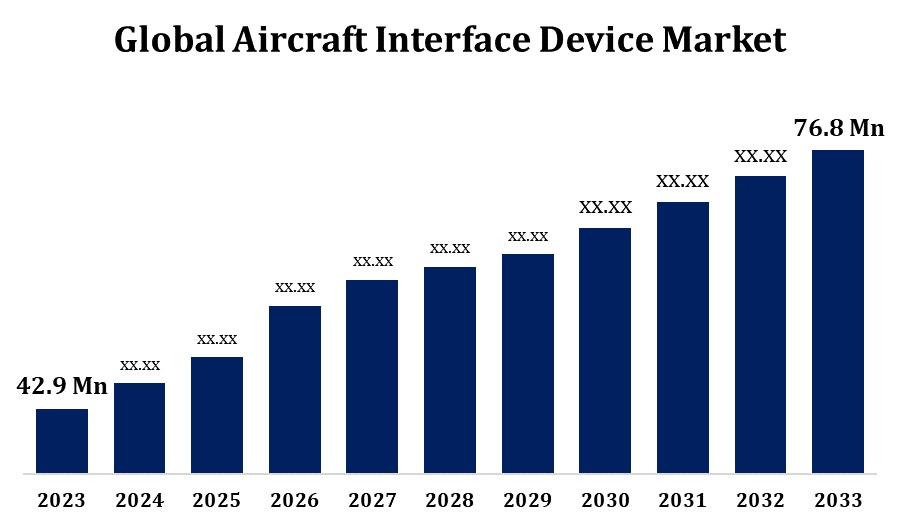

Global Aircraft Interface Device Market Size To Worth USD 76.8 Million By 2033 | CAGR of 6.00%

Category: Aerospace & DefenseGlobal Aircraft Interface Device Market Size To Worth USD 76.8 Million By 2033

According to a research report published by Spherical Insights & Consulting, the Global Aircraft Interface Device Market Size to grow from USD 42.9 million in 2023 to USD 76.8 million by 2033, at a Compound Annual Growth Rate (CAGR) of 6.00% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 240 pages with 110 Market data tables and figures & charts from the report on the "Global Aircraft Interface Device Market Size, Share, and COVID-19 Impact Analysis, By Application (Flight tracking, Quick Access Recording, Aircraft Condition Monitoring System (ACMS), DVR and Video Streaming, and Others), By Aircraft Type (Fixed Wing and Rotary Wing), By Connectivity (Wired and Wireless), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aircraft-interface-device-market

The Aircraft Interface Device (AID) market is rapidly expanding, driven by rising demand for upgraded avionics systems and enhanced in-flight connectivity. AID systems are key components that link multiple avionics systems to Electronic Flight Bags (EFBs), improving operating efficiency, safety, and real-time data exchange. Technological developments, increased adoption of wireless communication systems, and stringent regulatory requirements for greater safety measures are all driving market growth. Major market participants are focusing on innovation, partnerships, and acquisitions to strengthen their portfolios.

Aircraft Interface Device Market Value Chain Analysis

The Aircraft Interface Device (AID) market value chain includes several stages, ranging from component manufacture to end-user deployment. Specialised manufacturers source raw materials and electronic components first and then assemble them into AID systems. These manufacturers frequently work with avionics and software engineers to ensure a smooth connection with existing aircraft systems. Following production, the devices are distributed to original equipment manufacturers (OEMs) and airlines via a variety of channels, including direct sales and specialised distributors. Installation and extensive testing are required to ensure compliance with aviation requirements. Following deployment, ongoing support and maintenance are required from service providers and in-house airline teams to maintain optimal performance and regulatory compliance. Continuous feedback loops boost the value chain, encouraging innovation and advancements in AID technology.

Aircraft Interface Device Market Opportunity Analysis

The Aircraft Interface Device (AID) market has significant prospects due to the increased emphasis on improving aviation safety and operational efficiency. The increasing use of Electronic Flight Bags (EFBs) and modern avionics systems drives demand for AIDs, which serve as critical connectors. The trend towards digital transformation and data-driven decision-making in aviation presents a profitable growth opportunity. Opportunities are especially abundant in emerging nations, where rising airline fleets and modernization projects are common. Furthermore, the proliferation of wireless communication technologies and Internet of Things (IoT) connectivity creates new opportunities for creative AID solutions. Strategic collaborations, technical developments, and regulatory regulations for higher safety standards all contribute to market potential, stimulating investment in R&D to meet changing industry needs.

