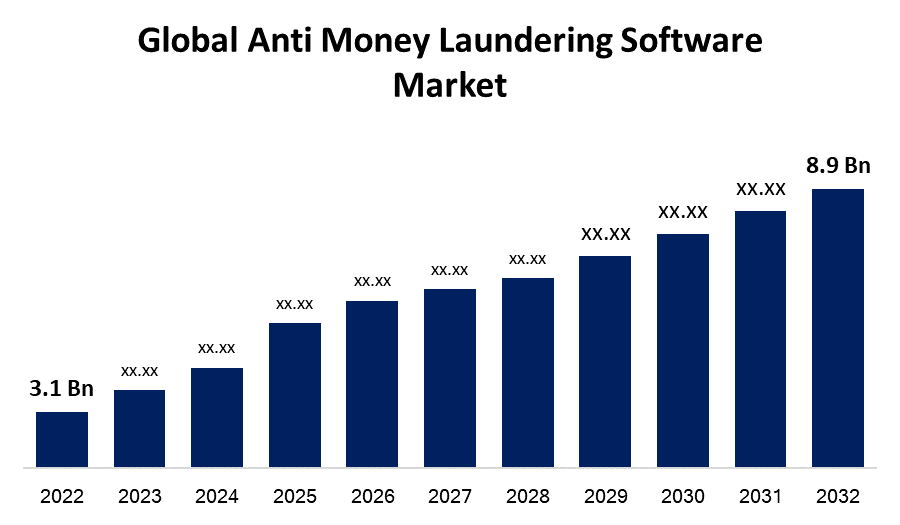

Global Anti Money Laundering Software Market Size To Worth USD 8.9 Billion By 2032 | CAGR of 12.3%.

Category: Information & TechnologyGlobal Anti Money Laundering Software Market Size To worth USD 8.9 billion by 2032

According to a research report published by Spherical Insights & Consulting, the Global Anti Money Laundering Software Market Size To Grow from USD 3.1 Billion in 2022 to USD 8.9 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 12.3% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 market data tables and figures & charts from the report on "Global Anti Money Laundering Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, Service); By Deployment (On Cloud, On Premise); By Application (Transaction Monitoring, Customer Identity Management, Currency Transaction Reporting, Compliance Management, Others); By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032." Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/anti-money-laundering-software-market

Anti-money laundering software is used to keep track of consumer data and identify any odd transactions. Any transaction that involves a sudden increase or significant outflow of money is considered unusual. The programme is heavily used in the legal and financial sectors. Anti-money laundering software facilitates a number of applications, such as client identification monitoring systems, current transaction reporting, transaction monitoring systems, and compliance management. It is also used for data management, predictive analysis, and procedural filtering.

COVID 19 Impact

The anti-money laundering system market has been significantly influenced by the COVID 19 epidemic. The global lockdown, which is to blame for the losses in the majority of businesses, has actually increased demand for anti-money laundering solutions. a significant trend caused by the increase in the use of electronic wallets. Due to this transformation, which has raised the possibility of the transmission or receipt of unlawful money as well as a number of other anti-money laundering risks, the market for anti-money laundering software has grown. Due to the globalisation of online transactions in recent years, there will be a rise in the demand for anti-money laundering systems over the projection period.

The increased use of big data analytics will aid companies in conducting analysis that can identify trends and extract useful information from the existing data sets. The use of Big Data analytics will lead to a substantial increase in demand for anti-money laundering software. Similar to this, big data analytics is regarded as the best tool for AML compliance because it can be tailored to enhance and automate different AML compliance processes. Big Data analytics will aid in risk mitigation and fraud trend detection.

The inability to identify fraud activities early on is a result of the high cost of software deployment and its associated difficulties. New operational issues are being brought about by the adaptation of practises to novel and unproven technological solutions or systems. Additionally, small and medium-sized fintech organisations lack the internal resources to assess the efficacy of cutting-edge solutions among well-known vendors and their goods, which poses serious operational difficulties. Over the projected period, all of these issues are likely to impede market expansion.

Component Insights

Software segment is dominating the market over the forecast period

On the basis of component, the global anti money laundering software market is segmented into software and service. Among these, the software segment is dominating the market with the largest market share over the forecast period. The expansion is linked to both the increased demand for software to meet governmental regulatory standards and the widespread presence of several domestic and international financial institutions. In addition to this, the software industry is also playing a crucial role in identifying clients and their transactions and assisting authorities in taking the appropriate action against frauds of any form. The market has expanded due to the availability of software from the well-known vendor. The anti-money laundering software is designed specifically to track transactions, manage client data, manage compliance, and report currency movements, enabling financial institutions to follow money transfers and spot fraud of any kind.

