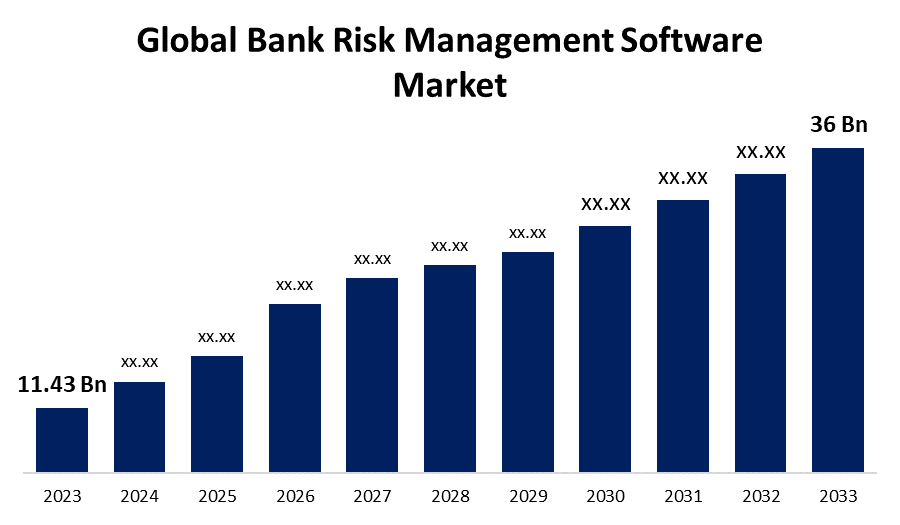

Global Bank Risk Management Software Market Size To Worth USD 36 Billion by 2033 | CAGR Of 12.16%

Category: Banking & FinancialGlobal Bank Risk Management Software Market Size To Worth USD 36 Billion by 2033

According to a research report published by Spherical Insights & Consulting, the Global Bank Risk Management Software Market Size is to Grow from 11.43 Billion in 2023 to USD 36 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 12.16% during the projected period.

Get more details on this report -

Browse key industry insights spread across 230 pages with 140 Market data tables and figures & charts from the report on the "Global Bank Risk Management Software Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Financial, Operational, Credit, Enterprise, Market, and Compliance), By Industry (Banking, Financial Services, and Insurance (BFSI), Healthcare, IT and Telecom, Government and Defense, Energy and Utilities, Manufacturing, and Retail), By Deployment Mode (On-Premises, and Cloud Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/bank-risk-management-software-market

The bank risk management software is used to help financial institutions identify, assess, and mitigate the risks they face, such as credit, market, operational, and compliance risks. It is essential for banks to maintain financial stability and regulatory compliance, and this software makes it easier. Financial firms get benefits like improved decision-making capabilities, easier compliance with regulatory standards, and mitigation of financial losses through accurate risk management and deeper insights. Factors like stringent regulatory requirements, rising number of cyber threats, technological advancements, and digitalization in the banking sector drive the market growth. However, factors such as high implementation costs, technical complexities, and data privacy concerns might hinder the global bank risk management software market growth.

The credit segment is anticipated to hold the greatest share of the bank risk management software market during the projected timeframe.

Based on the product type, the global bank risk management software market is divided into financial, operational, credit, enterprise, market, and compliance. Among these, the credit segment is anticipated to hold the greatest share of the bank risk management software market during the projected timeframe. This is because of the need for banks to manage credit risk effectively. The risk management software enables banks to evaluate the creditworthiness of borrowers, set appropriate credit limits, and monitor exposures in real time, minimizing potential losses.

The banking, financial services, and insurance (BFSI) segment is anticipated to hold the greatest share of the bank risk management software market during the projected timeframe.

Based on, the global bank risk management software market is divided into banking, financial services, and insurance (BFSI), healthcare, IT and telecom, government and defense, energy and utilities, manufacturing, and retail. Among these, the banking, financial services, and insurance (BFSI) segment is anticipated to hold the greatest share of the bank risk management software market during the projected timeframe. This is because the BFSI sector faces several risks, including credit, market, operational, and compliance-related challenges, which makes risk management a critical operational component.

The cloud-based segment is anticipated to grow at the fastest pace in the bank risk management software market during the projected timeframe.

Based on the deployment mode, the global bank risk management software market is divided into on-premises and cloud-based. Among these, the cloud-based segment is anticipated to grow at the fastest pace in the bank risk management software market during the projected timeframe. The cloud-based deployment of risk management software offers various benefits like scalability, flexibility, uninterrupted data transfer, cost-effectiveness, and seamless connection with other apps and tools, boosting the growth of the segment.

