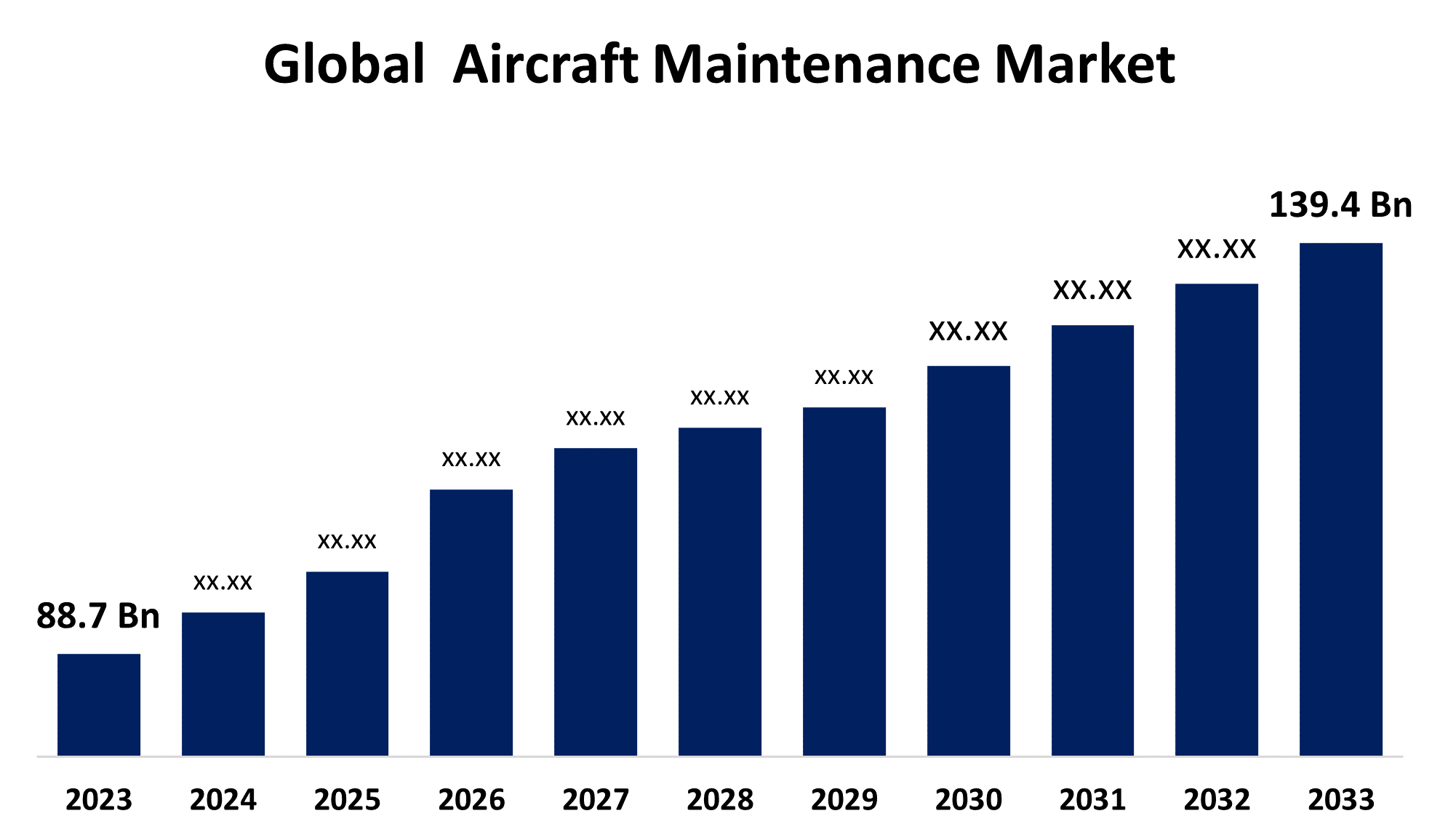

Global Aircraft Maintenance Market Size To Worth USD 139.4 Billion By 2033 | CAGR OF 4.62%

