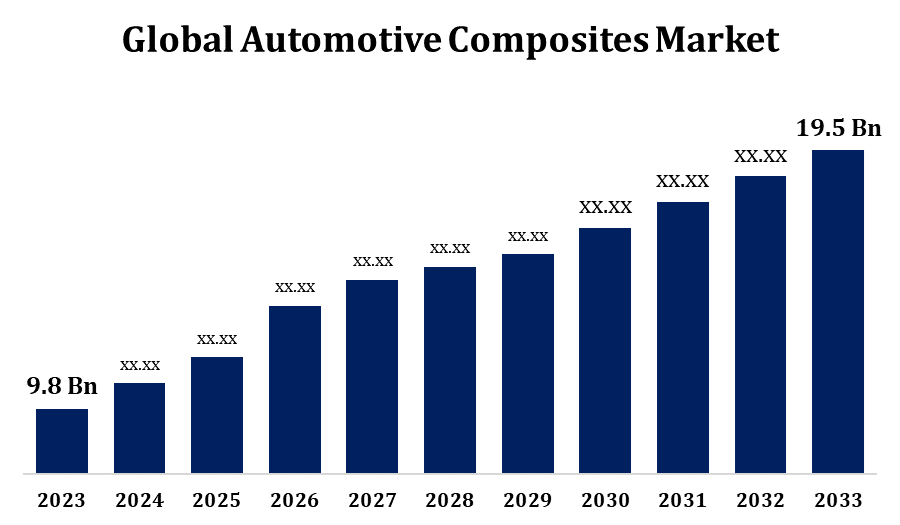

Global Automotive Composites Market Size To Worth USD 19.5 billion By 2033 | CAGR of 7.12%

Category: Chemicals & MaterialsGlobal Automotive Composites Market Size To Worth USD 19.5 billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Automotive Composites Market Size to grow from USD 9.8 billion in 2023 to USD 19.5 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 7.12% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 220 pages with 115 Market data tables and figures & charts from the report on the "Global Automotive Composites Market Size, Share, and COVID-19 Impact Analysis, By Fiber Type (Glass Fiber, Carbon Fiber), By Manufacturing Process (Compression Molding, Injection Molding, Resin Transfer Molding), By Application (Exterior, Interior, Powertrain), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/automotive-composites-market

The automotive composites market is expanding rapidly due to rising demand for lightweight, fuel-efficient vehicles with enhanced performance. These composites, made from materials like carbon fiber, glass fiber, and natural fibers, offer high strength-to-weight ratios and durability, making them well-suited for automotive use. Electric vehicles (EVs) particularly benefit, as composites help reduce battery weight and improve efficiency. Major automakers are increasingly adopting composites in structural, interior, and exterior parts to meet strict emissions and safety standards. However, high production costs and complex manufacturing processes pose challenges. Innovations in recyclable and bio-based composites offer growth opportunities, especially as sustainability concerns increase. Asia-Pacific, North America, and Europe dominate the market, with strong demand from key automotive regions such as China, the U.S., and Germany.

Automotive Composites Market Value Chain Analysis

The automotive composites market value chain consists of raw material suppliers, composite manufacturers, part fabricators, automotive OEMs, and end-users. Chemical suppliers provide raw materials like carbon fiber, glass fiber, and resin, which composite manufacturers process into sheets, prepregs, or molded components. These are then transformed by part fabricators into specialized automotive parts, including body panels, structural elements, and interior components. Automotive OEMs incorporate these lightweight, high-strength composites into vehicles to boost fuel efficiency and comply with emission standards. In electric vehicles (EVs), composites are crucial for reducing weight and enhancing battery range. With rising demand for durable, eco-friendly materials, the value chain is increasingly focused on innovations in recycling and bio-based composites, aligning with sustainability goals and driving further market growth.

Automotive Composites Market Opportunity Analysis

The automotive composites market presents significant growth opportunities, fueled by the rising demand for lightweight, fuel-efficient vehicles and the rapid adoption of electric vehicles (EVs). Advanced composites like carbon fiber and glass fiber are instrumental in reducing vehicle weight, improving fuel efficiency, and enhancing battery performance, especially critical for EVs to extend range. Stricter global emission regulations further drive automakers to incorporate these materials to meet environmental standards while maintaining performance. The shift toward electric, hybrid, and high-performance vehicles has spurred investments in composite innovation across structural, interior, and exterior applications. Additionally, growing interest in sustainability has accelerated the development of recyclable and bio-based composites as eco-friendly alternatives. With strong demand in Asia-Pacific, North America, and Europe, the market is poised for sustained growth amid the push for greener, more efficient vehicles.

The demand for lightweight, fuel-efficient vehicles is a significant growth driver in the automotive composites market. Increasing regulatory pressure for lower emissions and consumer demand for improved efficiency are pushing automakers toward advanced composites like carbon fiber and glass fiber, valued for their high strength-to-weight ratios. These materials play a crucial role in reducing vehicle weight, enhancing fuel economy in traditional vehicles, and extending battery range in electric vehicles (EVs), where weight reduction is critical. Composites also enable automakers to meet strict environmental standards without compromising safety or performance. Investments in composite technologies for structural, exterior, and interior applications are empowering manufacturers to create lighter, more sustainable vehicles. As efficiency and sustainability become central to the global automotive industry, the adoption of advanced composites is set for robust growth.

