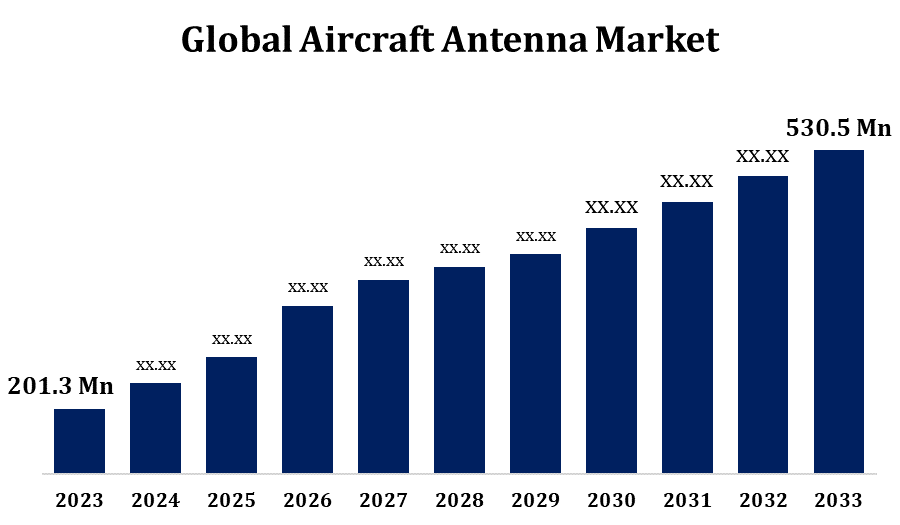

Global Aircraft Antenna Market Size to Worth USD 530.5 Million by 2033 | CAGR of 10.18%

Category: Aerospace & DefenseGlobal Aircraft Antenna Market Size to Worth USD 530.5 Million by 2033

According to a research report published by Spherical Insights & Consulting, the Global Aircraft Antenna Market Size to grow from USD 201.3 Million in 2023 to USD 530.5 Million by 2033, at a Compound Annual Growth Rate (CAGR) of 10.18% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 market data tables and figures & charts from the report on the "Global Aircraft Antenna Market Size By Application (Communication, Navigation & Surveillance), By End User (Original Equipment Manufacturer (OEM), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/aircraft-antenna-market

As it supports a variety of aircraft models' navigation, communication, and surveillance systems, the aircraft antenna market is vital to the aerospace industry. Antennas are necessary for ensuring consistent and efficient communication between an aircraft and other aircraft as well as ground stations. The number of people who travel by air is growing worldwide, which has raised demand for aeroplanes and, consequently, increased need for aircraft antennas. Airlines and operators regularly spend in updating and outfitting their present fleets with communication and navigation technologies, which creates a requirement for state-of-the-art antennas.

Aircraft Antenna Market Value Chain Analysis

Research and development is the initial stage of the value chain, during which companies invest capital in state-of-the-art antenna technology. The main goals of research and development are to increase functionality, reduce mass, strengthen resilience, and include advanced communication and navigation technologies. The next stage after finishing the antenna design is to begin producing the antenna's component parts. This entails producing components such as conductive elements, radomes, and other necessary materials. The actual assembly of the antennas takes place in this step. It is necessary to join the manufactured components to create the final antenna product. Before being included into aviation systems, antennas are placed through a rigorous testing procedure to ensure they meet industry standards and regulatory requirements. The antennas are supplied to MRO (maintenance, repair, and overhaul) facilities, aircraft manufacturers, and other end users following manufacturing and integration. When an aeroplane is being built, antennas are installed as a component of the avionics suite. The final stage involves the end users, which include both military and commercial airlines.

Aircraft Antenna Market Opportunity Analysis

Opportunities exist in the development and application of cutting-edge technologies into antennas, such as phased array systems, multi-function antennas, and smart antenna systems. The possibility of higher demand for new aircraft as well as the opportunity to equip current fleets with cutting-edge communication and navigation equipment will probably drive increased demand for advanced antennas. The continuous advancement in air travel will be the main driver of this need. There is room for market expansion because the aviation industries in emerging markets are expanding. The increasing use of satellite communication in aviation is creating opportunities for satellite-supporting antennas. The military aircraft antenna market may see opportunities due to various countries' rising defence budgets.

