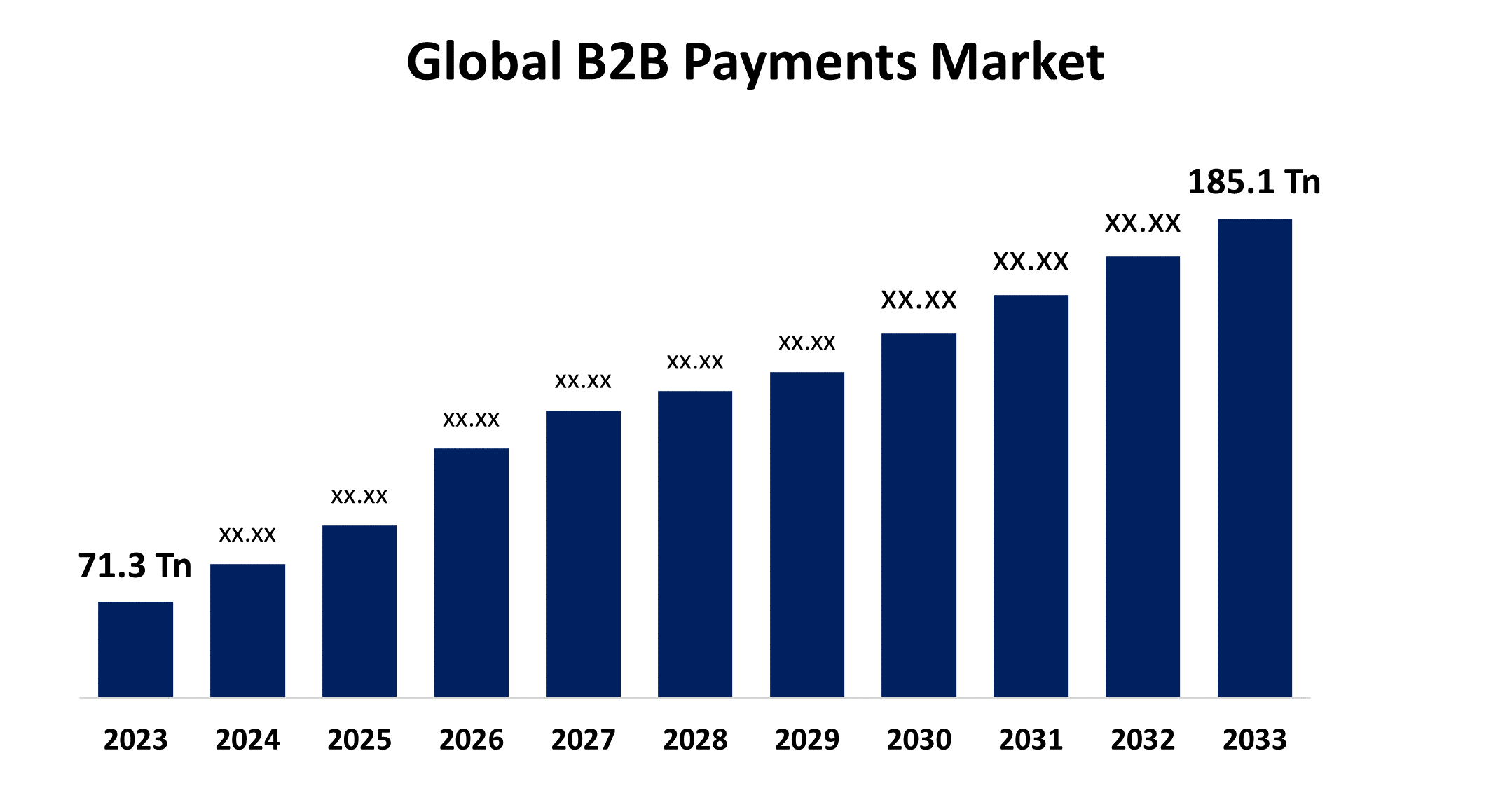

Global B2B Payments Market Size To Worth USD 185.1 Trillion By 2033 | CAGR OF 10.01%

Category: Banking & FinancialGlobal B2B Payments Market Size To Worth USD 185.1 Trillion By 2033

According to a research report published by Spherical Insights & Consulting, the Global B2B Payments Market Size is to grow from USD 71.3 Trillion in 2023 to USD 185.1 Trillion by 2033, at a Compound Annual Growth Rate (CAGR) of 10.01% during the projected period.

