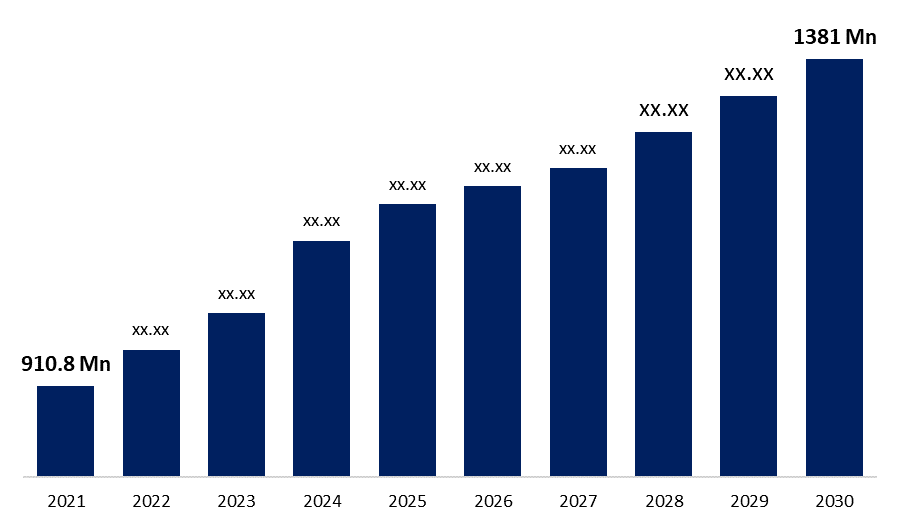

Global Automotive Wheels Aftermarket Market Size to reach USD 1381 Mn by 2030 | CAGR 5.77 %

Category: Automotive & TransportationThe Global Automotive Wheels Aftermarket Market Size was valued at USD 910.8 Million in 2021, the market is projected to grow USD 1381 Million in 2030, at a CAGR of 5.77 %. as per the latest research report by Spherical Insights & Consulting.

The main driving factor for the automotive wheel’s aftermarket market is rising vehicle dynamics and increased demand. The COVID-19 pandemic has become a major source of concern for automakers. The automotive industry has come to a halt due to the suspension of vehicle production and supply disruptions. Lower vehicle sales following the pandemic will be a major concern for automakers in the coming quarters. The automotive wheels aftermarket, on the other hand, is expected to grow significantly in 2022 due to an increase in the adoption of new wheel replacement by enthusiasts for luxury vehicles. Prior to that, lower vehicle sales and slow technological development for automotive wheels will result in sluggish growth of the automotive wheels aftermarket in 2021.

Get more details on this report -

Browse key industry insights spread across 196 pages with 138 market data tables and figures & charts from the report “Global Automotive Wheels Aftermarket Market Size, Share & Trends, Covid-19 Impact Analysis Report, By Vehicle Type (Passenger Cars, And Commercial Vehicles), By Aftermarket Type (New Wheel Replacement, And Refurbished Wheel Fitment), By Material Type (Alloy, Steel, And Others), By Product Type (Regular Wheels, And High-Performance Wheels), By Rim Size (13”–15” Inch, 16”–18” Inch, 19”–21” Inch, And Above 21” Inch), And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, And Africa), Analysis And Forecast 2021 – 2030”

Major automotive wheel manufacturers such as RONAL Group, Borbet Gmbh, Enkei Corporation, and Superior Industries suspended wheel sales/distribution/production due to decreased demand, supply chain bottlenecks, and to protect the safety of their employees in France, Germany, Italy, and Spain during the COVID-19 pandemic. Manufacturers are likely to adjust production/sales to avoid bottlenecks and plan production based on OEM and tier 1 demand.

These industries place a higher priority on meeting high safety standards, improving operational efficiency and productivity, and sustaining long-term development. The competitors are concentrating their efforts on capturing the market's top position. They are constantly looking for ways to improve their competitive advantage. Companies are identifying various strategic pillars, such as mergers and acquisitions, new product releases, product enhancement, and others, in order to achieve high market share and establish socially responsible businesses.

