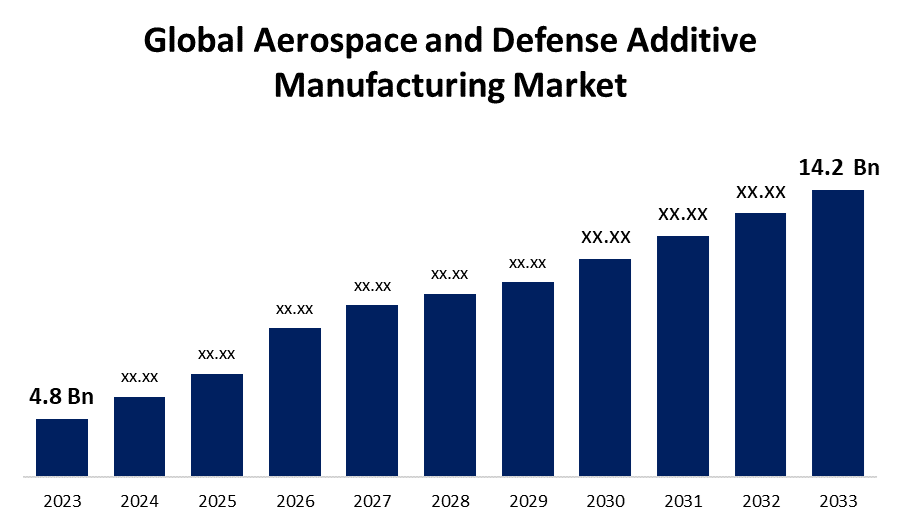

Global Aerospace and Defense Additive Manufacturing Market Size To Worth USD 14.2 Billion By 2033 | CAGR of 11.46%

Category: Aerospace & DefenseGlobal Aerospace and Defense Additive Manufacturing Market Size To Worth USD 14.2 Billion By 2033

According to a research report published by Spherical Insights and Consulting, the Global Aerospace and Defense Additive Manufacturing Market Size to grow from USD 4.8 billion in 2023 to USD 14.2 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 11.46% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 240 pages with 110 Market data tables and figures & charts from the report on the "Global Aerospace and Defense Additive Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Platform (Aviation (Aircraft and UAV), Defense (Combat Vehicles, Military PPE, Weapons, Submarine Hulls, and Others), Space (Engines, Satellites, Spacecraft, and Rockets)), By Vertical (Printer, Material, and Others), By Application (Engine Components, Space Components, Structural Components, Defense Equipment, and Others), By Technology (FDM, DMLS, SLA, CLIP, SLS, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033" Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aerospace-and-defense-additive-manufacturing-market

The aerospace and defence additive manufacturing market is expanding rapidly, propelled by advances in 3D printing technology and rising demand for lightweight, high-strength components. This market covers a wide range of applications, including the manufacture of sophisticated engine parts, aircraft structures, and specialised components for military and space applications. The advantages of additive manufacturing, such as reduced material waste, quicker production cycles, and the ability to create complicated designs, are major motivators for its adoption. Key industry companies are investing in RandD to improve the capabilities of additive manufacturing technology. Furthermore, regulatory agencies are adopting standards to verify the quality and dependability of 3D-printed parts, which will increase market confidence and growth.

Aerospace and Defense Additive Manufacturing Market Value Chain Analysis

The aerospace and defence additive manufacturing market value chain consists of numerous crucial stages, beginning with raw material suppliers who provide specialised metals, polymers, and composites required for 3D printing. These materials are subsequently processed by technology companies, which create and supply advanced additive manufacturing machines and software. The following level encompasses service providers who provide design, prototyping, and production services, utilising additive manufacturing to produce high-performance aerospace and defence components. Quality assurance organisations then test and validate these components to ensure that they meet demanding industry standards. Finally, original equipment manufacturers (OEMs) integrate the finished goods into aircraft, spacecraft, and defence systems, working with suppliers and regulatory agencies to assure peak performance and safety in difficult operational settings.

Aerospace and Defense Additive Manufacturing Market Opportunity Analysis

The aerospace and defence additive manufacturing market value chain consists of numerous crucial stages, beginning with raw material suppliers who provide specialised metals, polymers, and composites required for 3D printing. These materials are subsequently processed by technology companies, which create and supply advanced additive manufacturing machines and software. The following level encompasses service providers who provide design, prototyping, and production services, utilising additive manufacturing to produce high-performance aerospace and defence components. Quality assurance organisations then test and validate these components to ensure that they meet demanding industry standards. Finally, original equipment manufacturers (OEMs) integrate the finished goods into aircraft, spacecraft, and defence systems, working with suppliers and regulatory agencies to assure peak performance and safety in difficult operational settings.

The rising demand for lightweight parts and components is a primary driver of growth in the aerospace and defence additive manufacturing industries. Lightweight materials are vital for increasing fuel efficiency, lowering pollutants, and boosting aircraft and defence system performance. Additive manufacturing enables the creation of sophisticated, lightweight designs that traditional manufacturing processes cannot produce, resulting in significant weight savings without sacrificing strength or durability. The industry's desire for more sustainable and cost-effective solutions fuels this demand even more. As a result, manufacturers are increasingly using 3D printing technology to create optimised, high-performance components, thereby stimulating innovation and expanding the market.

