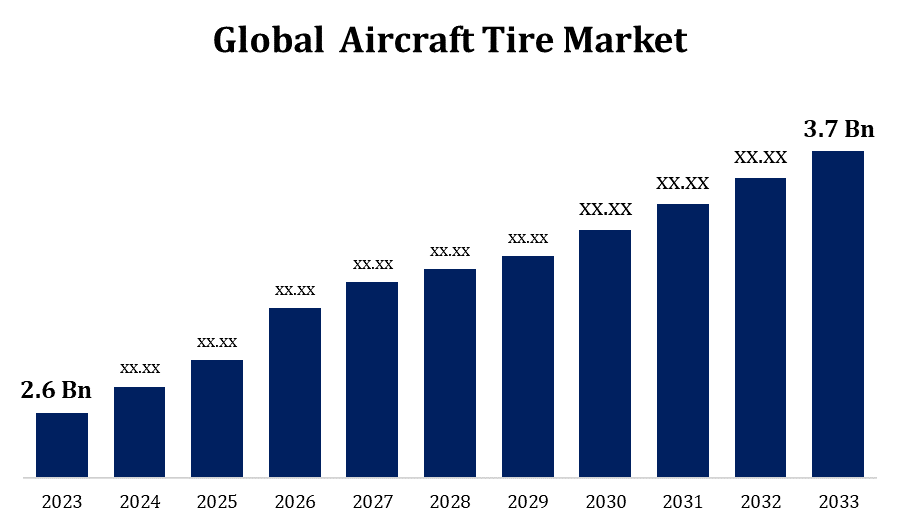

Global Aircraft Tire Market Size To Worth USD 3.7 Billion By 2033 l CAGR Of 3.59%

Category: Specialty & Fine ChemicalsGlobal Aircraft Tire Market Size To Worth USD 3.7 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Aircraft Tire Market Size to grow from USD 2.6 billion in 2023 to USD 3.7 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 3.59% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 231 pages with 105 Market data tables and figures & charts from the report on the "Global Aircraft Tire Market Size, Share, and COVID-19 Impact Analysis, By Type (Radial-ply Tires and Bias-ply Tires), By Position (Main-Landing Tire and Nose-Landing Tire), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033" Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aircraft-tire-market

The aircraft tire market is expanding rapidly, driven by increased air travel, rising demand for new aircraft, and the need to maintain the existing fleet. Modern aviation tires are designed to be more durable, perform better, and be safer as technology advances. The Asia-Pacific region, particularly China and India, is experiencing strong growth as its aviation sectors expand. To preserve a competitive advantage, key players prioritise innovation and strategic relationships. However, factors such as shifting raw material costs and tight regulations may have an impact on market dynamics in the coming years.

Aircraft Tire Market Value Chain Analysis

The aircraft tyre market value chain includes various crucial stages, ranging from raw material sourcing to end-user delivery. It starts with the acquisition of critical resources such as natural and synthetic rubber, fabric, and steel, which are required for tyre manufacture. Manufacturers then design and manufacture the tires, adding innovative technology to improve performance. These goods are rigorously tested and quality controlled before being provided to original equipment manufacturers (OEMs) and the aftermarket. OEMs supply tires for new aircraft, while the aftermarket provides maintenance, repair, and overhaul (MRO) services. Distributors and suppliers play critical roles in guaranteeing timely delivery to airlines and MRO providers. The value chain is influenced by innovation, regulatory compliance, and the need for continual product improvement to suit changing industry demands.

Aircraft Tire Market Opportunity Analysis

The increase in new aircraft deliveries, particularly in emerging areas such as Asia-Pacific and the Middle East, drives up demand for high-performance tires. Furthermore, the increased emphasis on fuel efficiency and environmental sustainability encourages innovation in tyre design, allowing producers to create lightweight, long-lasting, and environmentally friendly goods. The aftermarket industry, notably in maintenance, repair and overhaul (MRO) services, presents significant prospects due to the ongoing demand for tyre replacements and retreading in ageing fleets. Furthermore, advances in materials and technology, such as smart tires with embedded sensors, open up new opportunities for growth while improving safety and operating efficiency in the aviation industry.

Large commercial and military aviation fleets are important drivers of the aircraft tyre market's growth. The continued growth of global air travel has resulted in larger fleet sizes for major airlines, increasing demand for high-performance tires capable of withstanding repeated takeoffs and landings. In parallel, military aviation fleets, with their stringent operational requirements and numerous aircraft types, necessitate specialised tires that provide increased durability and safety. The requirement for frequent maintenance, repair and overhaul (MRO) of these large fleets drives up tyre demand, especially in the aftermarket. As both the commercial and military sectors prioritise operating efficiency and safety, manufacturers are focussing on new tyre technologies that provide longer service life, more fuel efficiency, and improved overall performance, resulting in market growth.

