Global Aircraft Engine Market Size To Worth USD 14.2 Billion by 2033 | CAGR of 5.68%

Category: Aerospace & DefenseGlobal Aircraft Engine Market Size To Worth USD 14.2 Billion by 2033

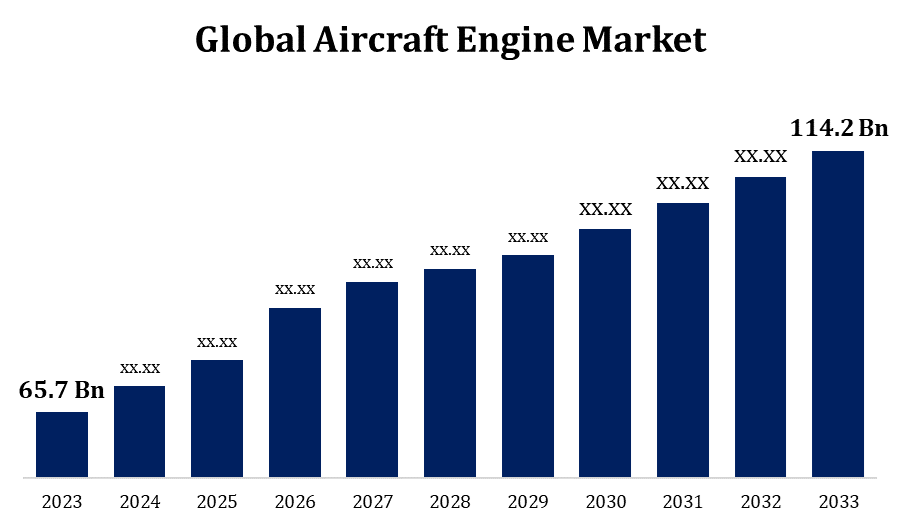

According to a research report published by Spherical Insights & Consulting, the Global Aircraft Engine Market Size to grow from USD 65.7 billion in 2023 to USD 114.2 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.68% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 264 pages with 110 Market data tables and figures & charts from the report on the "Global Aircraft Engine Market Size, Share, and COVID-19 Impact Analysis, By Engine (Turboprop, Turbofan, Turboshaft, Piston Engine), By Aircraft (Commercial, Military, Business & General Aviation), By Point Of Sale (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aircraft-engine-market

Due to the advent of low-cost carriers, increased worldwide air travel, and the need for fuel-efficient engines, the aircraft engine market is expanding rapidly. The industry is changing as a result of technological developments including the creation of lightweight materials and more efficient engines. The drive for eco-friendliness and lower emissions is also driving investment in next-generation engines, such as hydrogen- and electric-powered models. The market is dominated by large companies like Pratt & Whitney, General Electric, and Rolls-Royce, with advances aimed at boosting efficiency and cutting costs. But obstacles like exorbitant R&D expenses and strict regulations might impede industry expansion. Due to the growing global need for both commercial and military aircraft, the market is anticipated to continue growing.

Aircraft Engine Market Value Chain Analysis

There are multiple phases in the value chain of the aircraft engine market, ranging from suppliers of raw materials to end users. The first step is the provision of necessary components including titanium, aluminium, and composite materials by raw material providers. After that, these materials are given to producers of turbines, compressors, and combustion chambers—as well as other engine components. Important engine producers such as Pratt & Whitney and Rolls-Royce put these parts together to create entire engine systems. Distribution entails joint ventures with aeroplane producers like Boeing and Airbus, who incorporate the engines into various models. The provision of aftermarket services, such as maintenance, repair, and overhaul (MRO), is crucial in guaranteeing the engine's long-term functioning and yielding substantial revenue. To guarantee dependability and efficiency, the value chain is strictly monitored, with strict quality and safety standards at every turn.

Aircraft Engine Market Opportunity Analysis

Due to the rising need for engines that are both environmentally friendly and fuel-efficient, there are substantial prospects in the aircraft engine market. The growing number of passengers travelling by air worldwide presents opportunities for engine makers, especially in developing regions like the Middle East and Asia-Pacific. Technological developments in engines, such those that run on hydrogen and electricity, are opening up new creative possibilities and supporting the industry's drive towards sustainability and lower carbon emissions. Another profitable market is created by the necessity for modern military aircraft engines and the increase in defence budget. As airlines prioritise extending engine lifecycles and cutting operational costs, the aftermarket services sector, comprising engine maintenance, repair, and overhaul (MRO), also presents significant income prospects. Taken together, these characteristics create an environment that is conducive to innovation and growth in the aircraft engine market.

One major factor propelling the aircraft engine market is the increase in aircraft deliveries and air traveler traffic. Airlines are growing their fleets in response to the rise in air travel worldwide, especially in areas like Latin America, the Middle East, and Asia-Pacific. There is a rise in demand for fuel-efficient and sophisticated engines as a result of major aircraft manufacturers like Boeing and Airbus increasing their output. Passenger numbers are increasing due to rising disposable incomes and the growth of low-cost carriers, which is driving up demand for new aircraft. As air travel becomes more accessible, particularly in emerging nations, this tendency is anticipated to continue. Because of this, engine manufacturers are seeing an increase in demand for next-generation, eco-friendly engines, which boost market growth by reducing emissions and improving fuel efficiency.