Despite its high potential, the aerospace and defence additive manufacturing business confronts a number of obstacles. One notable impediment is the high initial cost of 3D printing equipment and materials, which can prevent widespread adoption, particularly among smaller businesses. Furthermore, assuring the quality and dependability of 3D-printed parts is critical, as these components must adhere to strict industry standards and regulatory criteria for safety and performance. There are additional technical constraints regarding the size and scalability of additive manufacturing techniques, which limit the creation of larger components. Furthermore, the sector must manage intellectual property issues and supply chain complexity.

Insights by Platform

The defence segment accounted for the largest market share over the forecast period 2023 to 2033. Additive manufacturing enables the production of lightweight, durable parts with complicated geometries, which are critical for modern defence applications such as unmanned aerial vehicles (UAVs), missiles, and advanced combat aircraft. The capacity to quickly develop and manufacture unique components improves operational efficiency and adaptability in defence strategies. Furthermore, the technology's ability to simplify supply chains and decrease logistical problems is especially useful in remote or war areas.

Insights by Vertical

The printer segment is dominating the market with the largest market share over the forecast period 2023 to 2033. The advent of 3D printing technology to build complicated, high-performance components is driving this rise. Additive manufacturing is becoming increasingly viable for aerospace and defence applications as 3D printer technology advances, including increases in precision, speed, and material capability. Manufacturers are rapidly investing in sophisticated printers to create lightweight, long-lasting parts that match industry standards. The development of multi-material and metal 3D printers has broadened the spectrum of applications, allowing for the manufacture of key engine parts, airframes, and custom components.

Insights by Application

The space components segment accounted for the largest market share over the forecast period 2023 to 2033. Additive manufacturing enables the creation of complicated geometries and customised components, which are crucial for improving performance and lowering spaceship weight. This technique enables rapid prototyping and shorter manufacturing cycles, allowing for more frequent revisions and advancements in space hardware. NASA and private space companies such as SpaceX are using 3D printing to manufacture anything from satellite components to rocket engines. The capacity to manufacture parts on-demand in space conditions opens up new options, encouraging growth and investment in this industry.

Insights by Technology

The FDM segment is dominating the market with the largest market share over the forecast period 2023 to 2033. FDM technique builds layers of parts from thermoplastic materials such as ABS and nylon, making it excellent for producing lightweight components with good mechanical qualities. In aerospace and defence, FDM is used to create drones, tools, fixtures, and even structural components for aeroplanes and spacecraft. The ability to develop designs quickly and manufacture complicated geometries without traditional tooling limits is a significant advantage. As FDM printers become more advanced and capable of handling high-performance materials, their use in the aerospace and defence industries is likely to increase, driving innovation and efficiency in manufacturing processes.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aerospace and Defense Additive Manufacturing Market from 2023 to 2033. Strong technology improvements and huge RandD spending are driving the rise. The presence of large aerospace and defence firms creates a strong demand for 3D-printed components, which improve performance and lower production costs. Government backing and financing for defence initiatives, such as those conducted by NASA and the Department of Defence, further stimulate industry growth. The region's well-established infrastructure and qualified personnel also help to drive the rapid adoption of additive manufacturing technologies. Furthermore, cooperation among academic institutions, industry leaders, and research organisations generate constant innovation, bolstering North America's position as a key player in the global aerospace and defence additive manufacturing market.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's robust manufacturing base and emphasis on technological breakthroughs encourage the use of 3D printing to produce lightweight, complicated components. Government measures that encourage research and development, as well as cooperation between local enterprises and worldwide leaders, help to drive market growth. Furthermore, the growing commercial aviation sector in Asia-Pacific presents significant prospects for incorporating additive manufacturing to improve efficiency and cost-effectiveness in aircraft manufacture and maintenance.

Recent Market Developments

- In February 2021, The US Department of Defence has signed a USD 1.6 million contract with ExOne for container 3D printing plants. According to the agreement, the company will construct a 3D printing pod in a standard shipping container measuring up to 40 feet long.

Major players in the market

- General Electric Company

- Raytheon Technologies Corporation

- The Boeing Company

- Lockheed Martin Corporation

- Airbus SE

- Northrop Grumman Corporation

- BAE Systems

- Safran SA

- Rolls-Royce Holdings

- Honeywell Aerospace

- Siemens Digital Industries Software

- OC Oerlikon Corporation AG

- Moog Inc.

- Aerojet Rocketdyne Holdings Inc.

- Carpenter Technology Corporation

- Renishaw PLC

- GKN Aerospace, Stratasys Ltd.

- EOS GmbH

- 3D Systems Corporation

- Proto Labs Inc.

- Materialise NV

- Desktop Metal Inc.

- SLM Solutions Group AG

- Optomec Inc.

- Sintavia

- Additive Industries

- Optisys LLC

- CRP Technology SRL

- BeAM Machines Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace and Defense Additive Manufacturing Market, Platform Analysis

- Aviation

- Aircraft

- UAV

- Defense

- Combat Vehicles

- Military PPE

- Weapons

- Submarine Hulls

- Others

- Space

- Engines

- Satellites

- Spacecraft

- Rockets

Aerospace and Defense Additive Manufacturing Market, Vertical Analysis

- Printer

- Material

- Others

Aerospace and Defense Additive Manufacturing Market, Application Analysis

- Engine Components

- Space Components

- Structural Components

- Defense Equipment

- Others

Aerospace and Defense Additive Manufacturing Market, Technology Analysis

- FDM

- DMLS

- SLA

- CLIP

- SLS

- Others

Aerospace and Defense Additive Manufacturing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East and Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?