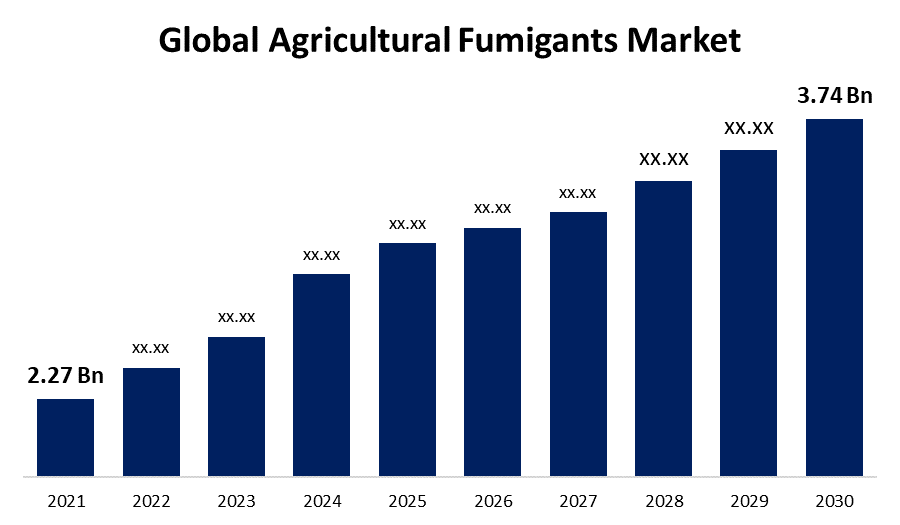

Global Agricultural Fumigants Market Size To Worth USD 3.74 Billion by 2030 | CAGR of 5.4%

Category: AgricultureGlobal Agricultural Fumigants Market Size To Worth USD 3.74 Billion By 2030

According to a research report published by Spherical Insights & Consulting, the Global Agricultural Fumigants Market Size is to Grow from USD 2.27 Billion in 2021 to USD 3.74 Billion by 2030, at a Compound Annual Growth Rate (CAGR) of 5.4% over the study period. Multiple factors, including increased consumer interest in improving the agricultural quality of the final product, changing farming methods, and highly developed storage technology, are driving the growth of the agricultural fumigants market during the predicted timeframe.

Get more details on this report -

Browse key industry insights spread across 200 pages with 130 market data tables and figures & charts from the report on "Global Agricultural Fumigants Market Size, Share, and COVID-19 Impact Analysis, By Products (Chloropicrin, Dimethyl Disulfide, Phosphine, Others), By Application (Soil, Warehouses), By Form (Solid, Liquid, Gas), By Pest Control Method (Tarpaulin, Non-Tarp, Vacuum), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/agricultural-fumigants-market

Fumigation, which involves spraying a pesticide gas into the soil or air to kill pests, is a standard procedure in agriculture. One of the pest management techniques used to kill or prevent the growth of pests is fumigation. It eliminates soil pathogens such as weeds, fungi, and nematodes while also promoting optimal crop development. These fumigants are effective at reaching pests and are useful for both pre-harvest and post-harvest applications. Agricultural fumigants include phosphine, 1, 3-dichloropropene, chloropicrin, methyl bromide, metam sodium, and others. They come in a variety of forms, including gas, solid, and liquid, and can be used in the soil as well as warehouses. The increased use of agricultural fumigants can be attributed to biotic and abiotic factors such as an increase in pest and insect infestations in warehouses and other crop storage rooms, increased awareness of crop protection chemicals, and urbanization in developing markets. Rapid technological advancements in the agricultural sector, growing concerns about post-harvest losses, and a shift in advanced farming practices that have resulted in increased yields are driving the agricultural fumigants market. However, fumigants can lead to several issues, including phytotoxicity, depending on the crop type and variety, climate variations, humidity, temperature, fumigant concentration, and treatment duration. Due to its toxic effect as a respiratory poison, it is only recommended for use by skilled fumigators.