The high expense of research and development (R&D) needed for modern engine technologies, like fuel-efficient and low-emission engines, is one of the main obstacles. Although necessary, these expenditures can negatively impact profitability, especially for smaller enterprises. Pressure is also increased by strict regulations on noise, emissions, and safety, which necessitate constant innovation and compliance. Production schedules and costs are further complicated by supply chain interruptions, such as shortages of vital raw materials like titanium and composite materials. In addition, engine makers are being pressured by the growing demand for environmentally friendly aviation to hasten the switch to engines that run on hydrogen and electricity, which presents infrastructure and technological problems. All of these elements work together to influence how quickly innovation and the aviation engine market are growing.

Insights by Engine

The turbofan engine segment accounted for the largest market share over the forecast period 2023 to 2033. Modern commercial aeroplanes such as Boeing 737s and Airbus A320s prefer turbofan engines because of their reduced noise, fuel efficiency, and capacity for long-haul flights. Manufacturers are being forced to innovate by the growing demand for ecologically friendly and fuel-efficient aircraft, leading to the development of sophisticated turbofan engines with higher bypass ratios and improved performance. This market is also being driven by the emergence of low-cost airlines and the growth of air travel in developing nations. The turbofan category is anticipated to maintain its leadership and make a major contribution to the overall growth of the aircraft engine market because to ongoing technical advancements, such as geared turbofan engines that offer even better efficiency.

Insights by Aircraft

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. In order to fulfil growing passenger demand and save operating costs, airlines are investing in new-generation aircraft, especially in expanding regions such as the Middle East and Asia-Pacific. Because of this, there is a greater need for sophisticated engines with reduced emissions and fuel consumption. This market is growing as a result of advancements in hybrid electric engine technology and lightweight material development. Engine demand is also being driven by the growth of low-cost and regional airlines, which is speeding up the delivery of new aircraft. The commercial aircraft market is expected to increase steadily despite obstacles like supply chain disruptions and regulatory pressures, helped by the post-pandemic recovery of the global aviation industry.

Insights by Point Of Sale

The aftermarket segment accounted for the largest market share over the forecast period 2023 to 2033. The need for engine service has increased as airlines look to maximise operating costs and prolong the life of their current fleets. The increasing quantity of operational aircraft, especially in older fleets, presents significant prospects for aftermarket suppliers. By providing full maintenance contracts and cutting-edge digital technologies for predictive maintenance, engine manufacturers are taking advantage of this and increasing efficiency and decreasing downtime. Technological developments in engine components also help the aftermarket sector, necessitating frequent updates and replacements. The increase in air travel and the emphasis on operational dependability guarantee that the aftermarket industry will remain vital to the expansion of the aircraft engine market.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aircraft Engine Market from 2023 to 2033. The area benefits from high air passenger traffic, fleet expansions, and defence spending, which all contribute to the strong demand in both commercial and military aviation. Innovation has intensified due to the drive for fuel efficiency and sustainability. North American businesses are at the forefront of developing next-generation engines, which include hybrid-electric and hydrogen-powered vehicles. The region's well-established ecosystem for maintenance, repair, and overhaul (MRO) services for aircraft is another factor propelling market expansion.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The desire for new, more fuel-efficient engines is being driven by the region's recent spike in deliveries of commercial aircraft. Additionally, the market for military aircraft engines is expanding due to rising defence budgets in nations like China, Japan, and India. Additionally, Asia-Pacific is becoming known as a centre for aircraft maintenance, repair, and overhaul (MRO) services, drawing alliances and investments from international engine producers. Growth, meanwhile, might be hampered by issues including volatile fuel prices, limitations in the supply chain, and the requirement to adhere to tight environmental standards. All things considered, the area offers significant prospects for engine development and growth in the defence and commercial sectors.

Recent Market Developments

- In March 2024, the Ministry of Defence said that it has agreed to purchase aircraft engines for MiG-29 aircraft from Hindustan Aeronautics Limited (HAL) for a sum of USD 5,249.72 billion.

Major players in the market

- Advanced Atomization Technologies Inc.

- Enjet Aero

- Engine Alliance

- Safran Group

- Pratt & Whitney

- Rolls-Royce Holdings plc

- MTU Aero Engines AG

- CFM International

- General Electric Company

- ITP Aero

- New Hampshire Ball Bearing (MinebeaMitsumi Aerospace)

- IAE International Aero Engines AG

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Engine Market, Engine Analysis

- Turboprop

- Turbofan

- Turboshaft

- Piston Engine

Aircraft Engine Market, Aircraft Analysis

- Commercial

- Military

- Business & General Aviation

Aircraft Engine Market, Point Of Sale Analysis

- OEM

- Aftermarket

Aircraft Engine Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?