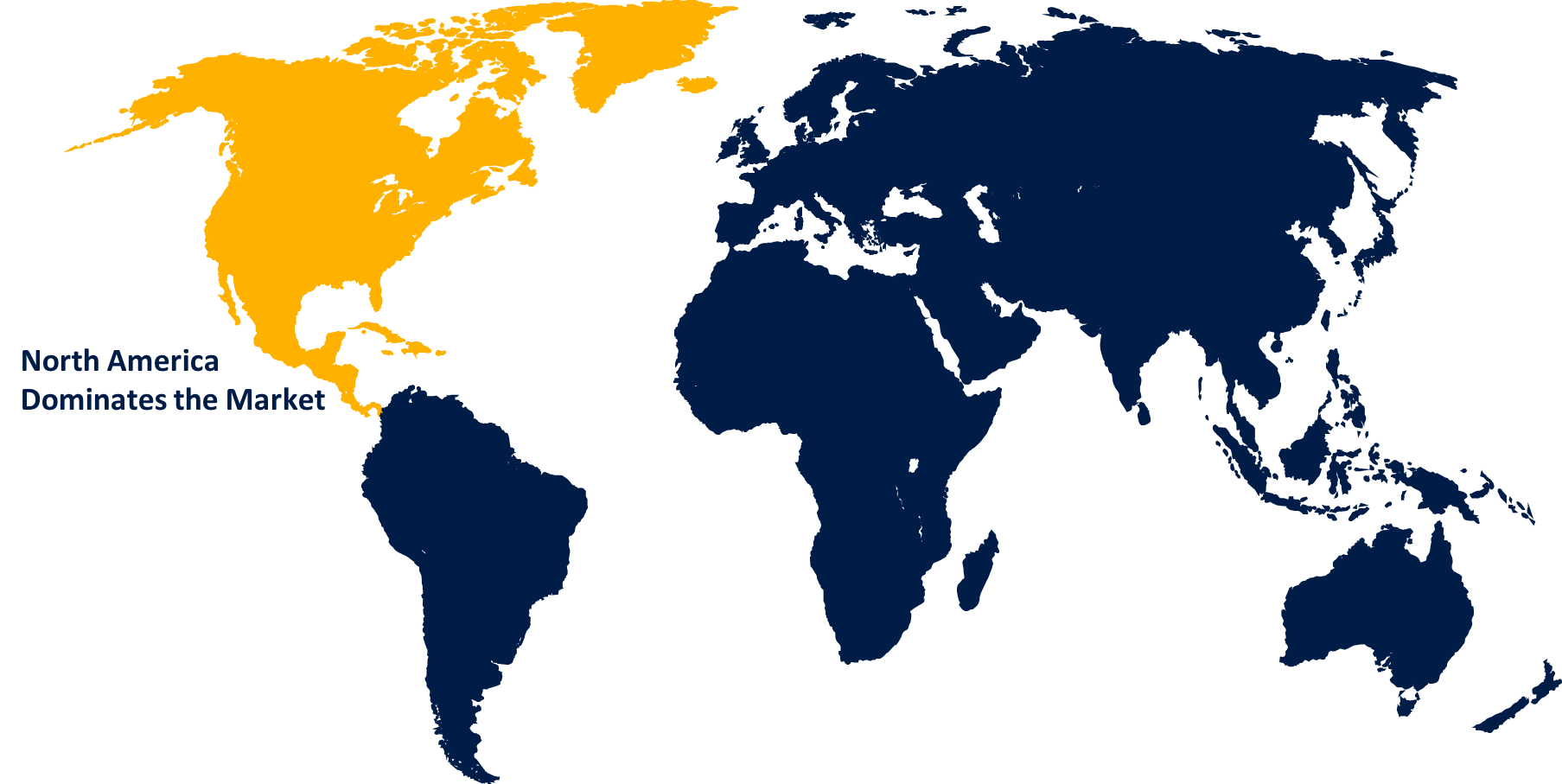

North America is anticipated to hold the largest share of the bank risk management software market over the forecast period.

Get more details on this report -

North America is anticipated to hold the largest share of the bank risk management software market over the predicted timeframe. The North American region’s market is driven by a well-established financial sector that includes leading banks that require advanced risk management solutions. The strict regulatory frameworks generate the requirement for robust compliance and risk management systems. The region is also a hub of technological innovation, resulting in the early adoption of advanced risk management technologies.

Asia Pacific is expected to grow at the fastest pace in the bank risk management software market during the forecast period. This is because developing nations like India, China, Japan, and Indonesia have been boosting financial inclusivity and digitization. The region’s growth is also because of the exponential economic growth and growing fintech industry.

Major vendors in the Global Bank Risk Management Software Market include Abrigo, Active Risk, Oracle, Ernst & Young Global Limited (EY), Kyriba, Experian, LogicGate Inc., Riskonnect, Comarch SA, S&P Global Inc, SAP, SAS, Pegasystems, Accenture, Fiserv, Temenos, IBM, and Others.

Recent Developments

- In August 2024, Treasury Prime, a leading embedded banking software company, announced the addition of Kobalt Labs, an AI-powered copilot for risk and compliance teams, to the Treasury Prime Partner Marketplace. Banks in Treasury Prime’s network now have the option to leverage Kobalt Labs to better manage their third-party diligence with AI, including the ability to streamline legal, compliance, and infosec diligence in one platform.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Bank Risk Management Software Market based on the below-mentioned segments:

Global Bank Risk Management Software Market, By Product Type

- Financial

- Operational

- Credit

- Enterprise

- Market

- Compliance

Global Bank Risk Management Software Market, By Industry

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- IT and Telecom

- Government and Defense

- Energy and Utilities

- Manufacturing

- Retail

Global Bank Risk Management Software Market, By Deployment Mode

- On-Premises

- Cloud Based

Global Bank Risk Management Software Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?