Large commercial and military aviation fleets are important drivers of the aircraft tyre market's growth. The continued growth of global air travel has resulted in larger fleet sizes for major airlines, increasing demand for high-performance tires capable of withstanding repeated takeoffs and landings. In parallel, military aviation fleets, with their stringent operational requirements and numerous aircraft types, necessitate specialised tires that provide increased durability and safety. The requirement for frequent maintenance, repair and overhaul (MRO) of these large fleets drives up tyre demand, especially in the aftermarket. As both the commercial and military sectors prioritise operating efficiency and safety, manufacturers are focussing on new tyre technologies that provide longer service life, more fuel efficiency, and improved overall performance, resulting in market growth.

Fluctuating raw material costs, notably rubber and steel, put pricing pressures on producers. Furthermore, high regulatory standards and safety certifications necessitate ongoing investment in R&D, raising operational costs. The intricacy of designing tires that can resist harsh circumstances while preserving durability and performance compounds the difficulties. The market also faces a delayed pace of innovation acceptance in some countries, which limits the penetration of sophisticated tyre technology. Furthermore, the worldwide push for sustainability necessitates the development of environmentally friendly products, which can be expensive and technologically hard. Finally, supply chain interruptions, whether due to geopolitical tensions or pandemics, jeopardise the timely manufacturing and distribution of aircraft tires.

Insights by Type

The radial-ply tires segment accounted for the largest market share over the forecast period 2023 to 2033. Radial-ply tires are becoming increasingly popular among commercial and military aircraft operators due to their higher fuel efficiency, longer service life, and improved heat dissipation. Demand for these tires is especially strong in high-traffic areas such as North America and Asia-Pacific, where airlines are looking to cut operational costs and enhance efficiency. Furthermore, advances in materials and manufacturing technology have resulted in lighter and more durable radial-ply tires, increasing their popularity. As the aviation sector prioritises safety, performance, and cost-effectiveness, the radial-ply tire segment is likely to increase steadily in the future years.

Insights by Position

The main-landing tires segment accounted for the largest market share over the forecast period 2023 to 2033. These tires are subjected to extreme stress, necessitating superior durability, heat resistance, and performance qualities. As worldwide air traffic grows, airlines are focussing on durable main-landing tires that can survive repeated operations, particularly in large commercial jets and military aircraft. The increasing tendency of replacing older aircraft with newer versions outfitted with superior main-landing tires is further propelling market growth. Furthermore, the requirement for frequent maintenance, repair, and overhaul (MRO) services to ensure peak tyre performance is driving up demand in the aftermarket industry. This segment's growth is further aided by advancements in tyre materials and design, which improve safety and efficiency.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Aircraft Tire Market from 2023 to 2033. The presence of large airlines, combined with significant air traffic, drives a steady need for high-performance tires. Furthermore, the region's advanced aerospace sector and strong emphasis on safety and efficiency encourage the use of novel tire technologies including radial tires and smart tire systems. The robust maintenance, repair, and overhaul (MRO) sector drives up aftermarket demand for aircraft tires, ensuring frequent replacements and retreading. The United States, as a leading competitor, makes a considerable contribution to the industry with its huge fleet of commercial and military aircraft.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The expanding demand for air travel, combined with rising disposable incomes and urbanisation, is causing a boom in new aircraft deliveries, which is driving tyre demand. Furthermore, the market benefits from the region's expanding military expenditures, which include considerable investments in defence aircraft. The growing maintenance, repair and overhaul (MRO) industry contributes to strong aftermarket tyre demand. Regional producers are rapidly adopting innovative tyre technologies to satisfy worldwide requirements, which is fuelling market expansion.

Recent Market Developments

- In March 2022, Shuguang Rubber Industry Research & Design Institute, an aircraft tire subsidiary of ChemChina, will collaborate with engineering firm Haohua Chemical Science & Technology to build a new civil aviation tire production facility.

Major players in the market

- Bridgestone Corp

- Goodyear Tire and Rubber Company

- Specialty Tires of America Inc.

- Dunlop Aircraft Tyres Limited

- Michelin

- Aviation Tires and Treads of America

- Qingdao Century Tires Company Limited

- Wilkerson Aircraft Tires

- Petlas Tire Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Tire Market, Type Analysis

- Radial-ply Tires

- Bias-ply Tires

Aircraft Tire Market, Position Analysis

- Main-Landing Tire

- Nose-Landing Tire

Aircraft Tire Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?