The increase in demand for in-flight connection is a major factor driving the growth of the Aircraft Interface Device (AID) market. As airlines aim to improve the passenger experience with seamless internet access and real-time data offerings, the demand for improved AID systems has increased. These devices are critical for integrating and controlling connection solutions, guaranteeing effective communication between onboard systems and ground operations. The spread of smart gadgets among passengers and personnel fuels this desire. Furthermore, regulatory requirements for improved communication and safety systems onboard are hastening the deployment of AIDs.

One key challenge is the high cost of developing and implementing advanced AID systems, which can strain airline finances, particularly for smaller carriers. Furthermore, guaranteeing compatibility and seamless integration with various avionics systems and Electronic Flight Bags (EFBs) across multiple aircraft models can be difficult and time-consuming. Regulatory compliance and certification processes are strict, which can cause delays in product implementation. Cybersecurity risks are another significant challenge, since increased connection increases the possibility of data breaches and system vulnerabilities. Furthermore, the market's reliance on the overall health of the aviation industry renders it vulnerable to economic downturns and fluctuations in air travel demand, which could affect investment and adoption rates.

Insights by Application

The Aircraft Condition Monitoring System (ACMS) segment accounted for the largest market share over the forecast period 2023 to 2033. ACMS enables real-time monitoring and analysis of important aircraft systems, resulting in early detection of possible problems and lower maintenance costs. The integration of ACMS and AIDs improves data collecting and exchange, enabling complete diagnostics and operational insights. Airlines are increasingly using ACMS to optimise fleet performance, increase dependability, and meet tough regulatory requirements. Technological improvements, such as the incorporation of improved sensors and IoT capabilities, help to push the segment's growth. As airlines strive to reduce downtime and improve safety standards, demand for ACMS-integrated AIDs continues to climb, propelling market growth.

Insights by Aircraft Type

The fixed wing segment dominates the market and has the largest market share over the forecast period 2023 to 2033. The growing demand for greater in-flight connectivity, operational efficiency, and real-time data monitoring in commercial aviation is driving this industry forward. Airlines are investing in modern AID systems to improve Electronic Flight Bag (EFB) functionality, optimise flight operations, and comply with changing safety rules. The military's need for reliable and secure communication networks for mission-critical activities pushes AID adoption. Wireless integration and Internet of Things (IoT) applications have increased the capability and appeal of AIDs in fixed-wing aircraft. As a result, the fixed-wing segment is witnessing significant growth, mirroring the overall expansion of the aviation industry.

Insights by Connectivity

The wireless segment accounted for the largest market share over the forecast period 2023 to 2033. Wireless technologies offer seamless communication between onboard equipment, Electronic Flight Bags (EFBs), and ground operations, resulting in increased operational efficiency and passenger satisfaction. Wireless AID systems are becoming increasingly popular because to their capacity to provide real-time data transfer, remote diagnostics, and software updates, all of which are critical for maintaining aircraft performance and regulatory compliance. Furthermore, integrating wireless capabilities allows for more flexible installation options and minimises wiring complexity, cutting airlines' installation and maintenance costs.

