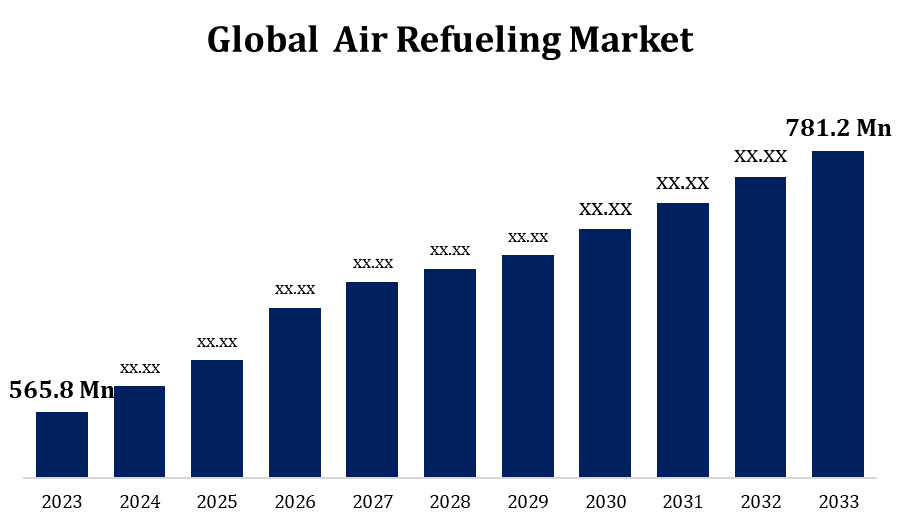

Global Air Refueling Market Size To Worth USD 781.2 Million by 2033 | CAGR Of 3.28%

Category: Aerospace & DefenseGlobal Air Refueling Market Size To Worth USD 781.2 Million by 2033

According to a research report published by Spherical Insights & Consulting, The Global Air Refueling Market Size to grow from USD 565.8 Million in 2023 to USD 781.2 Million by 2033, at a Compound Annual Growth Rate (CAGR) of 3.28% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 market data tables and figures & charts from the report on the "Global Air Refueling Market Size By Aircraft Type (Combat & Tanker, Turboprop & Helicopter, UAV), By System Type (Hose & Drogue, Boom & Receptacle), By Component (Hose, Drogue, Probe, Boom, Refueling Pods, Others), By End User (OE, Aftermarket), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/air-refueling-market

Many countries are upgrading their air refuelling capabilities as part of bigger efforts to modernise their forces. This covers the cost of purchasing new tanker aircraft, making fleet changes, and investing in state-of-the-art refuelling systems. The ageing tanker fleets in many countries and the need to support long-range missions and expeditionary operations are some of the factors driving the sustained high demand for tanker aircraft. International cooperation and alliances are crucial in the air refuelling industry. Countries often collaborate on tanker development and procurement initiatives to share costs, benefit from technological expertise, and enhance coalition forces' interoperability.

Air Refueling Market Value Chain Analysis

Companies including Boeing, Airbus, Lockheed Martin, and Embraer are involved in the construction of tanker aircraft. These companies design, build, and operate specialised tanker aircraft equipped with aerial refuelling systems. They also provide aftermarket services and support to tanker operators. Component suppliers provide a variety of parts and systems, including engines, avionics, hoses, booms, refuelling pods, and receptacle systems, for tanker aircraft. Engine manufacturers like General Electric and Rolls-Royce as well as businesses that specialise in refuelling equipment like Eaton Corporation and Cobham plc may be present in this sector. Some companies specialise in adding new refuelling technologies to tanker jets or adding refuelling systems to aircraft platforms that already exist.

Air Refueling Market Opportunity Analysis

The need for more mission flexibility, faster force deployment, and longer operational ranges has led to an increase in the demand for air refuelling capabilities worldwide. This presents an opportunity for manufacturers, service providers, and tech developers to adjust to the evolving requirements of commercial and military activities. Many countries are attempting to update their air refuelling infrastructure so that they can swap out their antiquated tanker fleets for more modern, fuel-efficient ones. This presents an opportunity for component suppliers and integrators to provide cutting-edge refuelling systems and technologies, and for aircraft manufacturers to secure contracts for the development and delivery of tanker aircraft.

Many countries are investing in modernising their defence capabilities, which includes purchasing new tanker aircraft equipped with state-of-the-art aerial refuelling systems. As a result of these modernization efforts, the need for aerial refuelling systems will rise as obsolete tanker fleets are replaced with more capable and efficient aircraft. Aerial refuelling systems allow military aircraft to refuel in-flight, increasing their endurance and range and expanding their operational reach. As military forces strive to enhance their ability to project power over longer distances and carry out operations in remote or contested locations, it is expected that the requirement for aerial refuelling systems would increase.