Category: Aerospace & DefenseGlobal Aircraft Maintenance Market Size To Worth USD 139.4 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Aircraft Maintenance Market Size to grow from USD 88.7 billion in 2023 to USD 139.4 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 4.62% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 203 pages with 110 Market data tables and figures & charts from the report on the "Global Aircraft Maintenance Market Size, Share, and COVID-19 Impact Analysis, By Maintenance Type (Airframe, Engine, Line Maintenance, Components, Others), By End-Use (Military, Commercial, Others), By Aircraft Type (Wide-body Aircrafts, Narrow-body Aircrafts, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aircraft-maintenance-market

The global aircraft maintenance market is expanding rapidly, fuelled by rising demand for air travel, fleet expansion, and severe safety standards. Airlines and aviation firms make significant investments in aircraft maintenance and upgrades to ensure operational efficiency and compliance with international standards. The market is divided into numerous divisions, such as line maintenance, heavy maintenance, engine overhaul, and component maintenance. Maintenance operations are becoming more efficient and accurate because to technological breakthroughs such as predictive maintenance and the integration of AI and IoT. Furthermore, the proliferation of low-cost carriers and increased air cargo demand are helping to drive market growth.

Aircraft Maintenance Market Value Chain Analysis

The aircraft maintenance market value chain is a complex network of stakeholders that guarantee that aircraft operate safely and efficiently. It starts with Original Equipment Manufacturers (OEMs), which offer aircraft parts and components. Maintenance, Repair, and Overhaul (MRO) suppliers conduct inspections, repairs, and upgrades to ensure compliance with safety regulations. Airlines and fleet operators play critical roles, monitoring routine maintenance and working with MROs for more substantial work. Regulatory authorities establish and enforce safety standards, whereas technology companies supply software and tools to improve maintenance operations. Furthermore, logistics and supply chain partners guarantee the prompt availability of spare parts. This integrated chain is crucial for reducing aircraft downtime, guaranteeing safety, and increasing operational efficiency throughout the aviation industry.

Aircraft Maintenance Market Opportunity Analysis

The aircraft maintenance market offers considerable prospects as global air traffic grows, fleets expand, and regulatory requirements evolve. With the growth of low-cost carriers and increased demand for air cargo, there is a greater need for efficient and cost-effective maintenance solutions. Predictive maintenance, artificial intelligence, and IoT integration are examples of technological breakthroughs that can help improve operational efficiency and reduce downtime. The trend towards more sustainable aircraft, including the use of greener technology and materials, opens up opportunities for specialised maintenance services. Furthermore, the increase of aircraft fleets in emerging areas, particularly Asia-Pacific and the Middle East, creates new opportunities for MRO providers. Companies that can innovate and adapt to changing demands are well positioned to gain significant market share.

The rise in worldwide air passenger traffic is a significant driver of growth in the aircraft maintenance market. As more passengers fly, airlines expand their fleets and increase flight frequency, resulting in increased wear and tear on aircraft. This increase in demand demands more frequent and thorough maintenance to maintain safety, dependability, and regulatory compliance. Furthermore, the growth of low-cost carriers and the opening of new routes, particularly in developing countries, are increasing the demand for maintenance services. The increase in passenger traffic also increases the use of advanced maintenance technology, including as predictive analytics and digital twin simulations, to reduce downtime and improve operations.

One of the most significant difficulties is a shortage of competent labour, as demand for qualified technicians frequently exceeds supply. This talent gap might cause maintenance schedule delays and higher operational costs. Furthermore, the high cost of maintenance, repair, and overhaul (MRO) services, particularly for newer, more technologically advanced aircraft, presents a difficulty for airlines with limited budgets. The intricacy of regulatory compliance across geographies adds another layer of difficulty, as businesses must traverse diverse standards and procedures. Furthermore, the volatility of fuel prices, as well as the economic impact of global events like pandemics or geopolitical tensions, can interrupt airline operations, reducing demand for maintenance services.