Engine downsizing is a new automotive industry trend that helps improve efficiency, mileage, and space utilization. Despite several downsizing efforts, the weight of the car has increased in recent decades due to the increased adoption of electronic components in the form of ECUs relating to safety and comfort features. Wheel manufacturers have been attempting to reduce wheel weight because heavier wheels slow vehicle speed. Lightweight wheels also provide more torque to propel the vehicle. Furthermore, because turning a wheel requires torque, lighter wheels provide better vehicle control.

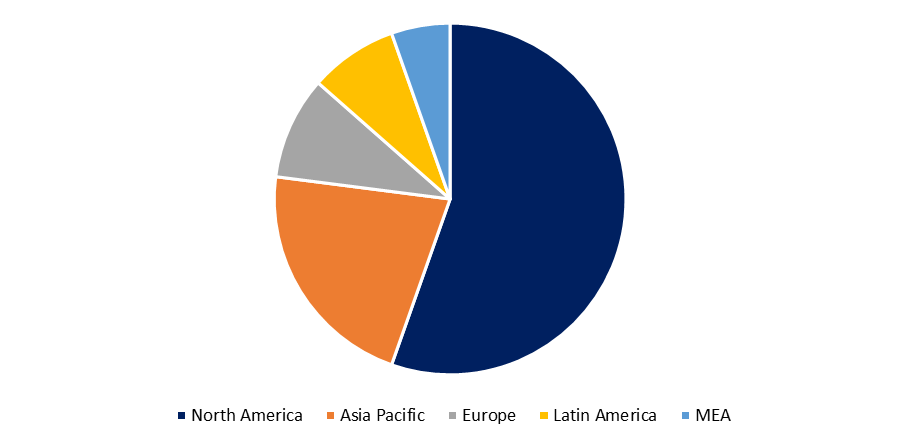

The global Automotive Wheels Aftermarket Market is segmented by Vehicle Type (Passenger Cars, and Commercial Vehicles), Aftermarket Type (New Wheel Replacement, and Refurbished Wheel Fitment), Material Type (Alloy, Steel, and Others), Product Type (Regular Wheels, and High-Performance Wheels), Rim Size (13”–15” inch, 16”–18” inch, 19”–21” inch, and Above 21” inch), and Region (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa).

This automotive wheel’s aftermarket market report contains information on new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, and product launches.

Get more details on this report -

The recent rising trend of aluminum vehicles in low commercial vehicles is expected to create significant market growth opportunities. Aluminum wheels, which are commonly used in light-duty vehicles, are widely used in developed countries. Because the major aftermarket part manufacturers and suppliers are located in these countries, the United States, Germany, and Japan are the largest production and consumption hubs for aluminum and carbon fiber wheels. These factors are expected to increase consumer demand while also causing a shift in R&D activities. Furthermore, as a result of the government-mandated mileage goals, automakers are using more carbon-based and aluminum wheels. Furthermore, the new material requires much less energy to produce and results in a more precisely formed wheel with better-defined and sharper body lines, making part replacement easier. However, alloy wheels have the largest market share due to properties such as durability, corrosion resistance, density, high tensile strength, malleability, and ductility. Furthermore, as hybrid electric vehicle models proliferate, the demand for unique wheels incorporated into these vehicles has skyrocketed.

Maxion Wheels, for example, announced in November-2021 that it would use Digital Twin technology to create a virtual duplicate of its light vehicle aluminium wheel production plant in Limeira, Brazil. Maxion Wheels can use the technology to predict and plan how the plant will operate under various conditions in order to improve efficiency. It intends to eventually roll out the technology to its other plants around the world. Ronal Group signed a Memorandum of Understanding (MoU) with Eccomelt, which manufactures secondary aluminium from post-consumer wheels, in February 2022. The Ronal Group secured a preferential supply of Eccomelt's post-consumer material, which has an extremely low carbon footprint, by signing this MoU.

