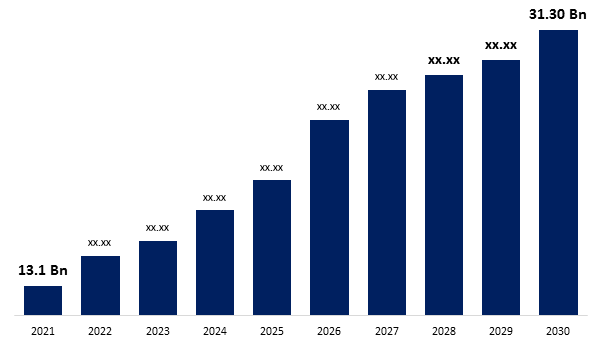

Global Algorithmic Trading Market Size To Reach USD 31.30 Billion By 2030 | CAGR of 13.6%

Category: Information & TechnologyGlobal Algorithmic Trading Market Size To Reach USD 31.30 Billion By 2030

The Global Algorithmic Trading Market Size was valued at USD 13.02 billion in 2021 and is expected to reach USD 31.30 billion by 2030, growing at a CAGR of 13.6% during 2021-2030.The market for algorithmic trading is growing as financial markets and market surveillance become more integrated. The expansion of financial institutions and the increase in investments are having a beneficial effect on market expansion. In algorithmic trading, a computer program is run according to a predetermined set of instructions, some of which include purchasing or selling an item. The market is expanding more quickly thanks to lower transaction costs, automatic inspections of various market circumstances, and trade execution at the best pricing. High-frequency trading technology is used by algorithmic traders, allowing the company to execute tens of thousands of trades per second.

Get more details on this report -

The requirement for the algorithmic trading industry is anticipated to be driven by elements including favorable governmental rules, rising demand for quick, dependable, and efficient order execution, rising demand for market surveillance, and declining transaction costs. The increasing adoption of API-based trading offers faster order execution and investors may execute trades based on insights and analytics while keeping customers in the analytics app and fostering greater customer loyalty. The API-based trading platform enhances digital wealth management solutions to connect with capital markets in order to offer rea-time trading and market data. Algorithmic trading is used by large brokerage firms and institutional investors to reduce the expenses of bulk trading.

During the projected period, market expansion is anticipated to be fueled by rising investments in trading technologies, particularly blockchain, an increase in the number of well-known algorithmic trading firms, and rising government support for international trade. Because of changes in technology and a rise in the usage of algorithmic trading by a variety of end users, including banks and financial organizations. The level of automation and electronification has significantly increased. Buy-side and sell-side desks decrease during the epidemic, and commissions and fees also decrease. The need for algorithmic trading services and solutions has increased due to the rise in volatility.

Browse 57 market data tables and 52 figures spread through 212 pages and in-depth TOC on “Global Algorithmic Trading Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Component (Solution, Services), By Deployment (On-premise, Cloud-based), By Type (Stock Markets, FOREX, Exchange-Traded Fund (ETF), Bonds, Cryptocurrencies & Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030”, To get a detailed report summary and research scope of this market, click here: https://www.sphericalinsights.com/reports/algorithmic-trading-market

Due to the huge volume of trades made by high-frequency traders each day, automated trading leveraging software and artificial intelligence is necessary, primarily to accelerate trade execution. Therefore, this technology may only be purchased by institutional investors. Additionally, they gain the benefit of value, which is based on millisecond arbitrage, to profit from it. Additionally, institutional-based investors use algorithmic trading by adhering to the arbitrage strategy when they want to profit from numerous sporadic little price disparities in the stock offered on two distinct exchanges.

The financial services industry's adoption of AI, ML, and big data is anticipated to play a significant role in the market growth for algorithmic trading. Because of the advancements in technology, regulators are also beginning to pay attention to the ways that people engage with the market. Some of the biggest institutions in the world began implementing such technologies to advance algorithmic trading.

The solution segment has dominated the market share in 2020 of global algorithmic trading market owing to advantages of algorithmic trading solutions, such as lower transaction costs owing to the absence of human intervention and quick and precise trade order placement, are what primarily fuel the demand for these solutions. The cloud-based segment has dominated the market share in 2020 of global algorithmic trading market owing to because financial firms are increasingly using cloud-based solutions to boost productivity and efficiency. Additionally, cloud-based algorithmic trading solutions are becoming more and more popular among traders since they guarantee efficient process automation, data preservation, and cost-effective management.

Get more details on this report -

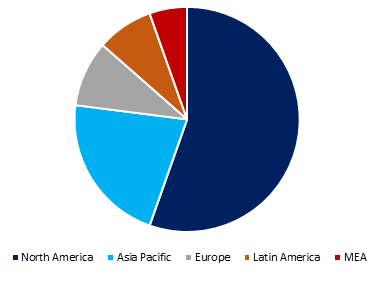

North America region is dominating the market share of global algorithmic trading market owing to a variety of variables, such as significant expenditures in trading technology and rising government backing for international trade. However, Asia Pacific region is anticipated to grow over the next few years of global algorithmic trading market owing to significant public and private sector investments in advancing their trading technologies.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?