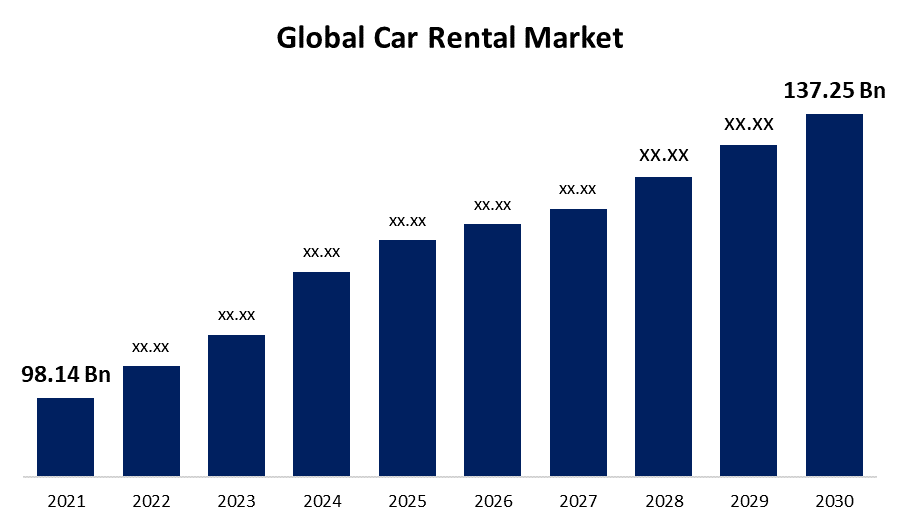

Global Car Rental Market Size to Grow USD 137.25 Billion by 2030 | CAGR of 0.046%

Category: Automotive & TransportationGlobal Car Rental Market Size To Grow USD 137.25 Billion By 2030

The Global Car Rental Market size was valued at USD 98.14 Billion in 2021, and it is expected to USD 137.25 Billion in 2030 CAGR of 4.6% from 2021 to 2030. as per the latest research report by Spherical Insights & Consulting.

Get more details on this report -

A significant increase in the number of people travelling for both business and pleasure around the world is driving the need for car rental services, which is accelerating the industry's growth.

The Global market for car rentals was valued at USD 98.14 billion in 2020, and it is projected to grow at a CAGR of 4.6% between 2021 and 2028. A significant increase in the number of people travelling for both business and pleasure around the world is driving the need for car rental services, which is accelerating the industry's growth. People increasingly choose on-demand transportation services for travel and daily communication due to rising vehicle pricing, declining parking spaces, and expensive car upkeep. As a result, it is anticipated that during the anticipated timeframe, consumer preference for on-demand transportation will support market expansion.

Browse key industry insights spread across 198 pages with 119 market data tables and figures & charts from the report “Global Car Rental Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Luxury Cars, Executive Cars, Economy Cars, SUVs, MUVs), By Application (Local Usage, Airport Transport, Outstation), By Region (North America; Europe; Asia Pacific; Latin America; MEA), And Segment Forecasts, 2021 – 2030 ”.

Improved customer and corporate information management and hassle-free internet booking software are the two most successful strategies for helping car rental service providers improve the services they offer to their customers.

Some Key Developments Offered in the Global car Rental Market Report:

-June 2022: Carro, an online Used car marketplace in southeast Asia, has 50% of stake in Indonesian car rental companies.

-January 2022: Sixt announced the expansion of its taxi and rental partner network to Italy

-December 2021: Enterprise Holdings announced that its subsidiary in Ireland has completed the acquisition of Dublin headquarter Walker Vehicle Rentals.

-August 2021: Zoomcar,an Indian car rental startup, announced its expansion plans worth USD 100 million in south Asia.

-July 2021: MBK Partners,a private equity fund manager,acquired 100% stake in china’s top vehicle rental company CAR Inc.