The demand for more robust and dependable communication systems is driving antenna upgrades. High-speed data transfer, satellite communication, and broadband connectivity are becoming more and more necessary for modern aircraft, necessitating the employment of complex antenna technology. Advances in navigation systems, such as GPS and other satellite-based technologies, are making modernised antennas that can efficiently receive and process data for precise navigation more and more important. When incorporating next-generation technologies like machine learning, artificial intelligence, and the Internet of Things into aircraft systems, antennas that can support these advancements are essential. The growing need for in-flight connectivity services is driving the usage of satellite communication technologies.

Aircraft antenna design must minimise aerodynamic drag and avoid negative impacts on the aircraft's overall performance and fuel economy. Finding the optimal aerodynamic design while maintaining antenna functionality is extremely challenging. Because weight is so important in aviation, there are strict weight limitations for antennas. The challenge is in developing designs and materials that satisfy these specifications without compromising usefulness, all the while being lightweight and robust. A few of the difficult meteorological conditions in which aeroplanes operate are extreme temperatures, high altitudes, and exposure to a range of meteorological variables.

Insights by Application

The Navigation & Surveillance segment accounted for the largest market share over the forecast period 2023 to 2033. Reliable surveillance and navigation systems are necessary for the world's aircraft traffic to grow sustainably. For these systems to deliver accurate and consistent data for air traffic control, antennas play a major role. In order for the worldwide implementation of ADS-B, a surveillance tool that transmits aircraft position and other data, to function effectively, antennas are required. This development drives the market for antennas that are compatible with ADS-B. For military aircraft to identify threats and maintain situational awareness, advanced surveillance systems are essential.

Insights by End User

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. Aircraft deliveries are increasing as a result of airlines and operators expanding their fleets and the global aviation industry's growth. When new aircraft are manufactured and delivered, there is a similar requirement for antennas to be installed as original equipment. New aircraft models, including as next-generation military and commercial aircraft, are creating and introducing need for advanced avionics equipment, including antennas. The latest technology are the main focus for OEMs while designing these new aircraft. The increased demand for air travel worldwide is putting more orders into the hands of manufacturers of aeroplanes.