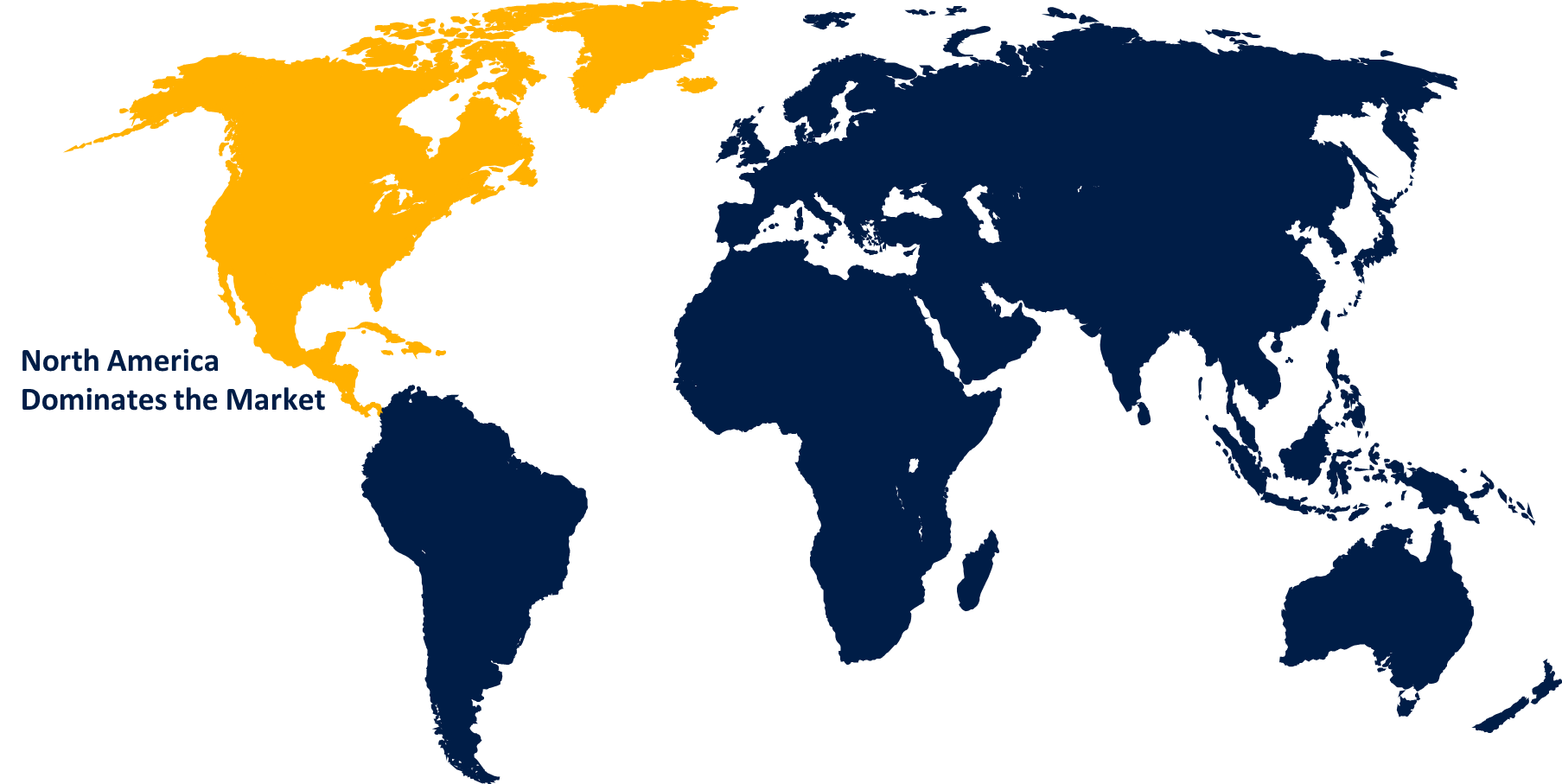

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aircraft Interface Device Market from 2023 to 2033. The existence of major aeroplane manufacturers like Boeing and prominent avionics companies encourages innovation and demand for AIDs. Regulatory authorities such as the FAA require high safety and connection criteria, which encourages the use of AIDs to improve operational efficiency and compliance. Furthermore, the region's strong air traffic and high passenger demand for in-flight connection and entertainment offerings drive market expansion. The continuing modernization of commercial and military fleets, together with significant investments in R&D, puts North America as a crucial hub for the growth and advancement of the AID market.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's developing low-cost carrier sector is also helping to drive market expansion, as airlines look for cost-effective ways to increase operational efficiency. Furthermore, favourable government policies and investments in aviation infrastructure development encourage the use of advanced avionics systems, including AIDs. Collaborations with major avionics manufacturers and technology suppliers are increasing the region's market potential, positioning Asia Pacific as a dynamic and viable environment for AID breakthroughs.

Recent Market Developments

- In August 2023, FLYHT Aerospace Solutions LLC announced that it had extended a five-year contract with a long-term aircraft lease customer to provide ongoing software services for the whole Boeing 777 and 767 fleets.

Major players in the market

- Astronics Corporation

- Esterline Technologies Corporation

- Collins Aerospace

- Global Eagle

- Teledyne Technologies Incorporated

- Avionica Inc.

- Thales Group

- The Boeing Company

- Skytrac System Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Interface Device Market, Application Analysis

- Flight tracking

- Quick Access Recording

- Aircraft Condition Monitoring System (ACMS)

- DVR and Video Streaming

- Others

Aircraft Interface Device Market, Aircraft Type Analysis

- Fixed Wing

- Rotary Wing

Aircraft Interface Device Market, Connectivity Analysis

- Wired

- Wireless

Aircraft Interface Device Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?