The automotive composites market faces several challenges, primarily due to the high costs of raw materials like carbon fiber and advanced resins, which restrict access for cost-sensitive manufacturers. Additionally, the complex and labor-intensive processes involved in molding and assembling composite parts make mass production more expensive and time-consuming compared to traditional materials. Recycling and disposal of certain composites also present difficulties, especially as sustainability concerns grow. Limited design flexibility and challenges in integrating composites with other materials can complicate manufacturing. Furthermore, high-performance composites require specialized equipment and skilled labor, adding to costs and hindering widespread adoption. Despite significant growth potential, overcoming these challenges through improvements in manufacturing processes, recycling methods, and affordable materials will be essential for broader adoption in the automotive sector.

Insights by Fiber Type

The glass fiber segment accounted for the largest market share over the forecast period 2023 to 2033. Glass fiber composites are extensively used in automotive components such as body panels, interiors, and structural parts, where strength and flexibility are essential. More affordable than carbon fiber, glass fiber provides a cost-effective solution suited to mass-market and mid-range vehicles, allowing manufacturers to improve fuel efficiency without significant cost increases. Its versatility and ease of production have also boosted its application in electric vehicles (EVs), where reducing weight is crucial for maximizing battery range. As automakers work to meet emission standards and respond to consumer demand for fuel-efficient vehicles, glass fiber composites are expected to continue as a key growth segment within the automotive market.

Insights by Manufacturing Process

The compression molding segment accounted for the largest market share over the forecast period 2023 to 2033. Compression molding is ideal for large-scale production, allowing automotive manufacturers to meet the rising demand for lightweight materials affordably. This method supports a variety of composite materials, including glass and carbon fiber, which offer durability and structural strength for applications like underbody shields, interior panels, and structural components. Its short cycle time and high material yield make compression molding particularly beneficial for electric vehicles (EVs), where reducing weight is essential to improve battery efficiency. Advances in compression molding technology, such as automation, are further boosting production efficiency, supporting broader adoption across the automotive sector for both conventional and electric vehicles.

Insights by Application

The exterior segment accounted for the largest market share over the forecast period 2023 to 2033. Composite materials like carbon fiber and glass fiber are increasingly used in exterior components such as bumpers, hoods, fenders, and panels, thanks to their high strength-to-weight ratio, impact resistance, and corrosion resistance. This demand is particularly strong for electric and hybrid vehicles, where weight reduction directly enhances range and efficiency. Additionally, composites offer design flexibility, enabling complex, aerodynamic shapes that boost both aesthetics and performance. With strict environmental regulations driving the need for reduced emissions, automotive manufacturers are investing heavily in advanced composites for exterior applications, positioning this segment for sustained growth as they work to develop safer, lighter, and more eco-friendly vehicles.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Automotive Composites Market from 2023 to 2033. Stricter fuel economy and emissions standards are driving increased use of composites, valued for their high strength-to-weight ratios that enhance vehicle efficiency without sacrificing safety. North America's established automotive sector, led by companies like Ford, General Motors, and Tesla, is investing in advanced materials, including carbon fiber and glass fiber composites, for applications in body panels, interiors, and under-the-hood components. Demand from the electric vehicle (EV) market further boosts composite use, as these materials help reduce battery weight and extend EV range. North America’s focus on sustainable composites, including recyclable and bio-based options, also supports market growth. With strong investments and rising consumer interest in innovative vehicles, the North American market is well-positioned for continued expansion.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Developing countries have become key automotive manufacturing hubs, with companies increasingly adopting advanced materials to meet emissions and efficiency regulations. In China, government support for electric vehicle (EV) production drives composite demand, as these materials reduce vehicle weight and enhance battery performance. Japan and South Korea are also incorporating composites in luxury and high-performance vehicles to boost fuel efficiency and reduce emissions. The region's lower manufacturing costs further attract foreign investment in composite technology. With growing EV adoption and ongoing innovations in composite manufacturing, the Asia-Pacific region is set for significant growth in the automotive composites market.

Recent Market Developments

- On June 2021, Mitsubishi Chemical Co., Ltd. has unveiled a new carbon fiber prepreg specifically developed for use in automotive engine components.

Major players in the market

- Toray Industries Inc. (Japan)

- SGL Carbon (Germany)

- Teijin Limited (Japan)

- Mitsubishi Chemical Holding Corporation (Japan)

- Hexcel Corporation (US)

- Owen Cornings (US)

- Solvay SA (Belgium)

- Gurit (Switzerland)

- UFP Technologies Ltd. (US)

- Huntsman Corporation (US)

- Hexion (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Composites Market, Fiber Type Analysis

- Glass Fiber

- Carbon Fiber

Automotive Composites Market, Manufacturing Process Analysis

- Compression Molding

- Injection Molding

- Resin Transfer Molding

Automotive Composites Market, Application Analysis

- Exterior

- Interior

- Powertrain

Automotive Composites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?