Get more details on this report -

Browse key industry insights spread across 187 pages with 110 Market data tables and figures & charts from the report on the "Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/b2b-payments-market

The B2B payments market is credited to the system of financial transactions and payment solutions particularly designed for business-to-business (B2B) transactions. Business-to-business (B2B) payments are the communication of goods and services offered for a precise value in currency. Business-to-business (B2B) payment encourages safer transactions for traders requiring recurring, periodic transactions and provides a variety of tasks to end users, including accounts receivable, accounts payable, payroll, and acquisition departments. Moreover, the implementation of electronic B2B payment solutions is being boosted by the constant digital transformation happening across many businesses. Administrations are changing from orthodox paper-based procedures to electronic payment systems to enhance workflow, boost productivity, and cut expenditures. Moreover, to modernize their financial operations, industries are looking for further economical and effective payment selections. However, B2B payments are striking targets for fraudsters and hackers owing to their high regulatory amounts and number of transactions. Payment scams, identity theft, and data breaches are instances of security flaws in payment structures that can challenge corporate confidence and foil the adoption of digital payment solutions. Moreover, adherence to several regulatory orders, such as data privacy laws, anti-money laundering (AML) rules, and payment card industry standards (PCI DSS), contributes to the complexity and expenses of business-to-business payment procedures

The cross-border segment is anticipated to grow at the fastest CAGR in the global B2B payments market during the projected timeframe.

Based on the payment type, the global B2B payments market is divided into domestic payments and cross-border payments. Among these, the cross-border segment is anticipated to grow at the fastest CAGR in the global B2B payments market during the projected timeframe. This can be attributed to increasing worldwide trade and growing cross-border transactions including several buyers, suppliers, wholesalers, retailers, and enterprises, which are the crucial drivers pouring into the global market.

The bank transfer segment is anticipated to hold the largest share of the global B2B payments market during the projected timeframe.

Based on the payment method, the global B2B payments market is divided into bank transfer, card, and online payments. Among these, the bank transfer segment is anticipated to hold the largest share of the global B2B payments market during the projected timeframe. This is attributed to various businesses still paying with bank transfers for fast-moving modern business workflows, which further involves a transaction fee for both sender and receiver.

The IT and ITES segment is predicted to hold the largest share of the B2B payments market during the estimated period.

Based on the verticle type, the global B2B payments market is divided into BFSI, IT and ITES, retail and e-commerce, travel and hospitality, healthcare, media and entertainment, transportation and logistics, and others. Among these, the IT and ITES segment is predicted to hold the largest share of the B2B payments market during the estimated period. This is credited to the IT and ITES sector has been a driving force in the development of the B2B digital payment market.

North America is expected to hold the largest share of the global B2B payments market over the forecast period.

Get more details on this report -

North America is expected to hold the largest share of the global B2B payments market over the forecast period. The reason behind this is the growing investments in the expansion of reliable and efficient payment solutions to achieve the cash flow and keep relationships with the material suppliers present across the U.S. and Canada lift the market development. Furthermore, the presence of large-sized B2B type of payment solution providers in countries, such as the U.S. and Canada.

Asia Pacific is predicted to grow at the fastest pace in the global B2B payments market during the projected timeframe. This is attributed to numerous enterprises from China, Japan, and India specifying in financial technology that have offered advanced payment technologies to industries. For instance, in April 2020, Harbour and Hills, a significant B2B cross-border payment provider in China, developed an 828 payments gateway that expands the corporate sector's commercial payment transaction process, pouring market growth in this area. In addition, cheques, bank transfers, demand draughts, and third-party gateways are protruding traditional commercial payment methods widely accepted by Asia-Pacific enterprises.

Major vendors in the Global B2B Payments Market include PayPal Holdings, Inc., Stripe, Inc., Square, Inc., Adyen NV, TransferWise Ltd. (now known as Wise), Bill.com Holdings, Inc., Payoneer Inc., Worldpay, Inc., Fiserv, Inc., Visa Inc., JPMorgan & Chase, American Express, Paystand Inc., Mastercard, and others.

Recent Developments

- In March 2023, Mastercard combined with Bahrain-based fintech company Infinios Financial Services to hasten the digitization of B2B portable payments in the Middle East and North Africa (MENA) region.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global B2B Payments Market based on the below-mentioned segments:

Global B2B Payments Market, By Payment Type

- Domestic Payments

- Cross-Border Payments

Global B2B Payments Market, By Payment Method

- Bank Transfer

- Card

- Online Payments

Global B2B Payments Market, By Verticle Type

- BFSI

- IT and ITES

- Retail and E-commerce

- Travel and Hospitality

- Healthcare

- Media and Entertainment

- Transportation and Logistics

- Others

Global B2B Payments Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?