COVID-19 Impact on the Global Car Rental Market

The rapid expansion of COVID-19 in 2020 had a huge influence on the tourism sector as a whole, which in turn had an impact on the automobile rental sector. The demand for airport car rentals has decreased as a result of the drop in international air travel. In order to maintain security and stop the spread of the virus, automobile rental providers adhere to safety and hygiene norms, such as sanitising their vehicles after each ride. Some car rental businesses offer free face masks and hand sanitizers to their customers. Major players in the industry, such as Hertz and Avis, have sold their older cars at a greater price than typical during the outbreak in order to turn these transactions into a source of money generation.

Global Car rental Market, By Vehicle Type

The car rental market is divided into luxury cars, executive cars, economy cars, sport utility vehicles (SUV), and multi-utility vehicles based on the kind of vehicle (MUV)

Due to their larger passenger capacities, SUVs and MUVs are in high demand, and families and groups of friends like to travel great distances in these types of vehicles because they are inexpensive and simple to find.Compared to other car sectors, the cost of purchasing and maintaining an economy car is minimal. As a result, the bulk of intercity taxis and airport taxis belong to the class of cheap cars.

Global Car Rental Market, By Application Type

Based on application, the car rental market is split into four groups: local use, airport transit, outstation, and others. It is anticipated that the recent sharp increases in international air travel will increase segment growth. In light of this development, several car rental companies are expanding their fleets and marketing their offerings at key airports.

