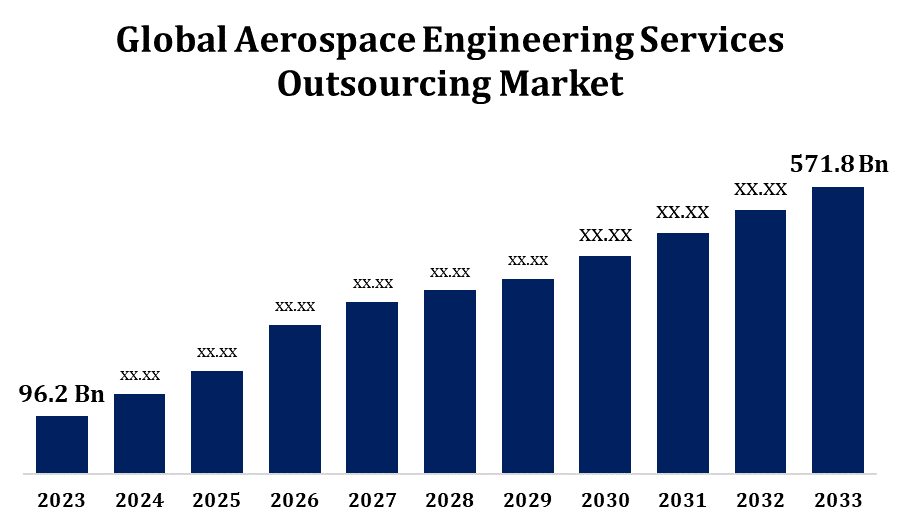

Global Aerospace Engineering Services Outsourcing Market Size To Worth USD 571.8 Billion By 2033 | CAGR of 19.51%

Category: Aerospace & DefenseGlobal Aerospace Engineering Services Outsourcing Market Size To Worth USD 571.8 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Aerospace Engineering Services Outsourcing Market Size to Grow from USD 96.2 Billion in 2023 to USD 571.8 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 19.51% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 Market data tables and figures & charts from the report on the "Global Aerospace Engineering Services Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Service (Design & Engineering, Manufacturing Support, Security & Certification, After-market Services), By Location (On-Shore, Off-Shore), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aerospace-engineering-services-outsourcing-market

The Aerospace Engineering Services Outsourcing (ESO) market is witnessing significant growth, driven by the increasing demand for innovative and efficient aircraft designs, as well as the need for cost optimization. This market includes a range of engineering services such as design, prototyping, testing, and system integration, which are progressively being outsourced to specialized providers. Key factors propelling this trend include the expansion of the global aviation sector, advancements in technologies like additive manufacturing and artificial intelligence, and the emphasis on reducing product lifecycle costs. Leading aerospace companies are collaborating with engineering service providers to tap into a global talent pool, utilize digital engineering tools, and stay competitive. The market is expected to keep growing, bolstered by rising R&D investments, a focus on sustainability, and the evolving regulatory landscape in the aerospace sector.

Aerospace Engineering Services Outsourcing Market Value Chain Analysis

The value chain of the Aerospace Engineering Services Outsourcing (ESO) market comprises several essential stages, starting with research and development (R&D) and extending through design, engineering, manufacturing support, and post-production services. During the R&D phase, aerospace companies collaborate closely with ESO providers to conceptualize and create new technologies, materials, and designs. In the design and engineering phase, outsourced services encompass CAD modeling, simulation, and testing, which ensure cost-effective and optimized solutions. ESO firms also deliver manufacturing support by offering expertise in process engineering, quality assurance, and regulatory compliance. Lastly, post-production services, including maintenance, repair, and overhaul (MRO), help maintain operational efficiency and safety. This value chain enables aerospace companies to utilize specialized skills, shorten development timelines, and enhance agility while concentrating on their core competencies.

Aerospace Engineering Services Outsourcing Market Opportunity Analysis

The Aerospace Engineering Services Outsourcing (ESO) market offers significant growth opportunities, driven by the increasing adoption of advanced technologies like AI, IoT, and additive manufacturing. As aerospace companies aim to innovate and cut development costs, they are turning to outsourcing for R&D, design, and testing services to tap into specialized expertise and digital engineering capabilities. The transition towards electrification and sustainable aviation, particularly with the emergence of electric and hybrid aircraft, is creating new opportunities for ESO providers. Additionally, emerging markets in Asia-Pacific and the Middle East are boosting demand for these services due to expanding aviation infrastructure and growing air passenger traffic. Furthermore, the aftermarket services segment, including maintenance, repair, and overhaul (MRO) activities, is anticipated to experience a surge in outsourcing, presenting ESO firms with long-term, value-added growth potential.

