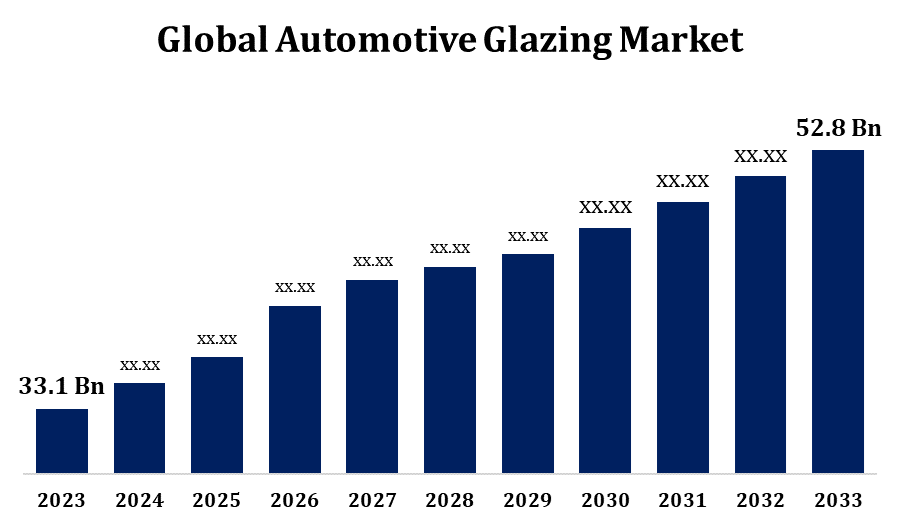

Global Automotive Glazing Market Size To Worth USD 52.8 Billion By 2033 | CAGR of 4.78%

Category: Automotive & TransportationGlobal Automotive Glazing Market Size To Worth USD 52.8 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Automotive Glazing Market Size to Grow from USD 33.1 Billion in 2023 to USD 52.8 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 4.78% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 231 pages with 115 Market data tables and figures & charts from the report on the "Global Automotive Glazing Market Size, Share, and COVID-19 Impact Analysis, By Application (Windscreen, Sidelite, Backlite, Others), By End Use (Passenger Vehicles, LCV, HCV), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/automotive-glazing-market

The automotive glazing market is experiencing robust growth, driven by advancements in vehicle design, enhanced safety standards, and increasing consumer demand for aesthetics and functionality. Glazing materials such as tempered glass, laminated glass, and polycarbonate are commonly used in windshields, windows, and sunroofs, offering durability, thermal insulation, and improved visibility. The shift towards electric and autonomous vehicles has boosted the need for lightweight, high-performance glazing solutions that improve energy efficiency and sensor integration. Asia-Pacific dominates the market, supported by expanding automotive production and technological advancements. Environmental concerns and regulations are driving the development of recyclable and energy-efficient materials, shaping the market landscape. Innovation and sustainability are key factors shaping the evolution of the automotive glazing industry.

Automotive Glazing Market Value Chain Analysis

The automotive glazing market value chain is made up of interconnected stages that facilitate the seamless production and distribution of glazing products. It begins with raw material suppliers who provide essential inputs like silica, soda ash, and advanced polymers for glass and polycarbonate manufacturing. Glass manufacturers transform these materials into tempered, laminated, or specialty glazing through processes such as cutting, shaping, and coating. Component suppliers integrate features such as UV protection, defrosting, and sound insulation. Automotive OEMs (original equipment manufacturers) install these glazing products in vehicles during assembly. Distributors and retailers ensure product availability across global markets. The value chain is shaped by innovations in material technology, sustainability initiatives, and regulatory standards. Collaboration among stakeholders enhances cost-efficiency, quality, and the development of advanced glazing solutions for modern vehicles.

Automotive Glazing Market Opportunity Analysis

The automotive glazing market offers significant opportunities driven by trends in electric vehicles (EVs), autonomous driving, and consumer demand for enhanced aesthetics and functionality. Lightweight materials like polycarbonate are becoming more popular, supporting fuel efficiency and reducing carbon emissions. Innovations in smart glazing technologies, such as switchable glass and solar control, provide avenues for added value. Emerging markets in Asia-Pacific and Latin America present growth potential due to rising vehicle production and urbanization. The push for sustainability is driving the development of recyclable and energy-efficient materials. Advanced driver assistance systems (ADAS) also require high-performance glazing for optimal sensor integration, opening up new opportunities for manufacturers. Strategic investments in R&D and collaborations can enable businesses to seize these opportunities and effectively address evolving industry needs.