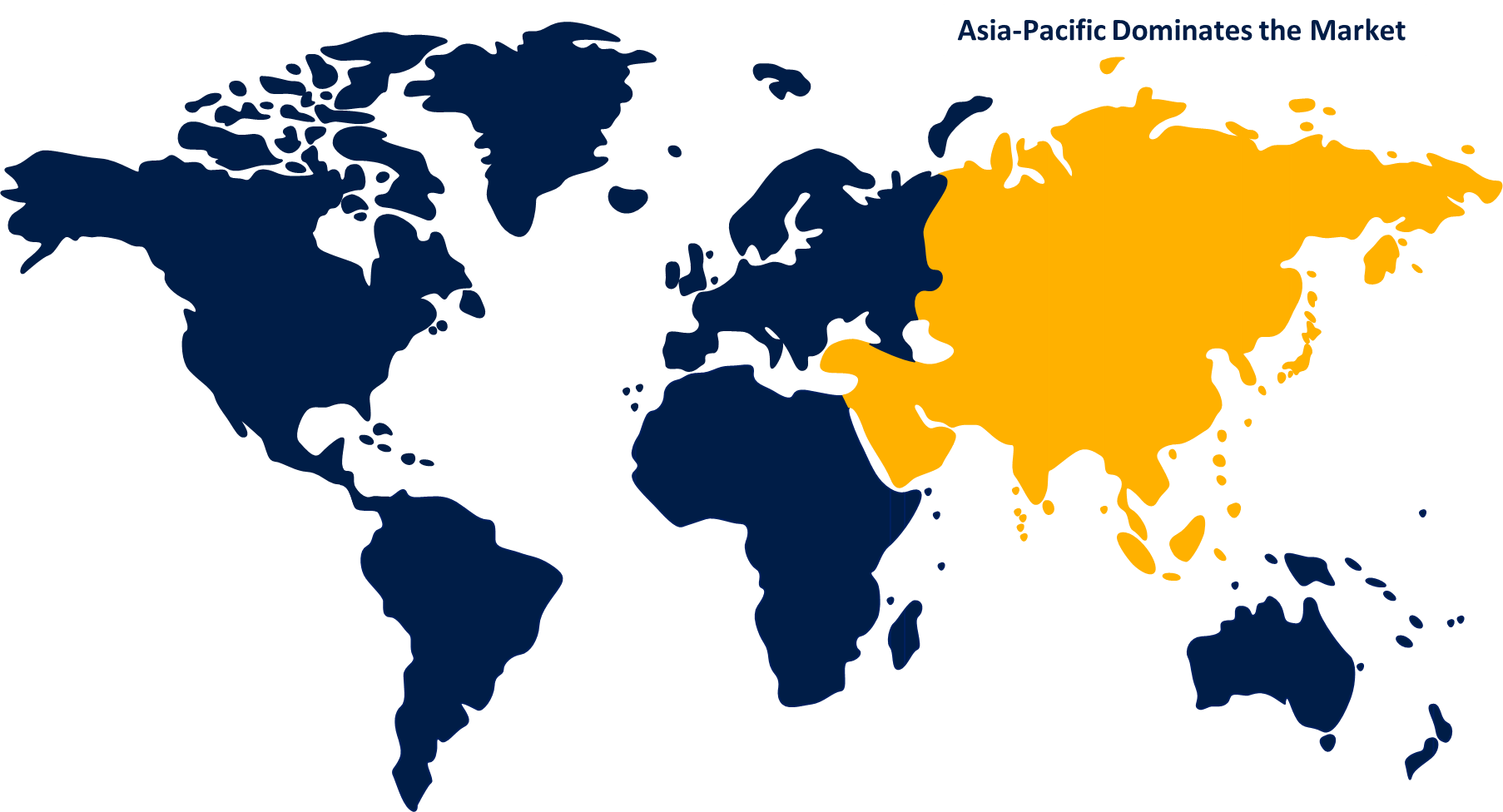

Global Car Rental Market, By Regional

Between 2021 and 2028, the market is expected to expand in the Asia Pacific region at the highest CAGR, or about 8.0%.

Get more details on this report -

The markets in China and India would grow quickly over the expected time span. Government limits on car purchases in some regions of China, which are an effort to address the escalating traffic and pollution issues, are likely to influence people's decisions to use car rental services.

North America had the largest market share, or over 52.0%, in 2020, with the United States being the biggest market.

Some key Points of the Car Rental Market Report are:

- An in-depth global Car Rental market analysis by the segments, along with an analysis of trend-based insights and factors.

- Profiles of major market players operating in the global Car rental market, which includes The Hertz Corporation(U.S), Enterprise Holdings Inc.(U.S), Avis Budget Group(U.S), Europcar Mobility Group(France),TOYOTA Rent a Car(Japan),Sixt SE(Germany),CAR Inc(China), Alamo Rent a Car LLC(U.S).

- Key impact factor analysis across regions includes analysis, along with the drivers,restraints, opportunities, and challenges that are prevailing in the global Car Rental market

- Impact of COVID-19 on the global Car Rental market.

Recent Developments In The Global Car rental Market

- June 2022: Carro, an online Used car marketplace in Southeast Asia, has a 50% of stake in Indonesian car rental companies.

- January 2022: Sixt announced the expansion of its taxi and rental partner network to Italy

- December 2021: Enterprise Holdings announced that its subsidiary in Ireland has completed the acquisition of Dublin headquarters Walker Vehicle Rentals.

- August 2021: Zoomcar, an Indian car rental startup, announced its expansion plans worth USD 100 million in south Asia.

- July 2021: MBK Partners, a private equity fund manager, acquired a 100% stake in china’s top vehicle rental company CAR Inc.

List of Key Market Players

- Hertz Global Holdings

- Enterprise Holdings Inc.

- TOYOTA Rent a Car

- Europcar Mobility Group

- Avis Budget Group

- Sixt SE

- Lotte Rental Co. Ltd.

- CAR Inc.

- Localiza Rent a Car SA

Segmentation

By Vehicle Type

Luxury Cars

- Executive cars

- Economy cars

- SUVs

- MUVs

By Application

- Local usage

- Airport transport

- Outstation

- Others

By Region:

North America

- North America, by Country

- U.S.

- Canada

- North America, by Vehicle Type

- North America, by Application

Europe

- Europe, by Country

- Germany

- U.K.

- France

- Rest of Europe

- Europe, by Vehicle Type

- Europe, by Application

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Asia Pacific, by Vehicle Type

- Asia Pacific, by Application

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Vehicle Type

- Middle East & Africa, by Application

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Vehicle Type

- South America, by Application

Need help to buy this report?