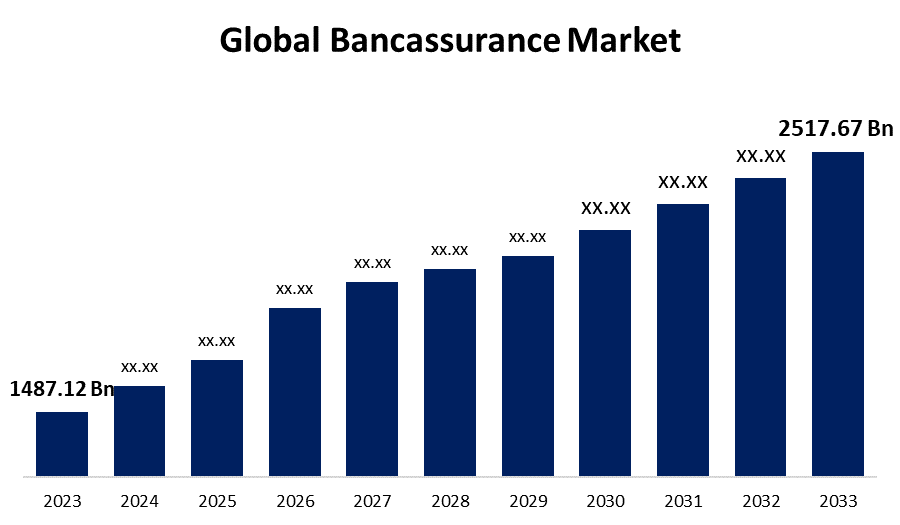

Global Bancassurance Market Size To Worth USD 2517.67 Billion By 2033 | CAGR of 5.41%

Category: Banking & FinancialGlobal Bancassurance Market Size To Worth USD 2517.67 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Bancassurance Market Size is to Grow from USD 1487.12 Billion in 2023 to USD 2517.67 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.41% during the projected period.

Get more details on this report -

Browse key industry insights spread across 219 pages with 110 Market data tables and figures & charts from the report on the "Global Bancassurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Life Insurance and Non-Life Insurance), By Model Type (Pure Distributor, Exclusive Partnership, Financial Holding, and Joint Venture), By Distribution Channel (Traditional Banks, Digital Platforms, and Insurtech Startups), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/bancassurance-market

The term "bancassurance" describes an agreement that enables an insurance company to market its goods and services to customers of banks. A deal like this benefits banks and insurance companies alike. Banks can offer a variety of insurance products due to this arrangement, including mortgages, annuities, and health, life, and health insurance. By doing this, they expand their market reach, boost equity returns, and enhance their whole financial portfolio. Banks that offer insurance policies might ultimately see a rise in earnings and increased revenue. Nevertheless, insurance companies can grow their clientele without investing in more staff or commissions for brokers and agents. The customers bought coverage based on the financial advice given and due to they were committed to their banks. Furthermore, with growing economies come growing numbers of individuals in need of financial services like insurance. Economic growth frequently results in higher income levels, opening up the market to a larger spectrum of consumers for insurance products. Furthermore, the rapid evolution of digital technologies has a substantial impact on the bancassurance sector as well. Advances in data analytics, artificial intelligence, and machine learning have made it possible for banks and insurance companies to offer more specialized and effective products. However, for bank employees, cross-selling insurance products and services alongside bank products might be difficult. These thus represent the main obstacles preventing bancassurance from achieving market share.

The life insurance segment is anticipated to hold the greatest share of the global bancassurance market during the projected timeframe.

Based on the type, the global bancassurance market is divided into life insurance and non-life insurance. Among these, the life insurance segment is anticipated to hold the greatest share of the global bancassurance market during the projected timeframe. The increasing recognition of the importance of financial security and life planning is a major contributing element. Customers, who are becoming more financially literate, recognize the value of life insurance policies in protecting their families' futures, especially in the instance of unforeseen circumstances like disability or death. Banks' existing clientele puts them in a strong position to introduce these necessary products. Furthermore, owing to the increase in dual-income households and higher levels of discretionary spending, a greater proportion of the population might now buy life insurance.

The pure distributor segment is expected to grow at the fastest CAGR in the global bancassurance market during the projected timeframe.

Based on the model type, the global bancassurance market is divided into pure distributor, exclusive partnership, financial holding, and joint venture. Among these, the pure distributor segment is expected to grow at the fastest CAGR in the global bancassurance market during the projected timeframe. Due in large part to its cost-effectiveness, this strategy appeals to both larger banks and smaller, regional institutions. Banks don't need to make large additional investments due to their might engage in their current infrastructure, clientele, and routes of communication. The bank only functions as a distributor of insurance products, not engaging in any underwriting risk. That being said, the cheap operating cost is one of the main driving forces behind this strategy.

The traditional banks segment is projected for the largest revenue share in the global bancassurance market during the estimated period.

Based on the distribution channel, the global bancassurance market is divided into traditional banks, digital platforms, and insurtech startups. Among these, the traditional banks segment is projected for the largest revenue share in the global bancassurance market during the estimated period. Traditional banks have successfully incorporated insurance products into their service portfolios due to they are well-known and experienced participants in the financial industry. Due to their extensive branch network and customer base, traditional banks have managed to capture a significant share of the bancassurance market.

Asia Pacific is expected to hold the largest share of the global bancassurance market over the forecast period.

Get more details on this report -

Asia Pacific is expected to hold the largest share of the global bancassurance market over the forecast period. Due to several economic factors. The growing middle class, with greater disposable income and financial literacy, is a big factor. A greater variety of financial goods, including insurance, are being used by this population more and more. Another characteristic that sets the area apart is the relative rarity of insurance services, which creates a significant untapped market for bancassurance services.Middle East & Africa are predicted to grow at the fastest pace in the global bancassurance market during the projected timeframe. In the past few years, bancassurance has expanded dramatically, even though it is still relatively new in this region compared to other regions of the world. Increasing awareness of insurance products and their benefits, a growing middle class, and increased disposable incomes are some of the causes propelling this expansion. Additionally, strategic partnerships between banks and insurance companies have fueled bancassurance's expansion of its product offerings by facilitating convenient client access to insurance through bank channels.

Major vendors in the Global Bancassurance Market include AXA, Allianz, ING Group, BNP Paribas Cardif, Aviva, Prudential plc, MetLife, Zurich Insurance Group, Assicurazioni Generali S.p.A., Ping An Insurance, China Life Insurance Company, HSBC Insurance, and Others.

Recent Developments

- In June 2023, The ING Group and Admiral Seguros announced an advanced digital bancassurance collaboration. The partnership results from ING's commitment to efficiently serving its customers' needs and Admiral Group's aim to provide premium insurance products to support the growth of its distribution network.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Bancassurance Market based on the below-mentioned segments:

Global Bancassurance Market, By Type

- Life Insurance

- Non-Life Insurance

Global Bancassurance Market, By Model Type

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Global Bancassurance Market, By Distribution Channel

- Traditional Banks

- Digital Platforms

- Insurtech Startups

Global Bancassurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?