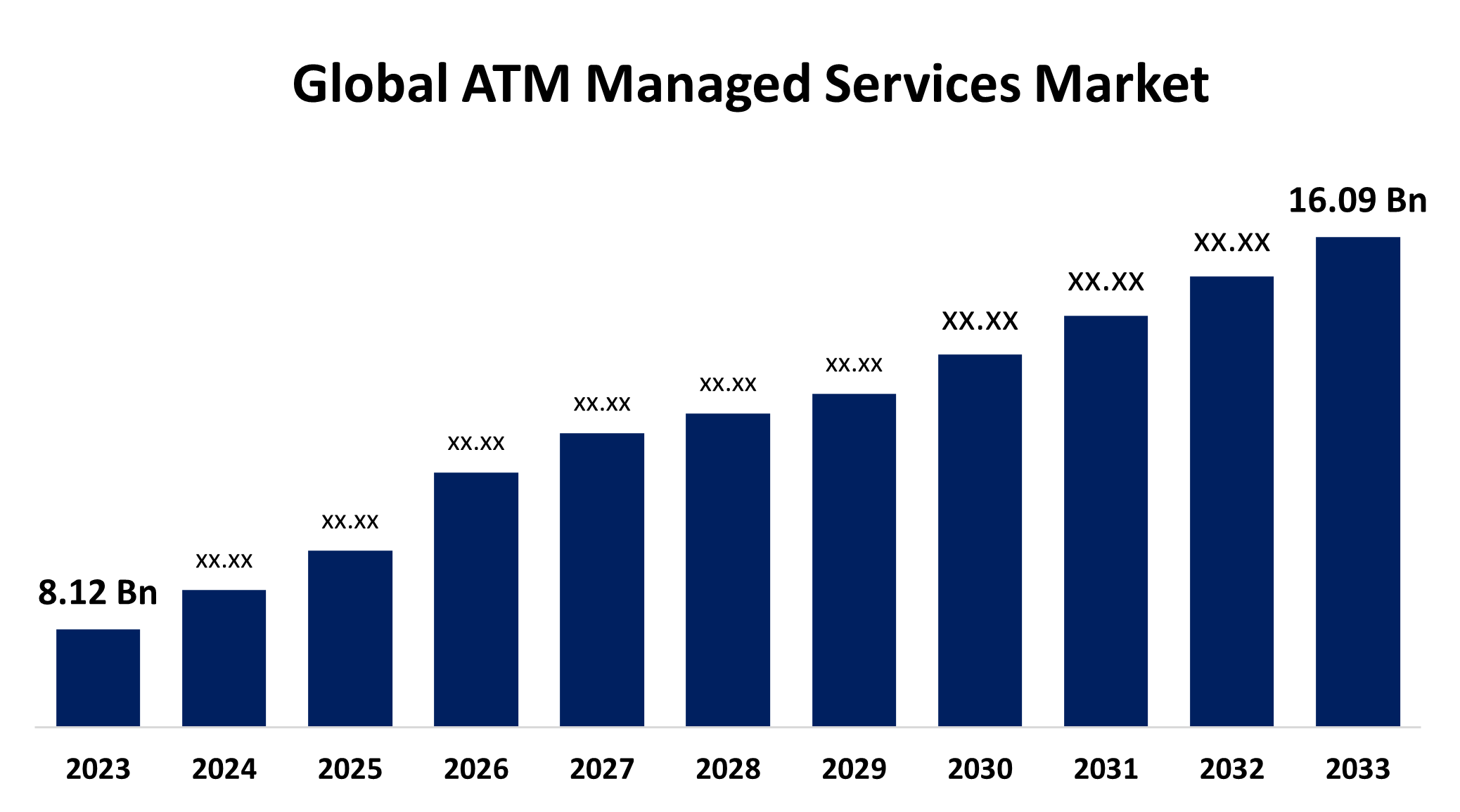

Global ATM Managed Services Market Size To Worth USD 16.09 Billion By 2033 | CAGR of 7.08%