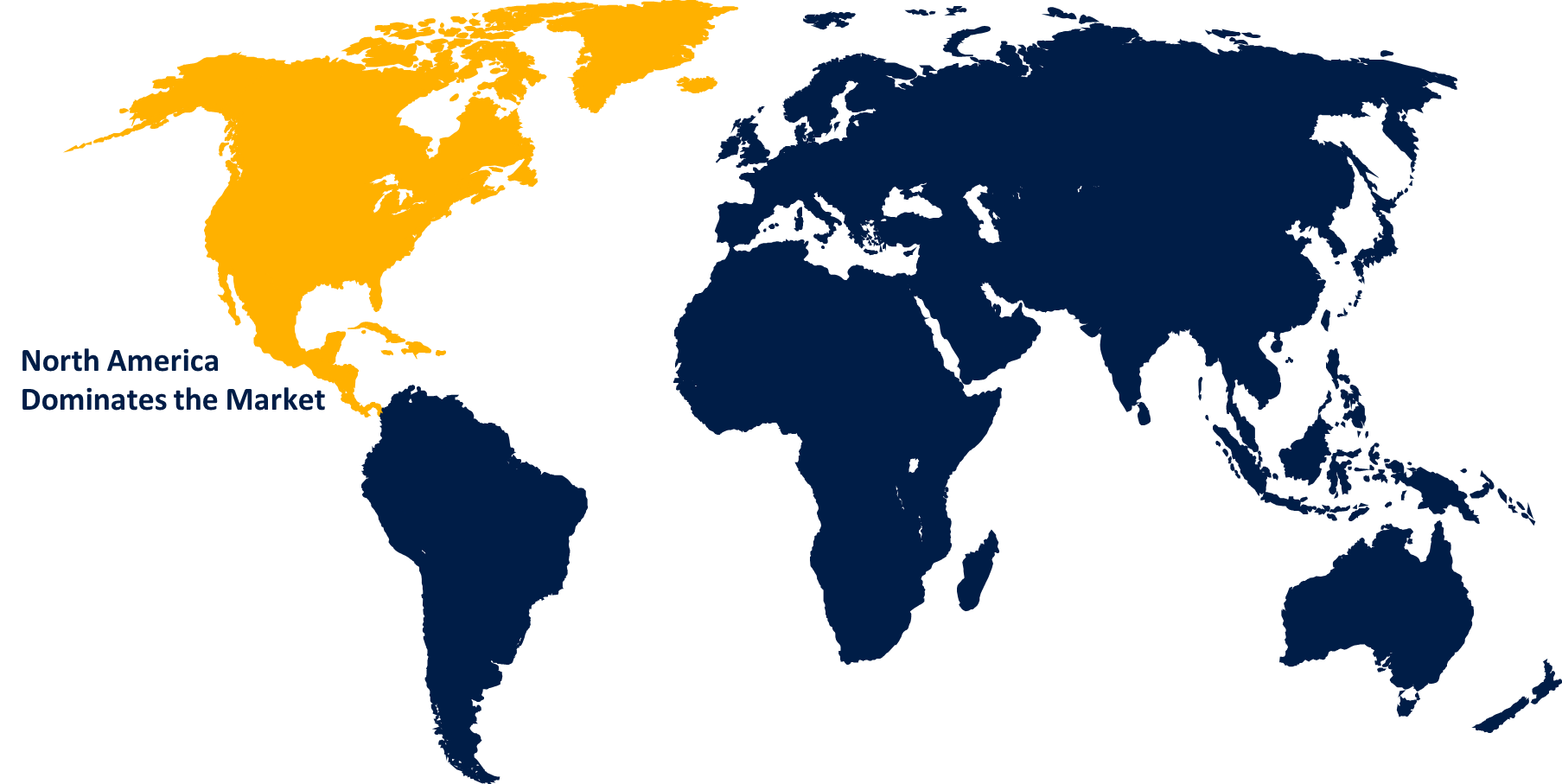

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aircraft Antenna Market from 2023 to 2033. The dominance of North America's defence sector is the primary driver of the requirement for military aircraft antennas. Specialised antennas are necessary for radar, electronic warfare, and communication systems in defence applications. The region is home to a substantial and well-established commercial aviation industry. Modern avionics, including as advanced communication and navigational antennas, are a continuing investment made by North American airlines to update their aircraft. The demand for in-flight connectivity and satellite communication services is rising in North America.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region has witnessed a notable surge in commercial aviation due to factors such as increasing urbanisation, economic development, and demand for air travel. This development is driving up the market for aircraft antennas. China and India are two of the major rising economies in Asia that are propelling the growth of the aircraft antenna industry. The nations' increasing investment in expanding their fleets is driving up demand for communication and navigation devices, especially antennas. In the Asia-Pacific region, there are programmes in place to improve national and international aviation connectivity.

Recent Market Developments

- In April 2020, the UK MOD's Defence Equipment and Support (DE&S) division awarded Cobham Aerospace a contract to investigate improved anti-jam techniques for the protection of GPS signals.

Major players in the market

- The Boeing Company

- Honeywell International Inc.

- Antcom Corporation

- RAMI Aviation.

- Sensor Systems Inc.

- McMurdo Limited

- Azimut Benetti Group

- Harris Corporation

- TECOM Group

- Cobham plc

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Antenna Market, Application Analysis

- Communication

- Navigation & Surveillance

Aircraft Antenna Market, End User Analysis

- Original Equipment Manufacturer (OEM)

- Aftermarket

Aircraft Antenna Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?