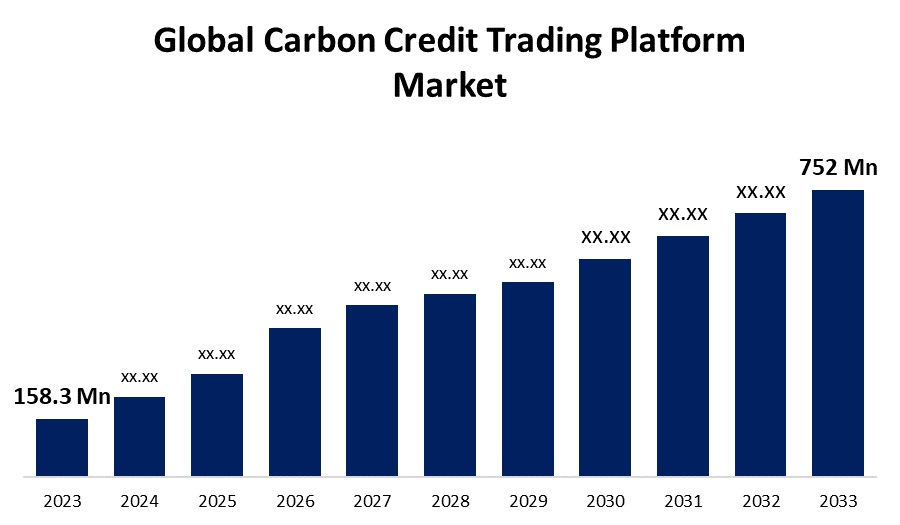

Global Carbon Credit Trading Platform Market Size To Worth USD 752 Million By 2033 | CAGR of 16.8%

Category: Energy & PowerGlobal Carbon Credit Trading Platform Market Size To Worth USD 752 Million By 2033

According to a research report published by Spherical Insights & Consulting, the Global Carbon Credit Trading Platform Market Size is to Grow from USD 158.3 Million in 2023 to USD 752 Million by 2033, at a Compound Annual Growth Rate (CAGR) of 16.8% during projected period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 Market data tables and figures & charts from the report on the "Global Carbon Credit Trading Platform Market Size, Share, and COVID-19 Impact Analysis, By Type (Voluntary, Regulated, Others), By System Type (Cap-and-Trade, Baseline and Credit, Others), By End-user (Industrial, Utilities, Energy, Petrochemical, Aviation, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/carbon-credit-trading-platform-market

Carbon trading, also known as carbon emissions trading, is the process of buying and selling credits on an exchange that lets businesses or other parties emit a specific quantity of carbon dioxide. By making it easier to acquire and sell carbon credits, the global carbon credit trading platform market helps companies and organizations cut back on their greenhouse gas emissions. Reducing greenhouse gas emissions and fighting climate change are its primary objectives. Additionally, these platforms promote finance for global sustainability programs and emission reduction projects by enabling the trading of carbon credits. Furthermore, the growing awareness of climate trade and its possible impacts on the environment and human welfare is driving the global market for carbon credit trading platforms. Lowering carbon emissions through stringent environmental regulations and government policies is driving the expansion of the global carbon credit trading platform. Governments everywhere are implementing carbon pricing and cap and trade programs to incentivize companies to reduce their emissions. The goal of achieving net zero is being pursued by the international community. Climate change has brought about a complete shift in the economy. To negotiate the resulting opportunities and challenges, a range of innovative tools, like carbon credits, are required. The expected increase in demand for carbon credits in the upcoming years is one of the key factors propelling the global market for carbon trading platforms. However, the growing price of carbon credits may act as a market restraint over the duration of the projection. Price fluctuation raises prices and increases transaction volumes due to demand. The certification and verification processes for carbon offset projects can be costly and time-consuming.

The voluntary segment is anticipated to hold the greatest share of the global carbon credit trading platform market during the projected timeframe.

Based on the type, the global carbon credit trading platform market is divided into voluntary, regulated, and others. Among these, the voluntary segment is anticipated to hold the greatest share of the global carbon credit trading platform market during the projected timeframe. This is because of the voluntary sector's increasing significance in reducing global warming. A voluntary sector that could help businesses lower their emissions is expanding as business executives make ever-more-ambitious pledges to reduce global greenhouse gas (GHG) emissions.

The cap-and-trade segment is anticipated to grow at the fastest pace in the global carbon credit trading platform market during the projected timeframe.