Insights by Maintenance Type

The engine segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines' fleets and flight operations grow, so does the demand for engine maintenance, repair, and overhaul (MRO) services. Technological improvements in modern engines, such as the usage of composite materials and improved efficiency designs, necessitate specialised maintenance skills and tools, fuelling growth in this market. Furthermore, the transition towards more fuel-efficient engines, as well as a greater emphasis on sustainability, has resulted in more regular engine upgrades and retrofits. Engine maintenance is extremely costly and complex, making it an important income source for MRO companies.

Insights by Aircraft Type

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines' fleets and flight operations grow, so does the demand for engine maintenance, repair, and overhaul (MRO) services. Technological improvements in modern engines, such as the usage of composite materials and improved efficiency designs, necessitate specialised maintenance skills and tools, fuelling growth in this market. Furthermore, the transition towards more fuel-efficient engines, as well as a greater emphasis on sustainability, has resulted in more regular engine upgrades and retrofits. Engine maintenance is extremely costly and complex, making it an important income source for MRO companies.

Insights by End Use

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are constantly growing their fleets to meet rising passenger demand, particularly in emerging economies, which creates an increased demand for maintenance, repair, and overhaul (MRO) services. The advent of fuel-efficient and technologically advanced commercial aircraft, such as the Boeing 787 and Airbus A350, demands specialised maintenance capabilities, which accelerates market growth. Furthermore, the ageing fleet of legacy carriers requires regular maintenance and updates to assure safety and regulatory compliance. The transition to predictive maintenance and the incorporation of digital technology into MRO operations are also improving efficiency and lowering downtime, making the commercial segment a top priority for MRO suppliers worldwide.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aircraft Maintenance Market from 2023 to 2033. The market is encouraged by the region's emphasis on technical innovation, such as the use of predictive maintenance and advanced digital tools to increase efficiency and reduce downtime. Regulatory compliance, enforced by agencies like as the Federal Aviation Administration (FAA), maintains tight maintenance standards, which drives up demand for high-quality MRO services. Furthermore, the ageing aircraft fleet in North America, particularly among legacy carriers, provides continued opportunities for maintenance, modifications, and retrofitting, hence maintaining the market's development trajectory.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Asia-Pacific is experiencing tremendous fleet growth, notably among low-cost carriers and new airlines. This expansion drives up demand for repair, Repair, and Overhaul (MRO) services, cementing the region's status as an aircraft repair hub. Furthermore, rising air cargo traffic and the necessity for fleet modernisation are driving the industry. Governments in the region are investing in infrastructure and regulatory frameworks to assist the aviation industry, which will improve the capabilities of local MRO providers. The implementation of innovative technologies, such as predictive maintenance and digital platforms, is also increasing, establishing Asia-Pacific as a prominent participant in the worldwide aircraft maintenance market.

Recent Market Developments

- In October 2023, Amazon has collaborated with a newly established Part 147 school in Lakeland, Florida, to create the Aviation Maintenance Training Program, which will provide career training for individuals interested in pursuing a new career path in MRO and contributing to the expansion of the aviation maintenance workforce pipeline.

Major players in the market

- Honeywell International

- Safran Aircraft Engines

- ST Aerospace

- Air France KLM Engineering & Maintenance

- GE Aviation

- Pratt & Whitney

- GMF AeroAsia

- Lufthansa Technik

- Airbus Group

- Delta TechOps

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Maintenance Market, Maintenance Type Analysis

- Airframe

- Engine

- Line Maintenance

- Components

- Others

Aircraft Maintenance Market, Aircraft Type Analysis

- Wide-body Aircrafts

- Narrow-body Aircrafts

- Others

Aircraft Maintenance Market, End Use Analysis

- Military

- Commercial

- Others

Aircraft Maintenance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?