The growing adoption of polycarbonate glazing is significantly shaping the automotive glazing market, primarily due to its lighter weight compared to traditional glass. Lightweight materials are essential for improving fuel efficiency and reducing emissions, aligning with stringent environmental regulations and the global shift toward sustainable transportation. Polycarbonate also offers enhanced impact resistance, design flexibility, and thermal insulation, making it an attractive choice for modern vehicle applications such as sunroofs, side windows, and rear windshields. Its compatibility with advanced technologies like integrated sensors and smart glazing further supports its demand, particularly in electric and autonomous vehicles. As automakers focus on lightweight and high-performance materials to enhance vehicle efficiency and functionality, polycarbonate glazing is becoming a key driver of growth in the automotive glazing market.

The high production costs associated with advanced materials like polycarbonate and smart glazing technologies make these options less accessible for budget vehicles. Additionally, stringent regulatory standards for safety and environmental compliance require manufacturers to invest heavily in testing and certification, which extends development timelines and increases costs. While polycarbonate glazing offers advantages, such as lighter weight, it faces challenges like lower scratch resistance compared to glass, necessitating additional coatings that raise costs. The push for sustainability also requires innovations in recyclable and eco-friendly materials, which demand significant R&D investment. Furthermore, fluctuating raw material prices and supply chain disruptions pose risks to stable production. Addressing these challenges is essential for the market to maintain growth and meet evolving consumer and regulatory expectations.

Insights by Application

The windscreen segment accounted for the largest market share over the forecast period 2023 to 2033. Windscreens play a crucial role in visibility and structural integrity, benefiting from innovations such as laminated glass, which offers improved impact resistance and UV protection. The integration of advanced driver assistance systems (ADAS), which require high-quality glazing for sensors and cameras, is boosting demand. In electric and autonomous vehicles, windscreens equipped with features like solar control, heads-up displays, and acoustic insulation are becoming increasingly popular. Stringent safety regulations worldwide drive the need for durable and energy-efficient materials, prompting manufacturers to innovate. As consumers prioritize premium and functional features, the windscreen segment is expanding, contributing to overall advancements in the automotive glazing market.

Insights by End Use

The passenger vehicles segment accounted for the largest market share over the forecast period 2023 to 2033. This segment benefits from innovations in glazing materials like laminated and tempered glass, which improve safety, aesthetics, and energy efficiency. The growing adoption of electric and hybrid vehicles has increased the demand for lightweight glazing solutions, such as polycarbonate, to enhance vehicle efficiency and reduce emissions. Premium features like panoramic sunroofs, acoustic insulation, and UV-protected windows are becoming more popular, further driving the segment’s growth. Additionally, stringent safety and environmental regulations necessitate the use of advanced glazing technologies to meet compliance standards. As automakers focus on passenger comfort and sustainability, the passenger vehicles segment continues to be a key driver of market growth.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Automotive Glazing Market from 2023 to 2033. The well-established automotive industry in the region, coupled with significant R&D investments, fosters the development of innovative glazing solutions, including lightweight polycarbonate and smart glazing technologies. Stringent safety and environmental regulations promote the use of advanced materials that offer improved durability, energy efficiency, and recyclability. The increasing popularity of large panoramic sunroofs and advanced visibility features further boosts demand for high-performance glazing. The United States leads the regional market, driven by a strong automotive manufacturing base and consumer demand for premium vehicles. As electric vehicles gain traction, North America continues to be a key market for lightweight and advanced automotive glazing solutions.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region, which includes countries like China, Japan, South Korea, and India, serves as a global automotive manufacturing hub with substantial investments and technological advancements. The increasing demand for electric vehicles (EVs) and autonomous driving technologies drives the adoption of lightweight and high-performance glazing materials like polycarbonate and smart glass. Stringent safety regulations and environmental policies encourage the use of durable, energy-efficient, and recyclable glazing solutions. Additionally, rising consumer demand for premium features such as panoramic sunroofs and noise-reducing windows boosts market growth. With its vast market potential and emphasis on innovation, Asia-Pacific continues to play a crucial role in shaping the future of automotive glazing technologies.

Recent Market Developments

- In June 2024, Guardian Glass, a prominent player in the glass industry, and Webasto Luxembourg (part of the Webasto Group), a manufacturer of sunroofs, batteries, heating, and cooling solutions, have entered into an agreement where Guardian Glass will provide its innovative coated glass solution, including the Guardian SilverGuard family, for Webasto’s panoramic sunroofs.

Major players in the market

- Central Glass Co., Ltd.

- Corning Incorporated

- Fuyao Group

- KRD Sicherheitstechnik GmbH

- Mitsubishi Electric Corporation

- Pilkington (Nippon Sheet Glass Co., Ltd.)

- SABIC

- Saint-Gobain Sekurit

- SCHOTT

- Trinseo

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Glazing Market, Application Analysis

- Windscreen

- Sidelite

- Backlite

- Others

Automotive Glazing Market, End Use Analysis

- Passenger Vehicles

- LCV

- HCV

Automotive Glazing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?