Global Aircraft Engines Market Size To Worth USD 280.7 Billion By 2033 | CAGR Of 6.13%

Category: Aerospace & DefenseGlobal Aircraft Engines Market Size To Worth USD 280.7 Billion By 2033

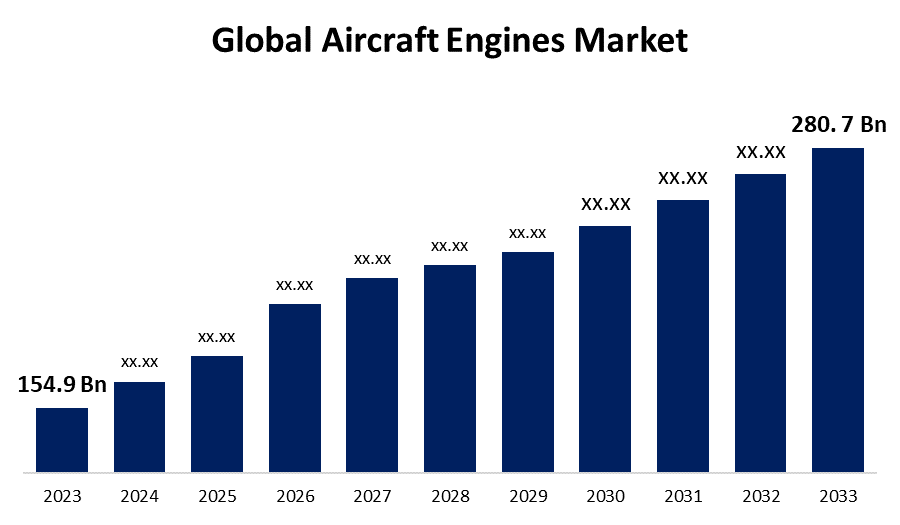

According to a research report published by Spherical Insights & Consulting, The Global Aircraft Engines Market Size to grow from USD 154.9 Billion in 2023 to USD 280.7 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 6.13% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 240 pages with 115 Market data tables and figures & charts from the report on the "Global Aircraft Engines Market Size, Share, and COVID-19 Impact Analysis, By Engine Type (Turboprop Engine, Turboshaft Engine, Turbofan Engine, and Piston Engine), By Technology (Conventional Engine, Electric/Hybrid Engine), By Component (Compressor, Turbine, Gear Box, Combustion Chamber, Fuel System, and Others), By End-Use (Commercial (Narrow Body, Wide Body, Business Jet, General Aviation, Helicopters) and Military (Fighter Aircraft, Military Transport Aircraft, Military Helicopters), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aircraft-engines-market

The aircraft engines market is a vital area of the aerospace industry, propelled by technological improvements and rising air travel demand. It encompasses a wide range of engines used in commercial, military, and general aviation, including turbofans, turboprops, and turboshafts. Fuel efficiency, environmental requirements, and hybrid-electric propulsion advances are all major market drivers. The market is dominated by major firms such as GE Aviation, Rolls-Royce, and Pratt & Whitney, which invest in R&D to improve performance and minimise emissions. The Asia-Pacific region is expanding rapidly, thanks to more air traffic and larger aircraft fleets. The market's future is determined by sustainability initiatives and the adoption of new technology.

Aircraft Engines Market Value Chain Analysis

From raw material procurement to final engine delivery and aftermarket services, the aircraft engines market value chain includes various crucial stages. The process begins with the procurement of high-quality materials such as titanium, nickel alloys, and composites, followed by the design and manufacture of engine components such as compressors, turbines, and combustors. Leading engine manufacturers, including GE Aviation and Rolls-Royce, manage the integration and assembling of these components into complete engines. The engines are then subjected to rigorous testing and certification to ensure compliance with regulatory and safety standards. After manufacture, the value chain includes engine installation on aircraft, as well as maintenance, repair, and overhaul (MRO) services. This aftermarket segment is critical for preserving engine longevity and operational efficiency, as well as generating continued revenue for manufacturers and service providers.

Aircraft Engines Market Opportunity Analysis

The aircraft engines market offers substantial prospects as technology advances, environmental goals are met, and global air traffic grows. The quest for greener aviation solutions has increased demand for fuel-efficient and low-emission engines, opening up a market for new propulsion systems such as hybrid-electric and hydrogen-powered engines. The rising fleet of commercial and regional aircraft, particularly in emerging areas like Asia-Pacific and the Middle East, creates prospects for new engine sales and retrofitting ageing fleets with more efficient versions. Furthermore, the growing market for unmanned aerial vehicles (UAVs) and urban air mobility (UAM) solutions creates opportunities for smaller, more specialised engines. Investment in modern materials and digital technology, such as predictive maintenance, increases market potential while maintaining dependability and cost effectiveness.

The aircraft engines market is expanding rapidly as more cost-effective and fuel-efficient aircraft are used. Airlines are prioritising fleet modernisation to save operational costs and comply with severe environmental rules. New-generation engines, such as Pratt & Whitney's GTF and CFM International's LEAP, provide significant fuel efficiency and pollution reductions, making them appealing to airlines looking to save money while also promoting sustainability. Furthermore, advances in materials and aerodynamics lead to lighter and more efficient engines. The trend is especially significant in areas with fast increasing air travel demand, such as Asia-Pacific and the Middle East, where airlines are extending their fleets with next-generation aircraft. This transition towards more efficient engines is increasing demand and promoting industry innovation.

