Global Aircraft Propeller System Market Size To Worth USD 529.3 Million By 2033 | CAGR Of 3.15%

Category: Aerospace & DefenseGlobal Aircraft Propeller System Market Size To Worth USD 529.3 Million By 2033

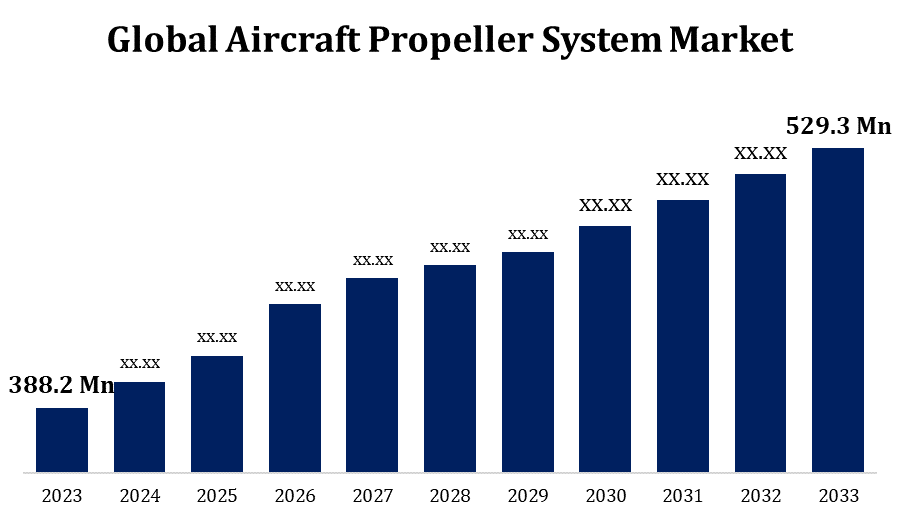

According to a research report published by Spherical Insights & Consulting, The Global Aircraft Propeller System Market Size to grow from USD 388.2 Million in 2023 to USD 529.3 Million by 2033, at a Compound Annual Growth Rate (CAGR) of 3.15% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 240 pages with 110 Market data tables and figures & charts from the report on the "Global Aircraft Propeller System Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed Pitch, Variable Pitch), By Component (Blade, Spinner, Hub), By Engine (Conventional, Hybrid & Electric), By Platform (Civil, Military), By End Use (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aircraft-propeller-system-market

The Aircraft Propeller System Market is expected to grow significantly, driven by rising demand for lightweight, fuel-efficient, and environmentally friendly aircraft. Propeller systems are critical to improving aircraft performance, especially in regional, turboprop, and unmanned aerial vehicles. Technological breakthroughs, such as the use of composite materials and innovative blade designs, are increasing propeller efficiency while decreasing noise levels. The market is also benefiting from the growing popularity of electric and hybrid propulsion systems, which are transforming the aviation sector. To address the aerospace industry's changing demands, key companies are focussing on innovation and strategic alliances. However, issues such as high manufacturing costs and tight regulatory criteria may stymie industry growth. Overall, the industry is likely to increase steadily in the following years.

Aircraft Propeller System Market Value Chain Analysis

Aircraft Propeller System The market value chain is a complex ecosystem that spans numerous phases, from raw material sourcing to end-user delivery. It begins with the acquisition of raw materials such as aluminium, composites, and other alloys, which are required for the manufacture of propeller components. Manufacturers then concentrate on designing, engineering, and manufacturing propeller systems that use modern technology for increased performance. Suppliers play an important role in delivering specialised components like as blades, hubs, and control systems. Original Equipment Manufacturers (OEMs) and Tier 1 suppliers play critical roles in assembling these systems into aircraft. The distribution network, which includes logistics providers and aftermarket service suppliers, guarantees that the propellers reach airlines and maintenance repair organisations (MROs). Finally, end users—commercial, military, and general aviation sectors—use these systems, with continued support from MRO services.

Aircraft Propeller System Market Opportunity Analysis

The Aircraft Propeller System Market has substantial development potential, driven by rising demand for fuel-efficient, low-emission propulsion systems in aviation. The growth of regional air travel, particularly in emerging nations, is increasing demand for turboprop aircraft, which require propeller systems. Furthermore, advances in electric and hybrid-electric propulsion are creating new opportunities for propeller technology, which has the potential to transform urban air mobility (UAM) and unmanned aerial vehicles (UAVs). The military industry also has opportunity to modernise fleets with new propeller systems. Furthermore, the continued emphasis on decreasing aeroplane noise and improving performance through novel materials and designs creates fertile ground for market participants. Strategic investments in research and development, together with collaborations, are critical for capitalising on these prospects.

The increasing number of Special Light-Sport Aircraft (SLSA) deliveries globally is having a significant impact on the Aircraft Propeller System Market. SLSAs, which are noted for their low cost, fuel efficiency, and ease of operation, are becoming increasingly popular among recreational pilots and flight schools. This spike in demand is driving the need for improved, lightweight propeller systems that improve the aircraft's performance and efficiency. Manufacturers are progressively focussing on designing propeller systems with greater aerodynamics, noise reduction, and durability to fulfil the unique needs of SLSAs. The tendency is especially strong in regions with growing general aviation industries, such as North America and Europe.

High manufacturing and maintenance costs continue to be a significant hurdle, especially for complex propeller systems that require specialised materials and precision engineering. Stringent regulatory regulations for safety and environmental impact add to the complexity, mandating costly testing and certification processes that can cause product delays and cost increases. The market also faces a trend towards jet engines in larger aircraft, which diminishes demand for propeller-driven versions in commercial aviation. Furthermore, technical advances in alternative propulsion systems, like as electric and hybrid engines, have the potential to challenge traditional propeller sectors if they become more affordable and widely accepted.