While the absence of experienced anti-money laundering software operators has boosted the demand for third party service providers, the services sector is anticipated to experience the fastest market development during the projection period. In addition, the software operation has become more specialist due to the use of artificial intelligence, machine learning, and big data analysis. As a result, during the coming years, the demand for the services sector will grow at a truly large rate.

Deployment Insights

On premise segment holds the largest market share over the forecast period

On the basis of deployment, the global anti money laundering software is segmented into on cloud and on premise. Among these, the on premise segment holds the largest market share over the forecast period. The use of on-premise deployment has increased as a result of the financial institutions' growing demand for a safer deployment method. In addition, the desire for better consumer financial data control has increased, which has contributed to the segment's expansion. The primary factor driving the segment's expansion internationally is the on-premises deployment's superior security over the on-cloud deployment.

On the other hand, it is expected that the on cloud segment would have the quickest market development during the podcast period due to the increasing demand for server setup cost reduction and time savings. The necessity for on-cloud deployment is also being driven by considerations like greater flexibility, higher scalability, and rising efficiency.

Application Insights

Transaction Monitoring segment is dominating the market over the forecast period.

Based on application, the global anti money laundering software market is segmented into transaction monitoring, customer identity management, compliance management, currency transaction reporting, and others. Among these, the transaction monitoring segment is dominating the market over the forecast period. The domination of this market sector is a result of the growing demand to track client activity in real time. Transaction monitoring assists in spotting any circumstance that violates the law or is inconsistent with the customer's profile, resulting in a report to the anti-counterfeiting, anti-terrorist financing, and anti-money laundering regime. In addition, as digital payment systems become more widely used, there is a greater need for transaction monitoring, which aids financial institutions in keeping track of significant volumes of electronic payments.

Regional Insights

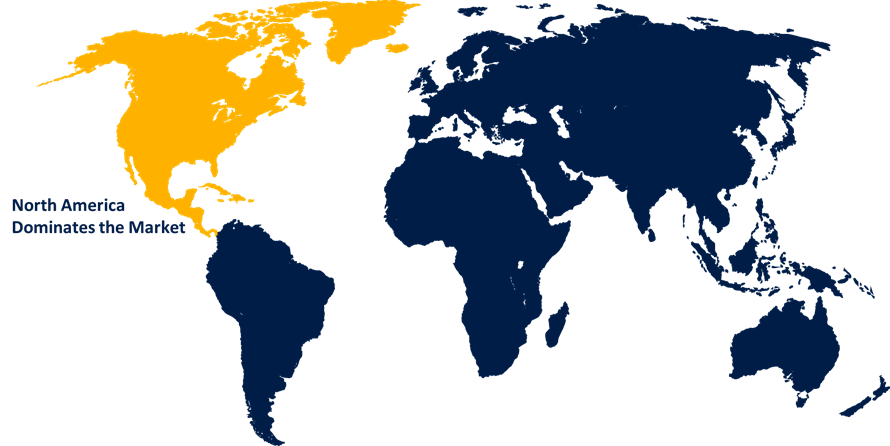

North America is dominating the market with the largest market share over the forecast period

Get more details on this report -

North America is dominating the global anti money laundering software market over the forecast period. Many leading AML software suppliers, including SAS Institute, Oracle Corporation, Fidelity National Information Services, and Fiserv, Inc., are well-represented in North America, which is attributed to the expansion. The expanding usage of eBanking and mobile banking for money transfers has increased the risk of criminal behaviour, which has drastically boosted the demand for AML software among North American financial institutions. The rise of the North American AML software market has also been spurred by the region's abundance of renowned financial institutions and strict government regulations governing anti-money laundering practises.

On the other side, Europe is expected to have the fastest market growth. Due to rigorous government regulations and increased demand for the newest technology in the finance business, Europe's various financial institutions are increasingly in need of AML software. Multiple legislative reforms, including as the General Data Protection Regulation, Anti-Money Laundering Directive 5, and Payment Card business Data Security Standard, are causing the business to expand. Due to a number of factors, including trade-based money laundering, virtual currencies, a tendency towards non-banking financial institutions, and non-financial professions, AML software sales are increasing in Europe.

Major vendors in the Global Anti Money Laundering Software Market include Accenture, SAS Institute Inc., Fiserv, Inc, Open Text Corporation, Experian Information Solutions, Inc., Oracle, FICO TONBELLER, Ascent Business, EastNets, Trulioo, BAE Systems, ACI Worldwide, Inc., Actimize, NameScan, Verafin Inc., LexisNexis, INETCO Systems Ltd, Global RADAR, Experian plc.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Learning Management Systems Market based on the below-mentioned segments:

Learning Management Systems Market, Component Analysis

- Solution

- Service

Learning Management Systems Market, Deployment Analysis

- On-Cloud

- On Premise

Learning Management Systems Market, End User Analysis

- Academic

- Corporate

Learning Management Systems Market, Enterprise Type

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Learning Management Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?