The growth of the Aerospace Engineering Services Outsourcing (ESO) market is primarily driven by the increasing demand for specialized engineering skills and expertise. As the aerospace industry grows more complex with the adoption of advanced technologies such as AI, IoT, and additive manufacturing, companies need highly skilled professionals in niche fields like avionics, aerostructures, and propulsion systems. However, sourcing and retaining this talent internally proves to be both challenging and expensive. As a result, aerospace firms are partnering with ESO providers who offer access to a global talent pool with expertise in cutting-edge technologies and adherence to stringent industry standards. By utilizing these specialized skills, companies can speed up innovation, shorten product development cycles, and improve overall efficiency, which in turn propels the growth of the ESO market.

The Aerospace Engineering Services Outsourcing (ESO) market encounters several challenges that can hinder its growth. A significant issue is the strict regulatory and compliance requirements within the aerospace sector, which complicate the outsourcing of critical engineering functions. Another concern is ensuring data security and protecting intellectual property (IP), as ESO providers manage sensitive information related to aircraft design and technology. Additionally, coordinating communication and collaboration among geographically dispersed teams can result in inefficiencies and project delays. The scarcity of highly skilled professionals in specialized fields such as avionics and systems engineering further restricts the scalability of ESO services. Moreover, fluctuations in demand driven by economic cycles or geopolitical factors can influence outsourcing strategies, necessitating that ESO firms remain agile and responsive to evolving market conditions.

Insights by Service

The manufacturing support segment accounted for the largest market share over the forecast period 2023 to 2033. This segment encompasses services such as process engineering, quality assurance, tooling design, and supply chain management, all of which are vital for improving manufacturing efficiency and minimizing time-to-market. As aerospace companies seek to optimize their operations and concentrate on core competencies, they are increasingly outsourcing these functions to ESO providers that offer specialized expertise and advanced digital tools, including digital twins and automation. The emergence of Industry 4.0 and smart manufacturing technologies further boosts the demand for outsourced manufacturing support. Additionally, the emphasis on lightweight materials and intricate component designs, especially for next-generation aircraft, is increasing the need for advanced manufacturing capabilities provided by ESO partners.

Insights by Location

The on-shore segment accounted for the largest market share over the forecast period 2023 to 2033. On-shore outsourcing entails utilizing engineering services within the same country or region, allowing aerospace firms to achieve closer oversight and alignment with ESO providers. This approach significantly reduces communication barriers, enhances project coordination, and ensures compliance with rigorous industry standards and intellectual property (IP) protections. The trend is particularly pronounced in North America and Europe, where local expertise is essential to navigate complex regulatory requirements and engineering challenges. Additionally, on-shore outsourcing mitigates risks associated with geopolitical tensions and supply chain disruptions. As a result, aerospace companies are increasingly turning to on-shore ESO solutions to improve operational flexibility, maintain stringent quality control, and optimize their engineering processes, ultimately fostering greater innovation and efficiency within the industry.

