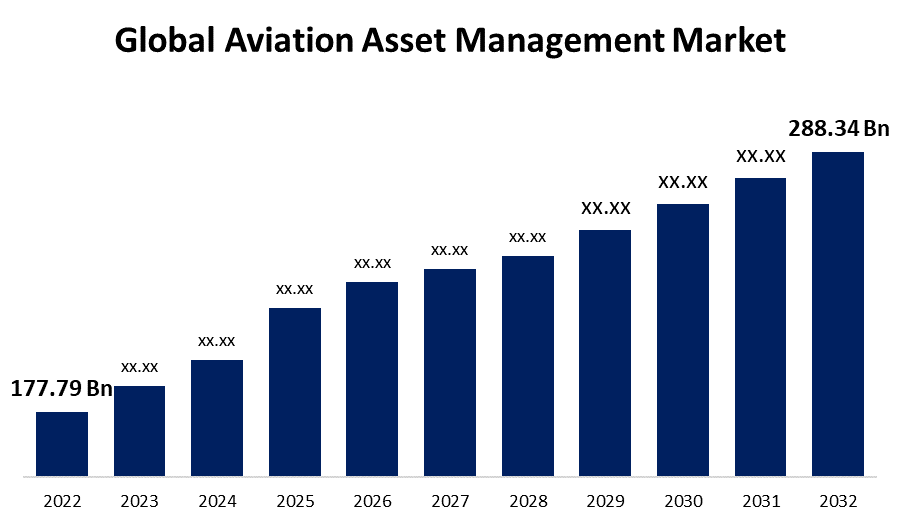

Global Aviation Asset Management Market Size To worth USD 288.34 Billion by 2032 | CAGR of 4.9%

Category: Aerospace & DefenseGlobal Aviation Asset Management Market worth USD 288.34 Billion by 2032

According to a research report published by Spherical Insights & Consulting, the Global Aviation Asset Management Market Size is to grow from USD 177.79 Billion in 2022 to USD 288.34 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 4.9% during the projected period. As the aviation industry evolves and expands, the Global Aviation Asset Management Market is expected to grow significantly in the coming years. Demand for efficient asset management solutions, combined with technological advancements, will drive market growth and create new opportunities for asset management companies.

Get more details on this report -

Browse key industry insights spread across 200 pages with 105 Market data tables and figures & charts from the report on "Global Aviation Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Type (Direct Purchase, Operating Lease, Finance Lease, Sale Lease Back), By Service Type (Leasing Services, Technical Services, Regulatory Certifications), By End Use (Commercial Platforms, MRO Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032" Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/aviation-asset-management-market

The Global Aviation Asset Management Market is a rapidly expanding industry focused on improving the utilization, maintenance, and value of aviation assets. It includes a wide range of services and solutions, such as aircraft leasing, fleet management, remarketing, and technical consulting. Aviation asset management assists airlines and aircraft lessors in maximizing their returns on investment by ensuring optimal fleet utilization, lowering operational costs, and increasing overall efficiency. Strategic planning, data analytics, and technical expertise are required to make sound decisions about fleet composition, maintenance schedules, and fleet expansion or contraction. The expansion of the aviation industry in emerging economies creates numerous opportunities for aviation asset management. There is a growing demand for aircraft leasing, fleet management, and technical advisory services as these markets develop. Airport expansion, the rise of low-cost carriers, and the liberalization of air transport policies in these regions all contribute to the growing demand for efficient asset management solutions. However, effective aviation asset management solutions necessitate significant upfront investments. Acquiring and implementing advanced technologies like IoT sensors, data analytics systems, and AI platforms can be expensive. This initial investment may act as a barrier to entry or hinder the ability of smaller airlines or lessors with limited financial resources to adopt comprehensive asset management practices.

The operating lease segment is expected to grow at the fastest CAGR in the global aviation asset management market during the forecast period.

Direct purchase, operating lease, finance lease, and sale lease back are the four types of global aviation asset management market. The operating lease segment in the global aviation asset management market is expected to grow at the fastest CAGR during the forecast period. Operating leases provide flexibility, cost-efficiency, and risk mitigation for airlines and lessors, making them a popular choice in the aviation industry.

The leasing services segment is expected to hold the largest share of the global aviation asset management market during the forecast period.

The global aviation asset management market is segmented into leasing services, technical services, and regulatory certifications. The leasing services segment is expected to account for the majority of the global aviation asset management market during the forecast period. The advantages it provides in terms of cost efficiency, fleet flexibility, and risk mitigation drive this segment's dominance.

The MRO services segment is expected to hold the largest share of the global aviation asset management market during the forecast period.

The global aviation asset management market is divided into commercial platforms and MRO services based on end use. The MRO (Maintenance, Repair, and Overhaul) services segment is projected to account for the majority of the global aviation asset management market during the forecast period. The reason for the increase is that maintenance is an important aspect of aviation asset management, and the maintenance needs of a large fleet of aircraft around the world drive demand for MRO services.

Asia Pacific is anticipated to hold the largest share of the global aviation asset management market over the predicted timeframe.

Get more details on this report -

The region's growing middle-class population, economic growth, and rising air travel demand are driving the demand for effective asset management solutions. The aviation sectors in China, India, and Southeast Asia are expanding rapidly, resulting in increased demand for leasing services, MRO activities, and asset management expertise.

North America is expected to expand at the fastest rate in the global aviation asset management market over the next few years. Major aircraft lessors, leasing companies, and MRO service providers are based in the region. The presence of established aviation hubs, such as the United States and Canada, helps to drive market growth.

The Middle East and Africa region have emerged as key players in the aviation industry, with prominent airlines and leasing companies based there. The Middle East is well-known for its major airlines and aircraft lessors. The region's strategic location as a global air traffic hub, as well as significant investments in aviation infrastructure, drive demand for asset management services.

Major vendors in the Global Aviation Asset Management Market include GA Telesis, LLC, BBAM Aircraft Leasing & Management, Aviation Asset Management Inc, Airbus Group, Charles Taylor Aviation (Asset Management) Ltd., Skyworks Capital, LLC., AerCap Holdings N.V, AerData, Acumen, GE Capital Aviation Services, and Others.

Recent Developments

- In February 2022, AirAsia signed a partnership agreement with Avolon, an aircraft leasing company based in Ireland, to lease a minimum of 100 VX4 eVTOL aircraft. This agreement is expected to assist the former in revolutionising air travel by providing passengers with advanced air mobility, allowing the airline to stay ahead of the competition.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Aviation Asset Management Market based on the below-mentioned segments:

Global Aviation Asset Management Market, By Type

- Direct Purchase

- Operating Lease

- Finance Lease

- Sale Lease Back

Global Aviation Asset Management Market, By Service Type

- Leasing Services

- Technical Services

- Regulatory Certifications

Global Aviation Asset Management Market, By End Use

- Commercial Platforms

- MRO Services

Global Aviation Asset Management Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?