Based on the system type, the global carbon credit trading platform market is divided into cap-and-trade, baseline and credit, others. Among these, the cap-and-trade segment is anticipated to grow at the fastest pace in the global carbon credit trading platform market during the projected timeframe. This is because market innovation and investment decisions are impacted by the carbon price, which is determined by the market through the cap-and-trade system. It thus raises demand for the carbon credit trading marketplace.

The utilities segment is predicted to grow at the highest pace in the carbon credit trading platform market during the estimated period.

Based on the end-user, the global carbon credit trading platform market is divided into industrial, utilities, energy, petrochemical, aviation, and others. Among these, the utilities segment is predicted to grow at the highest pace in the carbon credit trading platform market during the estimated period. The demand for carbon credit trading systems is rising as a result of the utilities sector's commitment to decarbonization efforts in the battle against climate change. Utility companies need to reduce their carbon footprints and mitigate the effects of climate change because they are major emitters of greenhouse gases.

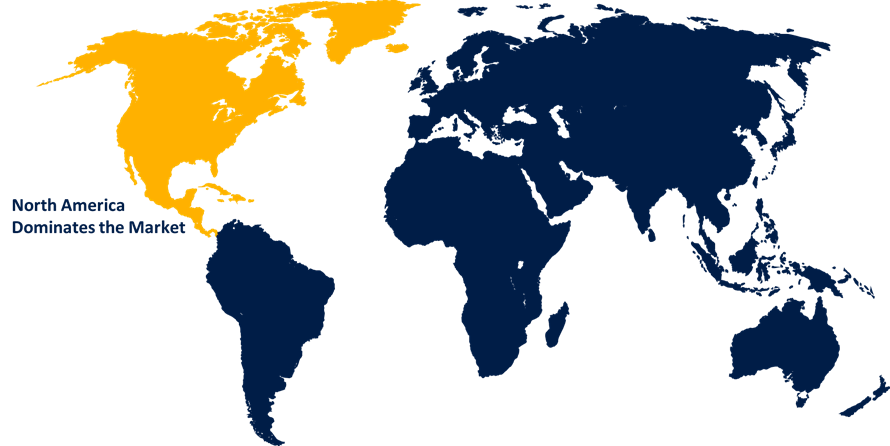

North America is expected to hold the largest share of the global Carbon Credit Trading Platform market over the forecast period.

Get more details on this report -

North America is expected to hold the largest share of the global Carbon Credit Trading Platform market over the forecast period. The US and Canada have been instrumental in creating North America's supremacy in the carbon credit trading platform market. Because of the US's increasing focus on sustainability and the Biden administration's promise to rejoin the Paris Agreement, interest in carbon credit trading platforms has increased dramatically. The United States has witnessed a surge in legislative acts and corporate operations aimed at meeting carbon neutrality targets. This has led to a rise in the market for carbon credits. Similar elements, such as Canada's robust carbon pricing framework and the federal government's objective of achieving net-zero emissions by 2050, contribute to the market's supremacy there.

Asia Pacific is predicted to grow at the fastest pace in the global Carbon Credit Trading Platform market during the projected timeframe. This is because the Republic of Korea has the most sophisticated national emission trading system (ETS) in the Asia-Pacific region. China is seeking an emission trading system (ETS) with no major defects that can improve operations, is adaptable, and is compatible with the environment. The objective of this initiative is to enhance the coherence and harmonization of national carbon trading systems throughout Asia, promote regional and global interconnectivity, and identify feasible approaches for their successful development and execution.

Major vendors in the Global Carbon Credit Trading Platform Market include Climate Impact X, Carbonplace, EEX Group, ClimateTrade, Veridium, AirCarbon Exchange, Nasdaq Inc., Carbon Trade Exchange, IHS Markit, CME Group, Likvidi, BetaCarbon, ShiftCabon, and Others.

Recent Developments

- In July 2022, To create a Kenya carbon exchange, Aircarbon Exchange (ACX) signed a collaboration agreement with the NSE and the Nairobi International Financial Center (NIFC) during the center's official opening. By working together, the two parties will create a carbon ecosystem in Kenya that is connected to ACX's worldwide client order book, enabling smooth and effective transactions between local and international buyers and sellers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Carbon Credit Trading Platform Market based on the below-mentioned segments:

Global Carbon Credit Trading Platform Market, By Type

- Voluntary

- Regulated

- Others

Global Carbon Credit Trading Platform Market, By System Type

- Cap-and-Trade

- Baseline and Credit

- Others

Global Carbon Credit Trading Platform Market, By End-user

- Industrial

- Utilities

- Energy

- Petrochemical

- Aviation

- Others

Global Carbon Credit Trading Platform Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?