Category: Banking & FinancialGlobal ATM Managed Services Market Size To Worth USD 16.09 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global ATM Managed Services Market Size was estimated at USD 8.12 Billion in 2023 and is expected to reach USD 16.09 Billion by 2033, growing at a CAGR of 7.08% from 2023 to 2033

Get more details on this report -

Browse key industry insights spread across 234 pages with 99 Market data tables and figures & charts from the report on the "Global ATM Managed Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Cash Management, ATM Monitoring, ATM Maintenance, ATM Replenishment, and Others), By ATM Type (Onsite ATMs, Offsite ATMs, Worksite ATMs, Mobile ATMs), By End-User (Banks and Financial Institutions, Independent ATM Deployers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/atm-managed-services-market

ATM managed services refer to a complete range of outsourced solutions offered to banks and financial entities, in which a third-party firm assumes full accountability for the installation, upkeep, operation, and oversight of their ATM networks. This encompasses duties such as cash restoration, network monitoring, technical support, security management, and facilitating seamless customer transactions, enabling the bank to focus on its primary business activities while delegating the daily routine ATM operations to the service provider. The widespread presence of ATMs in urban and rural regions, along with the growing complexity of operations, highlights the necessity for strong ATM management services. In this context, ensuring adherence to regulatory standards is vital, requiring attentive oversight and proficient management. The rising worldwide deployment of ATMs, coupled with the necessity for enhanced security measures to combat fraud and cyberattacks, has led to a growing adoption of managed services by financial institutions. These services optimize ATM management, ensuring efficient and secure operations. However, with the continuous tough nature of cyber threats and fraud, banks and financial institutions are becoming worried and investing in security services. Therefore, financial institutions need to heavily invest in sophisticated security measures and ongoing surveillance to safeguard ATM operations. The major expenses and activities are linked to these safeguards may discourage service providers, hindering industry growth.

The cash management segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the service type, the global ATM-managed services market is classified into cash management, ATM monitoring, ATM maintenance, ATM replenishment, and others. Among these, the cash management segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is attributed to, the crucial tasks necessary for the efficient operation of ATMs. These services focus on cash forecasting, collection, and optimization, making sure ATMs are stocked with enough cash to satisfy demands while reducing surplus holdings. The increasing intricacy of cash logistics and the necessity for effective cash management procedures propel the demand for these services. Cutting-edge technology in ATM networks, including intelligent cash management systems and instant monitoring, boosts cash efficiency and lowers costs, reinforcing the importance of this sector.

The offsite ATMs segment accounted for the highest share in 2023 and is expected to grow at a notable CAGR during the forecast period.

Based on the ATM type, the global ATM managed services market is categorized into onsite ATMs, offsite ATMs, worksite ATMs, and mobile ATMs. Among these, the offsite ATMs segment accounted for the highest share in 2023 and is expected to grow at a notable CAGR during the forecast period. This is because of their reduced overhead expenses and enhanced scalability, which makes them appealing to financial organizations. These ATMs can be thoughtfully positioned in busy areas such as shopping centers, airports, and convenience stores, requiring little infrastructure, making them attractive to independent operators. Offsite ATMs offer banking services outside of branch locations, serving diverse customers. Their strategic positioning improves customer accessibility and aids the bank's outreach initiatives. Effective managed services guarantee their accessibility and functionality, enhancing reach while keeping expenses in check.

The banks and financial institutions segment dominate the market in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the end-user, the global ATM managed services market is divided into banks and financial institutions, independent ATM deployers, and others. Among these, the banks and financial institutions segment dominates the market in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This segmental growth is driven by the reliance on cash withdrawals from a large customer base shifting towards ATMs. This robust infrastructure and extensive network provide banking services to their clients. This dependence is fueled by operational efficiency, increased security, greater customer satisfaction, scalability, and adherence to regulations. These services improve ATM operations, cut expenses, guarantee security, and elevate customer experience, rendering them essential for these institutions. Scalability and compliance additionally bolster their vast ATM networks, which are key factors impacting their investment in ATM-managed services.