Borbet will launch a rim for light commercial vehicles and caravans in September 2021. The Borbet CWZ is a 5-spoke design that is suitable for vehicles with wheel loads of up to 1,250 kilogrammes, such as the VW Crafter, Amarok, T5 and T6, Mercedes V-Class, and the new EQV all-electric people carrier, as well as the Citroen Jumper, Fiat Ducato, Peugeot Boxer, and MAN TGE. The agreement's purpose is to establish a private limited company (Joint Venture Company) whose primary objectives are to manufacture, import/export, process primary and/or secondary metal, recycle metal scrap, and sell aluminium alloys in molten and ingot forms.

A company's revenue can be increased through a variety of strategies. These include increasing innovation, developing and maintaining customer loyalty, hiring a talented and dedicated workforce, acquiring other businesses, deploying effective advertising, and pricing products and services efficiently. The recent rising trend of aluminum vehicles in low commercial vehicles is expected to create significant market growth opportunities. Aluminum wheels, which are commonly used in light-duty vehicles, are widely used in developed countries. Because the major aftermarket part manufacturers and suppliers are located in these countries, the United States, Germany, and Japan are the largest production and consumption hubs for aluminum and carbon fiber wheels. These factors are expected to increase consumer demand while also causing a shift in R&D activities.

AUTOMOTIVE WHEELS AFTERMARKET MARKET: RECENT DEVELOPMENT

- November 2021- Maxion Wheels announced the use of Digital Twin technology to create a virtual duplicate of its Limeira, Brazil, light vehicle aluminum wheel production plant. Maxion Wheels can use the technology to predict and plan how the plant will operate under various conditions in order to improve efficiency. It intends to eventually roll out the technology to its other plants around the world.

- February 2022- Ronal Group has signed a Memorandum of Understanding (MoU) with Eccomelt, a company that manufactures secondary aluminum from used tires. The Ronal Group secured a preferential supply of Eccomelt's post-consumer material, which has an extremely low carbon footprint, by signing this MoU.

AUTOMOTIVE WHEELS AFTERMARKET MARKET: REPORT OVERVIEW

The scope of the report includes a detailed study of regional markets for Global Automotive Wheels Aftermarket Market. The Global Automotive Wheels Aftermarket Market is segmented by Vehicle Type, Aftermarket Type, Material Type, Product Type, Rim Size, and Region. It reveals the market situation and future forecast. The study also covers the significant data presented with the help of graphs and tables. The report covers information regarding the competitive outlook including the market share and company profiles of the key participants operating in the Global Automotive Wheels Aftermarket Market.

SEGMENTATION

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Aftermarket Type

- New Wheel Replacement

- Refurbished Wheel Fitment

By Material Type

- Alloy

- Steel

- Others

By Product Type

- Regular Wheels

- High-Performance Wheels

By Rim Size

- 13”–15” inch

- 16”–18” inch

- 19”–21” inch

- Above 21” inch

By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Related Report.

Global Embedded In-Vehicle Infotainment Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Vehicle Type (Passenger Car, LCV, and HCV), By Component (Control Panel, Heads-Up Display, Integrated Head-Unit, and High-end DSPs and GPUs), By Operating System (Android, QNX, Linux, and Windows), By Application (Entertainment Services, E-Call Services, Navigation Services, and Vehicle Diagnostics Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2030

https://www.sphericalinsights.com/reports/embedded-in-vehicle-infotainment-market

Global Alternative Fuel Vehicles Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Medium & Heavy-duty Commercial Vehicles), By Fuel Type (BEV, HEV, PHEV, FCV, CNG, Biofuels, Other Gaseous Fuels), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2030

https://www.sphericalinsights.com/reports/alternative-fuel-vehicles-market

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?