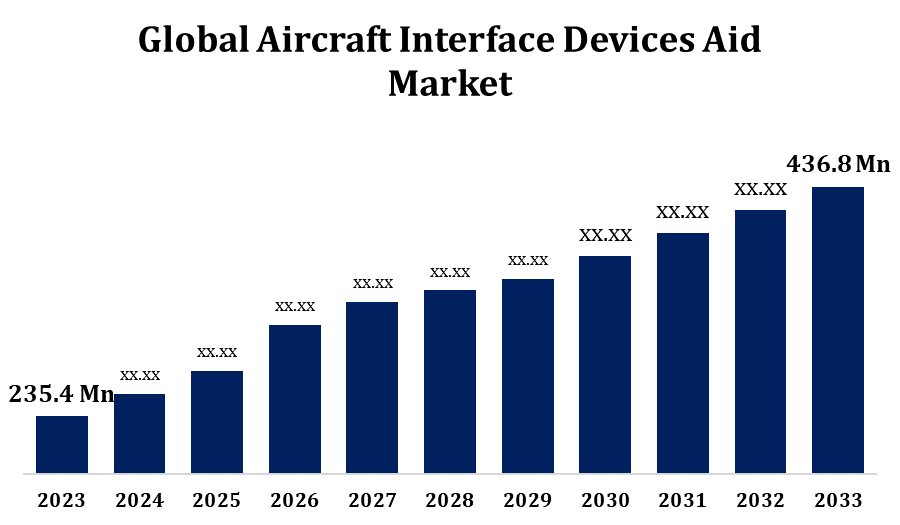

Global Aircraft Interface Devices Aid Market Size To Worth USD 436.8 Million by 2033 | CAGR of 6.38%

Category: Aerospace & DefenseGlobal Aircraft Interface Devices Aid Market Size To Worth USD 436.8 Million by 2033

According to a research report published by Spherical Insights & Consulting, the Global Aircraft Interface Devices Aid Market Size to grow from USD 235.4 million in 2023 to USD 436.8 million by 2033, at a Compound Annual Growth Rate (CAGR) of 6.38% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the "Girclobal Araft Interface Devices Aid Market Size, Share, and COVID-19 Impact Analysis, By Connectivity (Wired And Wireless), By Aircraft Type (Civil And Military), By End-Use (Fixed Wing And Rotary Wing) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aircraft-interface-devices-aid-market

Due to the growing need for smooth communication and real-time data sharing between avionics and aircraft systems, the Aircraft Interface Devices Aid (AID) market is expanding significantly. By acting as a vital bridge between avionics systems and other onboard technology, like as electronic flight baggage (EFB), AID facilitates improved situational awareness, operational effectiveness, and safety. Growing air traffic, the use of cutting-edge avionics, and the need to modernise aircraft fleets in the business, military, and commercial aviation sectors are the main factors driving the industry. Improvements in data security and wireless connectivity are two examples of technological developments that are driving market growth. To address industry objectives, major firms are concentrating on creating AID systems that are lightweight, adaptable, and efficient. Because of their developed aviation sectors, North America and Europe hold a dominant position in the market.

Aircraft Interface Devices Aid Market Value Chain Analysis

From component suppliers to end users, there are various important steps in the Aircraft Interface Devices Aid (AID) value chain. First, vendors of raw materials and components supply necessary components such as CPUs, communication modules, and sensors. Manufacturers of AIDs, who create interface devices according to aviation industry requirements, integrate these. These AIDs are then integrated into aircraft systems by Original Equipment Manufacturers (OEMs) and avionics system integrators, allowing avionics and external equipment such as electronic flight bags (EFB) to communicate data. Regulatory agencies are involved in the safety and compliance certification of AID systems. The finished goods are supplied to business jet operators, airlines, and military aircraft by distributors and resellers.

Aircraft Interface Devices Aid Market Opportunity Analysis

Due to the increasing demand for effective, real-time data sharing and communication amongst aircraft systems, the Aircraft Interface Devices Aid (AID) market offers substantial prospects. The need for improved AID solutions is growing as more and more military and airline aircraft integrate digital technologies like networked avionics and electronic flight baggage (EFB). Additional potential opportunities are presented by the trend towards predictive maintenance and the drive towards fleet modernisation. With their growing aviation industries, emerging countries in Asia-Pacific and the Middle East present AID makers with chances to enter unexplored markets. Furthermore, the incorporation of cybersecurity innovations and wireless technology into AID systems makes them more appealing and opens up new avenues for creativity and uniqueness. All things considered, there is a sizable market for AID solutions due to the demand for improved operational efficiency and safety in the aviation industry.