The chloropicrin segment is expected to grow the fastest in the market during the forecast period.

On the basis of products, the global agricultural fumigants market is differentiated into chloropicrin, dimethyl disulfide, phosphine, and others. The chloropicrin segment is expected to grow the fastest in the market over the projection period. Chloropicrin is predicted to grow at the fastest CAGR, due to its multifunctional nature in controlling various pests such as nematodes, weeds, insects, bacteria, and soil-borne fungus diseases while leaving agricultural produce residue-free.

The warehouse segment is anticipated to be the fastest growing segment in the market during the projected period.

On the basis of application, the global agricultural fumigants market is segmented into soil, and warehouses. The warehouse segment is expected to be the fastest growing segment in the market during the predicted period. Pest control techniques are used to kill, repel, or suppress insects, nematodes, and other pests that cause damage to infrastructure and stored food in warehouses. Because of the severe pest infestation caused in warehouses, the agricultural fumigants market has started to gain traction.

The liquid segment is anticipated to hold the largest market over the predicted period.

Based on the form, the global agricultural fumigants market is categorized into solid, liquid, and gas. The liquid segment is anticipated to hold the largest market over the study period. Liquid forms of soluble products often used to eliminate moulds, insects, and pests, among other things, are available. They are usually sprayed with standard sprayers over the desired land area. The volume of solvent to be dispersed is determined by the applicator.

The tarpaulin fumigation segment is anticipated to hold the largest market over the projected period.

Based on the pest control method, the global agricultural fumigants market is segmented into tarpaulin, non-tarp, vacuum. The tarpaulin fumigation segment is estimated to hold the largest market during study period. Because of its low cost, application simplicity, effectiveness, availability, and ability to prevent gas leakage, tarpaulin is broadly used.

North America holds the largest share of the Global Agricultural Fumigants Market.

Get more details on this report -

North America is one of the world's most important agricultural regions. North America has the largest agricultural fumigants market due to farmers' growing awareness of the importance of crop protection against insects and other pests in order to reduce agricultural commodity losses. Due to the stringent regulations imposed by multiple agencies in recent years, farmers and other agricultural associations are looking for viable alternatives to methyl bromide and chloropicrin. In the United States, some alternatives, such as phosphine, carbonyl sulphide, and sulfuryl fluoride, have been tested. These alternatives have a lower environmental impact than methyl bromide.

The Asia Pacific market is estimated to be the fastest-growing during the forecast period due to the high potential for growth, given the increase in agricultural production and the growing demand for agricultural fumigants with rising warehouses in countries such as China and India. The Latin American agricultural fumigants market is expected to grow significantly in the coming years due to Brazil's increasing capacity for adopting advanced agricultural practices and storage techniques.

Major vendors in the Global Agricultural Fumigants Market include AMVAC, Trinity Manufacturing Inc., Douglas products, Intertek, Nippon Chemical Industrial Co. LTD., MustGrow Biologics Inc, Nufarm, Solvay, Tessenderlo Kerley Inc., SGS SA, UPL, BASF SE, Syngenta, ADAMA, ARKEMA, and Others.

Recent Developments

- In June 2022, UPL Limited, a global provider of sustainable agricultural solutions, announced the launch of new insecticides in India that contain the patented active ingredient Flupyrimin and are designed to target the most damaging rice pests. The launch will take place during the Kharif crop sowing season, which typically begins in June, with rice being the most important crop sown at this time.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Agricultural Fumigants Market based on the below-mentioned segments:

Global Agricultural Fumigants Market, By Products

- Chloropicrin

- Dimethyl Disulfide

- Phosphine

- Others

Global Agricultural Fumigants Market, By Application

- Soil

- Warehouses

Global Agricultural Fumigants Market, By Form

- Solid

- Liquid

- Gas

Global Agricultural Fumigants Market, By Pest Control Method

- Tarpaulin

- Non-Tarp

- Vacuum

Global Agricultural Fumigants Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?