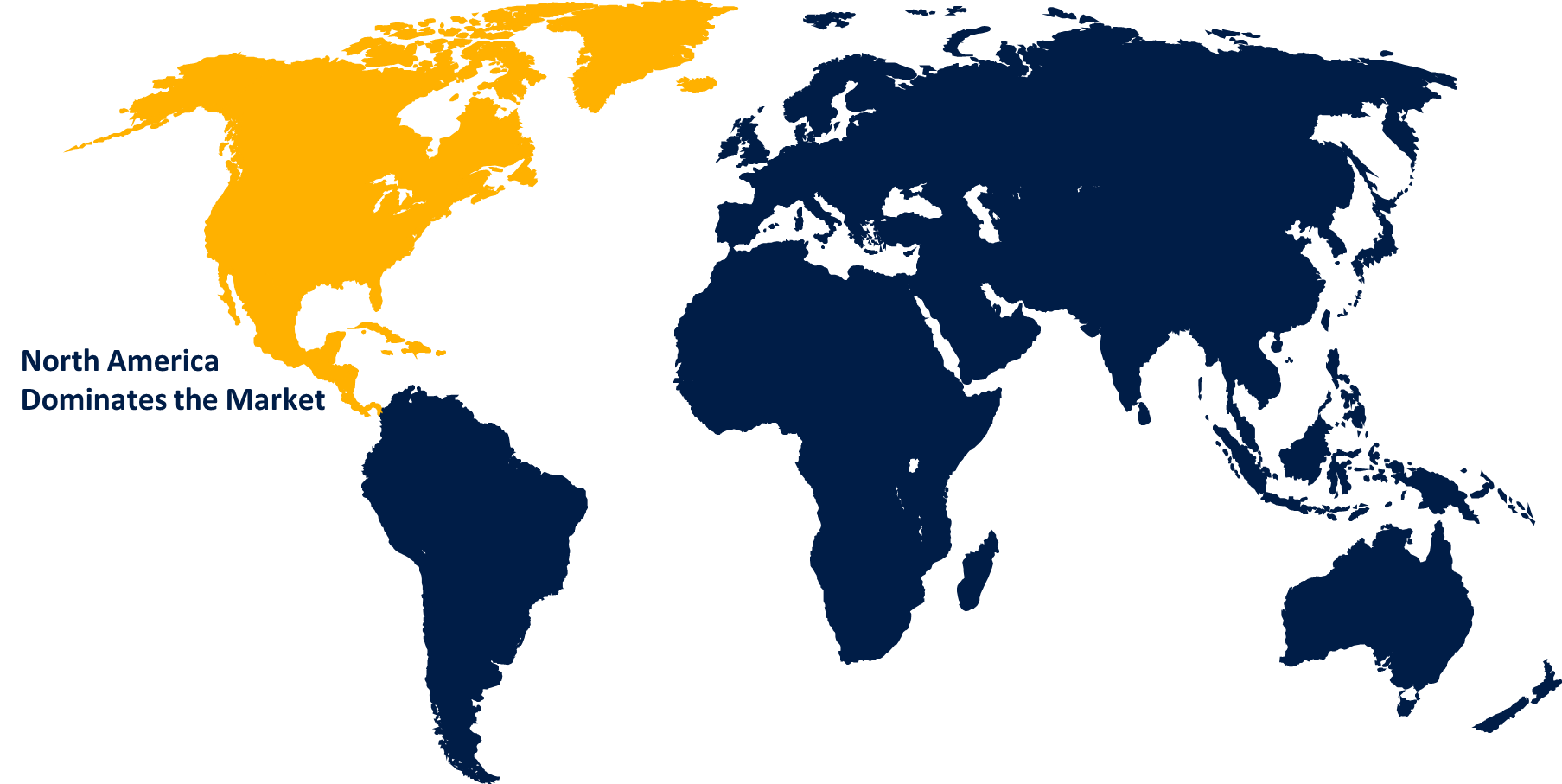

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aerospace Engineering Services Outsourcing Market from 2023 to 2033. The demand for outsourced engineering services in the region is driven by the necessity for advanced research and development (R&D), digital engineering solutions, and support for new aerospace initiatives. North American companies are increasingly turning to outsourcing for design, testing, and manufacturing support to optimize costs and foster innovation. The market's growth is further bolstered by investments in emerging technologies such as electric propulsion, autonomous systems, and next-generation aircraft. Moreover, the stringent safety and regulatory standards in the industry require specialized expertise, making outsourcing an attractive strategy for maintaining competitiveness and ensuring compliance within the ever-evolving aerospace landscape.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries such as India, China, and Japan are emerging as significant hubs for ESO services, thanks to their robust engineering talent pool and competitive cost advantages. Both local aerospace firms and international companies are increasingly outsourcing engineering functions like design, simulation, and manufacturing support to leverage these resources effectively. Government initiatives that promote aerospace R&D and the development of indigenous aircraft are further energizing the market. Additionally, collaborations between global aerospace leaders and regional ESO providers are enhancing technological capabilities. The region's emphasis on sustainability, innovation, and maintenance, repair, and overhaul (MRO) services is generating new outsourcing opportunities, positioning Asia-Pacific as a vital player in the global aerospace engineering services market.

Recent Market Developments

- In 2022, Altair, a leader in artificial intelligence (AI) and computational science worldwide, has acquired Concept Engineering, a leading supplier of software for electronic system visualisation that simplifies the design, production, and maintenance of intricate electrical and electronic systems in the automotive, aerospace, and industrial sectors.

Major players in the market

- Honeywell International Inc.

- LISI Group

- ALTRAN

- Bertrandt

- AKKA

- Altair Engineering, Inc.

- Alten Group

- L&T Technology Services Limited

- Safran

- QuEST Global Services Pte. Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Engineering Services Outsourcing Market, Service Analysis

- Design & Engineering

- Manufacturing Support

- Security & Certification

- After-market Services

Aerospace Engineering Services Outsourcing Market, Location Analysis

- On-Shore

- Off-Shore

Aerospace Engineering Services Outsourcing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?