The development, acquisition, and operation of aerial refuelling systems, including tanker aircraft and other equipment, might be financially unfeasible. The high upfront purchase costs and ongoing operating expenses pose a challenge to defence budgets, particularly in lean financial times. Aerial refuelling has seen significant technology advancements, including as automated refuelling systems and advanced communication/navigation systems, but difficulties with dependability and technological limitations still need to be resolved. The development and implementation of new technologies to enhance the efficiency, reliability, and security of aerial refuelling operations remain challenging. In the air refuelling industry, manufacturers, service providers, and technological innovators compete fiercely.

Insights by Aircraft Type

The combat and tanker segment accounted for the largest market share over the forecast period 2023 to 2033. Many countries are modernising their fleets of combat aircraft in an effort to maintain air superiority and confront evolving threats. For combat aircraft to have greater operational flexibility, endurance, and range, they must be able to refuel from the air. They will be able to accomplish operations across longer distances and stay visible in areas that are being attacked thanks to this. Tanker aircraft serve a vital role in augmenting global reach and force projection by enabling long-range strike missions, strategic airlift operations, and expeditionary deployments. Demand for tanker aircraft with aerial refuelling systems is expected to rise as countries seek to strengthen their expeditionary capacities and handle issues with regional security.

Insights by System Type

The hose & drogue segment accounted for the largest market share over the forecast period 2023 to 2033. Hose and drogue systems are often less expensive than boom systems when considering acquisition and running costs. Because of this, they are a popular option for countries trying to cut expenses or maximise their expenditures in aerial refuelling. The increased demand for aerial refuelling services for long-haul commercial flights is driving expansion in the hose and drogue section of the commercial sector. Particularly in the freight and logistics industries, commercial operators are looking into the feasibility of using hose and drogue systems to extend the endurance and range of their aircraft for ultra-long-haul operations.

Insights by Component

The boom segment accounted for the largest market share over the forecast period 2023 to 2033. Boom systems are a great help when refuelling large aircraft, like cargo planes, heavy bombers, and aerial tankers. Boom systems are becoming increasingly and more important to help refuel these platforms as countries modernise their tanker fleets and purchase larger aircraft for aerial refuelling and strategic airlift. Numerous countries are initiating modernization initiatives for tankers in order to replace their antiquated fleets with more advanced and capable ships that are equipped with state-of-the-art boom refuelling systems. Boom system suppliers and manufacturers stand to gain market share and contracts by means of these upgrading activities.

Insights by End User

The OE segment accounted for the largest market share over the forecast period 2023 to 2033. Many countries are investing in the procurement of new tanker aircraft equipped with state-of-the-art aerial refuelling systems as part of their efforts to update their defences. Modern platforms that can replenish at any moment are intended to replace antiquated tanker fleets through these programmes. Even though the OEM market primarily serves the military, OEMs may also offer aerial refuelling systems for business applications, particularly in the transportation and logistics sectors. OEMs may design specialised aerial refuelling systems for commercial tanker aircraft in order to improve operational efficiency and enable long-haul flights.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Air Refueling Market from 2023 to 2033. The United States, Canada, and other North American countries continue to fund defence modernization efforts in order to maintain strategic capabilities and counter new threats. Aerial refuelling capabilities play a critical role in the success of modernization projects by expanding the range and endurance of military aircraft, facilitating fast force deployment, and enhancing operational flexibility. In addition to military applications, commercial aerial refuelling services are becoming more and more in demand in North America. Businesses are looking into the feasibility of using aerial refuelling to extend the range of commercial aircraft for long-haul flights, particularly in the logistics and freight sectors.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Several Asia-Pacific countries are investing in military modernization programmes to strengthen their armed forces and adapt to evolving security threats. Aerial refuelling capabilities are considered essential for power projection, fast reaction times, and extended operational range, particularly in the region's vast marine and territorial domains. China's neighbouring countries and partners in the region are concerned about its plans to modernise its armed forces, especially the development and use of advanced aerial refuelling capabilities. In order to extend the range and endurance of their aircraft for long-haul flights over the vast regions of the Asia-Pacific area, commercial operators are looking into the feasibility of using aerial refuelling.

Recent Market Developments

- In December 2018, Lockheed Martin and Airbus came to an agreement to work together to explore the options for meeting the industry's demand for aerial refuelling for US defence clients.

Major players in the market

- Airbus SE

- Cobham plc

- Draken Internationnal

- Eaton Corporation

- GE Aviation

- Marshall Aerospace & Defence Group

- Parker Hannifin Corporation

- Safran

- Zodiac Aerospace

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Air Refueling Market, Aircraft Type Analysis

- Combat & Tanker

- Turboprop & Helicopter

- UAV

Air Refueling Market, System Type Analysis

- Hose & Drogue

- Boom

- Receptacle

Air Refueling Market, Component Analysis

- Hose

- Drogue

- Probe

- Boom

- Refueling Pods

- Other

Air Refueling Market, End User Analysis

- OE

- Aftermarket

Air Refueling Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?