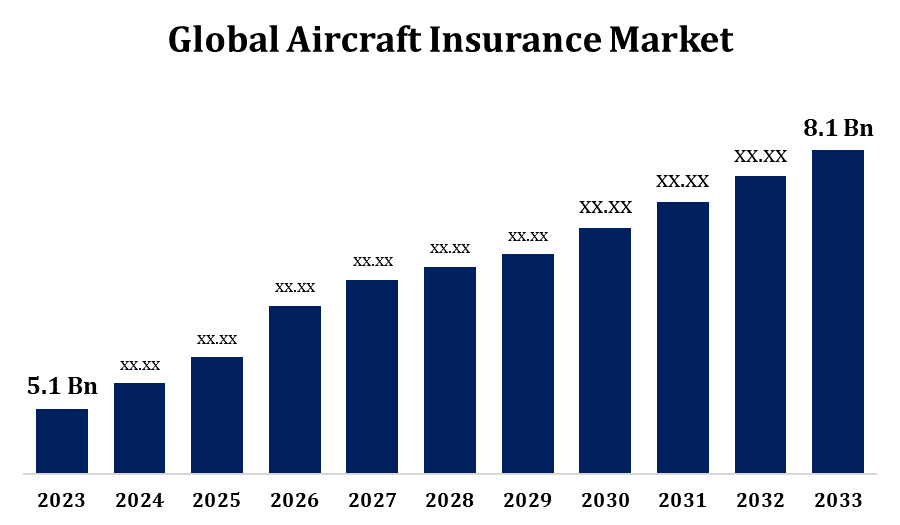

Global Aircraft Insurance Market Size To Worth USD 8.1 Billion By 2033 | CAGR of 4.73%

Category: Aerospace & DefenseGlobal Aircraft Insurance Market Size To Worth USD 8.1 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Aircraft Insurance Market Size to Grow from USD 5.1 Billion in 2023 to USD 8.1 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 4.73% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 223 pages with 110 Market data tables and figures & charts from the report on the “Global Aircraft Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Public Liability Insurance, Passenger Liability Insurance, Combined Single Limit (CSL), Ground Risk Hull (Motion) Insurance, Ground Risk Hull (Non-Motion) Insurance, Hangar & Ground Support Equipment Insurance, In-Flight Insurance, and Umbrella Insurance), By Application (Commercial Aviation, Business & General Aviation), By End-User (Airlines, Aircraft Product Manufacturers, Airports, Leasing Companies, and Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.” Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/aircraft-insurance-market

The number of commercial and private aircraft as well as increased air traffic are driving continuous expansion in the worldwide aircraft insurance market. This market is crucial for reducing financial risks in the aviation sector since it offers insurance coverage for passenger liabilities, hull damages, and aviation liabilities. The development of general aviation, the extension of airline fleets, and technological improvements in aerospace are important factors. Tight regulations and the increased demand for effective risk management measures also have an impact on the market. On the other hand, the industry faces difficulties such as exorbitant premium rates and unpredictability in losses from accidents and natural disasters. The market is dominated by North America and Europe, although growing regions like Asia-Pacific are predicted to develop significantly as a result of rising infrastructure investments in air travel.

Aircraft Insurance Market Value Chain Analysis

A number of parties are involved in the value chain of the aircraft insurance market, and each is essential to the administration and provision of insurance products. Owners and operators of aircraft initiate the process by requesting covering for hull damage, liabilities, and passenger claims. Underwriters and insurers evaluate risk profiles and offer customised insurance. Brokers negotiate agreements and get the best bargains for clients by acting as middlemen. Secondly, by taking up a portion of the possible losses, reinsurers assist insurers in risk management. During loss situations, legal professionals and claims adjusters intervene to assess damages and guarantee fair compensation. Regulatory organisations that uphold industry standards and compliance provide support to the chain.

Aircraft Insurance Market Opportunity Analysis

Significant prospects exist in the aircraft insurance market as a result of growing international air travel, expanding fleets, and improvements in aerospace technology. Due to growing investments in aviation infrastructure and the expansion of commercial airlines, emerging markets in Asia-Pacific, Latin America, and the Middle East provide profitable growth potential. In addition, the demand for speciality insurance products is increased by the growing popularity of private and business jets. Unmanned aerial vehicles and electric aeroplanes are examples of innovations that create new opportunities for customised insurance solutions. Insurance companies can lower premiums by utilising green technology efforts in light of the increased focus on sustainability. Digital transformation further improves customer experience and operational efficiency. Examples include blockchain for claims processing and AI-driven risk assessment. Businesses who take the initiative to create flexible products and incorporate technology stand to gain from these changing market conditions.

One of the main factors driving the expansion of the aircraft insurance market is the increase in air travel worldwide. Airlines are growing their fleets and launching new routes to keep up with the demand as more people travel for work and pleasure. Due to the increased frequency of takeoffs, landings, and maintenance, there is a greater demand for comprehensive insurance coverage as a result of the increased flight operations. Furthermore, more passengers mean greater liabilities, which forces operators to look for better passenger safety and compensation programs. The demand for customised insurance solutions is further increased by the expansion of low-cost airlines and regional aviation services, which go hand in hand with the growth in commercial aviation. In order to meet the needs of the growing market, insurers are taking advantage of this trend by launching cutting-edge products and adaptable coverage options.