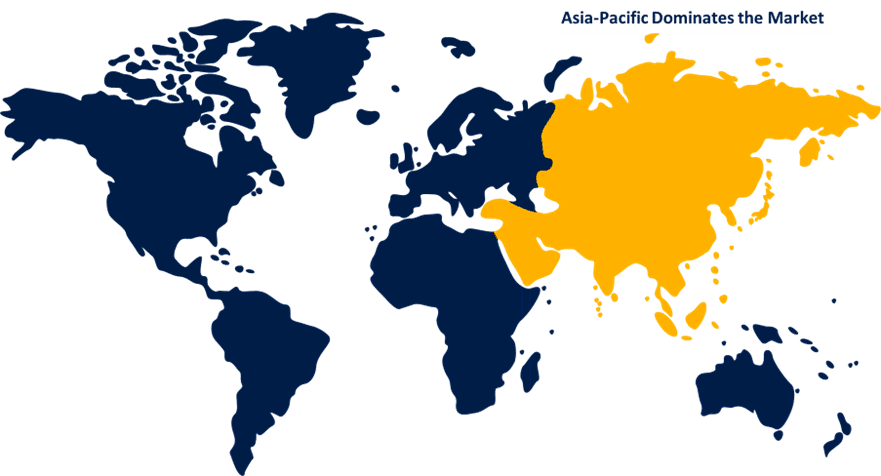

Asia-Pacific is projected to hold the dominant share of the global ATM-managed services market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is projected to hold the dominant share of the global ATM-managed services market over the predicted timeframe. This regional dominance is attributed to the rising urbanization and the growing demand for ATM services. This swift urban growth, driven by the inflow of migrants into cities, notably enhances the need for ATM services. As city populations expand, financial institutions are installing additional ATMs to meet the rising demand for easy cash access. The increase in housing and commercial projects requires convenient banking services. In addition, the influx of migrants into cities heightens the need for ATMs, guaranteeing that both current residents and newcomers can easily access their financial requirements. This trend highlights the essential function of ATMs in urbanized areas.

Additionally, the growth of digital banking across the Asia-Pacific region is playing a major role in the ATM services in the banking industry by providing digital payment services According to the statistical data by RBI, there were 67,224 ATMs operating across the urban cities of India during 2024. Whereas, cash remains important in the rest part of the region excluding urban areas, particularly in rural areas with limited banking access. This necessitates efficient currency management, replenishment, and incident management to keep ATMs operational and accessible. Which is fuelling regional dominance.

The North America ATM-managed services market is expected to grow with a significant CAGR during the forecasting period. This segmental growth is attributed Segment growth is driven by a strong banking framework and high ATM prevalence. The need to enhance infrastructure, and security, and adopt advanced technologies propels this expansion. A strong U.S. ATM network enables efficient repair and upkeep services. Key players like Paragon Application Systems, ATOS, Toshiba TEC, Cardtronics, Fiserv, and Euronet Worldwide further fuel growth.

Major key players in the ATM managed services market include AGS Transact Technologies Ltd., Cashlink Global Systems Pvt. Ltd., NCR Corporation, Fujitsu Limited, Cardtronics, Fiserv, Inc., GRG Banking Equipment Co., Ltd., CMS Info Systems Ltd., Euronet Worldwide, Inc., Hitachi-Omron Terminal Solutions, Corp., and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, Black Hills Federal Credit Union (BHFCU) partnered with NCR Atleos to transform self-service banking for over 110,000 members in South Dakota. By leveraging NCR Atleos' ATM-as-a-Service (ATMaaS) and ITM-as-a-Service (ITMaaS) solutions, BHFCU aims to simplify operations and replace its aging ATM fleet.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global ATM managed services market based on the below-mentioned segments:

Global ATM Managed Services Market, By Service Type

- Cash Management

- ATM Monitoring

- ATM Maintenance

- ATM Replenishment

- Others

Global ATM Managed Services Market, By ATM Type

- Onsite ATMs

- Offsite ATMs

- Worksite ATMs

- Mobile ATMs

Global ATM Managed Services Market, By End-User

- Banks and Financial Institutions

- Independent ATM Deployers

- Others

Global ATM Managed Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?