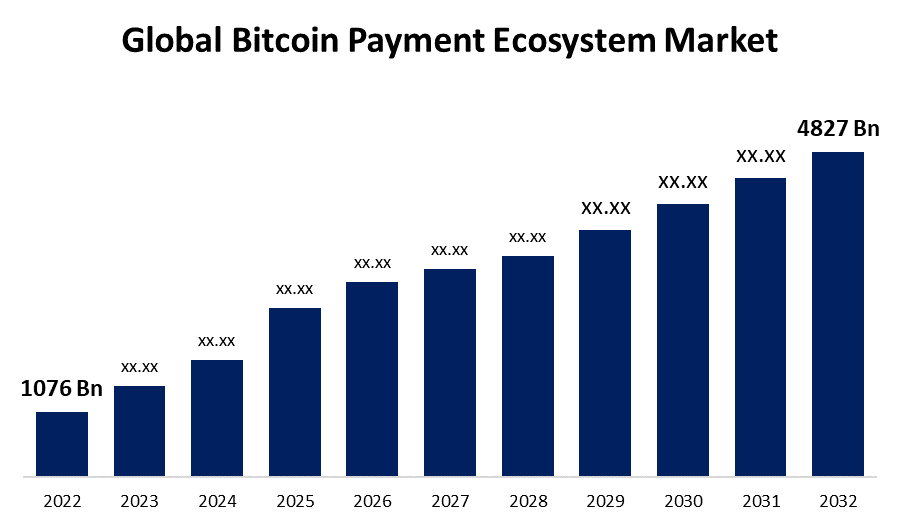

Global Bitcoin Payment Ecosystem Market Size to Exceed USD 4827 Billion by 2032 | CAGR Of 16.19%

Category: Information & TechnologyGlobal Bitcoin Payment Ecosystem Market Size to Exceed USD 4827 Billion by 2032

According to a research report published by Spherical Insights & Consulting, The Global Bitcoin Payment Ecosystem Market Size is to grow from USD 1076 Billion in 2022 to USD 4827 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 16.19% during the projected period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 market data tables and figures & charts from the report on the "Global Bitcoin Payment Ecosystem Market Size, Share, and COVID-19 Impact Analysis, By Type (Hardware, Software, Services), By Application (Decentralize Identity, Decentralize Organization, Smart Contacts, ATMs, Analytics and Big data, Trading Marketplaces, Others), By End User (Government, Enterprises, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032". Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/bitcoin-payment-ecosystem-market

The crypto ecosystem is a network of online resources and technological advancements that facilitate cryptocurrency transactions. It is based on blockchain technology. This technology enables digital asset storage and exchange that is both secure and decentralised. Growing exchange markets, non-compliance, and increasing flexibility of commercial transactions in e-commerce industries are some of the factors influencing the analysis of the bitcoin payment ecosystem's significant growth during the forecast period. Furthermore, the market expansion of the bitcoin payment ecosystem is anticipated to be greatly aided by these government regulations. Using cryptocurrencies like Bitcoin, mainstream banking and other financial institutions that are required to provide their clients with secure and legally binding services may bring in the next phase of financial transactions. Identity management, compliance management, reporting, and analytics require the development of new technology. However, the volatility of bitcoin prices is one of the primary factors impeding the growth of the bitcoin payment ecosystem market. Bitcoin prices are extremely volatile, rising and falling at breakneck speed. Many speculators want to profit from it, but genuine investors consider it too risky, discouraging users from investing in bitcoins. This factor has the potential to hamper the global expansion of the bitcoin payment ecosystem.

COVID 19 Impact

The COVID-19 pandemic had a mixed impact on the bitcoin payment ecosystem market. Initially, uncertainty and economic insecurity reduced overall transaction volume. However, as the crisis progressed, bitcoin gained traction as a digital asset and inflation hedge, leading to increased adoption. Furthermore, the pandemic hastened the shift toward digital payments, which has benefited bitcoin online transaction capabilities. While challenges emerged, the crisis also increased interest in and use of bitcoin in several sectors.

The hardware segment is witnessing significant CAGR growth over the forecast period.

On the basis of type, the global bitcoin payment ecosystem market is segmented into hardware, software, and services. Among these, the hardware segment is witnessing significant growth over the forecast period. A variety of devices, including power supplies, operating systems, and other parts that cooperate to run and decipher cryptography, are included in the hardware segment. This hardware consists of thousands of miners that power computers all over the world.

The trading marketplaces segment dominates the market with the largest revenue share over the forecast period

Based on the application, the global bitcoin payment ecosystem market is segmented into decentralized identity, decentralized organization, smart contacts, ATMs, analytics and big data, trading marketplaces, and others. Among these, the trading marketplaces segment is dominating the market with the largest revenue share over the forecast period. A bitcoin payment gateway accepts transactions of any size or destination, making it the most widely used payment gateway solution for trading the market applications.

The enterprise segment is expected to hold the largest share of the global bitcoin payment ecosystem market during the forecast period.

Based on end user, the global bitcoin payment ecosystem market is classified into government, enterprises, and others. Among these, the enterprise segment is expected to hold the largest share of the bitcoin payment ecosystem market during the forecast period. Major retailers now accept bitcoin payments for everything from groceries to airline tickets. A growing number of businesses around the world are using Bitcoin and other digital assets for a variety of investment, operational, and transactional purposes. Such factors are boosting the market growth.

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America dominates the market with the largest market share over the forecast period. One of the major factors driving the North American bitcoin payment ecosystem market is government regulations to legalize the use of bitcoin for various transactions and trading applications. Consumer and retailer acceptance of digital currencies is driving the market. Furthermore, the success of bitcoin mining, as well as the participation of several major players, dominate the North American market.

Asia Pacific is expected to grow the fastest during the forecast period. The advantages are faster transaction speeds, lower fees, improved security, greater transparency, and global reach. These features are valued by both businesses and consumers, accelerating bitcoin adoption as a mainstream payment option.

Major vendors in the global bitcoin payment ecosystem market are BitPay, Avalon, Mt. Gox, Coinsetter, BitcoinX, Nvidia, Butterfly Labs, Coinbase, ATI, Bitcoin Foundation, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, NAKA introduces a new decentralised approach to finance, based on an innovative blockchain-based payment scheme and a payment card that connects to the MetaMask wallet and can be read by any POS terminal worldwide

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global bitcoin payment ecosystem market based on the below-mentioned segments:

Bitcoin Payment Ecosystem Market, Type Analysis

- Hardware

- Software

- Services

Bitcoin Payment Ecosystem Market, Application Analysis

- Decentralize Identity

- Decentralize Organization

- Smart Contacts

- ATMs

- Analytics and Big data

- Trading Marketplaces

- Others

Bitcoin Payment Ecosystem Market, End-User Analysis

- Government

- Enterprises

- Others

Bitcoin Payment Ecosystem Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?