Insights by Type

The Fixed-pitch propellers segment accounted for the largest market share over the forecast period 2023 to 2033. Fixed-pitch propellers, which have blades set at a preset angle, are less maintenance-intensive and easier to produce, making them popular among private pilots, flight schools, and recreational aviation. The segment benefits from rising demand for lightweight, fuel-efficient aircraft in emerging nations, where affordability and convenience of use are important concerns. Furthermore, advances in materials and aerodynamic design are improving the performance of fixed-pitch propellers, accelerating their adoption. As the general aviation sector expands globally, the fixed-pitch propellers market is likely to rise steadily.

Insights by Component

The propeller blades segment accounted for the largest market share over the forecast period 2023 to 2033. Technological developments, such as the use of composite materials and creative aerodynamic designs, improve propeller blade efficiency, longevity, and noise reduction. These advancements are especially significant for modern turboprop aircraft, unmanned aerial vehicles (UAVs), and Special Light-Sport Aircraft (SLSA), where performance and fuel efficiency are vital. The increase in regional air travel, as well as the push for more ecologically friendly aviation solutions, are driving up demand for improved propeller blades. Manufacturers are focussing on R&D to manufacture lighter, stronger, and more efficient blades, preparing this market for long-term growth as the aviation industry advances.

Insights by Engine

The conventional engine segment accounted for the largest market share over the forecast period 2023 to 2033. Conventional engines, often paired with propeller systems, are still the favoured choice for small aircraft due to their proven performance, ease of maintenance, and cost-effectiveness. This segment benefits from continued demand for turboprop aircraft, particularly in emerging nations where short-haul routes are expanding. Furthermore, the section offers a wide range of applications, including leisure flying and military training, making it a versatile choice. However, while the category is expanding, it faces difficulties from the increased interest in electric and hybrid-electric propulsion systems, which have the potential to compete with conventional engines in the aviation industry.

Insights by Platform

The aircraft propeller system segment accounted for the largest market share over the forecast period 2023 to 2033. Enhanced performance and economy are critical aspects, with advances in materials such as composites and aerodynamic designs leading to more fuel-efficient and quieter propeller systems. The surge in regional air travel, combined with the growing popularity of Special Light-Sport Aircraft (SLSA) and unmanned aerial vehicles (UAVs), is driving up demand for sophisticated propeller systems. Furthermore, the demand for ecologically friendly aircraft solutions promotes the advancement of more efficient and sustainable propeller technologies. As manufacturers continue to innovate and address unique needs for various aircraft types, the market for aviation propeller systems is set to expand and advance technologically.

Insights by End Use

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. Original Equipment Manufacturers (OEMs) are incorporating cutting-edge technology, such as composite materials and innovative aerodynamic designs, to improve propeller system performance, fuel efficiency, and noise reduction. The growth of regional and business aviation, as well as the popularity of Special Light-Sport Aircraft (SLSA) and unmanned aerial vehicles (UAVs), is driving up demand for OEM-provided propeller systems. Furthermore, the modernisation of military and commercial fleets presents chances for OEMs to deliver cutting-edge propeller systems. As the aviation sector evolves, the OEM segment is poised for expansion and innovation.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aircraft Propeller System Market from 2023 to 2033. The region is home to prominent aircraft and propeller manufacturers who are at the forefront of technological innovation, emphasising lightweight materials, noise reduction, and fuel economy. The increasing use of turboprop aircraft for regional and corporate travel drives up demand for sophisticated propeller systems. Furthermore, the increase in Special Light-Sport Aircraft (SLSA) deliveries and the proliferation of unmanned aerial vehicles (UAVs) are driving market growth. The large presence of military aircraft, as well as continuous modernisation efforts, help to drive demand for high-performance propeller systems.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growth is being driven by increased air travel, economic prosperity, and increased investment in aviation infrastructure. Demand for regional and turboprop aircraft is increasing, especially in nations such as China, India, and Southeast Asia, where short-haul routes are rapidly expanding. This boom is increasing the demand for efficient and dependable propeller systems. Furthermore, the increasing use of Special Light-Sport Aircraft (SLSA) and unmanned aerial vehicles (UAVs) in this region is helping to drive market growth. The region's emphasis on modernising military fleets and improving general aviation capabilities fuels demand.

Recent Market Developments

- In February 2023, Hamilton Sundstrand Corp., a Collins Aerospace business, has been awarded a USD 135 million contract to build the NP2000 eight-blade propeller and electronic propeller control system for the US Air Force's (USAF) C-130 Hercules aircraft.

Major players in the market

- Hartzell Propeller, Inc. (Hartzell Propeller)

- MT-Propeller Entwicklung GmbH (MT-Propeller)

- Dowty Propellers

- Hartzell Propeller

- Hélices E-Props

- Hercules Propellers Ltd.

- MT-Propeller Entwicklung GmbH

- McCauley Propeller Systems

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Propeller System Market, Type Analysis

- Fixed Pitch

- Variable Pitch

Aircraft Propeller System Market, Component Analysis

- Blade

- Spinner

- Hub

Aircraft Propeller System Market, Engine Analysis

- Conventional

- Hybrid & Electric

Aircraft Propeller System Market, Platform Analysis

- Civil

- Military

Aircraft Propeller System Market, End Use Analysis

- OEM

- Aftermarket

Aircraft Propeller System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?