This industry is expected to increase significantly when regulations requiring Aircraft Interface Devices Aids (AIDs) are introduced. A growing number of rules are being enforced by aviation authorities, like the European Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA), with the goal of enhancing real-time data interchange, safety, and operating efficiency. Airlines and aircraft operators are required by these laws to incorporate advanced avionics systems, such as AIDs, in order to meet contemporary safety and data-sharing standards. By facilitating smooth connection between electronic flight baggage (EFB) and onboard systems, AIDs improve flight crew awareness and lower the possibility of mistakes. The need for certified, compliant AID solutions will increase as governments push for fleet modernisation and stricter adherence to safety standards. This will encourage manufacturers to develop and comply with changing industry rules.

This industry is expected to increase significantly when regulations requiring Aircraft Interface Devices Aids (AIDs) are introduced. A growing number of rules are being enforced by aviation authorities, like the European Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA), with the goal of enhancing real-time data interchange, safety, and operating efficiency. Airlines and aircraft operators are required by these laws to incorporate advanced avionics systems, such as AIDs, in order to meet contemporary safety and data-sharing standards. By facilitating smooth connection between electronic flight baggage (EFB) and onboard systems, AIDs improve flight crew awareness and lower the possibility of mistakes. The need for certified, compliant AID solutions will increase as governments push for fleet modernisation and stricter adherence to safety standards. This will encourage manufacturers to develop and comply with changing industry rules.

Insights by Aircraft Type

The military aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. In order to enhance communication, data exchange, and situational awareness in complicated mission contexts, military organisations are giving priority to the integration of AIDs. Real-time monitoring and diagnostics are made possible by AIDs, allowing for predictive maintenance that improves aircraft readiness and reduces downtime. The demand for AID solutions is also being driven by the military fleets' integration of advanced avionics and the increased emphasis on modernisation initiatives. The need for dependable and effective AIDs will only increase as militaries around the world upgrade their current platforms and acquire next-generation aircraft, positioning the military segment as a major growth area for the AID market as a whole.

Insights by End Use

The fixed wing aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. The majority of the world's fleet consists of fixed-wing aircraft, which depend more and more on AID solutions to support electronic flight bags (EFB), condition monitoring systems, and modern avionics. In order to enhance flight operations, minimise downtime, and maximise maintenance, airlines are investing in fleet modernisation and using AIDs. Growth is also facilitated by the military industry since AIDs allow mission-critical systems to be integrated seamlessly. Furthermore, the continuous advancement of lightweight, wireless AID technology amplifies their use in both newly constructed and modified fixed-wing aircraft, so rendering this sector a crucial driver of the broader market expansion.

Insights by Connectivity

The wireless segment accounted for the largest market share over the forecast period 2023 to 2033. By facilitating smooth communication between electronic flight bags (EFBs), ground control, and aircraft systems, wireless AIDs improve operational efficiency and situational awareness. The integration of AIDs into both new and existing aircraft is being made easier by the aviation industry's shift towards digitalisation and the development of wireless technologies like Wi-Fi and Bluetooth. In order to lower cable complexity, increase data transmission rates, and improve overall system reliability, airlines are giving priority to wireless solutions. The necessity for improved cybersecurity measures and regulatory support for cutting-edge technology are also driving up the deployment of wireless AIDs. As the aviation industry adopts smarter, more connected aircraft technology, this trend is anticipated to continue.