The aircraft engines market faces a number of obstacles that will have an impact on its growth and development. Stringent environmental rules need major investment in R&D to build lower-emission and more fuel-efficient engines, raising manufacturers' costs. Technological difficulties and the high precision necessary in manufacturing are significant obstacles, with any flaws possibly resulting in costly delays and recalls. The market's cyclical character, which is driven by swings in global air travel demand and economic conditions, adds another degree of uncertainty. Furthermore, supply chain interruptions, such as shortages of crucial raw materials or components, might impede manufacturing plans. The fierce competition among big players puts further pressure on corporations to innovate consistently, while geopolitical tensions and trade restrictions can affect market access and operations, complicating global business strategy.

Insights by Engine Type

The turbofan segment accounted for the largest market share over the forecast period 2023 to 2033. Turbofan engines, recognised for their high bypass ratios, provide a good blend of fuel efficiency, noise reduction, and thrust, making them suitable for commercial flying. The increase in air travel, fleet expansions, and the replacement of older, less efficient aircraft with modern models are all significant drivers of this segment's growth. Materials, aerodynamics, and engine design innovations, such as geared turbofans and ultra-high bypass ratios, are helping to improve efficiency and lower emissions. The growth of low-cost carriers, as well as rising demand for long-haul flights in Asia-Pacific and the Middle East, are driving the adoption of modern turbofan engines.

Insights by Technology

The conventional engine segment accounted for the largest market share over the forecast period 2023 to 2033. This expansion is being driven by the continued demand for dependable and proven propulsion systems in commercial, military, and general aviation. Conventional engines continue to power many aircraft, including narrow-body jets, regional aircraft, and helicopters. Fleet expansion and replacement cycles, particularly in emerging economies, maintain demand for these engines. Furthermore, advances in materials and design have increased the efficiency and performance of traditional engines, extending their usefulness. While there is a drive for more sustainable propulsion systems, conventional engines continue to dominate the industry, thanks to existing infrastructure and huge maintenance networks.

Insights by Component

The compressor segment accounted for the largest market share over the forecast period 2023 to 2033. Compressors play an important role in engine performance because they compress incoming air before it enters the combustion chamber, affecting fuel economy and power production. Advanced materials and manufacturing technologies, like as additive manufacturing, have made it possible to produce compressor components that are lighter, more robust, and highly efficient. This is especially critical for modern turbofan and turboprop engines, which demand high pressure ratios for peak performance. The continual trend of decreasing engine pollutants and increasing fuel efficiency encourages innovation in compressor design.

Insights by End Use

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are investing in new aircraft with innovative engines to improve fuel efficiency, lower operating costs, and meet rigorous environmental laws. The emergence of low-cost carriers, as well as the necessity for long-haul and regional flights, are driving demand for new, more efficient engines. Technological breakthroughs, such as high-bypass turbofan engines and geared turbofan designs, are accelerating the segment's growth by improving fuel efficiency and lowering emissions. Furthermore, the recovery of the aviation industry following the pandemic and the expansion of travel routes, particularly in growing countries such as Asia-Pacific, are major drivers of development in the commercial engine segment.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aircraft Engines Market from 2023 to 2033. Major airlines are modernising their fleets with more fuel-efficient planes to decrease costs and comply with rigorous environmental rules, which is boosting regional demand. The United States government's defence budget also adds to the market, as it continues to invest in modern military aircraft. North America is also a centre for research and development in next-generation propulsion technologies, such as hybrid-electric and hydrogen-powered engines. The market benefits from a well-developed supply chain, superior manufacturing capabilities, and a strong network of maintenance, repair, and overhaul (MRO) services, ensuring long-term growth and innovation.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Major economies, such as China, India, and Southeast Asian countries, are seeing an increase in both commercial and regional aviation, prompting airlines to invest in new, fuel-efficient aircraft to handle passenger growth and reduce operational costs. The region's industry is further bolstered by the growing presence of indigenous aircraft and engine manufacturers, as well as major government investments in aviation infrastructure. Asia-Pacific's emphasis on environmental sustainability fuels demand for modern, low-emission engines. Additionally, the growing interest in unmanned aerial vehicles (UAVs) and urban air mobility (UAM) systems opens up new possibilities.

Recent Market Developments

- In March 2024, the Ministry of Defence has signed a contract with Hindustan Aeronautics Limited (HAL) to purchase MiG-29 aircraft engines for USD 5,249.72 billion.

Major players in the market

- Honeywell International Inc.

- Safran

- Rolls-Royce plc

- Raytheon Technologies Corporation

- Lycoming Engines

- Engine Alliance

- Textron Inc

- MTU Aero Engines AG

- Euravia Engineering & Supply Co. Ltd.

- General Electric

- MITSUBISHI HEAVY INDUSTRIES, LTD

- IHI Corporation

- Barnes Group Inc

- CFM International

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Engines Market, Engine Type Analysis

- Turboprop Engine

- Turboshaft Engine

- Turbofan Engine

- Piston Engine

Aircraft Engines Market, Technology Analysis

- Conventional Engine

- Electric/Hybrid Engine

Aircraft Engines Market, Component Analysis

- Compressor

- Turbine

- Gear Box

- Combustion Chamber

- Fuel System

- Others

Aircraft Engines Market, End Use Analysis

- Commercial

- Narrow Body

- Wide Body

- Business Jet

- General Aviation

- Helicopters

- Military

- Fighter Aircraft

- Military Transport Aircraft

- Military Helicopters

Aircraft Engines Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?