There are various obstacles that the aircraft insurance market must overcome to maintain growth and profitability. For operators, high premium costs are a major obstacle because of the complicated risk environment and the rise in claims from accidents, natural catastrophes, and geopolitical events. The market is also very cyclical, with shifting demand for air travel and shifting insurance premiums as a result of shifting economic conditions. The complexity is increased by growing operational concerns, which include cybersecurity attacks on aviation systems and possible legal ramifications from emerging technology like drones and electric planes. Operators and insurers are additionally burdened by regulatory changes and compliance obligations. In addition, the unpredictability of pandemics and fuel price fluctuations adds to fleet operations' unpredictability, which affects insurance costs.

Insights by Type

The passenger liability insurance segment accounted for the largest market share over the forecast period 2023 to 2033. The passenger liability insurance segment is witnessing significant growth in the aircraft insurance market, propelled by the surge in global air traffic and an increased emphasis on passenger safety. As airlines enhance their fleets and introduce new routes, they encounter heightened exposure to passenger-related risks, including accidents, injuries, and compensation claims. This situation has resulted in a growing demand for robust liability coverage to mitigate potential legal and financial consequences. Stricter regulatory frameworks, such as the Montreal Convention, have imposed higher compensation limits, prompting airlines to pursue more comprehensive policies. Furthermore, the rise of low-cost carriers and regional airlines has intensified the need for passenger liability insurance. In response, insurers are developing tailored products with expanded coverage options, enabling operators to effectively navigate the evolving risk landscape and maintain their financial stability.

Insights by Application

The commercial aviation segment accounted for the largest market share over the forecast period 2023 to 2033. With the rising demand for air travel, particularly in emerging markets such as Asia-Pacific and the Middle East, airlines are expanding their fleets by acquiring new aircraft. This increase drives the need for comprehensive insurance solutions that cover hull, liability, and passenger claims. Technological advancements in aircraft design, including enhanced fuel efficiency and the introduction of electric and hybrid models, also impact insurance requirements and premiums. Moreover, the expansion of low-cost carriers and cargo operations has led to a greater demand for specialized policies. Insurers are seizing this opportunity by providing flexible coverage plans that adapt to evolving risks and offering extensive support to commercial airline operators.

Insights by End User

The airlines segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are investing in new aeroplanes and upgrading their current fleets since the world's passenger traffic is rebounding. This calls for extensive insurance coverage to reduce a variety of risks, such as hull damage, passenger liabilities, and operational interruptions. The market has become more diverse because to the rise of low-cost carriers, which has increased demand for insurance products that are specifically designed to meet certain operational demands. Airlines are also being compelled by legal obligations for risk management and safety to obtain greater coverage limits. In response, insurers are providing specialised policies, such as coverage for cyber hazards and developing technologies, that are tailored to the unique requirements of airlines. There are many chances for insurers to innovate and broaden their product offerings in the airline industry given this dynamic environment.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aircraft Insurance Market from 2023 to 2033. Major commercial airlines, general aviation operators, and owners of business jets are among the factors that drive up demand for all-inclusive insurance policies. Important companies in the sector, including Global Aerospace, Allianz, and AIG Aviation, are based in the area and provide a variety of hull, liability, and passenger coverage options. Aviation-related technological developments, such as new aircraft models and a rise in the usage of unmanned aerial vehicles (UAVs), have further raised demand for speciality insurance products. A stable market environment is also produced by strict regulatory standards enforced by organisations such as the Federal Aviation Administration (FAA), which guarantee adherence to safety and risk management procedures. As insurers investigate coverage for developing industries like UAVs and electric aircraft, growth potential arise.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries such as China, India, Japan, and those in Southeast Asia are experiencing significant growth in fleet sizes and the emergence of new airlines, leading to increased demand for aviation insurance. The rise of low-cost carriers and initiatives aimed at enhancing regional connectivity have further accelerated market development. Additionally, the growing interest in business jets and general aviation is driving the need for specialized coverage. The market is marked by the rise of local insurers and greater involvement from global companies eager to tap into the region's potential. While challenges such as regulatory complexities and fluctuating premiums persist, Asia-Pacific continues to be a vital growth area, with insurers rolling out innovative policies to address evolving risks and compliance requirements.

Recent Market Developments

- In Novembe 2021, IQUW, the specialized reinsurer within Lloyd's funded by ERS Group, has announced the launch of a new aviation portfolio, led by an experienced underwriter from Marsh and Cincinnati.

Major players in the market

- USAA

- American International Group, Inc.

- Global Aerospace

- USAIG

- Tokio Marine HCC

- Travers & Associates Aviation Insurance Agency, LLC

- AXA

- BWI Aviation Insurance

- STARR INTERNATIONAL COMPANY, INC.

- EAA Company Ltd

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Insurance Market, Type Analysis

- Public Liability Insurance

- Passenger Liability Insurance

- Combined Single Limit (CSL)

- Ground Risk Hull (Motion) Insurance

- Ground Risk Hull (Non-Motion) Insurance

- Hangar & Ground Support Equipment Insurance

- In-Flight Insurance

- Umbrella Insurance

Aircraft Insurance Market, Application Analysis

- Commercial Aviation

- Business & General Aviation

Aircraft Insurance Market, End User Analysis

- Airlines

- Aircraft Product Manufacturers

- Airports

- Leasing Companies

- Other

Aircraft Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?