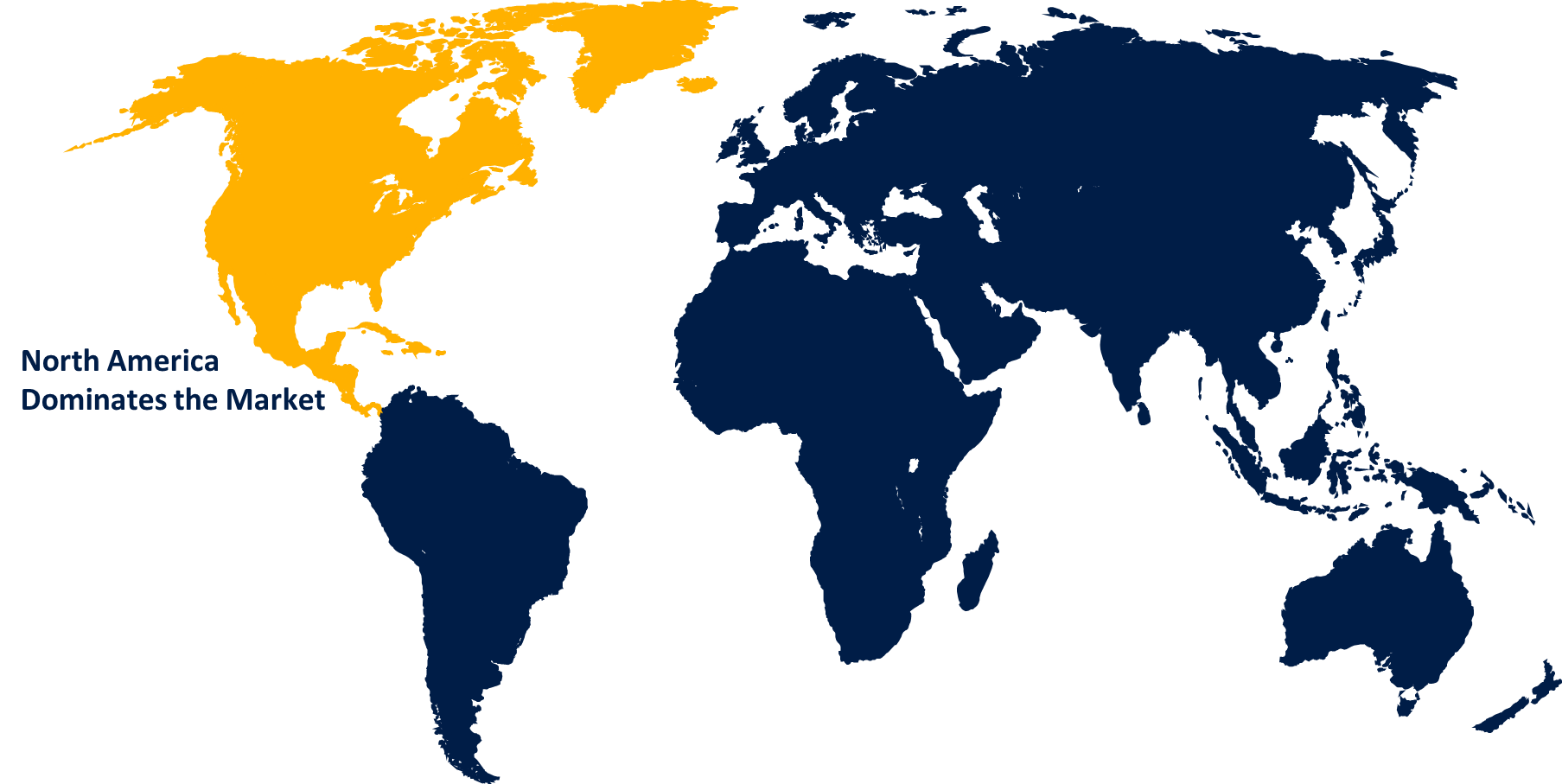

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aircraft Interface Devices Aid Market from 2023 to 2033. With significant aerospace firms, military fleets, and commercial airlines looking to update their aircraft systems, the United States in particular propels growth. Demand for AIDs is further increased by the Federal Aviation Administration (FAA), which is essential in enforcing adherence to safety and operating regulations. Furthermore, the region's emphasis on incorporating electronic flight bags (EFBs) and modernising older aircraft with real-time data-sharing capabilities drives market expansion. In order to maintain their position as industry leaders, North American AID manufacturers are investing in cutting-edge solutions to suit changing operational and regulatory needs, with a particular focus on cybersecurity and wireless technologies.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Due to the increase of aviation travel to developing countries, airlines are investing in data-sharing technology and improved avionics, including AIDS. The market demand is being further accelerated by fleet modernisation activities and the implementation of electronic flight bags (EFBs). Adoption may, however, be slowed in some places by difficulties including disparities in regulations and the high cost of implementation. In spite of this, demand in AID solutions is being fuelled by the growing emphasis on enhancing operational effectiveness, safety, and connectivity. Significant potential for manufacturers and suppliers are presented by the region's expanding business jet and defence sectors, which also contribute to market expansion.

Recent Market Developments

- In August 2023, FLYHT Aerospace Solutions LLC has revealed a five-year contract extension with a longstanding aircraft leasing customer, securing ongoing software services for their entire fleet of Boeing 777 and 767 aircraft.

Major players in the market

- Astronics Corporation

- Esterline Technologies Corporation

- Collins Aerospace

- Global Eagle

- Teledyne Technologies Incorporated

- Avionica Inc.

- Collins Aerospace

- Thales Group

- The Boeing Company

- Skytrac System Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Interface Devices Aid Market, Aircraft Type Analysis

- Civil

- Military

Aircraft Interface Devices Aid Market, End Use Analysis

- Fixed Wing

- Rotary Wing

Aircraft Interface Devices Aid Market, Connectivity Analysis

- Wired

- Wireless

Aircraft Interface Devices Aid Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?